A Milestone & Pantheon Resources Update

Six months of Value Situations; Pantheon Resources raises $96m

Disclaimer

Value Situations is NOT investment advice and the author is not an investment advisor.

All content on this website and in the newsletter, and all other communication and correspondence from its author, is for informational and educational purposes only and should not in any circumstances, whether express or implied, be considered to be advice of an investment, legal or any other nature. Please carry out your own research and due diligence.

While the main focus of this week’s newsletter is an update on Pantheon Resources Plc, I want to open it by acknowledging a minor milestone, in that this issue marks six months since I launched Value Situations back in June with my analysis of the Total Produce/Dole Food Company merger to form Dole Plc.

Given this milestone and as it’s approaching year-end, I wanted to mention some highlights since launching the newsletter (of course if you’d rather skip down to the update on Pantheon Resources, please feel free to do so too!):

Value Situations now has ~2,700 subscribers, including several hundred institutional investors. I’m pleased with the level and profile of readership, having started the newsletter from scratch with no following or readership prior to launching.

I’ve published 23 issues of the newsletter since inception, (including this issue), covering 21 stocks in varying levels of detail.

Of the 21 stocks covered, three have been high conviction memo ideas (Dole, Dalata Hotel Group, Willis Towers Watson), while the remaining 18 fall into various “quick idea” categories, ranging from thematic situations such as Hibernia REIT, US Silica and Pantheon Resources, to standalone value ideas (e.g. Daily Mail & General Trust, Kenmare Resources, Yellow Cake Plc), to thought exercises (Rivian, Tesla) and finally to idea bench summaries such as Avon Protection, Wood Group and Essentra.

The three most popular issues among readers have been (in descending order) The Real Asset Ownership Complex (covering PANR), Total Produce Plc / Dole Food Company and Willis Tower Watson PLC, and I’m pleased to see two of my high conviction ideas to date have resonated with readers.

My Dole idea was selected as one of five finalists at the inaugural FinTwit Stock Pitch Challenge, which was held on the Twitter Spaces platform. My Dole pitch came third in the public vote. My work on Dole was also picked up in the financial media, by MarketWatch and by online news publisher The Currency.

Value Situations has also been positively highlighted online:

One of the greatest challenges in writing the newsletter over the last six months has been endeavouring to originate interesting equity ideas on a weekly basis. This is perhaps not that surprising - as I’ve written about before, finding good ideas in such expensive and frenetic public equity markets as we have today is hard. Paul Singer, the founder and co-CEO of Elliott Management wrote a really interesting piece in the FT last week that reminded me of this challenge:,

… it is puzzling that a growing number of otherwise sober money managers are in the process of boosting their allocations to riskier assets, rather than trying to figure out ways to make some kind of rate of return without giving back years of capital accretion in the next crash or crisis.

[emphasis in bold above is mine]

My objective with Value Situations is to try and figure out ideas that offer asymmetric returns, and that are insulated from (or at least less correlated to) the elevated market risk we face today. I’ve always said I welcome engagement from readers on the newsletter, and now that I’ve reached the six month mark, I thought I’d ask readers to provide some feedback that might help me improve this newsletter further.

I’d be very grateful if readers could please participate in this very brief questionnaire linked below - it’s only four questions and shouldn’t take more than 2 minutes to complete:

Thank you for participating. And now onto the Pantheon Resources situation.

Pantheon Resources Plc Update

Last Tuesday Pantheon Resources Plc (PANR), one of my previous quick ideas released two new pieces of information: firstly, the company announced its FY21 annual results (June year-end) and secondly, a new fundraise of at least $70m, via a $20m new share placing and a $50m - $55m convertible bond issuance.

Regarding the FY21 results, there is little in the way of new information around operations given the corporate update and webinar in August and CEO Jay Cheatham’s update interview in September (both post-PANR’s financial year end).

The two most pertinent items from the accounts in my view were (1) the company’s current opex/cash burn rate (given that PANR is pre-production) and the implications of this on liquidity, and (2) the disclosures around the farm-out process.

Taking the first point on opex and liquidity, the FY21 accounts report an annual opex expense of ~$5m, and negative OCF (cash burn) of -$3.1m. To be conservative then, we can assume that ~$5m is the annual running cost of the company going forward (excluding development capex, which is funded separately via the fundraise). Additionally, PANR reports a cash balance of $5.7m at 30 June (pre-fundraise), so from this we can infer that current cash is approx ~$3.2m, assuming $2.5m of admin opex ($5m / 2) is incurred from June-December 2021.

With regard to the farm-out process, the FY21 results disclosed that PANR is currently in discussions with a potential partner:

The Company continues to be in advanced discussions with a potential farm in partner, where that party would be expected to commit to certain expenditures to earn a working interest in the project.

The status of the farm out is also referred to again in the fundraise placing announcement, which states that “Farm out discussions with one party remain ongoing.” Separate to the company’s disclosures, based on market intelligence I understand that all the oil majors are interested in PANR, so I would expect the potential farm out partner to be a major player that is able to pay a significant premium to acquire PANR’s assets in time.

The results of the fundraise were subsequently announced last Wednesday, with the key points as follows:

Total fundraise of $96m completed, exceeding the original $70m target due to strong interest from institutional equity investors. This is very notable, in that PANR’s share register has been retail-heavy in recent years, with the level of institutional interest now suggesting a recognition of the company’s prospects.

The equity raise was significantly oversubscribed, with PANR deciding to increase the size to $41m (2x the original target), comprising $38 million via an institutional placing, and $3m million via a retail offer. The new equity was placed at £0.65/share ($0.86) or a ~14% discount to the pre-fundraise announcement price.

$55m convertible bond issue completed with Heights Capital Ireland LLC, a global equity and equity-linked investment firm. The converts carry a 4% coupon and amortise quarterly at 5.0%, payable in either cash or new shares at PANR’s option. The initial conversion price is at a 20% premium to the £0.65 placing price, or ~£0.78 ($1.03).

The main purpose of the raise is to fund three wellbore operations at the Talitha, Theta West and Alkaid projects in H1 FY22, and the additional $21m of equity raised over the original $20m target will be used to fund further capex including additional drilling, testing and completion, as well as strengthening its balance sheet ahead of future farm-out and/or financing negotiations.

While the farm-out discussions are ongoing, the timing of any deal is uncertain and so management opted to proceed with the fundraise to ensure the winter drilling and testing campaign progresses as previously planned. Despite the dilutive impact of the fundraise (which I believe is immaterial to the overall value/upside story here as I outline below), it is the right move strategically for the company and shareholders in my view, for three reasons:

It allows PANR retain 100% control over its projects and operations, and puts the company in a stronger position to negotiate a farm out deal on the most attractive terms possible in the future. The alternative of doing a farm out now would likely have resulted in ~20% - 50% dilution at a very low value, leading to a massive (and premature) leakage in value for PANR shareholders.

Furthermore, pursuing a farm out to fund the winter campaign now would almost certainly have resulted in project slippage, a loss of momentum and potential liquidity issues down the road in terms of opex if negotiations became protracted, further weakening PANR’s negotiation position for a deal.

The success of the fundraise, with $26m of additional capital raised over the initial $70m target level (equating to ~5 x years of opex costs based on FY21), effectively removes liquidity risk for the forseeable future. This will allow management focus on the winter programme to position the company for a liquidity event, be it a farm-out or full sale, within the next two years and without the distraction of having to return to the capital markets again for liquidity reasons.

CEO Jay Cheatham summed up the fundraise result as follows:

Raising up to $96 million through a combination of equity and convertible debt is a fantastic result, and the fact that the equity raise was substantially oversubscribed is a great show of confidence in our projects by both existing and new shareholders. This funding allows the Company to fully execute our 2022 programme to assess eight targets across three wells - four targets with the reentry of Talitha #A, and two targets each at Theta West and at our Alkaid 2H development well adjacent to the Dalton Highway and TAPS. On success, the Alkaid 2H well will be the first producer for Pantheon on the North Slope, a fantastic milestone. In total we're targeting 17 billion barrels of oil in place and over 2.2 billion barrels of Recoverable Resource, according to our estimates. Additionally, we now have sufficient funding for additional drilling, testing and completion, and we can evaluate the drilling of a second production well. Further, the funding potentially gives us flexibility into 2023 and strengthens our balance sheet ahead of future farm-out or financing negotiations.

It’s also worth highlighting the point Cheatham makes above regarding Alkaid - the capital to be allocated to Alkaid ($23.2m) from the fundraise will enable it to become a producing asset (recall Alkaid is a 76.5m BO resource, independently verified as recoverable). This means PANR will be in a position to generate cash flow to service cash interest and amort on the convertible bond and thus avoid any further dilution.

Finally, one other positive of the fundraise is management participating meaningfully, subscribing for 629k shares, implying an investment of £409k / $540k.

The share price reacted by dropping ~12% to ~£0.67, broadly approximating the equity placing price and reflecting the indicative dilution from the new shares and the converts. On my numbers, the overall dilution to ordinary shares is at most 14.6% assuming the full $55m convertible bond converts to ords, which is well short of any dilution that would occur in a premature farm out scenario. Furthermore, I believe the dilutive impact to current shareholders is negligible on returns as I outline below.

PANR’s Post-Money Valuation

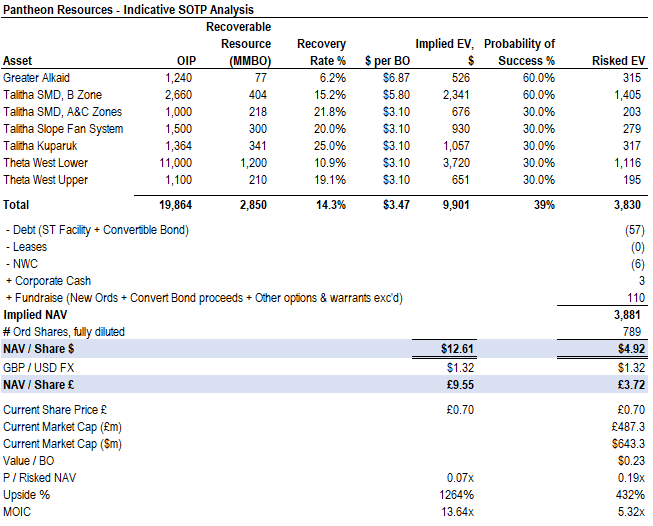

On a risk-adjusted, post-money basis, I estimate PANR is worth £3.72/share today, or ~5.3x its current share price of ~£0.70 as at the time of writing:

Source: Value Situations analysis; management information.

Commentary & Key Assumptions:

I’ve made no change to the assumptions around resource recovery rates, $ per BO and POS% that underpin the Implied EV and Risked EV valuations - these all remain as before in my original PANR analysis.

Debt of $57m now reflects the $1.5m short-term debt facility to secure essential equipment as disclosed in November (I assume its fully drawn here), and the new $55m convertible bond issue.

NWC and corporate cash balances are updated to reflect latest balance sheet position as disclosed in PANR’s accounts published last week; cash is net of assumed opex cash burn of $2.5m through H2 to date.

Fundraise cash balance reflects the new $41m of equity proceeds, $55m in convertible debt proceeds, and ~$13.6m of cash proceeds from in-the-money share options and warrants that I assume are exercised and to reflect fully diluted value (fully diluted ordinary share count is 789m shares as a result).

My updated analysis implies a risked NAV/share of £3.72/share, indicating that PANR currently trades at just 0.19x its risk-adjusted NAV, and implies 430% upside / 5.3x MOIC vs. the current share price. (Alternatively, if I value the Alkaid and Talitha SMD Zone B assets at $3.10 in line with the Pikka/Horseshoe comp transaction rather than their NPV/BO, the implied risk-adjusted NAV/share is still a multiple of the current share price, at £2.93, or ~4x the current share price).

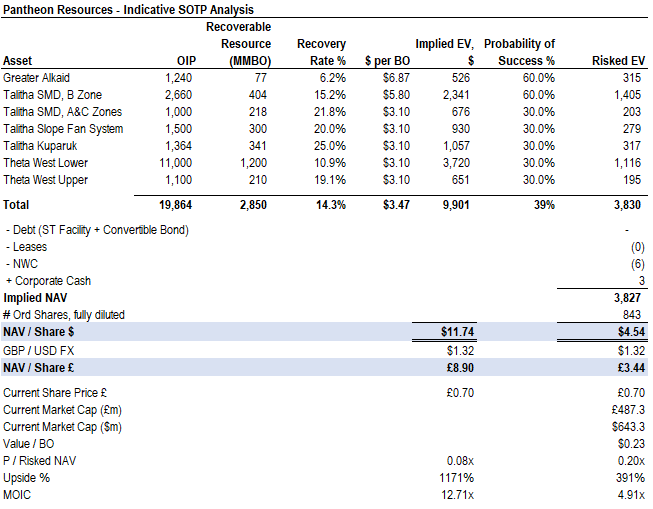

The above analysis presents the post-money value today, after the new placing but doesn’t factor in the dilutive impact of the converts. My further analysis below attempts to present the fully-diluted value assuming the debt is converted to ordinary shares on the assumption that PANR will have proved the assets by this time and the company is sold to an oil major/partner and thus providing the liquidity event-exit for shareholders:

Source: Value Situations analysis.

The above indicates that the impact of dilution is really negligible in an overall value context with an implied exit value of £3.44/share or still ~5x the current share price, based on the following assumptions:

The company is assumed to be debt-free on the conversion of the convertible bonds and clearance of the short-term facility.

I assume corporate cash equal to 6 months opex remains, in line with post-money valuation above.

Fully diluted share count increases to 843m shares, reflecting an additional 53.4m shares issued on conversion of the $55m of convertible debt at a price of $1.03, being a 20% premium to the current share price (£0.70 converted at $1.32 : £1.00). (In reality dilution is likely to be less as PANR’s share price would likely rise it progresses assets to an exit scenario, thus reducing the number of converted shares to be issued).

This implies a value of £3.44/share, indicating the dilutive impact vs. the post-money value above is just ~8% (vs. £3.72 above), and the overall return on the current share price is still ~5x.

Furthermore the above analysis assumes no incremental asset value is created from the deployment of the $96m raised - if I assume incremental $-for-$ value is created from development expenditures using these proceeds, the indicative exit value/share increases to £3.53/share, reducing dilutive impact on value to ~5% in this scenario and MOIC of ~5x.

In my original analysis, I estimated PANR’s value at £3.80/share with a MOIC return of 6.3x vs. its then share price of £0.60 - while MOIC appears to have contracted based on the updated analysis above, much of this apparent contraction is attributable to the increase in share price to ~£0.70 today. If the current share price was still at £0.60, the return implied in my exit scenario at £3.44 would be a MOIC of 5.7x, very close to my original underwrite. If I were to give $-for-$ credit to PANR’s assets for the $96m yet to be deployed, the MOIC on this basis rises back to ~6x again.

On this basis, the dilutive impact is really limited and supports my view that the fundraise was the right decision by management.

In conclusion, I believe the fundraise actually de-risks PANR further, removing its reliance on the capital markets for liquidity, increasing institutional equity interest in the name, and fully funding it to an exit scenario with negligible value dilution to shareholders. I therefore continue to believe PANR is a very compelling situation that offers very substantial upside, with very limited downside given its enormous resource asset backing.

Thanks for your work, Conor. Your newsletter has been a blessing so far. Keep it coming, it is much appreciated.

Nice analysis. I agree here. There is so much potential reward with so little potential risk here. Its truly one of the few asymmetric plays out there. And this even without considering the price of the underlying commodity which in my opinion also more more upside than downside potential, statisticially speaking. In that sense PANR is a leveraged play with a considerable skew in risk/reward.