Situation Review & The Value Sits Model Portfolio

Reviewing names and constructing a model portfolio for 2022

Disclaimer

Value Situations is NOT investment advice and the author is not an investment advisor.

All content on this website and in the newsletter, and all other communication and correspondence from its author, is for informational and educational purposes only and should not in any circumstances, whether express or implied, be considered to be advice of an investment, legal or any other nature. Please carry out your own research and due diligence.

For this first issue of 2022 I thought I would start with an end-of-year review of some names analysed during 2021, similar to my Q3 quarterly review. From this review, I will then select the names that I am most positive on to form the basis of the Value Situations Model Portfolio for 2022.

End of Year Situations Review

As I’ve mentioned before, I’m don’t read much into quarterly performance as it reflects the type of short-term orientation that frequently creates the mispriced value situations that I seek out. However, as before I do think this exercise is useful and can serve as a sense-check on previous analysis following the passage of time as new facts or events may have transpired.

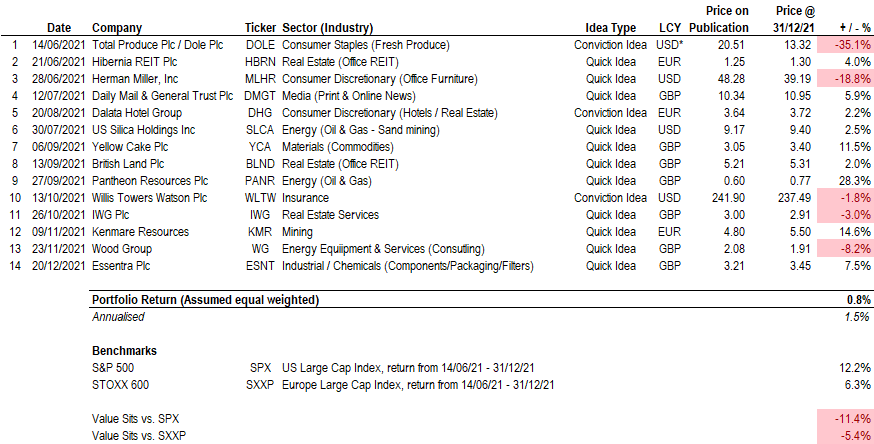

The summary table below sets out the performance of each of the 14 names analysed in the newsletter during 2021, comprising the three conviction memo names (DOLE, DHG and WLTW) and the 11 quick idea names that were analysed and presented in varying degrees of detail:

Source: Value Situations analysis; share prices are closing prices as at 31 Dec-21 per Koyfin.

In the above I exclude Tesla and Rivian as these were valuation thought exercise write-ups rather than actual investment calls. I also exclude idea bench names mentioned during 2021 (ATO, AVON, KAPE, VTU and VSAT) as these were preliminary ideas of interest rather than meaningfully analysed names.

I don’t propose reviewing every name in detail here or rehashing the theses for each, as I believe the previous write-ups and underwrites largely still stand for now (apart from the DMGT idea which is effectively dead as it’s going private, with its shares delisting from the LSE on 10 January).

Rather I’ll provide my current thoughts on the three high conviction names (DOLE, DHG, WLTW) and three quick idea names that I believe represent the most promising opportunities for 2022 among the quick ideas cohort, namely PANR, YCA and KMR.

DOLE

My first high conviction idea, DOLE is down ~35% based on the pre-merger & IPO share price of predecessor company Total Produce Plc at the time of my original investment memo. I’ve written extensively about why it has underperformed since its IPO last July and I continue to believe DOLE is significantly undervalued. It is trading in line with my original worst case downside scenario at ~$13/share currently, or an absurdly cheap 6.4x EBITDA (or ~5.9x including post-merger estimated synergies) vs. an average NTM multiple of ~13.7x for its (smaller, less diversified) US-listed peers!

The valuation looks particularly anomalous following a very positive update from management on DOLE’s Q3 earnings call last month, in which management stated that they have effectively secured customer price increases to fully offset cost inflation in FY22. DOLE has only been a public company for ~5 months yet management are already delivering on the pre-IPO plan with leverage sub-3x, YoY EBITDA growth of 6.5% (vs. 5% - 7% management target) and the initiation of a dividend equating to an annualised yield of ~2.4%.

Furthermore, DOLE’s prospects are enhanced now by the further catalyst of food price inflation given how management have been able to secure customer price increases for FY22. I’ve outlined the reasons for why DOLE continues to be mis-priced in my recent update analysis and in a Base Case I still see the stock getting to $40+/share (3x the current price) over the next 2-3 years.

On this basis, my investment thesis for Dole remains intact. No change to underwrite or thesis.

DHG

As with all travel/hotel/leisure stocks, the re-rating of my second high conviction idea DHG has been held back by the emergence of the COVID Omicron variant towards the end of 2021, resulting in reduced travel and further restrictions in Q4. DHG’s stock had been trading as high as €4.38 or +20% above the stock price at the time of my memo’s publication in early October before Omicron was discovered in November.

At the current share price DHG trades at ~8.4x pre-COVID EBITDA vs. ~11x for its UK-listed peers, and just ~7x stabilised FY24 EBITDA. Looking at it another way, at the current EV of ~€1.1bn, one can acquire an interest in DHG’s ~6,200 room freehold (owned) hotel portfolio valued at €1.2bn AND get its ~3,000 room leasehold portfolio AND its ~2,300 room development pipeline for free! In a further indication of the value on offer here, real estate PE firm Henderson Park recently acquired a portfolio of 12 Hilton-branded hotels comprising ~2,400 keys across the UK and Ireland which provides an interesting read-across. While no deal value was disclosed by Henderson Park, market intelligence indicates a value paid of ~€380k+ per key, which compares to a current EV/key of just ~€115k for DHG based on the current share price (blended, including the freehold and leasehold rooms but not the pipeline).

As COVID eventually passes (and it will) and economies and travel/hospitality markets re-open, I expect DHG to re-rate substantially in line with peers and the value of its underlying RE. Furthermore, the combination of real asset backing, post-COVID recovery prospects and its cheap valuation make DHG a strong takeover target in my view - there is clearly both ample dry powder and the appetite for a PE/RE acquirer to take it private at a meaningful premium to its current price if the public markets cannot value it appropriately.

No change to my original underwrite or thesis and I continue to see substantial upside to DHG’s share price.

WLTW

My third high conviction idea of 2021, WLTW’s share price has gone nowhere since I published my analysis of the situation, being down ~2% by 2021 year-end. This is somewhat surprising given the positive and potentially catalytic events that have occurred since I wrote about WLTW.

Firstly, the Q3 earnings report indicated a more positive trajectory for the business following the termination of its merger with AON, with revenues growing 4% in Q3 and on track to grow 6% YoY for the full FY21 year, while operating margins improved across all segments of the business and free cash generation was robust.

Secondly, in November WLTW replaced four of its non-exec directors, including Chairman Victor Ganzi following discussions with activist shareholder Elliot Management. With fellow activists Starboard Value and TCI also on WLTW’s share register, I believe management led by newly appointed CEO Carl Hess are sufficiently motivated to deliver on WLTW’s enormous ~€10bn+ capital return plan, which is a significant driver of the value story here (WLTW is intending to return ~30% of its current market cap to shareholders by 2024).

In addition, WLTW continues to enjoy a position within the Big Three industry oligopoly with Marsh & McLennon and AON. Given this position and the characteristics of the industry (increasingly complex client needs, high barriers to entry, high recurring revenues, long-term, sticky client relationships), I see WLTW generating steadily growing earnings and FCF in a more complex post-COVID environment.

Despite this favourable backdrop, WLTW continues to trade at a wide discount to its oligopoly peers, at 13x LTM EBITDA vs. 17x for MMC and 18x for AON. I still see WLTW as a $400+ stock by 2024, offering 70%+ upside from the current market price with limited downside given its competitive position and cash generation.

On this basis, I see no change to my original underwrite and I believe the value thesis for WLTW remains intact.

Moving on from the three conviction names, I view PANR, YCA and KMR as the most compelling names from among the quick ideas of 2021 as their respective situations have evolved since initial publication. I provide my current thoughts on these as follows.

PANR

While I originally wrote about PANR as a quick idea, I have spent considerable further time on it and most recently provided an updated valuation analysis last month following its completion of a $96m fundraise. PANR is the best performer to date among my published ideas, up 28% at 31 December from when I first wrote about it (and up ~35% as at the time of writing this). The market has rightly shrugged off the minimally dilutive impact of the recent fundraise and the company is now progressing its 2022 drilling programme with a fully funded balance sheet.

Indeed I believe PANR is fully funded to an eventual sale to an oil major within the next two years, meaning further dilution or capital requirements are highly unlikely. This position combined with its enormous, world class oil resource of close to 20 billion BO provides very substantial downside protection, while the upside is extreme even under conservative assumptions around recovery rates and oil pricing - PANR is a ~5x opportunity based on my analysis, with limited downside given its resource asset backing.

On this basis I see no change to my original thesis and following the fundraise de-risking PANR’s balance sheet, I am upgrading PANR to a high conviction idea for 2022.

YCA

I originally presented a high level analysis of YCA as part of my wider exploration of the uranium theme back in September. I identified YCA as a lower risk play on the uranium thesis compared to miners who may offer more torque, but also carry more downside risk as they come with development, mining, re-start and/or processing risk. By contrast, YCA simply holds the physical uranium commodity itself and does operate mines or carry out exploration or development activities. As such I believe it offers the simplest and lowest risk way to play the underlying theme while also offering asymmetric, multibagger upside returns if the thesis plays out.

Regarding that thesis, the backdrop has certainly become more favourable since I wrote about YCA initially. The Sprott Physical Uranium Trust’s hoovering up of uranium supply in the spot market provided an initial financial catalyst last year, which is now likely to be followed by policy catalyst via the ongoing energy crisis. The energy crisis appears to have softened policy makers attitudes towards nuclear energy, with the European Commission recently including nuclear energy as “green” energy investment in its sustainable finance taxonomy, (albeit with disagreement from Germany and some other EU members). The reality is that apart from a growing supply deficit (~180m lbs of annual demand for uranium vs. ~125m lbs of available supply/production), nuclear energy provides clean and reliable baseload power, something renewables cannot currently offer and is the most obvious solution to bridging the energy transition gap.

Combining increased investment in nuclear power with climate concerns and an increase in the global nuclear reactor fleet suggests that the price of uranium will have to increase significantly. The question is by how much? The current spot price is ~$45/lb, and the marginal cost of production is estimated at $50 - $60/lb for the larger miners, meaning the market price of uranium needs to rise to at least that level to incentivise re-starting of mines and bringing new supply on stream. A further tailwind is that utilities’ contracted supply is starting to roll off this year, meaning the utilities will have to step into the market and compete for uranium feedstock, where demand is already ~1.5x the available supply and rising. It’s worth remembering here that nuclear reactor operators are price-insensitive to the uranium commodity as it represents only a small % of operating costs and has no substitute. As such, utilities are effectively a buyer of uranium at almost any price - idled reactors, leading to power black-outs on top of the existing energy crisis is an unthinkable scenario for the utilities, policy makers and society.

A further reality is after an 11 year bear market with no investment in mines, utilities have little leverage when negotiating with miners for new supply. Market analysts believe uranium prices of $80/lb or even $100+/lb are very possible if new investment and production to support the global reactor fleet is to occur. Given their price-taker position, utilities will need to agree long-term supply contracts at much higher prices to ensure security of supply.

Finally, the situation in Kazahkstan, which accounts for ~43% of global uranium production, now provides a further possible catalyst for uranium prices to rise significantly, if supply is interrupted due to conflict in the region.

In this context, YCA looks to be a very compelling and asymmetric situation - at $80/lb, YCA at 1x NAV would be worth £7.35/share or 2x the current share price, and at $100/lb the implied NAV is 2.5x the current price. The downside is also very limited - given the market dynamics, its hard to see uranium dropping back below $40/lb, but assuming it drops to $35/lb somehow (-24% on today’s spot price) this implies a share price for YCA (at 1x NAV) or £3.17 or just -13% vs. the current share price, indicating upside of 7.5x the downside at $80/lb for uranium.

Given the compelling market set-up and YCA’s structure as a vehicle offering exposure to the uranium commodity I am upgrading YCA to a high conviction idea for 2022, as I believe we will see a significant, positive move in uranium this year as utilities are compelled to initiate a new contracting cycle.

KMR

The final name that merits comment is KMR, on which I published an extended quick idea analysis in November. Against the backdrop of very bullish sentiment towards commodities coming into 2022 and the prospect of a multi-year commodities supercycle, KMR is an overlooked and somewhat unique situation.

KMR is a mineral sand miner and the world’s largest producer of ilmenite, a titanium feedstock, and the fourth largest producer of titanium feedstocks overall. Titanium feedstocks are used in the manufacture of titanium dioxide (TiO2) pigment, which in turn is used in everything from paints, plastics, paper and ceramic tiles, to cosmetics, food additives and titanium metal. There is no economic or environmentally safe substitute to TiO2 and therefore KMR’s commodities are essential to industry and the modern economy. It’s key asset is the Moma mine in Mozambique, which is a world class mineral sand asset, and KMR now accounts for ~10% of the global supply of titanium feedstocks following a production capacity expansion completed in H1 2021.

After several years of significant capex, lumpy earnings and operating under a leveraged balance sheet, KMR is now at an inflection point in terms of both its earnings power and its balance sheet following the capacity expansion - EBITDA is projected to more than double vs. 2020 levels and the company will transition to a net cash position by early 2022 thanks to this earnings inflection and resultant cash conversion.

The company recently completed a tender offer, buying back 14.8m shares or ~13% of its outstanding shares, which along with its improving fundamentals helped the stock price rise ~15% by year-end from when I published the idea. Yet the market is pricing KMR at a meaningful discount to listed peers and the private market valuations of comparable assets.

As the world’s largest producer of ilmenite KMR occupies an important position in the global supply chain for most industries, and owns a highly valuable, strategic asset in the Moma mine. It’s market position, financial attributes and a favourable supply/demand profile for its commodity products would suggest KMR’s distressed-like valuation at ~4x FY22 EBITDA and 0.7x EV/IC is truly anomalous and indicative of a clear value situation. KMR just seems too cheap given its earnings inflection, its transition to net cash, its unique asset and the inflationary outlook for commodities. Previously it was the subject of several takeover attempts by larger peer Iluka Resources, and I see KMR as a very obvious takeover target now.

Given all the above, I am upgrading KMR to a high conviction idea for 2022, and I believe it should see a substantial re-rating or a takeover bid given its fundamental position and attributes.

The Value Situations Model Portfolio

To date, I have written up names that I find interesting and which meet my investment framework. As we start 2022 I want to build on this by constructing a model portfolio from the names that I believe are best placed to generate above-average returns over the next 2 - 3 years.

To recap, I’m looking for typically overlooked, lesser known and/or misunderstood companies and situations with the following characteristics:

Undervalued, with upside of 50% - 100% over a 2-3 investment time-frame

Downside protection, with max downside of ~30% in a worst case

Asymmetric risk/return profiles, where the potential upside is a multiple of my assessment of the downside risk (preferably 3x+)

Clear, plausible catalysts to value realisation/re-rating

Typically US or European publicly listed companies, and not large cap names

To kick off 2022, the Value Sits portfolio will include the six names discussed above, and in the spirit of Charlie Munger’s maxim on simplicity (“Take a simple idea and take it seriously”), I’m assigning equal weightings to each of these names to begin with. The “seriousness” of this simple weighting approach is in the level of conviction I have having done my analysis on each name.

Over the course of 2022, my intention is to add new high conviction names to the portfolio until it comprises a maximum of 10-12 names in total, depending on the market opportunity set. Why 10-12 stocks? I believe the benefits of diversification diminish significantly beyond this number of stocks, as the more diversified a portfolio is in terms of the number of stocks (as opposed to diversification across industries or idiosyncratic situations), the more likely it will tend towards the market average performance. Rather the Value Sits Model Portfolio is a high conviction one offering asymmetric returns, so I prefer to concentrate on what I feel are my best ideas.

I’m also comfortable in stating again that I’m likely to be wrong on some names, but over a 2-3 year timeframe I believe the portfolio will produce above average returns (as denoted by benchmarks the S&P 500 and European STOXX 600) thanks to the Arithmetic of Asymmetry.

So starting out in 2022, the Value Sits Model Portfolio looks as follows:

Source: Value Situations analysis. Current price shown is market close price from Friday 7th January.

Notes:

DOLE target price updated for Dec 6 Update following Q3 results.

YCA target price assumed based on 1x NAV and $80/lb uranium, and updated for uranium holdings and balance sheet as at Dec-21, as cited above.

PANR target price updated for post-fundraise analysis published Dec 13.

One final point I’d make on the portfolio’s composition is its intended low correlation to the wider equity markets. I believe that names selected each come with their own idiosyncratic catalysts and circumstances (e.g. corporate events, takeover targets, earnings inflections etc. ) As such these names should exhibit lower correlation to the wider equity markets. While I’m not a subscriber to the CAPM model or the efficient market hypothesis, I do find it interesting to note that if I look at each of my six names’ beta coefficients over the last three years, their average beta factor is ~0.5x (ranging from -0.03 for KMR to 0.8 for WLTW). This compares to an average beta of ~1.3x for Apple, Amazon, Microsoft, Facebook/Meta and Tesla over the same period (with these mega-caps being responsible for much of the US equity market’s returns in that time). So on this measure at least, I think its fair to assume my names should be less impacted by wider market dislocations if they arise.

To conclude, against the backdrop of an expensive and speculative equity market environment I see the Value Sits Model Portfolio as an eclectic basket of idiosyncratic situations that are well positioned to realise substantial upside regardless of what the wider market does in the coming year. Time will tell if I’m right.

Hi ValueSits,

I think that your usage of EBITDA in the Dole plc analysis has led your valuation astray. Dole has considerable maintenance capital expenses as an asset-heavy business (particularly DFC) and if you track working capital over the last five years, you'll see that DFC has a considerable amount of that as well. These factors all depress cash flows considerable and EBITDA thus become unrepresentative for how the business operates. Another metric would probably be better to use.

Unlike you, I also believe that inflation is a big problem. While I do agree with your conclusion regarding Dole's ability to increase prices, I have an issue with menu lag costs. Prices are raised 3-6 months after the costs that arise from inflation make their way into the income statement. As such, Dole will always be 'chasing' inflation and won't be able to recoup lost margins. Raising prices in 2022 to offset inflation is great, but if these adjustments lag behind the newly incurred inflation costs in 2022 you won't see much margin improvement.

I'm skeptical of Dole's abilities to execute and see fair value to be around $15-18/shr, not the $40/shr your EBITDA valuation results in. I'd be happy to hear your thoughts on the concerns I raised above! Keep up the great work

Have you taken a look the NYT acquisition. Currently down around 10%. Market thinks the acquisition isn't so good.