Dole Plc Update & a New Quick Idea

Dole Plc reports Q3 numbers; Essentra Plc announces strategic reviews

Disclaimer

Value Situations is NOT investment advice and the author is not an investment advisor.

All content on this website and in the newsletter, and all other communication and correspondence from its author, is for informational and educational purposes only and should not in any circumstances, whether express or implied, be considered to be advice of an investment, legal or any other nature. Please carry out your own research and due diligence.

Dole’s Q3 Results & Valuation Update

My first high conviction name Dole Plc (DOLE) reported its first set of quarterly results as a newly-listed US public company for Q3 on Friday. On balance I believe the results were impressive in the context of what has been a uniquely challenging year in terms of cost inflation and supply chain disruption.

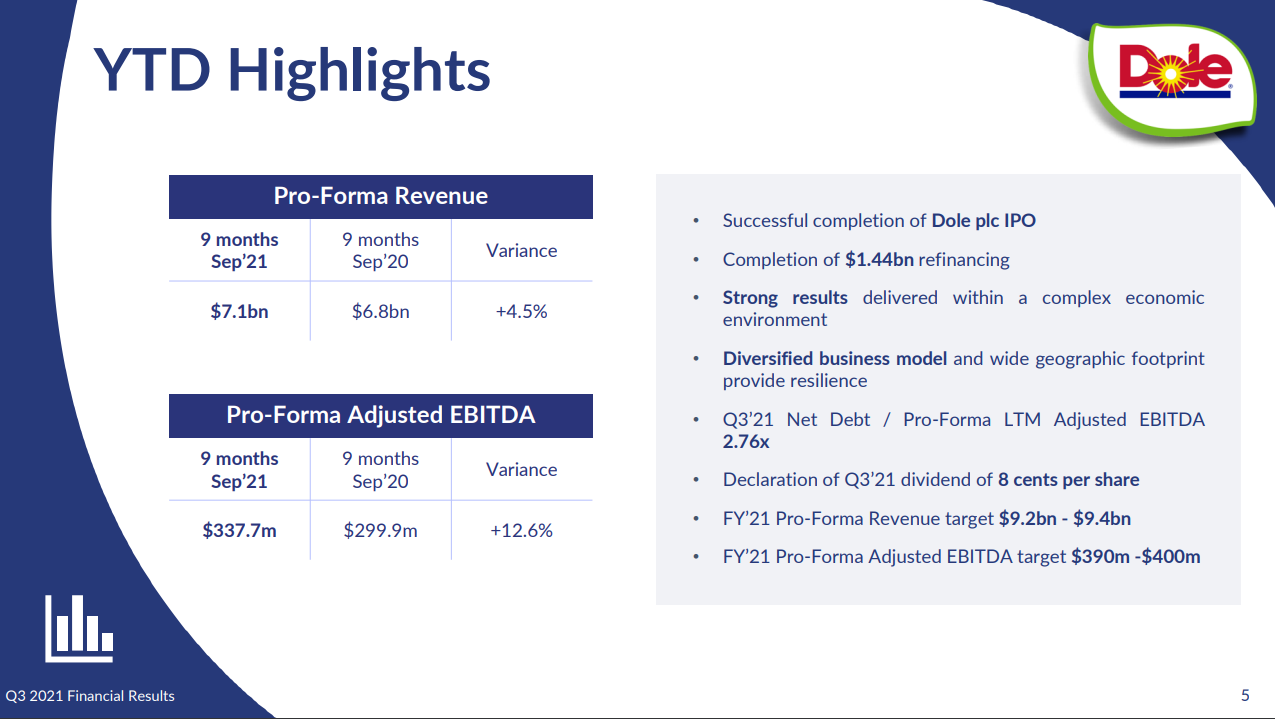

As expected, and similar to what Fresh Del Monte’s (FDP) Q3 results indicated last month, cost inflation pressures came to the fore in Q3 with Dole’s GAAP reported numbers showing an operating loss of -$27m for Q3 vs. a profit of +$22m in Q3 FY20, despite GAAP revenues in Q3 being up +64% YoY. However it’s worth pointing out that there is a lot of noise in Dole’s GAAP numbers, reflecting once-off costs relating to the Total Produce/Dole Foods merger as well as accounting presentation quirks - Dole’s Q3 and YTD numbers reflect 7 months of Total Produce numbers to July (which includes equity earnings from TP’s 45% holding in DFC up until then) but only 2 months of fully consolidated numbers to 30 September quarter-end. On that basis, I’m inclined to focus on the PF numbers which present the fully consolidated Dole business in a more accurate light in my view, and which show:

Source: Dole Plc Third Quarter 2021 Results presentation

Putting these results in some relative context vs. FDP, Dole’s performance is at least in line with FDP’s, but with further synergies of $30m - $40m to come, plus Dole’s greater scale advantage:

Source: Company reporting; Value Situations analysis.

Despite Dole being 2x FDP’s scale and achieving comparable margins and leverage, it continue to trades at a discount to FDP, which makes little sense. Again I believe this is attributable to US investors’ lack of familiarity with the former Total Produce management team now running Dole plus the limited trading record to date given the TP/Dole merger only completed at the end of July plus only one quarterly filing to date. I continue to believe that with a couple of quarters of continued positive performance and with cleaner numbers as the accounting quirks for the merger wash-out, the market will be better understand, and re-rate Dole accordingly.

I’m not going to rehash the earnings release here as I see little analytical value in that, and instead I want to focus on an updated valuation analysis based on the latest, post-IPO numbers now available.

However, I will offer my key takeways from the Q3 results which comprise a number of clear positives, which are as follows:

Dole has been able to raise prices across key produce categories to mitigate inflationary cost increases, and management explicitly stated the following on the earnings call:

…. now that's clear that inflation is pervasive and persistent, we have reacted by increasing prices in the segment of our business that have longer-term contracts, such as our Tropical Fruit division and Value-Added Salds. And we're pleased that our customer base has largely been supportive and understanding. Within the diversified segments of our business, pricing tends to be more dynamic, and to date, we've been able to largely pass-through cost increases by working closely with our suppliers and our customers.

and furthermore:

…. we have been pleased with the response from our customers to the price increases that we have looked for and we're progressing well towards having the pricing in place to offset current inflationary pressures in full, in 2022.

[emphasis above in bold mine]

It’s important to understand what management are saying here - they have managed to secure price increases to fully offset current cost pressures in FY22 under long-term contracts for the Fresh Fruit and Fresh Vegetables segments which account for 45% of revenues, while in the diversified Fresh Produce segments (55% of revenues) where pricing is “dynamic” they’ve been able to mostly pass-through cost increases. On this basis, it would seem that much of the cost inflation pressures experienced during Q3 should reverse out in FY22 as customers have agreed to accept higher pricing.

Another significant positive was Dole taking delivery of two new ships during the summer which has further optimised their supply infrastructure:

Year-to-date, as numerous global ports have suffered with congestion and delays, leading to equipment shortages and rising shipping costs, we have been able to insulate ourselves from the worst of the crisis by relying on our owned assets and by operating out of ports where we have our own operating teams on the ground. In addition to the protection of our integrated supply chain, has afforded us in the current environment. I'm very pleased to say that both the size of the new vessels and the new routes we have implemented, bring both a better environmental footprint as well as reduced costs. To give it a color, with the two new ships, we were able to retire 4 old ones.

It is my sense that while the fleet has reduced by two ships, this should increase efficiencies while maintaining Dole’s supply chain/infrastructure advantage vs. peers.

Leverage is already below their post-IPO target of 3x, at 2.76x indicating the balance sheet is in robust shape and already ahead of management’s target leverage level communicated at the time of the IPO.

Dole has also initiated a dividend of $0.08/share set to be paid out in January - this equates to 2.4% annualised yield and is exactly in line with management’s previous approach at Total Produce - similar to the leverage point, this again indicates management are already delivering on their plan.

Finally, management provided full-year FY21 guidance of ~$9.2bn - $9.4bn in revenue and $390m - $400m in EBITDA; at the midpoint this is 6.5% YoY EBITDA growth vs. FY20 and again in line with management’s longer term guidance of 5%-7% EBITDA CAGR - BUT it should be noted this is before any synergies; assuming FY22 customer price increases kick in as outlined and a minimum EBITDA of say $400m is achieved this implies an FY22 base case EBITDA of ~$430m before any YoY growth on FY21 (assuming the midpoint of $35m in previously guided synergies).

On balance, the Q3 results were very positive in my view and certainly more impressive than FDP’s, while I believe management made a good first impression on for their first earnings call with analysts. Yet the stock dropped further following the call, closing down ~2.6% to ~$12.82 which implies Dole is now valued at just 6.4x FY21 EBITDA before synergies, or just 5.8x EBITDA including ~$35m of synergies!

I continue to believe my investment thesis for Dole remains intact, and if anything is possibly enhanced now by the further catalyst of food price inflation given how management have been able to either contract or negotiate price increases across all its major produce categories - remember, fresh produce is an essential staple, and wellness and healthy heating are structural tailwinds that the business will benefit from, particularly as economies (eventually) re-open post-COVID and the food service industry also returns.

So what is Dole worth based on the latest facts now available?

Updating my Base Case valuation, I continue to see Dole reaching ~$40/share in time, assuming a 14x multiple on CURRENT FY21 EBITDA as follows:

Source: Value Situations analysis.

Key assumptions and commentary as follows:

Multiple - I’m aware this seems high in the context of the current multiple and FDP’s historic range, but I believe 14x is justifiable for the following reasons:

Competitive Position - It reflects Dole’s global market leading competitive position as the largest fresh produce business globally, with scale advantages and the most extensive owned supply chain and distribution network.

Growth - My Base Case EBITDA assumes no growth being the FY21 outturn, therefore a higher multiple is justified to price in the growth potential of ~5% - 7% EBITDA CAGR out to FY25, which management are already delivering on (+12.6% LTM YoY and +6.5% YoY based on full year FY21 outturn of $395m) despite the supply chain and cost challenges. Note that if Dole achieves synergies of $35m and grows EBITDA at the low end of 5% of management’s growth targets, this 14x drops to 11x which is broadly in line with historic private market deal multiples in the fresh produce sector (Chiquita, Fyffes Plc).

Comps - Dole’s US-listed peer group has historically traded at an average of ~14x - 15x; while FDP has fallen from a 10x to ~8x currently due to a weak Q3 performance (which partly reflects issues specific to FDP’s own model and sales strategy with no read across for Dole), the direct US peer group of FDP, Mission Produce (AVO) and Calavo Growers (CVGW) have in aggregate traded at an average of ~15x YTD, and on average are trading at ~14x currently on both a LTM and NTM basis:

Source: Value Situations analysis.

On this basis, given Dole’s scale, growth prospects and competitive position relative to peers, I believe a 14x multiple is not unreasonable for a re-rating over the ~2 years.

For earnings power I assume the midpoint of management’s guidance of $390m - $400m for the full year FY21, being $395m.

In line with my original underwrite, in arriving at equity value I adjust EV for pension liabilities, shares of JVs and other investments and non-core real estate assets, which implies a current valuation of ~7.3x when these are factored in.

In my Base Case, I get to ~$41/share or 220% upside vs the current price, and implying an IRR of 79% / MOIC of ~3.2x over a two year term.

In my updated Downside Case, I assume a flat 7x multiple on current year EBITDA with no synergies or further growth achieved (which I believe is extremely pessimistic assumption) - this implies downside of just ~8% vs the current share price, indicating a an extreme asymmetric set-up vs. the Base Case. (At a reward/risk ratio of ~26x, this might be the most asymmetric situation on a risk-adjusted basis in the market currently).

Why Do I think Dole continues to be so mis-priced?

In addition to a lack of familiarity with management and limited public financials, it’s seems the market is pricing Dole for cost inflation-induced stagnation.

The market is effectively extrapolating current conditions out into future years, i.e. the market assumes the Q3 PF EBITDA ~$59.7m and the implied Q4 EBITDA of ~$57m (FY21 guidance of $395m - LTM PF EBITDA of $337.7m) is representative of future earnings power - to “invert, always invert,” as Charlie Munger would say, rounding Q3 and Q3 PF EBITDA to ~$60m of EBITDA a quarter equates to annualised PF EBITDA of ~$240m. Breaking back from the current EV of ~$2.5bn, this implies a forward multiple of ~10.5x.

This might seem like a fair multiple relative to FDP’s historic multiple and private market deals. However, it ignores the fact that management have been able to fully offset the cost pressures from FY22, which clearly suggests that Q3 and Q4 are NOT representative of Dole’s NTM or future earnings power. Furthermore, if inflation does subside and Dole have already contracted price increases for ~45% of their business, Dole may even outperform in terms of EBITDA margins. But for now, based on my indicative downside scenario, I think the bottom for Dole is close to being priced in.

In conclusion, it must be remembered that Dole has only been a publicly-listed company in the US for 129 days - it is very early days in terms of the investment community and wider market becoming familiar with management and the combined business, which needs to include an understanding that this is not David Murdock’s Dole Food Company. The fact that Dole is now paying a dividend and is yet to be added to indices and ETFs will also mean more institutional capital will be pulled into this name in time.

One final thought I have is that if newer plant-based wellness names like Oatly (OTLY) and Beyond Meat (BYND) can trade at 4.7x and 7.8x NTM sales while being consistently loss-making (and that’s after steep share price declines for these two), then it strikes me that Dole as the largest fresh produce company in the world, with a global asset base and stable earnings power just might be mis-priced at ~0.26x NTM sales / 6.4x EBITDA as well as at a meaningful discount to peers.

Essentra Plc - A New Idea Bench Name

Essentra Plc (ESNT) is a name that I’ve just recently added to my Idea Bench as on initial review it appears to have many of the characteristics and upside potential that I seek out in an overlooked value situation.

ESNT is a UK-listed manufacturer and distributor of industrial components, healthcare packaging and cigarette filters. Previously known as Filtrona, the company was primarily a cigarette filter manufacturer before it diversified into industrial components manufacturing, and more recently healthcare packaging through a series of acquisitions. This diversification strategy/spree was lead by the previous CEO Colin Day, and its fair to describe it as disastrous. Day stepped down in 2017 and since then his successor Paul Forman has led a rationalisation and operational restructuring of the business, culminating in its three current segments - Components, Packaging and Filters.

ESNT’s share price reflects this poor performance of the recent past, with the stock down ~25% over the last 5 years amid profit warnings and disappointing performance through its ongoing turnaround. What makes ESNT so interesting now is that it may finally have reached a turning point as management recently announced two separate strategic reviews of the Filters and Packaging segments, with a new strategic goal to become a pure-play industrial components business. Management outlined their rationale as follows:

Over the last few years, Essentra has simplified its portfolio into three global businesses, each with leading market positions and a clear purpose and strategy. These businesses all have strong prospects and the potential to deliver compelling returns for investors, but are at different stages of their development and have limited synergies. The Board has therefore concluded that, in order to maximise shareholder value and the potential of each of its businesses, Essentra should become a pure play global Components business over time. This will enable strategic focus and an acceleration of organic and inorganic growth.

Management’s rationale here makes complete sense - there are no obvious synergies between the 3 units and their combination under one roof must surely mean they’re not being run optimally. ESNT currently trades at a multiple of ~10x LTM EBITDA compared with components peers such as Grainger and Fastenal which trade at 14x and 24x respectively, as well as UK industrial services peers such as Electrocomponents Plc and Diploma Plc which trade at ~16x and 24x respectively.

My initial sense is that these strategic reviews may lead to the successful divestment of the Packaging and Filters segments by end of FY22, transforming ESNT into a pure play industrial components business that should merit a higher multiple in line with peers. I see the Components business as being an attractive core asset here, in that it supplies a wide range of essential components to a number of industries that should continue to exhibit robust growth, including the automotive, equipment manufacturing, metal fabrication and electronics industries. Furthermore, the cash proceeds from these disposals could effectively clear ESNT’s ~£290m of debt and transition its balance sheet to a net cash position and possibly facilitate share buybacks, generating further value for shareholders.

So what type of a value situation might ESNT offer here?

I need to do some proper work on this name, but on a preliminary, high level basis I could see ESNT re-rating to £4.80/share of ~50%+ upside vs the current share price (£3.16 as at time of writing), based on a 15x multiple on FY24 EBITDA of ~£76m for the component business, which assumes 5% revenue CAGR and a 24% EBITDA margin (in line with current margin levels so I’m not giving any credit for improved operating performance as a more focused, standalone business).

The 15x multiple is derived from the average NTM multiple for a number of US and UK-listed peers (~40% of ESNT’s revenues are generated in the US), including names such as WW Grainger, MSC Industrial, Fastenal (all US-listed) and Electrocomponents Plc, Ferguson Plc, Trifast Plc and Diploma Plc (all UK peers). My initial analysis here also assumes that the Packaging and Filters units are sold at 9x, with ~£495m of cash proceeds (net of taxes and costs) which would fully wipe ESNT’s debt, leaving a net cash position of ~£330m.

Beyond these divestments, a further catalyst for value realisation in time may be a take-private once ESNT transitions to being a pure-play components business. This is only a quick gauge of the situation, but ESNT certainly looks like it may offer some meaningful upside, with limited downside given the current indifference/negative perception around the stock due to its recent past.

Good summary on $dole, agree with your overall assessment. I also read your initial write-up as I researched the name recently.

US investors are notoriously inward-looking and often gave an initial cold shoulder to companies listed overseas, even though Dole is as America as it gets.

I would hesitate to tag 14x as the base case, but I do think 8-10x would be a very reasonable range, which offers decent upside potentials.

All in all an excellent job finding this hidden gem. patience is (fortunately) unfortunately very much needed in this case. Cheers

Siyu

Essentra is an interesting opportunity - took a hard look at this one back in Sept / Oct and spoke to one of their bankers about breaking up the company...was surprised to see their announcement just a few short weeks later. In my view, current management has done a good job at streamlining and improving the quality of businesses over past few years. On consensus numbers, this one trades much cheaper - around 7x, due to expectation of improved performance in healthcare packaging segment.

For this one to re-rate, Filters needs to be sold - the marginal institutional UK / European buyer won't touch this due to ESG and the tobacco exposure here. But the growth opp in this segment is compelling, with the premium filter business in China and adoption in EU market of biodegradable filters, as regulations on plastic filters are changing in 2024-25.

Healthcare packaging has been a hot mess in recent years but their acquisition in Sept '20 looks like a great move as they bring on strong operators in North America. So far, they've provided great disclosures on improvements made to this business and even recently remain committed to margin targets, even with cost and labor inflation creeping into this biz, which I doubt they'd do unless super confident about their ability to perform. Currently this is a 4% EBITDA margin business, and management has guided to 8% to 10% improvement next year. Longer-term, this should be a 10% to 12% EBITDA margin business, so the margin expansion opportunity is very real here and will simply come down to shifting out of restructuring mode and getting some operating leverage on the business. Will just take time for performance to flow through the financials and market has been burned before by them, so will take some time to believe margins are sustainable. And this is a highly-fragmented industry with loads of opportunity for consolidation. Always envisioned them growing this to critical mass and then spinning this off from Industrial, but think that would take a few years, which is why the announcement surprised me.

And for industrial distro segment, this one has fantastic margins and seems well-positioned post-Brexit. They'll just need to return this to growth which can be done by bolt-on deals, as they play in a highly-fragmented market. Organic growth has been a weak point, though, I think.

Your initial valuation work is reasonable in terms of the upside opportunity here.