More Items of Interest

Exploring Tesla's valuation, and a new name for the idea bench - Wood Plc

Disclaimer

Value Situations is NOT investment advice and the author is not an investment advisor.

All content on this website and in the newsletter, and all other communication and correspondence from its author, is for informational and educational purposes only and should not in any circumstances, whether express or implied, be considered to be advice of an investment, legal or any other nature. Please carry out your own research and due diligence.

Following on from last week’s Items of Interest, for this week’s newsletter I thought I’d explore two news stories that piqued my interest over the previous week, one being a valuation exploration of Tesla and the second a new quick idea, namely UK-listed Wood Plc.

Tesla - Fundamental Valuation & What It Implies

Last week’s discussion of the Rivian IPO overlapped with some recent news coverage of Tesla (TSLA), which has prompted me to try and get my head around its current, almost inexplicable valuation. TSLA is perhaps more than any other stock emblematic of the current market environment, which is widely regarded as being at best overvalued or at worst a full-on bubble. Interestingly, TSLA straddles most of the hot themes that have driven equity markets since the COVID crash in March 2020, with it being perceived as:

A structural growth story, given the secular shift to electric vehicles and the energy transition

A FOMO/YOLO /meme stock, thanks to the Twitter antics of Elon Musk

A bitcoin and cryptocurrency play, thanks to its holding of ~43,200 bitcoins worth ~$2.5bn at current prices (Musk’s personal holdings in bitcoin and other “altcoins” are also a driver of sentiment for TSLA stock among crypto-followers)

A high-growth tech stock on a par with the FAANGM complex, and now part of the “Trillion Club” with a market cap of ~$1.1trn.

A cult-of-personality-story stock akin to the Steve Jobs-era Apple, with Musk as the corporate visionary that one should not bet against; as some evidence of this Musk is the 14th most followed person on Twitter, with ~64m followers (more than Bill Gates and the Twitter corporate account itself, and notably the only corporate CEO in the Top 20 list, perhaps cementing his “rockstar” CEO perception)

None of the above speak to TSLA’s specific fundamentals (revenues, earnings power and assets) that would (and should) ordinarily drive corporate valuation. Yet these narratives have proven so powerful in investors minds that they have driven TSLA to a $1.1trn market cap. To put that in context, the current market cap underpins TSLA’s (enterprise) valuation of ~24x LTM sales and ~147x LTM EBITDA (per Koyfin data as at the time of writing).

So what is TSLA worth, and what does it’s current valuation imply?

Professor Aswath Damodaran, Professor of Finance at NYU’s Stern School of Business, often referred to as the “Dean of Valuation,” is perhaps best placed to answer the first part of this question. Damodaran wrote an interesting piece in the FT last week, in which he convincingly made that case that the extreme valuations of Tesla, Rivian and other story stocks are driven by narratives rather than business fundamentals, causing value investors to disregard them and miss out on their subsequent price appreciation. TSLA is an exemplar of this narrative effect with stocks - it is up ~61% YTD vs. a robust ~25% for both the S&P 500 and NASDAQ indices. But even this doesn’t fully capture the full power of how these narratives have worked - if we step back further in time to the COVID market bottom of ~18th March 2020, TSLA is up 1,221% vs. ~119% for the NASDAQ and ~86% for the S&P 500, a staggering outperformance for a company with questionable financial fundamentals:

What is TSLA worth on a fundamental basis? Damodaran’s piece in the FT led me back to his latest TSLA fundamental valuation analysis on his blog, which I recommend reading.

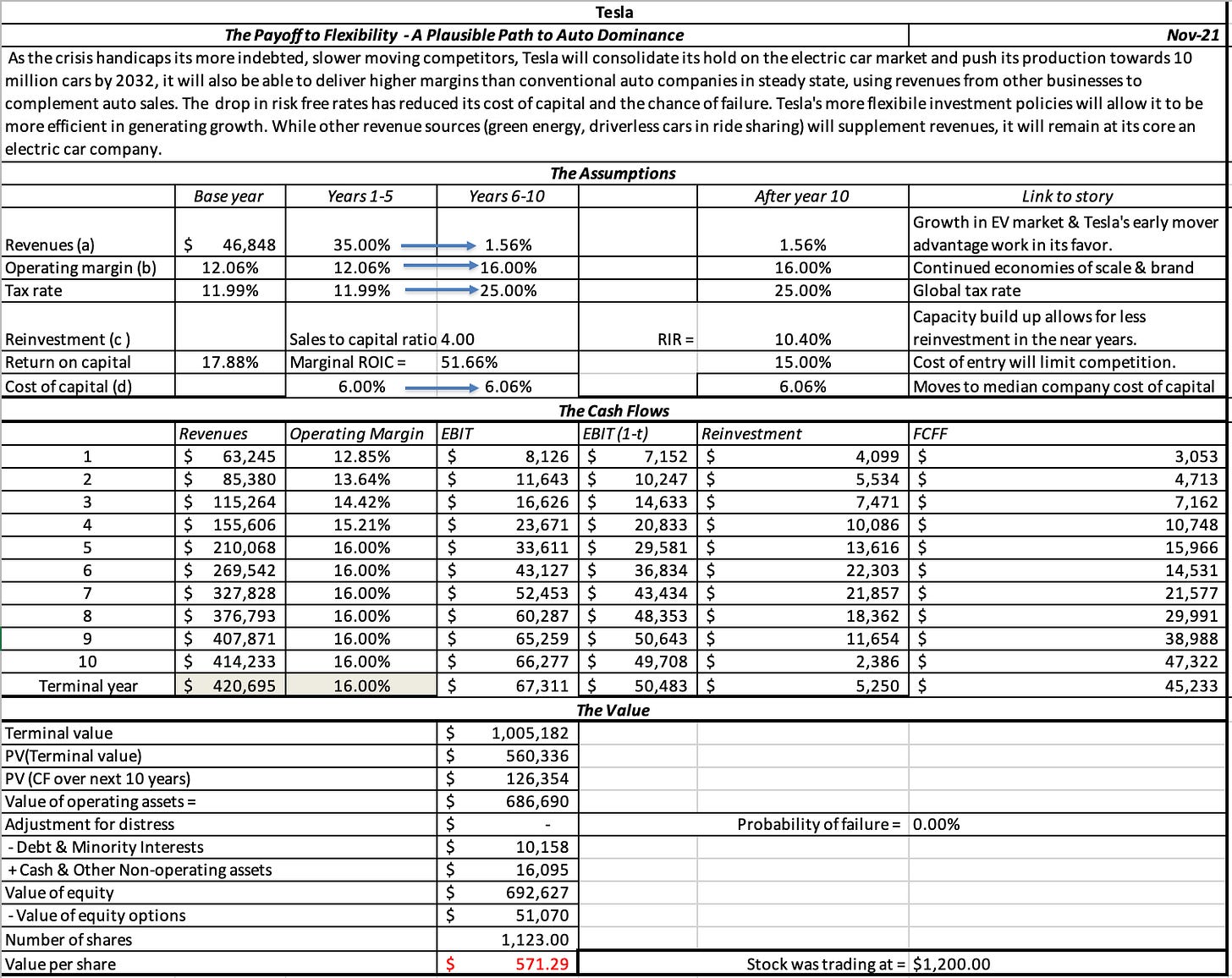

Crunching the numbers and projecting future revenues and earnings power for TSLA, Damodaran concludes that TSLA is worth ~$571/share today, or about half the current share price. Inverting this, his analysis indicates TSLA is 100% overvalued today:

Source: Musings on Markets

This begs the question then that if TSLA is worth $571/share today, what is the other ~$586/share within the current share price ($1,157 based on yesterday’s close) pricing in? This led me to an interesting post on Twitter by Nitzao who stated that TSLA “is much more than just a car company”:

Breaking down the 6 sectors that TSLA straddles (as identified by Nitzao) this seems like a fair assessment - it isn’t just a conventional car company as it has had to invest across an array of other technologies and markets given the wider electrification and technology transition that EVs are part of:

Source: @Nitzao, Twitter

This got me thinking that perhaps one way of looking at TSLA’s current share price is to view it as a stock with an embedded option value. The core business itself might be worth $571/share based on prospective, fundamental earnings power and growth potential, while the balancing $586/share is effectively the option value of TSLA’s successful execution on all the ancillary technologies it has invested in, across hardware & software, energy, batteries, engineering and other sectors. Perhaps this is how equity markets are justifying TSLA’s current valuation?

However, there are two problems with this in my view. Firstly, it would suggest that at $571/share alone, TSLA’s core auto business is valued at ~74x LTM EBITDA, which still seems VERY rich, given the enormous competition it faces and the execution risk with increasing production, vehicle quality etc. Secondly, it also suggests that the option value of the other technologies being developed today is greater than the value of the core business, which seems excessively optimistic in my view. And again that’s before factoring in the enormous competition it faces across each adjacent sector it has entered as @Nitzao’s breakdown above shows.

My conclusion is that despite the genuine promise of the various narratives and technologies underpinning TSLA’s share price, this exercise confirms it remains a highly speculative investment proposition. I would not bet against Elon Musk or his personality cult but TSLA clearly faces significant competition in every aspect of its business model in the years ahead. And so it seems to me that the majority of TSLA’s current valuation rests on hope value rather than fundamental value.

Quick Idea: Wood Group, a new name for the Idea Bench

London-listed engineering services business Wood Group (WG) caught my eye as a quick idea last week upon reading a report in the FT about its latest trading update. WG announced it has initiated a strategic review of its Built Environment Consulting business, as one option to potentially unlock value “for shareholders that Wood believes is not currently being recognised in its market capitalisation.”

WG has historically operated as an oil & gas-field services business, but has been pivoting towards green economy/ESG-related sectors such as renewables and carbon capture in recent years, with ~20% of revenues now being generated from construction and ~25% from renewable energy (across solar, wind and hydrogen).

WG’s share price has dropped ~33% YTD to ~£2.07/share (as at the time of writing) and is down ~50% from its pre-COVID high of £4.22, following a disappointing H1 FY21 performance, with revenue and profiting warnings issued due to delayed projects and investment decisions among its customers as a result of the COVID pandemic. The company provided a further trading update as part of its strategic review announcement last week which included a further lowering of guidance for the FY21 year outturn, with the stock dropping 7% in reaction to this update.

Despite the disappointing YTD trading update, management indicated a positive outlook, stating:

Overall, we expect to deliver improved revenue and earnings in the second half of 2021 relative to H1 2021. While we are seeing robust activity in Consulting and Operations, the rate of recovery in Projects has been slower than anticipated largely due to the deferral of activity and awards into 2022. We have maintained strength in our order book which is up c18% at the end of September compared to December 2020, with growth in Consulting and Operations, and representing a book to bill of 1.3x.

So while the current year looks challenging, the indications are that the business should rebound in FY22 - note that management have said activity is deferred, rather than projects (and revenues) being actually lost. So this appears to be a timing issue. And when one considers WG’s exposure to ESG tailwinds, the robust outlook for O&G with rising oil prices like to be sustained, and a healthy book-to-bill ratio, it seems reasonable to think WG’s performance is temporarily depressed rather than impaired.

The potential sale of its Built Environment Consulting (BEC) business is interesting also - note the company’s description of this division:

The built environment business provides consulting and engineering solutions that address environmental risks, increase climate resilience, help to build more sustainable infrastructure and improve mobility. It operates across government, transportation, water, industrial, energy and mining markets and has a track record of attractive growth and resilient performance through Covid-19. A growing order book and exposure to both government stimulus for infrastructure development and the drive for sustainability and climate resilience, most notably in North America and the UK, positions the business well for future growth.

Again this unit appears to be leveraged to the ESG/sustainability/infrastructure end-markets, which all benefit from a supportive outlook in the medium term.

In that context and noting that Jacobs Engineering Group recently acquired a majority stake in PA Consulting at an implied valuation of ~15x and KKR acquired ESG consultancy ERM for 19.6x, WG’s overall valuation of just 5.5x on FY21E EBITDA looks excessively pessimistic, even bordering on distressed, for a business that will still do revenue of ~$6.4bn and EBITDA of ~$550m this year (and this is a bad year!).

On this basis, WG looks like an interesting situation worthy of a spot on my idea bench. At a very high level, my initial thought process/thesis here is as follows:

WG appears undervalued at 5.8x FY21 / 5.5x LTM vs. its long-term average of ~9x and vs/ listed peers such as Saipem and TechnipFMC currently trading at ~7x+.

The stock is mis-priced due to market short-termism with an overreaction to temporarily depressed current year performance, which ignores actual future prospects.

Possible event catalyst in place with the divestment of its attractive BEC unit, for which there is likely to be strong private market interest at robust valuations - average multiple for most recent private market comps involving Jacobs and KKR is ~17x.

The disposal would clear outstanding debt and leave the residual WG business in a net cash position, thereby repositioning the company which still benefits from a favourable outlook across its other businesses - the strong order book and rebound in activity deferred in H1 also offers some visibility to improving performance into FY22.

Admittedly, this is a just a quick take on the situation and a deeper dive is required to properly assess the investment case but I think there’s enough here on an initial basis to merit further investigation.

My quick valuation analysis is as follows:

Source: Value Situations analysis; current share price of £2.08 as at time of writing, 22 Nov-21

Key points:

Current year FY21E EBITDA of $550m based on midpoint of forecast EBITDA margin of 8.6% on revised guidance revenue of $6.4bn, implying CY valuation of 5.8x.

I assume BEC net divestment proceeds realised of $1.55bn, based on a 12x multiple (vs. 15x - 19.6x for recent private market deals) on BEC unit EBITDA of $162m; BEC EBITDA is estimated from an assumed 12.5% EBITDA margin on expected $1.3bn in unit revenues for FY21 as disclosed in the recent announcement, and net of assumed 20% tax and cost leakage (a guesstimate for the sake of conservativism):

Source: Value Situations analysis

On a PF basis, assuming the BEC business is sold at 12x, WG’s balance sheet moves to a net cash position (~$267m) with an implied valuation of 4.3x at the current share price and PF EBITDA of $388m after backing out BEC unit EBITDA.

I then assume a re-rating to WG’s historic average multiple of 9x on PF EBITDA of $388m, which I propose supported by the favourable outlook for the remaining business; this implies ~96% upside and a 25% IRR / 2x MOIC return profile over a 3 year investment hold.

For an indicative downside, I assume a depressed 5x multiple on reduced EBITDA, which I assume drops by 30% from FY21E levels to just $272m. This is a fairly draconian case, effectively on a par with 6 months of depressed earnings - note that EBITDA for H1 this year was $262m, which reflected the project delays and fall-off in revenues.

Indicative downside is -15% vs. the current share price, implying a highly asymmetric risk/reward with upside of over ~6x the downside risk.

On this cursory basis then, WG has many of the characteristics I seek for an attractive value situation - a very cheap absolute valuation relative to peers and private market transactions, an out-of-favour stock that is mispriced on short-term concerns, solid business prospects, a transformative event/catalyst in the near-term, and a highly asymmetric risk/reward profile that helps mitigate downside risk. A very interesting situation in my view.

Thank you, Conor, for the great post. Regarding the part on Tesla, I totally agree with you but it looks like we are in another case in which markets can stay rationale for longer than we can stay liquid. This said, what is your perspective on the analysis now that 2 years have passed?

Great analysis. Some points of note:

Using LTM to analyze high growth stocks such as Tesla is not the best approach? Look at TAM of EV's, Tesla's potential/estimated market share of the EV market on a forward looking basis and then forecasted volume/revenue growth. Implies a forward looking P/E that is high but more in line with other high potential growth stocks. Gary Black's analysis is exceptional.