Welcome to the third Value Situations investment memo on my latest actionable public equity situation, Willis Towers Watson Plc, which I believe is fundamentally mispriced following the termination of its proposed merger with AON Plc.

I have written before about the importance of creative thinking in finding attractive investment ideas, with mergers being one area within this framework that can offer attractive equity opportunities that don’t correlate with the direction of the wider equity markets.

With equities near all-time highs and supported by record margin debt and retail speculation against a backdrop of macro concerns ranging from Evergrande contagion to an energy crisis, mergers and other event-driven situations seem like a good pond to fish in to avoid any swells that might flow from wider market risks crystallising.

Reading over a recent note from asset manager GMO prompted me to look again at merger arbitrage situations. In the note, GMO reports that current deal spreads are wider than historically observed levels within its merger arb funds, indicating an opportunity for investors, as wide deal spreads are a key indicator of attractive prospective returns. In the note, GMO cites the recent collapse of the AON-Willis Towers Watson merger as a possible trigger for the widening of deal spreads, thus creating an opportunity set for equity investors.

Having examined the broken AON-Willis deal in further detail, I believe Willis Towers Watson (WLTW) is ironically the most interesting opportunity to come out of the current merger arb arena. Following my analysis of recent events, WLTW is my latest high conviction value situation, as I outline in this week’s memo edition of the newsletter.

Feedback is welcome and if you like this newsletter please share with friends and colleagues.

Disclaimer

Value Situations is NOT investment advice and the author is not an investment advisor.

All content on this website and in the newsletter, and all other communication and correspondence from its author, is for informational and educational purposes only and should not in any circumstances, whether express or implied, be considered to be advice of an investment, legal or any other nature. Please carry out your own research and due diligence.

We operate in an oligopoly which not everyone understands.

Attributed to AON Plc Chief Broking Officer, US Department of Justice Antitrust Complaint, June 2021.

WLTW is the third largest insurance brokerage and advisory business globally and operates in an oligopoly with a small number of other brokers.

Its proposed merger with AON Plc collapsed in July after the US Department of Justice sued to block the transaction on antitrust grounds.

It is now significantly undervalued relative to peers and its future prospects following the presentation of a new growth strategy that includes a substantial capital return plan at its recent Investor Day.

I estimate WLTW’s equity will be worth ~$403/share upon delivery of management’s plan, implying ~67% upside from today’s share price (+72% including dividends), with a indicative return profile of 19.9% IRR / 1.72x MOIC over a 3 year investment term to FY24).

Furthermore, the WLTW situation comes with limited downside risk, which I estimate to be at ~$205/share or -15% vs. the current share price, implying a highly asymmetric return/risk profile with upside being 4.3x the downside risk (or ~7x including expected dividends)

The stock is mispriced as the market does not appear to buy management’s growth plan due to historic underperformance with regard to financial targets; however there are a number of mitigants which suggest the market view is overly pessimistic, while even in a downside the capital return targets can be achieved.

The primary catalyst for value creation is the execution of management’s new strategy, however the situation also comes with secondary catalysts in the form of multiple activist investors on the shareholder register and growing private equity interest in the insurance industry which could unlock value.

In summary, with a simple growth strategy that includes a substantial capital return plan, multiple activists on the shareholder register, an incoming new CEO with a strong track record, and an entrenched position in an oligopolistic market, WLTW has all the ingredients for significant value creation.

Situation Overview

At a ~$30bn+ market cap and with 13 analysts covering the name, WLTW doesn’t fit the profile of the smaller, overlooked situations that I typically look at. However, following the collapse of its proposed merger with AON Plc and management’s subsequent release of its new growth strategy, I believe WLTW is now fundamentally mispriced and constitutes a highly asymmetric value situation.

WLTW is a the third largest insurance brokerage and advisory business globally, in an industry that is essentially an oligopoly between 4-5 players, with Marsh & McClennon Inc (MMC), AON Plc (AON) and WLTW being the “Big Three” dominant players:

Source: Company filings; Koyfin. Note: Revenue is for FY20, being most recent full financial year; Koyfin.

Having considered a bid for WLTW for over a year, in March 2020 AON announced it had agreed to acquire WLTW in an all-share deal for ~$232/share or a ~16% premium to WLTW’s pre-deal announcement share price, in a transaction that valued WLTW at an EV of ~$35bn / 14x EBITDA at the time. The transformative deal would have created the largest insurance broker globally with combined revenue of ~$20bn, surpassing MMC.

However the deal collapsed in July with both companies agreeing to terminate the transaction after the US government’s Justice Department sued on antitrust grounds. The collapse of the deal is costly for AON, as it will have to pay a $1 billion termination fee to WLTW under the terms of the original agreement.

Following the failed merger, two notable further developments have occurred:

In August WLTW announced it was divesting of its Willis Re reinsurance business to peer Arthur J Gallagher & Co (ARJ) for a total consideration of $4bn (~15x), with $3.25bn upfront and a further $750m earn-out payment subject to certain conditions in 2025; and

In September, management presented a new growth strategy at WLTW’s Investor Day, summarised in the chart below:

Source: Willis Towers Watson Investor Day, September 2021

Under this strategy, management outlined key financial targets are as follows:

Grow revenues to $10+ billion by delivering growth in the mid-single digit range or greater (implies a CAGR of ~4%+ from FY20 ex-Willis RE to FY24)

Improve operating margins to 24-25% (vs. ~20% currently) through $300+ million net run-rate savings driven by transformation and efficiency initiatives, and operating leverage as the business grows.

Generate higher FCF conversion to deliver $5-6 billion in cumulative FCF by FY24, which when combined with the post-tax proceeds from the Willis Re divestiture and corporate cash balance will give WLTW ~$10-11 billion of available cash by 2024 to drive further shareholder value.

Return significant capital to shareholders via of $4+ billion in share buybacks during FY21/22, while maintaining the ability to do bolt-on acquisitions to accelerate growth and support the business, as well as further share buybacks.

Achieve adjusted EPS of at least $18-21 per share and deliver industry leading total shareholder return.

The chart below summarises these specific financial targets:

Source: Willis Towers Watson Investor Day, September 2021

The Value Creation Opportunity

The value situation with WLTW essentially centres around an enormous capital allocation/return plan combined with a growth strategy involving modest revenue growth and cost efficiency initiatives to drive greater FCF generation.

The growth plan involves very achievable 4% - 5% top-line growth out to FY24 with $300m of cost efficiencies to drive operating margin from ~20% to 24% - 25%. Both these measures seem reasonable in my view for the following reasons:

Regarding revenue growth, 4% - 5% is in line with the company’s historic growth rate since 2016 (post the Towers Watson acquisition), and a continuation of historic trend seems a reasonable expectation given WLTW’s entrenched position within a global oligopoly that has consistently exhibited low, but steady predicable growth (~5% average revenue CAGR among WLTW / AON / MMC over FY16 - FY20 period).

In terms of cost efficiencies, the $300m equates to ~3% of FY20 revenues (ex-Willis RE) and are to be achieved via rationalisation of the company’s real estate footprint, upgrading and modernising IT systems and simplifying operations. AON had identified $800m of synergies under the failed merger plan, which will have highlighted to management where costs savings can be best achieved, and $300m seems readily achievable against this previous target.

A key component of the value thesis for WLTW is management’s substantial capital return plan, with $8.5bn - $9.5bn projected to be returned to shareholders (of a projected $10bn - $11bn in available cash) by FY24:

Source: Willis Towers Watson Investor Day, September 2021

The key points on capital allocation are as follows:

$3.5bn of post-tax proceeds receivable from the Willis RE disposal ($3.25bn) and the AON merger termination fee ($1bn).

$5bn - $6bn in projected FCF generation over FY22 - FY24 driven by growth and cost efficiencies outlined above.

$1bn share buy-back underway through FY21 plus a further $3bn buyback to be implemented in FY22, funded from the Willis RE disposal and AON termination fee proceeds.

$1.3bn in dividends to be paid out over FY22-FY24.

Further share buy-backs of ~$4bn to be implemented by FY24.

With the share buybacks and dividend targets, management intend to return ~$9.3bn to shareholders by FY24, which equates to ~30% of WLTW’s current market cap and ~25% of total shares outstanding at the current share price, which is a significant driver of value creation for WLTW.

Business Overview

Business Description

WLTW is the third largest insurance brokerage and advisory business globally, with 46,000 employees and services clients in more than 140 countries. It’s client base ranges from large multinational corporates to middle-market domestic companies and includes many of the world’s leading corporations, including ~93% of the FTSE 100, 91% of the Fortune 1000, and 91% of the Fortune Global 500 companies.

The business operates across 4 segments:

1. Human Capital & Benefits( HCB, 35% of revenues) - provides advice, broking, solutions and software for client employee benefit plans, and client HR departments and management teams. HCB is the largest segment of the Company, and has 4 primary offerings:

Retirement - actuarial support services, pension plan design, pension admin services.

Health & Benefits - provides plan management consulting, broking and administration across the spectrum of health and group benefit programs, including medical, dental, disability, life and other coverage.

Talent & Rewards - provides advice, data, software and products to address clients’ rewards and talent needs.

Technology and Administration Solutions - provides benefits outsourcing services to clients across multiple industries.

2. Corporate Risk & Broking (CRB, 32% of revenues) - provides risk advice, insurance brokerage and consulting services, and places more than $20 billion of premiums into the insurance markets on an annual basis. Main business lines include Property & Casualty, Aerospace, Construction, Financial, Facultative (reinsurance), Marine and Natural Resources.

3. Investment, Risk and Reinsurance (IRR, 18% of revenues) – works closely with investors, reinsurers and insurers to manage investment risk and return profiles, and provides investment consulting, discretionary management services and insurance-specific services and solutions.

4. Benefits Delivery & Administration (BDA, 15% of revenues) - provides primary medical and ancillary benefit exchange and outsourcing services to active employees and retirees across both group and individual markets. A significant portion of the revenue in this segment is recurring in nature, driven by either the commissions from policies sold or from multi-year service contracts with clients.

Business Model

As an insurance broker, WLTW is an intermediary between clients and insurance carriers and so does not underwrite insurance risk itself. It generates the majority of its revenues from either commissions or fees for brokerage and consulting services. Commissions are typically set at a % of insurance premiums paid by clients to the insurers, with these rates agreed between WLTW and the insurer. While commissions fluctuate with the underlying premiums, consulting and other service fee income is typically stable.

Insurance brokerage is an attractive, resilient business in that insurance itself is an essential requirement for clients regardless of economic environment, and the brokerage industry enjoys high barriers to entry on top of this for a number of reasons:

As should be clear from the segment descriptions above, corporate clients’ requirements are complex and often specialised, and therefore clients NEED the expertise and scale of service offering provided by brokers such as WLTW.

Sticky recurring revenue profiles with high retention rates (WLTW retention rate is 95%+ in various segments) due to long-term client relationships, that are subject to multi-year contract terms in many instances.

While brokerage is a relationship business, client relationships are protected from employee attrition via non-compete and non-solicitation clauses in employment contracts, further supporting client retention rates.

Following consolidation in recent years, the large global brokers like WLTW enjoy an oligopoly position where there are few alternative brokers that can provide the array and depth of services and advice required by clients.

As a brokerage business, capital requirements are relatively low resulting in significant free cash flow generation.

Finally, given their scale and access to large client bases, brokers have some degree of leverage over insurers in negotiating commission rates and fees.

Competition & Performance

With regard to competition and consolidation in recent years, following the DOJ action and collapse of the AON/WLTW merger, further consolidation among the top 4 players (MMC, AON, WLTW, AJG) is now unlikely, and so further growth is likely to be achieved by bolt-on acquisitions and organic growth.

The resilience and stability of the brokerage model is obvious from the historic track record of the big three brokers MMC, AON and WLTW, with all three growing revenues through the GFC and COVID:

Furthermore, looking specifically at WLTW’s track record, its has exhibited steady, consistent YoY growth over a 20 year period, with the notable increase in 2016 following the acquisition of Towers Watson by Willis Group as it was then known:

One area where WLTW has lagged peers is its mixed track record in terms of capital allocation and returns on capital:

Return on Capital - WLTW vs. peers since 2014:

As the above chart shows, WLTW’s ROC declined steadily from ~10% in 2015, largely attributable to the then Willis Group’s “merger of equals” with Towers Watson in 2016 which created the present WLTW business. In summary, the merger didn’t achieve the synergies originally projected and ROC has lagged peers since, which has clearly been reflected in subsequent share price performance since then, with WLTW a clear laggard among its peer group:

However despite the historic under-performance and the failed AON merger (which only offered a modest 16% premium to shareholders) I believe the current set-up for WLTW is compelling , with the busted deal actually being the catalyst for management’s new growth and capital allocation strategy that I expect will drive significant value creation, as I set out below.

How Much Can I Make? - Valuation & Return Analysis

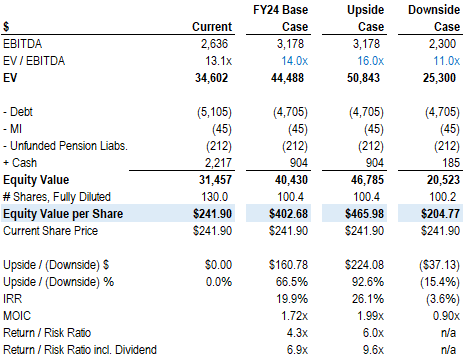

I estimate WLTW to be worth $403/share upon delivery of management’s growth and capital return plan by FY24, based on FY24 EBITDA of ~$3.2bn at a 14x multiple, and capital returns via share buybacks and dividends.

Financial Projections & FY24 Earnings Power

I estimate EBITDA of ~$3.2bn by FY24 vs. LTM EBITDA (ex-Willis RE unit) of ~$2.4bn, implying a CAGR of ~9% from FY21 - FY24 vs. 10% from FY18 - FY20:

Source: Company filings; Value Situations analysis.

Key assumptions as follows:

Revenue grows at ~5% CAGR from FY21- FY24 to $10.4bn, in line with 4.8% CAGR from FY18 - FY20.

Operating Income margin expands by 3.5% from ~21% to 24.5% (mid-point of management target margin) via cost efficiencies and operating leverage.

Bridging from adjusted operating income to EBITDA, assuming D&A and other items continue to run at ~6% of revenues (in line with historic average), FY24 EBITDA runs to ~$3.2bn (~30.5% margin).

FCF/EBITDA converts at ~50% in FY21-FY22, in line with historic average conversation rate from FY18-FY20, before picking up to 55% by FY23-FY24, in line with LTM adjusted FCF conversion of ~56% - 57%. Note that this adjusted FCF conversion in LTM period excludes a once-off payment of $185m incurred in H1 FY21 relating to a historic legal settlement. As this is non-recurring it is reasonable to assume FCF conversion improves to this ~55% level under management’s growth plan.

Note that the projected FY21 - FY24 CAGRs for revenues, operating income, EBITDA and FCF are all either below or in line with their respective historic CAGRs from FY18-FY20, i.e. I do no assume any above historic trend or industry growth rates, and on that basis I believe these are reasonable assumptions.

Valuation Multiples

I conclude that a 14x multiple is appropriate for valuing WLTW on a standalone basis, derived from its own historic valuation through the cycle (10 year average of 14.1x) and that of its main peers (13.6x):

Source: Koyfin; Value Situations analysis.

Notably, WLTW is trading at a significant discount to peers on a LTM basis despite a clear growth strategy being presented to the market:

Source: Koyfin; Value Situations analysis.

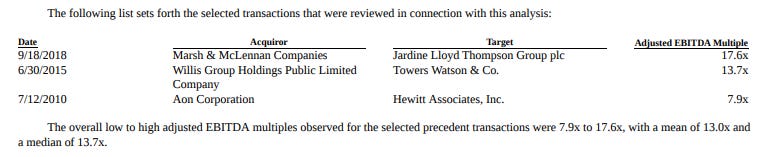

In addition to WLTW and listed peers’ trading multiples, it’s also worth highlighting recent precedent transactions in the insurance brokerage industry:

Source: Schedule 14-A SEC filing for AON-WLTW merger, July 2020

Excluding AON’s acquisition of Hewitt Associates above on the basis of it being a dated deal, the average precedent transaction multiple is ~15.6x.

Finally, looking at the most recent value reference points, AON were bidding ~14x LTM EBITDA for WLTW, while its also worth highlighting that ARJ are acquiring the Willis RE unit for 15x.

On the basis of the above market evidence, I conclude that 14x is a reasonable multiple to value WLTW at today for my Base Case underwrite.

Valuation Analysis

Pulling the above together, in a Base Case that (reasonably) assumes delivery of management’s growth and capital return plan I estimate WLTW’s EV at ~$44.5bn, with the equity worth ~$40.4bn, or ~$403/share, assuming the 14x multiple on FY24 EBITDA of $3.2bn as per the projections above. This implies ~67% upside to the current share price (~72% including dividends) and a 19.9% IRR / 1.23x MOIC over a 3 year investment term to end of FY24.

My Base Case assumes management executes on its plan and returns ~$9.3bn via buybacks and dividends based on the above FCF projections, and as set out in the valuation bridge analysis below:

Source: Value Situations analysis.

Key assumptions are as follows:

Total cash available to drive value creation of ~$11.3bn, comprising existing cash reserves of $2.2bn, aggregate proceeds of $3.5bn from Willis RE disposal and AON termination fee, and ~$5.6bn in cumulative FCF generation over FY22 - FY24.

Proceeds from Willis RE disposal and AON fee net of tax are $3.5bn as per management guidance

Cumulative FCF over H2-FY21 - FY24 is $5.6bn, which is estimated on basis of cumulative $5.9bn in FCF generated over FY21-FY24 projections above, minus $287m of FCF generated in H1 FY21 per Q2 10-Q.

Total share buy-backs of $8bn over FY21 - FY24, assumed to be completed at average price of ~$270/share (or ~12% above the current share price) on the basis that share price appreciates over time as management start to deliver on plan - I assume buybacks are completed at +10% vs. current price in FY22 / +15% vs. current price in FY23 / +20% vs. current price in FY24. This results in share count being reduced by ~29.6 million shares by FY24.

Total dividend payments of $1.3bn made over FY22-FY24 period

Debt paydown of $400m assumed from cash reserves following Willis RE divestment, as per September Investor Day commentary

Once-off costs of $750m incurred as part of investment to deliver the $300m in cost savings over FY22 - FY24, as per September Investor Day commentary.

In terms of the overall value bridge to FY24 equity value, of the Base Case upside of $161/share management’s growth strategy contributes ~$67/share (or ~40%) of this upside, with the capital return plan being the greater driver of upside, contributing ~$94/share (~60% of the upside):

Source: Value Situations analysis.

My Base Case valuation analysis implies a share price by FY24 of $403/share, indicating upside of +67% before dividends (+72% including dividends) with a target return profile of 20% IRR / 1.72x MOIC over 3 year hold period from today.

In a secondary Upside Case, I assume a 16x multiple to FY24 EBITDA, in line with current YTD and last 3 year average multiples for WLTW’s peer group, resulting in a value of $467/share, or +93% upside before dividends (+99% upside including diviends) with a target return profile of 26% IRR / 1.99x MOIC.

How Much Can I Lose ? - Downside Analysis

I estimate downside risk at $205/share or -15% vs. the current share price, based on a “no growth scenario” with an 11x multiple on flat LTM EBITDA (ex-Willis RE) of $2.3bn:

Source: Value Situations analysis.

This downside assumes the following:

11x multiple reflects low-end of WLTW’s historic trading range post the Towers Watson integration post-2016, and is ~20% below WLTW’s long-term average multiple of 14x; as such I believe this is a very punitive multiple to assign to WLTW given its entrenched position and predictable earnings power, even in a no-growth scenario. Furthermore, given the substantial capital return plan communicated to the market it is unlikely that WLTW would trade at such a low multiple.

Management do not deliver the expected growth or cost efficiencies over the FY22 - FY24 period, and EBITDA flatlines at LTM level of $2.3bn.

FCF conversion of 50% on lower EBITDA results in reduced ~$4.5bn of cumulative FCF being generated through to FY24, which combined with the Willis RE & AON termination proceeds is still sufficient to deliver the $8bn share buyback programme as outlined above.

As per Base Case, dividends and debt paydown are implemented, however only 50% of once-off investment costs incurred as business performance flatlines; further investment assumed suspended as these costs yield no return.

This Downside analysis reflects a stagnation scenario, with the equity valued at $205/share, broadly in line with the WLTW share price pre-AON bid in March 2020, implying downside of ~15% or a 0.9x MOIC based on the current share price and including dividends received over the assumed 3 year hold period.

So even in a pessimistic (and unlikely) downside scenario, WLTW can still deliver on its capital return targets.

In terms of risk/return, WLTW has one of the most favourable and asymmetric return profiles that I can find in the current market, with my Base Case value of $403/share implying upside of 4.3x the downside risk before dividends, and ~7x downside risk including dividends:

Source: Value Situations analysis.

The asymmetry is even more extreme under the Upside Case, with the implied upside before dividends being ~6x the downside (and almost 10x including dividends).

On a risk-adjusted basis, my view is that there is limited downside to owning WLTW at the current share price given the stability and competitive position of the business combined with management’s achievable growth and capital return plans.

As a final point on the downside risk, in reality if WLTW’s performance were to stagnate as outlined above, at an 11x valuation the company would almost certainly become a takeover target, which would likely mean that such a downside scenario would be temporary before a re-rating event would occur.

Why Does This Opportunity Exist?

WLTW is mis-priced as a result of it being a broken arbitrage play with a new growth strategy that the market does not believe will be delivered.

The market has priced in only the Wills RE disposal and AON fee receivables component of the capital return plan, and appears to ascribe no value or probability of success to management’s growth strategy:

Source: Value Situations analysis.

As the above analysis shows, WLTW is trading at a flat 13x EBITDA pre-and-post the Willis RE and AON fee proceeds, implying that beyond this cash receivable the market just doesn’t buy the growth and margin expansion targets set by management. So WLTW is effectively priced for zero growth from the LTM period 13x market valuation (which compares with ~21x for AON and ~18x for MMC currently).

A secondary concern underpinning the mispricing is that investors may also be concerned with the risk of poor capital allocation. This view is most likely held due to WLTW’s historic track record of underperformance relative to peers following its challenging integration of Towers Watson.

I believe these concerns are overly pessimistic for the following reasons:

New CEO Carl Hess will lead the implementation of the new growth strategy, when he commences the CEO role on 1 January 2022. He has a proven track record in the business, having served as head of the Investment, Risk and Reinsurance business since October 2016, where he drove margin expansion of 540bps for that segment over FY17 - FY20. Prior to that, he led WLTW’s Americas business and delivered revenue CAGR of 6.5% during his tenure. As such he is well qualified to deliver the new strategy.

Management’s plan is a relatively straightforward one in that it does not constitute a wholesale turnaround or overhaul of the business. No further transformative M&A is planned and with Towers Watson now fully integrated, the strategy is simply to drive growth broadly in line with historic CAGRs (mid-single digit annual growth), and to improve margins, EBITDA and FCF through identified cost efficiencies, simplifying operations and focusing on core growth areas (such as Health & Benefits and growing market share in Corporate Risk & Broking).

WLTW is part of the industry oligopoly with MMC and AON, and given its position and the characteristics of the brokerage industry (increasingly complex and evolving insurance needs, high barriers to entry, high recurring revenues, long-term and sticky client relationships), a stagnant, or no growth revenue scenario seems highly unlikely, particularly as economic growth rebounds post-COVID.

On the basis of these factors, the market appears to be clearly mispricing WLTW’s future growth prospects.

Catalysts to Value Creation

The primary catalyst for value creation is management’s execution of its growth and capital return strategy, which is already underway with the recent approval of the $4bn share buyback programme, and the disposal of Willis RE to AJG agreed (pending UK competition approval).

Management’s execution of the strategy should result in WLTW re-rating towards my Base Case target valuation by FY24. However, shareholder activism may also be a secondary catalyst that drives further value creation, considering the following recent events:

Insurance Insider recently reported that activist fund TCI have been building a stake in WLTW in the wake of the collapsed AON merger. TCI are said to be engaging with management around WLTW’s broking and professional services businesses.

Separate to TCI, activist firms Starboard Value and Elliot Management have also recently acquired stakes in WLTW

Glenview Capital Management and Vltava Fund have also recently invested in WLTW, further supporting the share price while increasing the potential for additional shareholder activism to drive value.

In summary, with a simple growth strategy that includes a substantial capital return plan, multiple activists on the shareholder register, a new CEO with the right track record, and an entrenched position in an oligopolistic market, WLTW has all the ingredients for significant value creation.

Finally, while not part of my core thesis, it’s also conceivable that WLTW may become a private equity takeover target should it’s stock price continue to underperform vs. peers and/or management falls short of its financial targets.

It’s worth highlighting that WLTW possesses a number of key characteristics that would make it suitable as well as attractive to a PE acquirer:

Stable, predictable revenues and earnings

Strong competitive position with high customer retention and barriers to entry

Strong FCF generation

Low leverage (~1x net debt/EBITDA), with scope to lever up significantly (in tandem with its FCF generation)

Surplus cash available from divestment and AON termination proceeds

According to Marsh Berry, deal activity for insurance brokers was the second highest on record in Q3 2021, with total announced transactions in the United States broker market increasing by ~23% YoY, and within this private capital-backed buyers accounted for ~74% of transactions. While this M&A activity relates to small and middle-market level brokerages, it is indicative of increasing PE interest in the wider insurance-related market.

At the larger-cap end of the market, insurance-related M&A has largely related to acquisitions of insurers by PE firms including Apollo, Blackstone, and CVC. According to S&P Global Market Intelligence, PE-backed M&A in the insurance sector has reached a record high this year by deal value, reaching $19.3bn to August, which already exceeds the full year total for 2020 of ~$13bn and is almost double the 2019 total of ~$10.6bn.

In this context, with increasing PE interest in insurance-related businesses and given WLTW’s current situation with multiple activists present on the share register, a sale or takeover seems like a plausible alternative catalyst for a value re-rating. Notably, at its recent Investor Day Brookfield Asset Management identified Insurance Solutions as one of its 5 new growth strategies over the next 5 years. While BAM’s insurance focus is in areas such as reinsurance and offering liability-matching products to insurers, the acquisition of a global brokerage business such as WLTW could complement this wider strategy in time.

Risks

The primary risk to my thesis is execution risk, where management fail to deliver on their financial targets and capital return plans. However, I believe there are clear mitigants to this.

To recap, under my Base Case and excluding existing corporate cash of $2.2bn, management are projecting $9.1bn in cash available to fund share buy-backs, dividend distributions, debt paydown and once-off cost investments, to come from the following sources:

$3.5bn in combined proceeds from the Willis RE disposal and AON termination fee

$5.6bn in cumulative FCF over FY22-FY24

I see little risk to the $3.5bn receivable from the Willis RE sale and AON fee, as these amounts are contractually agreed. When combined with current cash reserves of ~$2.2bn, there is therefore ~$5.7bn in cash resources to meet the initial $4bn share buyback programme, the $750m once-off investment for cost efficiencies/margin expansion and a $400m debt paydown, with ~$570m of cash remaining.

This therefore leaves the revenue growth and cost efficiency targets as the key risk area to the thesis, as these underpin the targeted $5.6bn in FCF generation from which a further ~$5.3bn will be returned to shareholders in the form of dividends ($1.3bn) and a second buyback programme (~$4bn ). This ~€5.3bn of capital return is a material component of the overall value creation, accounting for ~57% of the total ~$9.3bn of capital to be returned to shareholders under my Base Case.

I believe this execution risk is mitigated by the following:

The AON merger process identified $800m in potential synergies, which will have provided a good guide to management on where and how to best implement their target of $300m in synergies

Even in a flat EBITDA/FCF scenario as outlined in my Downside scenario above, ~$4.5bn of FCF generation is achievable which is sufficient to meet the second $4bn share buyback programme. Combined with residual cash reserves (after the first $4bn buyback programme, debt paydown and cost investment) there is also sufficient cash available to meet the $1.3bn dividend.

On this basis, execution risk around management’s strategy appears to be well mitigated.

A secondary risk to the thesis is that with such substantial cash generation projected, management could decide to pursue other initiatives (e.g. further transformative M&A) that results in poor capital allocation, distraction from the core strategy and ultimately value destruction. Again I believe this risk is low, given the following:

Lessons learned from the Towers Watson integration, which eroded ROIC and stock underperformance relative to peers.

A clear and defined strategy has been communicated at the September Investor Day, which management are unlikely to diverge from after the collapse of the AON merger.

Strategy is being led by new CEO Carl Hess, whose priority on appointment is to deliver on the capital return and turnaround strategy for the business.

Management also made it clear at the Investor Day that they will not be pursuing further large or transformative M&A transactions, and instead will focus on complementary bolt-on M&A where appropriate.

Finally, the presence of a number of activist investors should ensure management are disciplined and pursue the targets outlined in the first instance.

I think you make a good case for the revenue/margin growth and against the execution risk, but your math for buybacks seems generous.

> I assume buybacks are completed at +10% vs. current price in FY22 / +15% vs. current price in FY23 / +20% vs. current price in FY24. This results in share count being reduced by ~29.6 million shares by FY24.

If your price target is $403/share by 2024, it seems unlikely they are going to buy back significant shares at $298 (+20% vs. current price) in 2024.

If you make the conservative assumption that they do their entire $8B buyback at the end at $400/share, then the retire 20M shares and your base case share price would be $367.50, which is 53% above current price, or 15.2% IRR, which is still pretty good.

I'm trying to figure out the business model risk regarding tech disruption. For instance, what is to stop someone like Paycom or ADP from cannibalizing the HR business? Or prevent some startup with an insurance marketplace from eating the brokerage? Is it just that WLTW's clients have such unique needs that commodity SaaS solutions will never support them?