The Real Asset Ownership Complex

The appetite for real assets, and an overlooked real asset play in the O&G sector.

Disclaimer

Value Situations is NOT investment advice and the author is not an investment advisor.

All content on this website and in the newsletter, and all other communication and correspondence from its author, is for informational and educational purposes only and should not in any circumstances, whether express or implied, be considered to be advice of an investment, legal or any other nature. Please carry out your own research and due diligence.

I create nothing – I own.

Gordon Gekko, Wall Street.

This week’s newsletter was originally intended to be a quick idea on how to play the the surging energy prices in the US and Europe but has evolved into something of a dissertation on the current interlinkages between inflation, private capital and real assets. So please forgive the length of this issue, and feel free to skip down to the Quick Idea section for this week’s equity situation.

In Oliver Stone’s Wall Street, financier Gordon Gekko declares his privileged position as an owner of assets (in his case equities and real estate) to his would-be protégé Bud Fox, and this idea of asset ownership strikes me as particularly relevant for investors today amid inflation concerns.

Perhaps the hottest topic in the today’s financial markets and the issue on which most investment decisions currently hinge is inflation. Inflation rates across major western economies are running at their highest rates in over a decade - Eurozone inflation is at a decade high of 3%, (within this Germany’s inflation rate is at a 13 year high of 3.4%); in the UK, inflation is running at a 9 year high of 2.9%, while in the United States the inflation rate is 5.3% (again the highest in ~13 years).

This has prompted a debate on whether the current inflationary trend is transitory or structural in nature. The consensus among central banks is it is transitory, being attributable to one-off or temporary issues such as supply chain bottle necks and labour shortages following the pandemic shutdowns across economies and industries. Now with the re-opening of economies and the release of pent-up demand running ahead of supply, there are time lags and bottle necks with re-ramping production to meet the rebound in demand. This is essentially the transitory argument.

The structural inflation view is that the record amounts of central bank stimulus in response to the pandemic (estimated at ~$9 trillion of QE among the Big 4 central banks in the US, UK, Europe and Japan) has resulted in an increase in the money supply such that inflation is unavoidable, particularly given that this spending (unlike the GFC response post-2008) has flown directly into the real economy with wage and business supports initially, and now rising wages (a key ingredient for inflation). This combination of increased spending and rising wages with pent-up demand and a build-up in consumer savings during the lockdowns is therefore expected to drive up the cost of goods and services beyond the near-term.

It’s also worth highlighting that there is a third view outside the transitory/structural debate, which holds that beyond the initial re-opening the long-term outlook is in fact deflationary, due to 4 forces that were present pre-COVID and which will continue to persist:

Debt - The enormous global debt overhang post the pandemic will ultimately dampen demand as corporations and governments who borrowed their way out of it will need to service this debt for years to come, at the expense of investment and growth. This overhang will weigh on global growth, with the implication of higher taxation needed for governments to service this debt, further dampening consumer demand.

Demographics - globally the population aged 65 and over is growing faster than all other age groups and a retiring “baby boomer” generation (the wealthiest generation of all) means the drawdown of savings to fund retirement, leading to reduced spending and consumption by what was once a key demographic cohort for growth.

Globalisation - globalisation has reduced the cost of goods thanks to cheaper labour and manufacturing overseas, and this is expected to resume again post-COVID, with a reversal or unwinding of global supply chains viewed as unlikely.

Technology - technological innovation in areas such as automation and e-commerce have steadily reduced the demand for labour, putting downward pressure on wages. This in turn will continue to reduce demand for goods and services as workers generally have less money to spend (the retail apocalypse is perhaps the best example of this).

I’m not an economist nor can I predict the future, so my conclusion is that I simply don’t know whether the current inflation is transitory or structural. If I was pressed to give a view with the proverbial gun to my head, my sense is that the truly enormous debt overhang has the potential to override everything else, and so central banks will intervene as required to ensure interest rates remain low for two fundamental reasons:

Low rates make the global debt burden serviceable, at both the sovereign and corporate levels. Significantly higher rates could trigger mass defaults and a deep recession or even depression. After the GFC and the COVID recessions, my sense is that central banks will work to prevent another economic crash - the “whatever it takes” approach to central banking. One only has to look at the co-ordinated response to the pandemic - a wave of defaults expected never materialised and the S&P 500 rebounded past its pre-COVID high within ~6 months of the market low in March 2020.

Given the debt burden, we actually need inflation above 2% in order to reduce the real cost of this debt, or simply put the goal is to inflate the debt away. Maintaining a low rate environment via supportive monetary policy works to this end.

My guess as to the result of this approach is inflation may persist beyond a transitory period, for financial assets at least. In thinking about how to invest in such an uncertain environment, I think it’s instructive to look at where the “smart money” is flowing to in response to current conditions. In a colloquial context, the smart money may be defined as the guy or the family that owns most of the property or stores in your local town. They effectively have a controlling interest in the town’s economy and generate wealth from it. In a financial market context, the smart money is that group of market participants who own all the assets and have the key relationships with banks and funders. This group was once known as private equity, but is now better described as private capital.

The Real Asset Ownership Complex

It is said that COVID accelerated a number of trends that existed before the pandemic hit, such as remote working and e-commerce penetration. I believe it also accelerated private capital’s appetite for real assets.

With interest rates being so low for so long (since the GFC), capital has increasingly flowed out of traditional fixed income and equities in search of yield, into so-called alternative investments comprising private equity, hedge funds, venture capital, real estate, private credit and infrastructure, sometimes collectively referred to as private capital.

As I’ve written about before, private capital has enjoyed a continued boom through the pandemic and has record amounts of dry powder to invest. It’s interesting to note that within the private capital arena, real assets such as real estate, infrastructure and natural resources have come to represent a much greater share of industry AUM over time:

There are numerous examples of this shift away from traditional LBO investing to the buying up of real assets, with firms like Blackstone and Brookfield Asset Management among the leading exponents within this shift. It’s also interesting to note this shift has occurred while the question of inflation has become more and more prominent. Key real asset themes that have attracted private capital include last-mile logistics warehousing (Blackstone’s “highest conviction theme”), travel & hospitality real estate, housing (and specifically single family rental and low income housing), and and most recently even supermarkets and office real estate.

Infrastructure, traditionally funded from public finances, has also become an increasingly sought-after real asset class for private capital, in anticipation of a construction super-cycle for infrastructure projects (thanks to government stimulus in response to COVID), with ~$300 billion of dry powder currently waiting to be deployed into infrastructure projects alone.

Other notable examples of private capital’s increasing appetite for real assets include the recent KKR-led bid for Sydney Airport and Bill Gates’ ownership of farmland through his Cascade Investments vehicle - Gates is the largest private farmland owner in the US, owning ~269,000 acres of land across 18 states, on which essential staples such as carrots, onions, potatoes and soybeans are grown.

So what is the common link between all these types of real assets that have come under the control of private capital ?

It’s helpful to recall a textbook definition of real assets - physical assets that have an intrinsic worth due to their substance and properties, and which include precious metals, commodities, real estate, land, equipment, and natural resources.

In thinking about the types of real assets that private capital has pivoted towards, one could also think of them as “real-ly needed” assets, essential physical assets that ordinary people need and use - housing, supermarkets, farmland, hospitality and even warehouse real estate today all meet fundamental needs in the modern economy, rather than being conventional financial assets.

Returning to my point of looking at where the “smart money” is flowing to, what makes private capital’s pivot into real assets most interesting at the current juncture is that these assets may be potential hedges in both inflationary and deflationary environments - in an inflationary regime, income streams from real estate, farmland and infrastructure assets are usually CPI-linked. In addition, as real assets, their replacement cost (e.g. comprising concrete, lumber, labour costs etc.) should increase in inflationary times also, making them more valuable. Conversely, in a deflationary climate, given these assets’ essential role or output their value should hold up better than other asset classes; as economist David Rosenberg has said, in deflationary times you want to own whats scarce, and assets that hold their value more relative to others are the most scarce of all in a deflationary market.

So the appeal of essential real assets to private capital is that they offer a way to play the current inflation vs. deflation conundrum; hence private capital has evolved into what I term the “Real Asset Ownership Complex.”

Oil & Gas: An Out-of-Favour Real Asset Sector

Readers might note in my discussion above that I don’t mention commodities, the most actively traded of all real asset classes. Furthermore within commodities, oil is the most traded and yet despite an improving demand profile and its wide range of industrial uses, until this year it remained an unloved commodity among investors.

Notably, despite its appetite for real assets the Real Asset Ownership Complex has avoided the traditional energy sector (despite it being a major funder of expansion in the previous cycle) due to the ESG considerations of its limited partners.

Indeed the energy sector has never been more unpopular, and is at its lowest weighting within the S&P 500 index in over 30 years:

It’s declining profile among investors reflects a number of factors, including the experience of the US shale boom and bust, steadily declining oil and gas prices and perhaps most obviously, growing climate change concerns and the ESG-led shift away from fossil fuels. With respect to oil, the politics and motivations of OPEC+ also plays a part, adding an additional layer of risk for investors given the cartel’s ability to artificially intervene in the market and regulate supply.

So with the energy sector at a historic low in terms of market weighting, where has the capital flowed instead? Investors have steadily rotated out of energy into technology since about 2014, with this best conveyed by the chart of the XLE ( US energy sector ETF, comprising large cap traditional oil & gas names) vs. the XLK (US technology sector ETF, comprising large cap tech growth stocks) - the divergence since 2018 is stark:

Even the energy majors themselves have been shifting away from oil and gas (O&G), and pivoting to renewable energy as part of their ESG mandates, resulting in large asset divestment programmes, making traditional energy perhaps the least loved sector with even its own majors turning away from it.

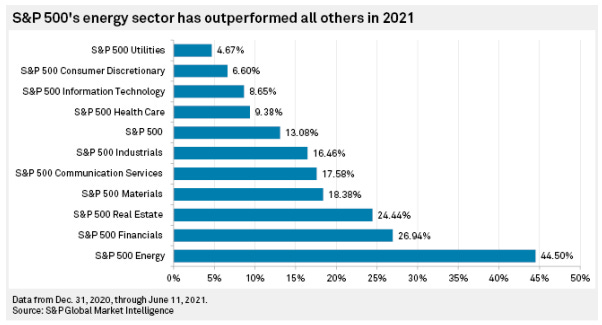

Interestingly, despite its clear unpopularity the O&G-heavy energy sector within the S&P 500 is in fact the best performing sector this year by a wide margin:

This out-performance has been driven by 2 factors:

Capital recently rotating back into energy names as part of a post-COVID cyclical recovery and inflation trade; and

Improved cash generation prospects for O&G companies that have been more disciplined with regard to new production capacity, instead focusing on free cash generation and returning capital to shareholders after years of over-expansion and poor returns through the previous energy cycle.

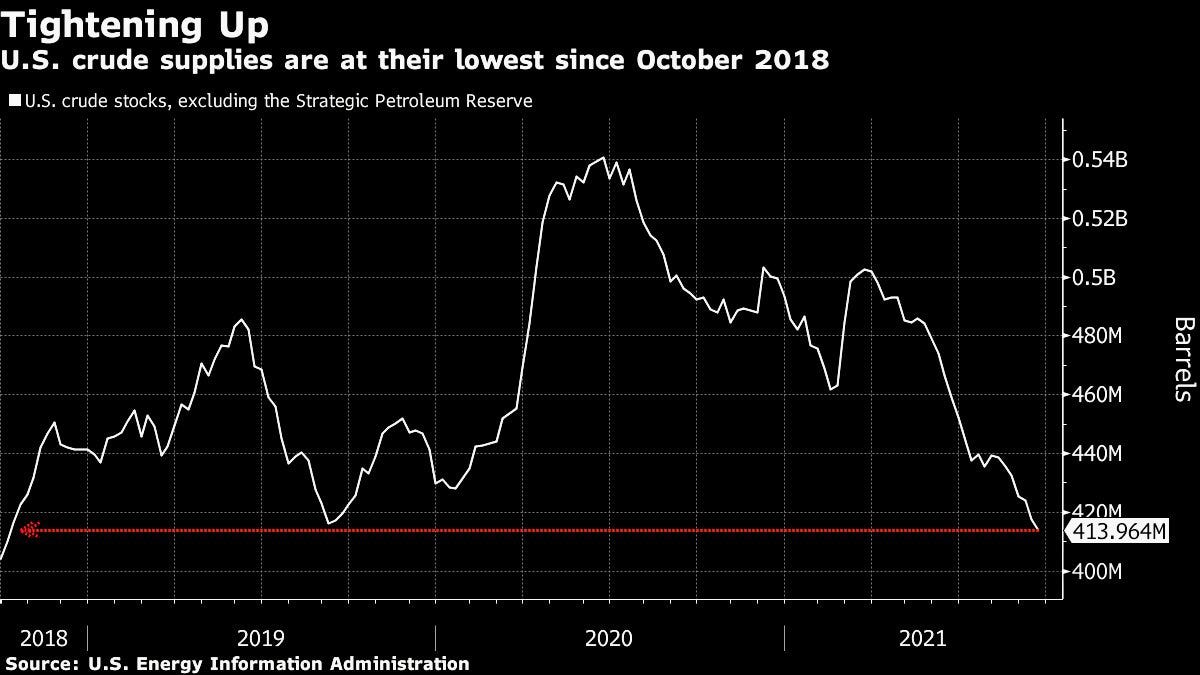

Most recently, performance has been helped further by the surging energy prices and an expectation of oil prices to increase meaningfully due to rising demand and supply concerns - as COVID shutdowns curbed production over the last ~18 months, inventories have been run down, and US crude oil supplies are now at their lowest in ~4 years as we approach a potentially harsh winter :

Source: Bloomberg

Against this backdrop of tight supply, the oil price outlook continues to strengthen, with Goldman Sachs forecasting an oil price of $90/barrel if the coming winter is colder than usual, and Bank of America forecasting $100+/barrel oil by next year, or earlier if a harsh winter materialises. OPEC, the IEA and the US EIA are now forecasting that global oil demand will exceed 100 million barrels per day (higher than pre-COVID 2019 levels) by next year.

The positive price outlook and rising demand for oil has prompted renewed M&A activity within the energy sector, with the most recent deal of note being ConocoPhillips agreeing to acquire Royal Dutch Shell Plc’s Permian Basin assets for $9.5 billion in cash. This perhaps portends further consolidation among industry players as the O&G majors divest of assets for ESG reasons and smaller operators exit the market.

Yet despite this robust outlook for oil, digging into the wider energy sector’s performance this year its interesting to note that oil is the laggard. Firstly, regarding the underlying commodities, oil is up ~50% YTD but well behind natural gas (~100%) and coal (the world’s most hated commodity, up ~120%+ YTD):

The very strong performance by natural gas (NG1 above) and coal (XAL1) has flowed through into their respective equities, with coal producer Peabody Energy up ~460% YTD (and ~690% until 2 weeks ago) and natural gas producer Antero Resources (AR) up ~230%), with other gas and coal names ahead of major oil equities such as ExxonMobil (XOM) and Occidental Petroleum (OXY):

Reflecting on the above, within the energy complex oil equities stand out as being relatively overlooked and therefore a potential value situation having lagged natural gas and coal, and with very positive fundamentals:

Despite ESG mandates and a focus on carbon emission reduction, oil remains an essential commodity for energy and industry, and its usage is not going to decline in the medium term.

Rising demand for oil, likely to return to pre-COVID levels or higher

Constrained supply, with oil inventories at multi-year lows

An energy crisis due to surging natural gas prices creating the possibility of oil-to-gas fuel substitution, driving incremental demand (and therefore oil prices even higher) from a switchover from gas to oil for electricity generation

It’s becoming increasingly understood that the various ESG policies to reduce fossil fuel usage are having a counter-productive effect on energy prices, as renewable energy generation is not able to bridge the gap between continued demand and fossil fuel plants going offline as we transition to renewable energy sources - a Twitter thread by John Arnold articulates this whole point very clearly and succinctly:

There is therefore the potential for oil prices to follow coal and gas and move substantially higher over the next 12-24 months, which bodes well for oil equities.

Much like the Real Asset Ownership complex, I’m interested in owning real assets that are essential to economies and industries and which are supported by favourable dynamics, particularly given the current inflationary outlook. Within this frame of thinking, certain oil equities strike me as being an interesting way to participate in the real asset ownership theme in a way that the private capital complex cannot given its ESG constraints.

A Real Asset Quick Idea - Pantheon Resources Plc

My quick idea on how to play this oil theme is Pantheon Resources Plc (PANR, PTHRF).

Company Overview

PANR is a ~GBP£420m / $575m market cap independent O&G exploration and production company listed on the London AIM market. While incorporated in the UK, its business is focused on an enormous oil resource on the Alaskan North Slope spanning approximately 160,000 acres, where it has a 100% working interest over a world-class oil resource, with an estimated ~16 -21 BILLION barrels of oil in place (OIP), making it one of the largest oil finds since the 1960s.

In January 2019, PANR acquired the assets of Great Bear Petroleum ("GBP") for ~$50m. GBP was an O&G explorer focused on the Alaskan North Slope (ANS), where it had been operating for almost a decade. As part of this transaction, hedge fund Farallon Capital Management acquired ~20% of PANR as a part of a debt settlement owed to it by GBP when PANR acquired GBP. Farallon remain the largest shareholder in PANR, owning ~19% of the company, and continue to periodically sell off shares as a way of recovering the legacy debt owed to it.

PANR’s key assets comprise 3 projects with an estimated 16 billion barrels OIP, of which ~1.9 billion barrels are currently estimated as recoverable:

Greater Alkaid - 1.2 billion barrels of OIP, of which 76.5 million barrels of oil (MMBO) have been independently verified as recoverable

Talitha Shelf Margin Deltaic (SMD), Zone B - 2.7 billion barrels OIP, of which ~404 MMBO is estimated as recoverable by management (note this excludes 2 other zones within the Talitha SMD, zones A and C)

Theta West - total of 12.1 billion barrels OIP, of which 1.4 billion BO are estimated as recoverable

Source: Company filings and management commentary.

It should be noted that management, in addition to disclosing vast amounts of detail and technical data to support their estimates of OIP and recoverable barrels, tend to be conservative. The entire Talitha SMD project (including zones A,B and C) was previously estimated to contain 1.8 billion barrels OIP, of which ~483 MMBO was estimated as recoverable. In July management announced a resource upgrade for Zone B, estimating that it alone contained the 2.7 billion barrels OIP with ~400 MMBO recoverable, representing a ~50% increase in recoverable oil resource for SMD Zone B.

Furthermore, the currently estimated 1.9 billion barrels of recoverable oil across these 3 projects equates to a recovery rate of ~12% which again appears conservative relative to recovery rates of 20%+ at other comparable oil fields on the ANS.

In addition to the above 3 projects, PANR also has other holdings with an estimated ~4.9 billion barrels OIP, of which potential ~1 billion barrels are currently estimated as recoverable (see SOTP analysis below which sets out each project).

So all told, PANR is sitting on up to 21 billion barrels of oil, of which conservatively ~2.9 billion BO (~14%) is currently estimated as recoverable.

Pantheon’s near-term focus is to prove the commercial potential of the Greater Alkaid and Talitha projects. As management stated on the recent August 2021 webinar and technical update, the strategy is clear:

We plan to prove up and sell this asset. For many on our team this is our last endeavour. And we plan to exit with a big win.

In terms of immediate next steps, PANR needs to obtain funding or achieve a farm-out of assets in Q4 2021 to ensure sufficient resources for working capital and to fund the next stage of its drilling and testing programme. The near-term objective is to test all zones of the Talitha discovery well, and to drill at least one other well at either Alkaid or Theta West. With regard to funding requirements, management are in ongoing discussions with various development partners to progress this.

Thesis & Valuation

PANR sits on a world-class oil discovery of 16 billion+ barrels of oil, and appears significantly undervalued based on precedent comparable transaction valuations for similar assets in the Alaskan North Slope area.

PANR’s current market cap of £420m / ~$575m implies a valuation of just $0.20 per barrel of oil (BO), based on the total estimated recoverable resource of ~2.9 billion BO. To put this in perspective, the most recent comparable transaction for PANR’s assets was Oil Search’s acquisition of interests in the Pikka and Horsehoe oil developments in 2017, when it paid $3.10/barrel of recoverable oil, or 15.5x the value of PANR’s assets as implied by the current market cap.

The value gap between the Oil Search assets and PANR’s is particularly notable given the following factors:

PANR’s Alkaid and Talitha projects are in a superior location for development compared to Pikka /Horseshoe, being located adjacent to the Dalton Highway and Trans-Alaskan Pipeline System (TAPS). Pikka/Horseshoe are located much further away from critical infrastructure, meaning that the cost to develop PANR’s assets should be relatively lower (and therefore have a NPV higher also).

Oil Search acquired partial interests (25.5% interest in Pikka and 37.5% in Horseshoe) as opposed to PANR’s 100% working interest in its assets

The Pikka/Horseshoe interests acquired by Oil Search were much smaller, at ~129 MMBO recoverable vs. PANR’s 1.9 billion barrels at its 3 key assets alone

At the time of Oil Search’s deal, WTI oil was trading at $55/barrel vs. today’s price of $74/barrel and forecasted to rise above $80, enhancing the NPV of PANR’s assets.

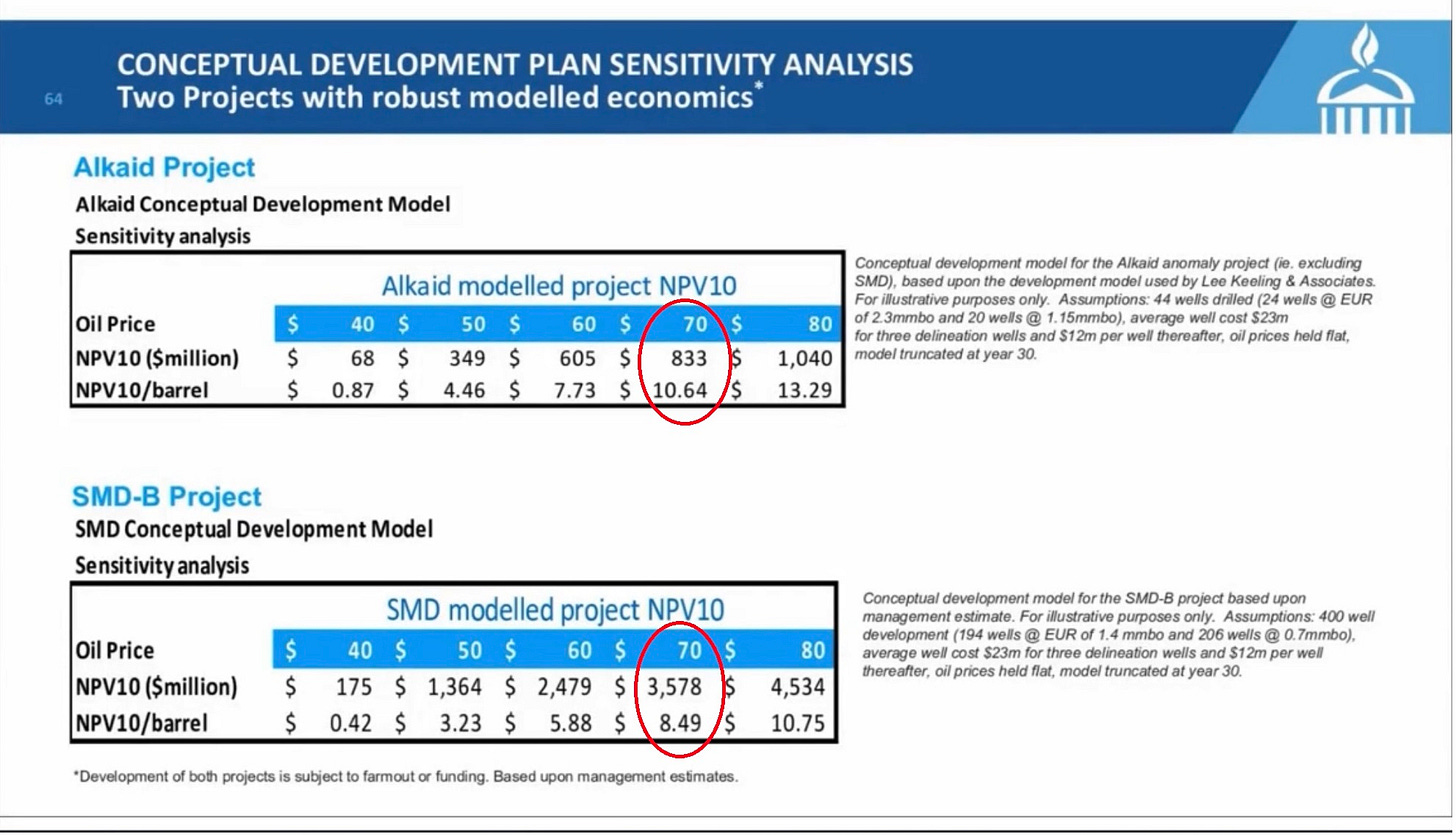

Furthermore, management’s latest development analysis for the Alkaid and Talitha SMD Zone B assets indicates NPVs per barrel significantly higher than the $3.10 Pikka/Horseshoe comp - assuming $70/barrel oil price and a 10% discount rate, management estimate an NPV per barrel of $10.64 (or 3.4x Pikka/Horsehoe) for Alkaid and NPV/barrel of $8.49 for Talitha SMD-B (2.7x Pikka/Horseshoe) :

Source: Pantheon Resources Plc Technical Presentation, August 2021

Pulling all this together, my indicative SOTP analysis values PANR at a risk-adjusted NAV of $5.20/share or £3.80/share, or ~6x the current share price of £0.60, as follows:

Source: Value Situations analysis; management information.

Commentary & Key Assumptions:

OIP and recoverable resources as per management disclosures

$ per BO - for Greater Alkaid and Talitha SMD Zone B, given the relatively superior profile of these assets vs. the Pikka/Horsehoe assets, I assume these merit a premium value per barrel. For these 2 projects I assume the midpoint of the $3.10/barrel comp and their respective NPVs per barrel at a $70 oil price as outlined above; for the other projects I assume the $3.10/barrel in line with Pikka/Horseshoe, which may be conservative.

Cash - PANR had reported cash of ~$30m in the most recent financial statements (Dec-20); however given passage of time and ongoing WC requirements, I assume this cash is not available to shareholders and is needed to fund opex pre-farm out, and so ascribe a nil value in the above SOTP.

Risked EV & NAV arrived at by assigning probability of success rates to each of PANR’s assets - in the August technical update, technical director Bob Rosenthal stated the following with regard to risk and probability of success:

We’ve eliminated the exploration risk, we’ve found hyrdocarbons, and we’re well beyond the exploration stage….. we are at 60% - 70% confidence of success.

I assume the 60% low end of management’s probability range in arriving at a risk weighted value for the Alkaid and Talitha SMD B Zone assets, being the most progressed projects, and assign lower probabilities of 30% for the remaining Talitha sections and the Theta West project. Given that oil has been confirmed at each of these locations, and the extent of work done to date and management’s conservatism I believe 30% is a reasonable assessment for these. Leonis is an exploration play and so I assign a 10% probability to reflect greater uncertainty around this project.

This SOTP analysis implies a risked NAV of $3.8bn or $5.20/share, equating to ~£3.80/share at current USD/GBP FX rate, which implies PANR is currently trading at just 0.16x risk-adjusted NAV, and offers 533% upside / 6.3x MOIC at the current share price.

Alternatively, if I value the Alkaid and Talitha SMD Zone B assets at $3.10 in line with the Pikka/Horseshoe asset the implied risk-adjusted NAV/share is still a multiple of the current share price, at £2.98, or ~4x the current share price.

Looking at the valuation another way, if we just consider the Alkaid and Talitha SMD Zone B assets ONLY, and value their estimated recoverable oil resources at the $3.10/barrel and a 60% probability of success, this implies a risk-adjusted NAV of $1.20/£0.87 per share, or +45% above the current share price, and implies one would still get the remaining ~2.4 billion barrels of recoverable oil resource for free. On that basis it seems like PANR offers an extremely wide margin of safety given this real asset backing, while offering multibagger return potential.

Catalyst

The catalyst to realise value here is a farm-out or sale of the company to a major development partner, and this is actively being pursued by management against the backdrop of increasingly positive news around the scale of PANR’s oil resources.

As CEO Jay Cheatham stated during the August webinar update, management’s intention is to further prove their resource estimates and monitise the company’s assets to realise a return for shareholders, similar to the historic Oil Search transaction, and management are actively looking to progress this.

Discussions are ongoing with a number of potential development partners regarding a farm-out of part or all the company’s projects. The strategically advantaged location of PANR’s assets close to key infrastructure, the recent resource upgrade for the Talitha project as well as the enormous potential for Theta West should generate strong interest from development partners. Furthermore, the recent oil price strength and the more robust outlook for oil demand is likely to heighten interest further for a full acquisition.

In order to trigger the ultimate catalyst of a full sale/exit, PANR needs to obtain new funding or achieve an initial farm-out in Q4 2021 in order to further prove their resources at Talitha and/or the Alkaid and Theta West projects this winter.

Based on the information provided to date by management, I would expect a successful winter drilling and testing campaign to result in a full farm-out or buy-out of PANR.

Why Does This Opportunity Exist ?

From initial review, I believe the PANR opportunity exists for the following reasons:

Speculative Risk Perception - while PANR has potentially enormous recoverable oil reserves, further drilling and testing is required to prove resources sufficiently to attract a bid similar to the Oil Search deal.

Funding / Farm-Out Risk - PANR is not income generating and requires further funding to progress with the winter testing programme; as such it needs to progess with a farm-out or other funding discussions to progress its strategy. There is also the potential for further dilution in obtaining new funding.

Non-fundamental selling by Farallon - Farallon’s shareholding in PANR is a legacy of it previously being a lender to Great Bear Petroleum (acquired by PANR in 2019). Farallon converted its former loan to GBP into equity in PANR and has been periodically selling down its shares as a way of recouping the historic GBP debt. As such, this is a weight on PANR’s share price.

Negative sentiment towards O&G due to fossil fuel & ESG concerns and oil price decline trend since 2008 have reduced investment appetite among oil majors and development partners.

PANR is a small-cap O&G stock listed on the AIM, with only 2 brokers covering it and as such is overlooked by equity investors.

In summary, investors require further visibility on the outcome of points #1 and #2 above in particular before being convinced that a buy-out of PANR at $3.10/barrel (or more) is likely.

While there remain some uncertainties, my initial sense is that given the extent and quality of work done by management to date, and the sheer scale of PANR’s oil discovery in a strategically advantaged location on the ANS (a proven, oil-rich location), the probability of a successful outcome here is high, even after factoring in delays and/or dilution from a farm-out or funding round.

For example, PANR previously raised $30m in November 2020 to drill the Talitha discovery well, which diluted shareholders by ~12% at the time. If PANR sought to raise twice that amount (which it does not currently require) at the current share price, this would indicatively increase the share count by ~73m shares and reduce the SOTP risked NAV value above from £3.80 to £3.46 (or still 5.7x the current share price), a reduction of ~11% to my risk-adjusted NAV.

In terms of a downside (no funding/farm-out or a failed drilling campaign), it should be emphasised that PANR is debt-free and currently valued at $0.20/barrel based on the current market cap - it is effectively priced like an option with a binary outcome including a zero value possibility, which seems implausible after the latest update has clearly shown that PANR is now beyond the option-like exploration stage and has confirmed finding a world-class oil resource.

I would argue the uncertainty in this situation is NOT that PANR may recover no oil, but rather it is around quantum - i.e. how many million or billion barrels of oil will be recovered in time. This uncertainty is not the same thing as risk in this situation.

Conclusion

To conclude, on a preliminary analysis PANR is a highly asymmetric real asset play, but priced like an option that could expire worthless despite it being past the exploration phase. While the ultimate value of PANR’s assets currently remains uncertain, given the facts to date it seems reasonable to conclude that they are worth much, much more than $0.20/barrel today.

For those interested, I would recommend watching the April and August 2021 webinar updates where management set out their key projects and the work done to date in extraordinary detail, which I believe provides comfort to the tangibility and recoverability of PANR’s oil resources.

Much appreciate the great work you have always been doing!

The motivation of why Farallon (aka. the investment manager of CHONS and the concert GBPO) has been consistently selling seems to be a continuous puzzle. Looks to me all the info we have about "Farallon's debt fund not allowed to hold equity so they are selling for non-fundamental reasons" has been guesswork, which has been proved wrong several times (about why Farallon "stopped" selling. The latest TR-1 disclosure looks like Farallon's selling is "unstoppable".

Curious if you have any smoking guns in that regard.

Thanks.

This is really, really interesting stuff. Lately, been spending a lot of time in midstream Oil and Gas as I like the value proposition there amongst increased consolidation like you mentioned. PANR looks like a good R/R here.

What do you think about increasing allocation to an Oil/Gas ETF? I like the capital cycle dynamics at the moment, but I don't believe that the situation around ESG will get any worse – these companies are hated by the public and policymakers, and seem like the typical "sin stocks".