Welcome to the second Value Situations investment memo on my latest actionable public equity situation, Irish hotel business Dalata Hotel Group Plc. I believe this is a highly compelling situation, constituting both an overlooked COVID recovery play and a real estate take-private candidate.

Feedback is welcome and if you like this newsletter please share with friends and colleagues.

Disclaimer

Value Situations is NOT investment advice and the author is not an investment advisor.

All content on this website and in the newsletter, and all other communication and correspondence from its author, is for informational and educational purposes only and should not in any circumstances, whether express or implied, be considered to be advice of an investment, legal or any other nature. Please carry out your own research and due diligence.

I have often repeated the mantra that a company’s worth is determined largely by its earnings starting three years from now.

Dr. Michael J. Burry, Scion Capital Investor Letter, Q2 2006.

Irish-listed Dalata Hotel Group Plc (DHG) is the largest hotel chain in Ireland with a growing presence in the UK market.

DHG is significantly undervalued, trading at a discount of ~50% to my estimate of fundamental value based on stabilised earnings, and a discount of ~40% to current private market value based on recent transactional evidence.

The industry view is that the Irish and UK hotel markets will recover to pre-COVID (FY19) levels by 2023/24 – on that basis, DHG trades at just 8x FY19 EBITDA and 6.6x stabilised EBITDA which reflects both a hotel market recovery and delivery on its pipeline of ~2.9k new rooms over the next 3-4 years - this compares to it’s historic average multiple of 15x, an historic average multiple of ~12x for UK-listed peers and a range of ~12x – 26x for comparable private market transactions.

Furthermore, DHG owns a hotel real estate portfolio valued at €1.2bn and at its current EV of ~€1.1bn trades at a discount to its underlying real estate value, implying it’s substantial leased hotel portfolio (2.8k rooms) and its future pipeline is available for free at the current share price.

I estimate DHG is worth ~€7.17/share if it remains publicly listed through a hotel market recovery out to FY24/25, implying ~97% upside to the current share price (25.4% IRR / 2.0x MOIC over an expected 3 year investment term to market re-rating).

Additionally, I believe DHG is a take-private target in the near-term if the share price remains near current levels – I estimate it is worth ~€6/share to a private equity or real estate fund acquirer, implying ~67% upside if bought out in the next 18 months (40.7% IRR / 1.67x MOIC).

DHG comes with significant downside protection given its hotel real estate portfolio and I estimate downside risk in a worst case of ~€3/share or -16.5% below the current share price, implying a highly asymmetric return/risk profile with upside of ~6x the downside risk if it remains public, and ~4x in a take-private scenario.

The stock is mispriced for 3 reasons: (1) market short-termism, with a misguided focus on the near-term earnings outlook which is not representative of normalised earnings power post-COVID recovery (2) excessive pessimism due to COVID and virus variant concerns, and (3) DHG is an Irish small-cap with limited analyst coverage and therefore not widely known.

Catalysts to value realisation are (1) a market re-rating as hotel and travel markets recover with COVID vaccine roll-out and lifting of restrictions, and/or (2) a take-private in line with recent market transactions if the share price remains depressed near current levels.

Situation Overview

Like all hotel stocks, DHG was severely impacted by the COVID-19 pandemic when it hit in March 2020. The share price declined 67% from its pre-COVID high of €5.36 (EV/EBITDA ~10x) in Jan-20 to a low of €1.76 (~5x) in Mar-20 as restrictions were put in place, travel ceased and the UK and Irish economies were shut down. By the end of FY20, revenues declined 68% YoY, while EBITDA (pre-IFRS 16) turned negative, at -€11.9m:

Source: Dalata Annual Report 2020

Despite these challenges, DHG weathered the pandemic exceptionally well after management took a number of steps to successfully stabilise the business and maintain sufficient liquidity to weather the disruption:

Sale & Leaseback of the Clayton Charlemont Hotel, Dublin to Deka Immobilien – this was completed in April-20 during the depth of the COVID market crash, and generated €65m in cash. Notably the Charlemont traded at a yield of 4.25%, representing a widening of just 25 bps to the pre-COVID market yield, demonstrating the quality of both the asset and DHG’s covenant

Bank Covenants renegotiated – coming into COVID, DHG’s net leverage was 2.8x excluding leases (4.5x including leases); management successfully negotiated a reset of covenants with DHG’s banking club, with DSCR and Interest Cover covenants dropped until June 2022, and replaced by LTV and minimum liquidity covenants until then. DHG also obtained a €39m increase to its RCF facility until Sep-22 to further bolster liquidity.

Raised~ €94m in equity via a share placing in Nov-20 at a price of €2.55 (~8x LTM EBITDA at that time) to further increase liquidity.

The result of these measures was that any liquidity concerns were addressed, with available liquidity (cash plus undrawn bank facilities) increasing from €162m at the start of FY20 to €298m by year-end (vs. minimum liquidity covenant of €50m). This allowed DHG trade through the pandemic while also paying its rent in full to the landlords of its leased hotels. This was notable in that only DHG and UK peer Whitbread Plc among the large domestic Irish and UK hotel chains paid rent in full to landlords without seeking any concessions. This served to further enhance DHG’s covenant among institutional investors and lenders with regard to future growth plans.

In terms of current YTD performance, DHG reports H1 performance on 1 September, but a recent Q2 FY21 trading update indicating better than expected performance with average occupancy of ~27% across the portfolio, vs. 10% for Q2 FY20.

DHG’s share price is down -4% YTD, with the business valued at ~8x pre-COVID EBITDA, and 44x FY21 consensus forecast EBITDA (LTM is not meaningful), but remains ~32% below the pre-COVID high.

Saudi Arabian conglomerate the Zahid Group built up a ~10% shareholding in DHG in H2 FY20, while an undisclosed European investor approached other institutional shareholders in February this year in an attempt to build a ~14% stake in the business at a price range of €3.50 - €3.75/share. No deal was completed by this unnamed investor but Zahid’s interest and this unsolicited approach to shareholders has supported DHG’s share price and suggests possible takeover interest.

In March this year, founder and CEO Pat McCann (69) announced he was stepping down as CEO having led the company through COVID and stabilising the business. He is succeeded by Dermot Crowley (53), the deputy CEO and Head of Business Development & Finance. Dermot Crowley is regarded as a strong and highly capable successor, having both a background in private equity and in hotels (ex-Jurys and Forte Hotels), and was key to DHG’s successful IPO and a transformative portfolio acquisition (Moran Bewley hotels acquisition) completed in 2015.

Business Overview

DHG was founded in 2007 by experienced Irish hotelier Pat McCann, an ex-CEO of the Jurys Hotel Group, the leading Irish domestic hotel chain at that time. Backed by private capital and managed by an experienced former Jurys’ team, DHG acquired a group of companies from Choice Hotels Ireland that held leases and management contracts for 11 hotels in Ireland.

DHG’s initial business model was to operate leased hotels in the wake of the Irish property market crash of 2008-2009, which severely hit the hotel sector. In 2008 DHG rebranded its leased hotels under its new “Maldron Hotels” brand and in 2009 Dalata Management Services was established to provide hotel operational and management services to receivers and domestic banks that controlled hotel assets through insolvency processes following the market crash.

In March 2014, DHG listed on the Irish ESM and London AIM junior exchanges, raising €265m in capital to acquire a freehold hotel portfolio as part of its’ strategy to grow the group through a mix of owned, leased and managed hotel assets. It completed the acquisition of the Moran Bewley’s Hotel Group in 2015 for €453m (~2,500 rooms) and was admitted to the Irish and London Stock Exchanges’ main exchange listings in 2016.

At the time of its IPO, DHG operated 13 hotels under the Maldron brand, with 12 of these hotels located in Ireland and 1 in the UK. Since then DHG has grown to become the largest hotel group in Ireland with an established foothold in the UK market, and operates 44 hotels / 9,261 rooms across the UK and Ireland (29 hotels owned, real estate GAV of €1.2bn / 12 leased hotels / 3 management contracts).

DHG operates across two distinct brands, with the Maldron brand being a strong 3-to-4 star product, and Clayton Hotels, introduced in 2016, offering a 4 star product.

DHG’s operating model since the IPO has been primarily a freehold ownership one with its hotel portfolio having a ~70% owned / 30% leased mix. This mix will evolve to a more capital-light 55% owned / 45% leased mix in the next 3-4 years, given the group’s development pipeline of ~2,900 keys, of which ~2,500 keys (~87% of pipeline) are leasehold. The leasehold pipeline is being funded by institutional investor/developer partners who own the real estate and fund construction of the hotels with the benefit of a pre-let agreement with DHG. Under the pre-let agreements, DGH has committed to leasing the completed hotels for a fixed rent on institutional-quality 35 year leases.

With its quality 3 and 4 star offering in strong city centre locations, DHG’s customer mix is broadly 50% corporate travel and 50% leisure, with a similar mix across international and domestic guests.

Portfolio Segmentation

Current portfolio composition by number of keys:

Source: Company Annual Report 2020

Current pipeline composition by number of keys:

Source: Company Annual Report 2020

Future portfolio composition post-delivery of pipeline:

Source: Company Annual Report 2020

Summary Historic Performance

Snapshot of historical financial performance:

Source: Company Annual Reports 2015 – 2020

Over the pre-COVID 5 year period to FY19, DHG has grown room count by a cumulative 2.8k rooms / ~45% to ~9k keys, and has delivered consistently strong EBITDAR, EBITDA and FCF margins driven by stable occupancy of ~83% and steadily increasing ADRs over the period.

Market Overview

Irish Hotel Market

Being a small, open island economy, Ireland’s hotel and hospitality sector is a key component of the national economy and is estimated to contribute ~2% to GDP. The hotel industry benefits from Ireland’s traditionally strong tourism sector, with consistently rising overseas visitor numbers pre-COVID, and a record 10.8m overseas visitors to Ireland in 2019. Within this, Dublin attracts ~60% - 70% of visitors.

Additionally, Dublin has a strong business tourism offering, benefiting from a cluster-effect among multinational corporations – Dublin is a recognised European tech hub with the European HQ’s for Google, Facebook, Twitter, Linkedin and Microsoft all located in Dublin, while Amazon, HubSpot, Salesforce among other tech names also have a significant presence in the city. Dublin is also a hub for multinational corporates in the financial services, aviation, pharma and professional services sectors. This backdrop has supported a strong hotel sector for both leisure and corporate conference business historically, with the Dubin hotel market characterised by high occupancy and strong room rates prior to COVID.

The Irish hotel market comprises ~64k rooms (Irish Hotel Federation & CBRE data) with Dublin accounting for ~22k rooms / 35%. The market comprises by a mix of large groups and small single-asset operators and is highly fragmented, with the top five groups accounting for ~15.5k rooms or 24% of the market. Within this, DHG is the market leader by rooms with ~9.3k rooms, for a ~15% market share:

Source: Company reports; Value Situations research.

Prior to COVID, the new hotel development pipeline for Dublin comprised ~6.3k new rooms, with the market undersupplied vs. annual visitor demand, reflected by the very high occupancy rates achieved during peak season (90%+ occupancy and low room availability).

However, post-COVID the realistically deliverable pipeline is now estimated at ~4.5k rooms (per real estate agency Savills data), with the majority of this new supply in the budget and aparthotel categories (~60%). Furthermore, the existing stock of rooms in Dublin is expected to decrease due to a shakeout of smaller operators not surviving the COVID disruption, as well as conversion of some hotel properties to alternative uses.

In terms of outlook, the Dublin and wider Irish hotel markets are expected to rebound given the traditional strength of the tourism sector and the country’s position as a strong leisure and business tourism destination. Savills forecast that local and inbound tourism will return to pre-pandemic levels in the next 2 – 3 years, while economic advisory firm Tourism Economics predict visit numbers to Dublin will return to 2019 levels by 2024.

UK Hotel Market

The UK hotel market is a large and highly fragmented one that can be characterised by a bifurcation between the London and regional hotel markets.

As a global finance centre, the London market has traditionally been heavily reliant on international visitors and business travel, while the UK’s regional hotel markets are driven largely by domestic leisure business.

The overall UK hotel market is ~11x the size of the Irish hotel market, comprising ~710k+ rooms with no dominant player in either the London or regional sub-markets. In terms of competitive positioning, the budget brands are the largest players in the UK hotel market overall, with Whitbread Plc the market leader with a ~11% market share:

Source: Whitbread Plc Investor Presentation, May 2021

Approx. 80% of DHG’s UK portfolio is in regional UK cities reflecting a strategic focus on regional city markets that are highly fragmented, with no dominant brand or operator in place. In these markets, only budget brands such as Whitbread (Premier Inn) and Travelodge have any meaningful market share, with limited 3 and 4 star accommodation comprising dated stock of mixed quality. In the regional markets targeted by DHG it is estimated ~60% of 3 and 4 star stock is aged 10 years+, and 40% is aged 20 years+ (according to market research firm AM:PM data).

The larger, international brands (e.g. Hilton, IHG, Marriot) have limited presence in these regional markets given their franchising models, which has resulted in few local operators with any meaningful scale. As a result, DHG has focused on providing modern quality 3 and 4 star accommodation in prime city locations in these markets.

Regarding outlook, the UK had been leading a recovery in occupancy rates across European hotel markets, with occupancy levels consistently above 60% through July (according to STR data), attributable to the UK’s more advanced vaccine roll-out and earlier re-opening of its economy compared to other European countries.

Industry analysts expect that domestic leisure tourism will drive UK hotel performance and recovery in the short-to-medium term, with an overall recovery for UK tourism demand by 2024. By 2025, domestic accommodation demand is expected to be ahead of 2019 levels, while international demand may be marginally below pre-COVID levels.

Investment Thesis

The core thesis for DHG is two-fold: either it will re-rate substantially in a post-COVID market recovery for travel and hospitality, or it will be acquired before it reaches its stabilised level of earnings power that reflects both a market recovery and the delivery of its new hotel pipeline.

DHG possesses a number of attractive investment characteristics that position it strongly as both a post-COVID recovery play and as a take-private target:

Quality Hotel Portfolio – DHG operates a portfolio of modern, well invested and well located 3 and 4 star hotels that will immediately benefit from increased travel and business activity post-COVID.

Tangible Asset Backing provides strong Downside Protection – DHG owns a substantial and high quality portfolio of hotels valued at ~€1.2bn post-COVID (-18% reduction vs. pre-COVID, so the COVID write-down is already factored in), which exceeds DHG’s current EV (current EV/IC multiple of ~0.9x). This provides significant downside protection, while it’s direct ownership of ~70% of its existing hotel real estate would appeal to private equity/real estate fund acquirers.

Highly Competent Management – management are best-in-class hotel operators with a proven track record in growing the business into the market leader in Ireland while delivering consistently impressive financial performance and growth. This supports view that performance will rebound strongly under management as the market recovers

Covenant & Reputation – being one of only two hotel groups in Ireland and UK to pay landlords in full throughout the pandemic (in stark contrast to Travelodge who angered landlords with a CVA scheme to cut rents) means that DHG are regarded among institutional landlords as having an investment grade covenant on a par with Whitbread Plc (Premier Inn). This provides DHG with a competitive advantage for future growth allowing it achieve favourable rental terms for its leasehold pipeline and tighter yields that enhance landlords’ asset values.

Capital-light Growth Runway – DHG’s pipeline is leasehold driven, allowing the company to drive cumulative ~30% growth in rooms without major capex, facilitated by its covenant strength and relationships with institutional landlords.

Visibility to Earnings Power Growth - I estimate DHG’s new hotel pipeline will generate ~€20m+ in incremental EBITDA by FY24/FY25, indicating stabilised earnings power for the group of ~€162m, +20% ahead of FY19 levels.

Given these attributes, DHG appears very cheap at the current price relative to its asset backing and future earnings power. Based on my €162m estimate for stabilised EBITDA, the business is currently valued at just ~6.6x, which is significantly below its own historic 5 year average multiple of 15x, and 12x for direct UK-listed peers Whitbread Plc, IHG Plc and PPHE Hotel Group Plc. Similarly based on my estimate of €128m in stabilised FCF, DHG appears extremely cheap at 9x EV/FCF and a 13%+ FCFE Yield by FY24.

As such, I believe a post-COVID market recovery is simply not priced into the stock. Given that we know the vaccine roll-out is progressing and of its efficacy against the Delta variant, it seems that public markets are not valuing DHG correctly. This suggests that more patient private capital could be the catalyst to realise value if the share price does not re-rate as economic and travel activity resumes.

At the current EV of ~€1.1bn plus an acquisition premium, DHG is a digestible bite size for a private equity or real estate fund bidder looking to acquire a quality hotel real estate portfolio with a growing income yield. Closest peer Whitbread’s EV is ~£6.1bn before any bid premium, making it a more challenging ask for a full take-out. Furthermore, the recent attempt to acquire a 14% stake in DHG last February by an unnamed investor is clearly indicative of institutional interest in owning DHG.

How Much Can I Make? – Valuation Analysis

Summary Valuation Analysis

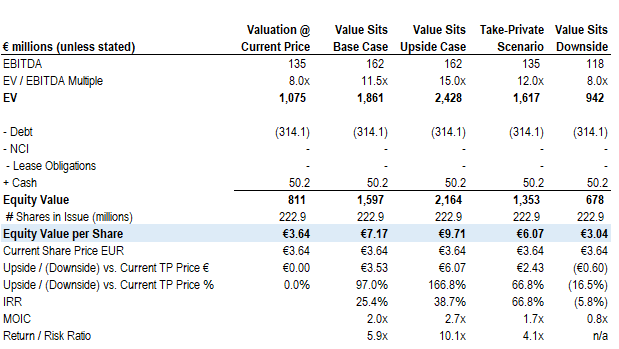

Source: Value Situations analysis.

Commentary on Current Value

The current share price of €3.64 implies an EV/EBITDA multiple of 8x FY19 EBITDA on a pre-IFRS 16 basis. I present current valuation with reference to FY19 EBITDA as it reflects the last year of normal trading given that FY20 was meaningless due to the COVID-19 pandemic.

In my valuation analysis for DHG throughout this memo, I calculate DHG’s equity value on a pre-IFRS 16 basis and ignore both lease “debt” in my EV calculation and adding back of lease rent to EBITDA for the following reasons:

IFRS 16 distorts EBITDA earnings power - rent is a normal business expense for DHG and peers with leasehold assets, and should be treated in the same way as other operating costs in estimating earnings power

IFRS 16 also distorts the balance sheet, in that it inflates debt to account for future lease payments that are normal operating expenses.

As a result, post-IFRS 16 EV and EBITDA metrics are not comparable to historic ones for DHG or its peers, preventing a true like-for-like valuation comparison over time without retrospectively re-stating all historic financials on a theoretical IFRS 16 basis.

While I believe appraising DHG on a pre-IFRS 16 makes the most sense, I show the current valuation on a post-IFRS 16 basis above for illustrative purposes. This indicates the company is still cheap, being valued at ~9x FY19 EBITDAR at the current share price, reflecting capitalised lease obligations of ~€400m and the adding back of ~€27m in fixed rent payments to FY19 EBITDA of €135m.

Base Case

In my Base Case I estimate DHG’s EV at €1.9bn, with the equity worth ~€1.6bn, or ~€7.17/share, assuming a 11.5x multiple on stabilised EBITDA of €162m (pre-IFRS 16) achieved by FY25.

This €162m in stabilised EBITDA assumes the existing portfolio’s EBITDA recovers to FY19 levels of ~€135m by FY25 with DHG’s pipeline of new rooms generating an incremental ~€25m in EBITDA (pre-IFRS 16, net of lease rents) by this time. Note that on a post-IFRS 16 basis, this would equate to €219m in EBITDAR by FY25 vs. the €162m of EBITDAR in FY19).

Notably, the current EV of €1.1bn reflects a valuation of just 6.6x stabilised EBITDA of €162m under my Base Case.

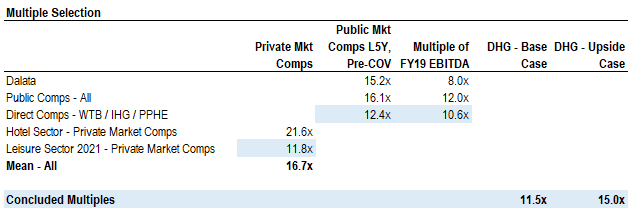

The 11.5x multiple assumed is the average of the following:

recent (FY21 post-COVID) private market multiples paid for leisure/hospitality assets (11.8x)

5 year historic average multiple (pre-COVID to Feb-20) of 12.4x for listed UK peers Whitbread Plc (WTB), IHG Plc (IHG) and PPHE Hotel Group Plc (PPHE)

Current average multiple of 10.6x on FY19 EBITDA for these peers as a proxy for a normalised forward EBITDA multiple.

See further details in multiple analysis below.

My Base Case value of €7.17/share indicates a return profile of ~25% IRR / 2x MOIC over a 3 year investment term, which assumes a re-rating to 11.5x by that time as the hotel market recovery strengthens with clear visibility to stabilised FY25 EBITDA at the stage.

Upside Case

In an upside case, I estimate DHG’s equity is worth ~€2.2bn or €9.71/share, which reflects a 15x multiple in line with DHG’s own five-year historic average multiple of ~15x (pre-COVID to Feb-20). Historically, DHG has traded at a higher multiple vs. direct UK-listed peers given it’s higher growth rate and EBITDAR margins. Given DHG’s stronger margins historically and the fact that it has the flexibility to pursue further growth strategies beyond its current pipeline (e.g. entering the very large and highly fragmented German market), a higher multiple in line with its historic average is plausible to reflect this further growth potential.

Valuation Multiple

In concluding on my 11.5x valuation multiple for DHG, I reviewed multiples paid in recent private market transactions for hotel and leisure-related assets and the valuations ascribed to DHG’s publicly-listed peers.

In terms of private market transactions in the hotel sector, no notable hotel group or portfolio deal multiples have been publicly disclosed for transactions completed post-COVID. In terms of comparable transactions pre-COVID, Apollo Global Management acquired Irish hotel group Tifco Hotels for ~26x in Q4 2018, while Chinese group Huazhu acquired Germany hotel business Deutsche Hospitality for 17.5x in Q4 2019 prior to COVID hitting:

Source: Media reporting; transaction announcements; Value Situations analysis.

More recently, Blackstone acquired Bourne Leisure Holdings at 11.8x FY19 EBITDA in Q1 this year. While Bourne is not a pure hotel deal (it owns and operates UK domestic holiday parks and hotels), it is a hospitality related-asset and given the lack of direct hotel M&A comps YTD, it is a relevant indicator of where hotel and leisure assets are trading at in a post-COVID world.

Similarly, RIU Group bought out it’s JV partner TUI AG’s 49% interest in a portfolio of 21 hotels in Q2 this year, at an implied value of 11.9x FY19 EBITDA:

Source: Media reporting; transaction announcements; Value Situations analysis.

The reporting of these transactions referenced deal multiples based on pre-COVID FY19 EBITDA, indicating that private market acquirers are able to take a more patient view on a hotel and leisure market recovery compared with public markets, and are comfortable using FY19 as a reference point for valuing assets in a post-COVID market environment.

With regard to public market valuations, I reviewed trading multiples for DHG’s peers for the five year period pre-COVID, given that current year and NTM multiples are not meaningful due to EBITDA being so depressed due to the rolling impact of the pandemic on FY21 and FY22 forecasts. Similar to private market acquirers, I believe it makes more sense to appraise DHG on a normalised basis by reference to historic pre-COVID valuation multiples.

In the five year period to Feb-20 before the pandemic, DHG traded at an average multiple of 15x EBITDA, while its North-West European compset (comprising Whitbread Plc, IHG Plc, PPHE Hotel Group , Accor SA and Pandox AB) traded at an average of 16x over the same period. Within this, the most directly comparable peers are UK-listed Whitbread, IHG and PPHE who have traded at an average of 12.4x historically, as shown below:

Source: Koyfin; Value Situations analysis.

Additionally, it’s worth noting that direct comps Whitbread, IHG and PPHE all currently trade at 10x - 11x FY19 EBITDA, compared to DHG at ~8x based on its current share price (which highlights how anomalous its under-valuation is).

I conclude on the 11.5x multiple for DHG as it reflects the average of the most recent private market deal multiples, the historic 5 year average of its most comparable UK-listed peers and the average multiple of FY19 EBITDA for these peers.

For the Upside Case, I simply assume DHG’s historic average multiple of 15x in the five year period pre-COVID.

Earnings Power

In fairly valuing DHG (or indeed any hotel stock), current year and next year projected earnings are just not meaningful for valuation purposes as they are not representative of stabilised earnings power given the impact of COVID on travel and hospitality.

Both DHG management and industry analysts expect the hotel market to recover to FY19 levels by 2023/24, and so as the Michael Burry quote at the top of this memo states, it’s really DHG’s earnings 3-4 years from now that are relevant for a fair appraisal of the business.

I’ve estimated DHG’s earnings power of €162m in EBITDA (pre-IFRS 16, net of rent) based on my own bottom up model that reflects the existing hotel portfolio of ~9k rooms plus the ramp up and stabilisation of its pipeline of ~2.9k new hotel rooms to be delivered by FY24. I also assume a recovery curve for occupancy and average daily room rates (ADR) out to FY25 as part of this analysis which assumes a recovery close to FY19 levels by then:

Source: Value Situations analysis.

I believe my recovery curve is prudent in that I do not assume a full recovery to, or exceeding FY19 levels. Additionally I assume stabilised trading levels are achieved in FY24/25, which is 12 months beyond current market expectations for FY23/24 which allows for some delay given ongoing Delta variant issues and vaccine roll-out programmes.

Please refer to the appendix to this memo for extract of full model projections and key assumptions.

Take Private Valuation

As a core part of my thesis is the possible take-private of DHG, I also consider an indicative take-private/ LBO valuation for DHG to estimate what the group could be worth to a private equity or real estate fund acquirer.

In line with Blackstone’s Bourne Leisure acquisition and RIU’s buy-out of its JV assets from TUI, I estimate an acquirer could buy-out DHG at 12x FY19 EBITDA, equating to ~€6/share or ~67% premium to the current share price and still achieve a post-tax return of ~15% IRR / 1.9x MOIC over a 5 year investment period.

I would also highlight this return profile is before an acquirer might implement any balance sheet or portfolio optimisation, such as pursuing a full asset-light model (e.g. similar to Accor, IHG Plc) which could involve the sale and leaseback of owned hotel assets to release capital and drive returns higher:

Key assumptions on DHG take private:

Financial projections – as per my bottom-up model, see appendix

Financing – €1.05bn senior debt facility at L+ 5.5% / 65% LTV on 12x EV, broadly in line with debt financing provided by Starwood and Blackstone lending funds to Blackstone on the Bourne Leisure deal

Irish Stamp Duty tax at 1% on share value of €6/share for acquisition, deal fees/costs at 1% of deal EV.

Exit after 5 years at 12x via assumed trade sale or IPO, exit proceeds to equity are net of 20% assumed capital gain/distribution tax

Returns and capital structure shown before any management sweet equity or incentive package, to show returns on underlying basis.

It’s also worth noting a take-private of DHG would not trigger any tax on unrealised gains unlike Irish REITs, as it structured as a trading business rather than a REIT. Given the strong institutional investment demand for Irish real estate in recent years, this makes DHG an attractive alternative play on Irish real estate for prospective investors.

The stabilised cash-on-cash yield to equity in this scenario is 12.5%, which combined with an implied return profile of ~15% IRR / 1.9x MOIC makes DHG very attractive to real estate or income yield-seeking acquirers.

In this take private scenario, I assume 12-18 months is a reasonable timeframe for this catalyst to play-out should DHG’s share price remain depressed at the current valuation, which implies a return profile of ~40.7% IRR / 1.7x MOIC on an 18 month investment term (~67% IRR on a 12 month timeframe).

Notably the current share price is within the €3.50 - €3.75/share range at which the undisclosed European investor approached other DHG shareholders back in February to acquire their stakes at, suggesting its now at a level that could put it in play.

How Much Can I Lose? – Downside Risk

In a worst case, I estimate downside risk at ~€3/share or -17% down vs. the current share price, based on a stagnant 8x multiple on average projected EBITDA for FY22/23 of ~€118m, on the assumption that no meaningful recovery for travel and hospitality occurs:

Source: Value Situations analysis.

While the €118m in EBITDA for FY22/23 is only -13% below FY19 levels, its important to note that DHG will have a much larger estate of hotels by FY23, with total rooms of ~11k, +20% larger than FY19 total rooms across the portfolio as it delivers on its pipeline. This equates to average EBITDA per room of €17k in FY22/FY23 vs. €20k per room achieved in FY19 (-17% lower EBITDA on a per room basis).

The 8x multiple is assumed on the basis of DHG’s current trading multiple of ~8x which appears to price in a very limited recovery over the next 2 years, with group RevPAR of just ~€81 (vs. €93 in FY19) despite the vaccine roll-out and the expected reopening of cities and pent-up travel demand in the next 12 months. As such, I believe this downside case reflects a very pessimistic scenario.

It’s also worth noting that even in this downside scenario, DHG remains within its banking covenants which are set to kick back in in June 2022, with net leverage of 2.5x at end of FY22 and 1.3x at end of FY23, and interest cover of 11x in FY22 increasing to 13x by FY23.

The ~17% downside implies upside of almost 6x the downside risk under my Base Case, and 10x in the Upside Case, illustrating just how asymmetric the returns are for this situation. Furthermore, DHG comes with a substantial margin of safety provided by its €1.2bn hotel real estate portfolio which equates to €5.39 of GAV/share (€4.18/share on NAV basis).

A final comment on downside risk is that I don’t believe DHG’s share price will hit COVID lows of sub-€2/share again, for 2 reasons:

The COVID sell-off was a panic-driven one, when markets entered a sell-everything mode given the fear and uncertainty caused by this previously unknown virus; since then an effective vaccine has been formulated which mitigates these previous fears, and travel and economic activity is slowly resuming

Previous credit and liquidity concerns arising from the forced closure of hotels throughout much of FY20 have been addressed by management actions including the renegotiated bank covenants and Sep-20 share placing. Current liquidity (cash plus undrawn debt facilities) of ~€270m equates to ~17 months of liquidity at current opex levels, assuming full payment of all rent and bank interest. In effect, the business could continue with zero income for the next 17 months, a highly implausible scenario given that Q2 occupancy was 24% - 30% across the portfolio and is to improve further in H2 with the gradual lifting of restrictions and vaccine roll-out.

Variant Perception - Why Does This Opportunity Exist?

DHG is mis-priced for 3 reasons:

1. Market Short-termism – public market investors are fixated on current year and FY22 earnings, with consensus forward estimates implying DHG trades at 44x FY21 EBITDA and 12x FY22 EBITDA respectively. On this basis the stock would appear to be fully priced. However, as explained above, it’s not current year or NTM earnings that matter for DHG, but its earnings 3-4 years from now.

FY21 and FY22 are not representative of normal trading, with FY21 expected to be perhaps only marginally better than breakeven given that COVID-mandated restrictions remained in place for much of H1 FY21, while FY22 is likely to be the first year of rebuilding for hotels as the COVID vaccine roll-out reaches a critical level across populations, with cities re-opening and travel resuming.

The market is clearly not factoring in DHG’s full, stabilised earnings power given that a hotel market recovery is not expected until FY23 at the earliest and the fact that DHG have a committed pipeline of ~2.9k new rooms (a ~31%+ expansion to its total estate) that will add ~€20m+ in incremental EBITDA. On this basis, it seems evident that the current share price for DHG is a classic case of market short-termism and ignores the company’s medium-term prospects.

2. COVID Uncertainty & Virus Variants – DHG is priced as if COVID is becoming an endemic situation with no real recovery ahead. While it is true that COVID cases are rising currently, this was not unexpected given the easing of travel restrictions for the summer season while the vaccine programme is still in progress. I believe the market is looking at the wrong set of numbers, being case numbers, rather than hospitalisation rates, in assessing the outlook for travel and hospitality.

It’s important to understand that the key factor for implementing new restrictions (and therefore damaging a travel and hospitality recovery) is the prospect of national health services (hospitals) becoming overwhelmed with COVID patients. This is not happening in DHG’s home markets, despite currently rising COVID case numbers due to the Delta variant.

The market’s pricing of DHG therefore seems excessively pessimistic, and it’s worth highlighting the following data points that support a market recovery coming into FY22:

Hospitalisation rates remain well below previous peaks in the UK and Ireland despite currently rising case numbers - at the time of writing, patients in hospital with COVID are at just ~16% and ~12% of the previous January peak levels for the UK and Ireland respectively, while weekly new admissions are ~20% and 18% of January peak admissions for the UK and Ireland respectively. (Source: Our World in Data).

The vaccination rates in the UK and Ireland during the previous January peak were ~7% in the UK and 0% in Ireland, however the current situation is very different: population vaccination rates now exceed 70% for at least one dose in both UK and Ireland (60+% on two doses; source: Our World in Data), which clearly explains the low hospitalisation levels. Therefore a surge in hospitalisations to a level that would prompt new travel and accommodation restrictions seems highly unlikely given that a majority of the population is already vaccinated, and which is to increase further.

COVID vaccines are proving to be effective against infection and hospitalisation, including for the Delta variant; with key recent findings including the following:

Imperial College London’s latest React-1 study found that full vaccination halves the transmission of the Delta variant of coronavirus and is up to 60 per cent effective at preventing symptoms of Covid-19

Recent “real-world” analysis of ~14k cases of the Delta variant in the UK by Public Health England (UK government health agency) found the BioNTech/Pfizer and Oxford/AstraZeneca vaccines were 96% and 92% effective respectively against hospitalisation after two doses. Other studies have found lower effectiveness against infection, ranging from 64% - 88%, however again it is hospitalisation level rather than infection level across populations that determines whether lockdowns and travel restrictions are implemented.

The effectiveness of vaccines is clearly borne out in the low level of hospitalisations and furthermore, it’s now likely that winter booster programmes will be implemented, which combined with the vaccination of school-age children prior to schools re-opening in September, will further protect hospitals and facilitate the re-opening of economies and travel.

A final point to highlight here is that even if a resumption in travel activity is delayed by 12 months due to vaccine delays and the Delta variant, DHG has the balance sheet to trade through further disruption, with ~17 months of liquidity assuming zero revenue. In reality this scenario is not plausible as noted above, given that occupancy levels are already improving (ahead of Q2 expectations), and the continued vaccine roll-out to support improving trading conditions into next year.

So the key takeaway from all of this is that the market appears to be following the panicky media headlines around daily case numbers rather than actual hospitalisation rates, which are the key determinant of restrictions and lockdowns.

While COVID cares are currently rising, hospitals are nowhere near being overwhelmed as vaccination rates should approach herd immunity levels (to be supported by winter boosters) by Q1 FY22. , thus setting DHG up to participate in a market recovery through FY22.

3. Underfollowed, Irish Small-Cap – DHG is an Irish small-cap with only 3 analysts covering the stock, compared with 23 analysts covering Whitbread and 22 covering IHG Plc. As such, it is overlooked by public equity investors, which contrasts with its institutionally accepted covenant in the private markets.

Furthermore, the fact that DHG is undervalued relative to peers based on a multiple of pre-COVID earnings further supports the view that DHG is overlooked despite its favourable relative performance vs. peers historically. Recall that DHG trades at ~8x FY19 EBITDA compared with ~11x for Whitbread and PPHE, despite it delivering superior performance overall through FY17-FY19 in terms of revenue CAGR and EBITDAR margins:

Source: Value Situations analysis.

It is also notable that PPHE trades on a stronger multiple of pre-COVID earnings despite it being of similar scale (~8.8k rooms) and market cap (~£645m / €760m). I believe this points to an “Irish discount” being unfairly applied to DHG, something which other Irish real estate-related stocks have suffered as a consequence of the Irish real estate market collapse in 2009.

The mispricing seems all the more anomalous when one considers DHG’s recovery prospects in the post-COVID environment:

Market leader in Ireland, a small but very strong business and leisure travel market historically

Growing presence in strong city markets in the larger and fragmented UK market

Reduced competition from smaller, less well capitalised and single hotel operators who will likely fail or cease trading due to COVID impact

Reduced competition from groups with weaker covenants and/or suffering with weakened reputations following COVID, e.g. due to non-payment of rent to landlords (e.g. Travelodge in UK), repositioning to quarantine hotels for travellers (e.g. Tifco in Ireland).

In summary, to believe DHG is not mispriced at present is to effectively believe there will be no real recovery from the COVID pandemic for the Irish and UK hospitality sectors in the next three years, despite the vaccine roll-out accelerating, supportive policies from Irish and UK governments to revive economies post-COVID and the resumption of travel and office work.

Such a view is just not plausible in my view, as it would imply on/off restrictions continuing over a multi-year period, limited travel and cities ultimately hollowing out, the economic consequences of which would be extremely dire. On that basis, it is reasonable to assume a gradual and robust recovery within the next 3-4 years, which should drive a re-rating of DHG given its quality assets and market positioning.

In the event that public markets continue to discount DHG’s prospects against an improving market backdrop in FY22, I would expect the more patient private markets to value DHG appropratiately via a take-private.

Catalysts to Value Realisation

I see two clear catalyst to value realisation for DHG:

1. Post-COVID Recovery by FY24/FY25 – as outlined above, the hotel and leisure markets are expected to recovery to FY19 levels by FY23, which implies DHG is very cheap at ~8x FY19 EBITDA (vs. peers at ~11x) and sub-7x stabilised EBITDA.

As vaccinations reach key levels across the general population and travel and economic activity resumes within the next 12 months, I would expect DHG’s earnings power to become better appreciated by public markets, resulting in a re-rating of the stock towards my Base Case value of ~€7+ over the next 3 years.

2. Take Private by PE/RE acquirer – should the public markets continue to misprice DHG as a market recovery takes hold, I would expect a private market acquirer to step in and take DHG private at a significant premium to the current share price, as outlined above.

On the evidence of post-COVID private market deals including DHG’s own sale and leaseback of the Charlemont Hotel to Deka in April 2020 and the recent Blackstone / Bourne Leisure and TUI / RIU deals completed at full multiples on 2019 EBITDA, it’s clear that the public markets are not valuing DHG correctly given its quality and prospects.

With regard to the take-private thesis, there are a number of notable points that further support this catalyst:

CEO Dermot Crowley has a background in private equity, having worked with a Dublin-based PE firm earlier in his career, indicating he is well-placed in understanding the rationale (and value) in going private. Additionally, his background also makes him an ideal CEO from a PE bidder’s perspective given this combination of PE and hotel management experience.

There are very few quality hotel groups that own their real estate at such a digestible bite size for a PE fund acquirer – at a 12x multiple on FY19 EBITDA, I estimate a buy-out of DHG would require an equity cheque of ~€600m, significantly less than what would be required on a take-out of Whitbread ( ~8x larger than DHG by current market cap) or IHG (~10x larger than DHG).

The fact that DHG directly owns a substantial hotel property portfolio and has a strong institutional covenant among landlords would appeal to PE or RE acquirers who could unlock further value via sale and leaseback transactions on DHG’s owned hotel assets.

DHG has a very unusual shareholder on its share register, with the Saudi conglomerate the Zahid Group owning ~10% of the company since H2 FY20. Zahid has interests across a diverse range of sectors, including construction, real estate, manufacturing, O&G and hospitality and acquired its interest via its European subsidiary Perpetua Holdings Europe Sarl. Additionally, it is possible that the unnamed European investor that sought to acquire a 14% stake in February this year was the Zahid Group, which would have brought it close to the 30% level at which it must make a mandatory offer to acquire the company under Irish Takeover Rules legislation. I believe it is possible the Zahid Group may mount a takeover bid for DHG if its share price remains at current levels.

Risks To Thesis & Mitigants

There are 3 main risks to my DHG thesis, each of which have clear mitigants in my view:

Risk 1 - COVID Variants and Vaccine Ineffectiveness: the key risk to my thesis is that COVID becomes endemic and/or vaccine-resistant variants emerge which prevents a recovery from happening for the travel and hospitality industries.

While this is clearly a risk, I believe it is mitigated by the following:

Evidence to date suggests vaccines continue to be effective against COVID and its variants, with further booster programmes now being planned to prevent further spread of the virus

Hospitalisation rates have remained low as vaccination rates have increased, indicating that if the virus continues to circulate among the population, vaccinations will reduce infection rates and prevent hospitals from becoming overwhelmed, which is the key determinant of further travel restrictions and societal lockdowns.

Although unlikely, I believe such a bleak scenario is already priced into the stock at the current price which implies ~9x my downside case EBITDA which assumes a very limited recovery vs. pre-COVID levels.

Risk 2 - Corporate Travel Business Never Recovers: ~50% of DHG’s business is generated from corporate/international travel, meaning DHG is meaningfully exposed to the risk of a permanent reduction in corporate and international business travel in a post-COVID marketplace, with a view that Zoom and other remote work technologies will reduce cross-border travel and the need for in-person meetings.

I believe the risk of a significant and permanent decline in corporate business for hotels is low given the following mitigants:

Travel Rebound Indicators - Recent data and reporting point to a rebound in business travel, with several surveys indicating business travel will resume gradually, in tandem with vaccine roll-out and the return of workers to city offices –

A recent Deloitte survey found that by Q4 FY22, nearly 9 in 10 respondents expect to reach 75% or higher of FY19 levels of business travel expenditure

An extensive survey from software group SAP found that 96% of business travellers are willing to travel for business over the next 12 months, for two reasons – firstly, concerns around the adverse impact on transactions, contracts and business relationships without in-person meetings, and secondly the ability to mix business trips with leisure opportunities after travel restrictions over the past ~18 months.

In it’s latest travel recovery survey conducted in June, consultants Oliver Wyman found that globally ~75% of business travellers expect to travel the same as or more than they did pre-pandemic, with the key driver being a fear of missing out on business relationships. The survey did find however that Europeans were planning to travel less than before the pandemic, with business travel possibly stabilising at a lower level in the medium-to-long term.

Airline IAG Plc’s management stated in their Q2 earnings call that they are seeing pent-up demand for business travel amid corporate clients’ frustration with Zoom calls, which suggests that once workers are vaccinated and normal economic activity resumes, increased corporate travel is likely. Similarly, Whitbread stated in their Q1 June trading update that their corporate hotel bookings were improving, with occupancy levels growing steadily from 35% at the start of the quarter to ~ 50% in the first two weeks of May, driven by demand from business customers.

WFH & Alternative Meeting Space - Another mitigant that will offset any longer term decline in business travel is the fact that as WFH practices increase among corporate workforces, some corporates will reduce or eliminate office space but still require suitable space for team “off-site” meetings, events and conferences. Previously teams would have collaborated in-office, but with an increase in remote working, hotel groups with a strong corporate offering such as DHG should benefit from rising demand for alternative corporate meeting and conference business.

City Hubs & Office Return - Dublin is an established multinational business hub, while despite both Brexit and COVID London remains a global city and was named the most desirable city to work in globally according to a recent BCG Global Talent Survey. As the above-cited surveys indicate, corporate activity such as cross-border transactions, client relationship building, and new business wins have been held back by travel restrictions – essentially business pipelines cannot be built via Zoom. As such, with Dublin and London representing ~55% of DHG’s total room count, it is well positioned to take advantage of increased economic activity in these cities as offices reopen and corporate activity increases coming into FY22.

Risk 3 - Competition & New Supply: Although DHG is the dominant player in the Irish market, it faces increasing competition from new hotel room supply coming into the Dublin market with Savills estimating ~4.5k new rooms will be added to the Dublin market by FY23 (+20% increase in market size). While increased competition could result in declines in RevPAR and margins across DHG’s Dublin portfolio (~50% of total portfolio), I believe this risk is substantially mitigated by several important factors:

Pre-COVID, the Dublin hotel market was undersupplied with annual new room supply growing at just ~1.6% CAGR from 2010 – 2019, while overseas visitors grew at a ~6.7% CAGR over the same period; this state of undersupply was evidenced by occupancy rates exceeding 90% during summer months and low availability of rooms. As such much of the new supply is catch-up vs. historic visitor demand, which is forecast to return given Dublin’s position as a strong tourist and business destination (see next point).

Dublin has traditionally been a strong tourist destination, proving highly resilient following previous disruptions (post-911, GFC and Eurozone debt crisis of 2010-12). Pre-COVID, Ireland received record visitor numbers YoY in 2019. Given Ireland’s strong tourist offering and position as a tech and multinational employment hub, leisure and corporate visitor levels are expected to rebound strongly by FY23.

Of the new supply of 4.5k rooms, ~60% is in the budget and apart-hotel categories which DHG does not compete in, with just ~22% /990 rooms to be delivered within the 4 star grade that DHG primarily trades at. Furthermore, hotel closures and conversions are expected due to a combination of a post-COVID shakeout of weaker assets and repurposing of stock for other uses e.g. hospital and embassy conversions will remove ~600 existing rooms from the Dublin market in the near term.

Given DHG’s market leading position, well-located quality assets, and the above mitigants, I do not see new competing supply in Dublin as a significant risk to the business.

Regarding UK competiton, DHG is a relatively new and smaller player competing against much larger groups including Whitbread, IHG’s Holiday Inn Express chain and Accor’s Ibis chain. Despite the size disparity and lesser-known brand, I do not see competition as a major risk for DHG in the UK for the following reasons:

Approach to UK expansion has been highly selective, with quality assets being opened in prime locations in larger UK cities with no dominant brand, that should benefit from a mix of corporate and leisure visitors

DHG has successfully established a foothold in the UK with an excellent reputation having met all rental obligations to landlords through the course of the pandemic across its leasehold assets. This contrasts with Travelodge and other operators who had to reduce rents via restructuring at the expense of landlords. DHG is now recognised as an institutional grade covenant on a par with Whitbread for leased hotels, which provides it with a competitive advantage for future growth in the UK via its leasing model.

The fact that market leader Whitbread has ~11% market share in the UK shows that the UK hotel market is sufficiently large and fragmented for DHG to compete and grow in. Furthermore it’s strong balance sheet and covenant should see it take market share as smaller, less viable hotel operators fail post-COVID.

Finally, DHG’s track record to date in the UK with superior RevPAR growth and EBITDAR margins vs. market leader Whitbread clearly evidence its ability to successfully compete in the UK market.

Appendices

1. DHG Financial Model Projections

Model Recovery Key Assumptions