Forced Purchasers and a Quick Idea

The implications of record dry powder for public equities.

Welcome to the second issue of Value Situations, and the first of the “quick ideas” editions of the newsletter. In this issue, I discuss an area of opportunity in public equities that I think represents a good pond to fish in for ideas, and I highlight a particular situation within this theme that I think merits further consideration.

Disclaimer

Value Situations is NOT investment advice and the author is not an investment advisor.

All content on this website and in the newsletter, and all other communication and correspondence from its author, is for informational and educational purposes only and should not in any circumstances, whether express or implied, be considered to be advice of an investment, legal or any other nature. Please carry out your own research and due diligence.

The Rise of the Forced Purchaser

With equity markets near all time highs, the risk of a wider market decline in the event of an unforeseen shock is perhaps higher than ever. The most followed barometer of equities globally, the S&P 500, trades on a Shiller CAPE ratio (which adjusts for inflation and earnings cyclicality) of ~37x vs. its long-run average of ~16x, and is not far off its all time peak of ~44x at the height of the dot.com bubble in 2000. Admittedly, the Shiller ratio has proven to be almost useless in timing the market, but it does go some way to allowing us gauge what Howard Marks calls the “temperature of the market.” And when we look from the Shiller data to the year-to-date box-office market action that has included such highlights as the GameStop/ Reddit day-trading frenzy, the Archegos implosion, and the bitcoin/dogecoin/crypto market mania, it’s hard not to think we’re in a moment of heightened risk here. And this is just the first six months of 2021 and we’re still emerging from COVID!

This type of environment and elevated valuations makes it more difficult than usual to find attractive equity ideas, but I’m a believer in being creative in looking for undervalued situations. One thread that I’ve been pulling on to uncover new ideas is that of private equity. The FT recently reported that private capital has soared to a record $7.4 TRILLION, of which ~$3 trillion sits in traditional private equity (LBO) funds. But what I find most interesting about this boom in private capital is that uncalled capital or dry powder is at record highs (and indeed has been steadily piling up since 2015).

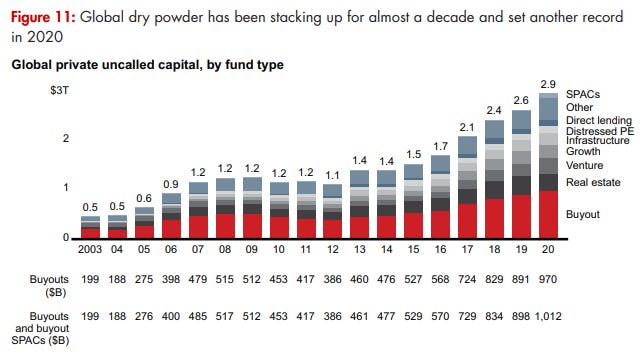

Coming into 2021, Bain & Co. reported that global dry powder stood at ~$2.9 trillion, of which ~$1 trillion related to conventional PE buy-out strategies:

Source: Bain & Co., Global Private Equity Report 2021

More recently in May, Preqin reported that global PE dry powder now stands at $1.6 trillion. To put that into context, that is not far off President Biden’s existing $1.9 trillion stimulus package to pull the United States out of the worst recession since the Great Depression. If we include Real Estate, Growth and Infrastructure funds as well as the newly popular SPACs that have all started to compete in the buy-out space, dry powder focused on corporate targets now exceeds $2 trillion. So private equity appears to have more firepower at its disposal for acquisitions than the world’s largest economy has to fund its re-emergence from a global pandemic.

But the dry powder story doesn’t just stop with private equity. According to S&P Global, US corporations also sit on record cash piles following a flood of debt issuance in response to the pandemic. US corporates now have cash reserves of $2.5 trillion, of which one obvious use is growth by acquisition.

So how is this relevant to public equities?

I believe we can expect an increase in take-privates of public companies at premium valuations, which presents an opportunity set within public equities that may not necessarily correlate with the direction of the wider stock market.

Thinking through this thesis, I was reminded of a quote from Baupost’s Seth Klarman who has said investors should “always look for forced urgent selling” for investment opportunities, that is sellers of assets that are motivated to sell for non-economic reasons (such as margin-calls). Looking at the mountains of uncalled cash sitting on the investment landscape, I believe we have the inverse of a forced sellers’ market. I think much of this dry powder will be deployed in line with what Warren Buffett termed the “institutional imperative” - “Just as work expands to fill available time, corporate projects or acquisitions will materialize to soak up available funds.” The rise of private equity and corporate dry powder is effectively the rise of what I will call the Forced Purchaser – this capital has been raised with finite terms and at a cost to its providers, and so it must be put to work.

Why am I confident that this dry powder will be deployed into public company buy-outs? Buffett’s partner Charlie Munger perhaps captures the point best: “Show me the incentives and I will show you the outcome.” Very simply, if this uncalled capital isn’t put to work, a lot of highly motivated and financially-driven people won’t get paid bonuses or carry. In contrast to the forced sellers who sell for uneconomic reasons, the stewards of this unspent capital NEED to acquire other assets for purely economic reasons, including their own.

This leads onto why I think public companies will become the focus of increased take-private activity. As private market assets have gotten increasingly expensive given the increased competition that comes with record levels of dry powder, and public markets generally are close to all time highs, there are few places left for this capital to be put to work. So undervalued or mispriced public companies that haven’t participated in the wider rise in asset values are an obvious place for this capital to flow into.

Indeed, in the year-to-date there are numerous examples of PE-backed bids for public companies, such as Brookfield Asset Management’s take-private of its own real estate platform, Blackstone’s take private of QTS Realty, as well as a flurry of activity among UK-listed names.

So how does one capitalise on this Forced Purchaser theme?

Merger arbitrage is one obvious way to play this, but the level of upside I seek (50%+) is not typically available on deals once they are announced, as arbitrageurs step in and spreads narrow relatively quickly. I’m therefore more interested in identifying plausible take private or acquisition candidates ahead of any bids.

Such a strategy is not an easy one to execute and comes with the risk of a low hit rate, so I’m not suggesting building an entire investment strategy around the Forced Purchaser theme - this shouldn’t be construed as a speculative pre-arbitrage “Boesky bets” strategy (minus the inside information!) of betting on companies in the hope that someone will take them out. Rather I see it as another pond to fish in for differentiated ideas in a volatile and richly valued market.

In my experience I believe it is possible to identify takeover candidates if one knows where to look, and I suggest that target stocks can be identified using certain criteria, including the following:

Valuable assets that will be prized by PE e.g. prime real estate portfolios valued at less than private market value

Brands with predictable businesses and cash-flows – such companies can be leveraged and provide enhanced yield to a new owner

Steadily growing cash generators e.g. certain types of software businesses

Underleveraged / debt-free assets – again can be leveraged to maximise equity returns by PE owners

Scarcity value, e.g. companies that own unique or niche assets, or produce essential products with limited competition

Iconic brands

Cheap for no good fundamental reason other than being overlooked or illiquid

Companies in fragmented industries where consolidation is happening

Stocks that have attracted bids in the past which did not complete – often such assets come back into play

The above is NOT an exhaustive list of criteria, just illustrative of some of the situations where I think genuine takeover targets can be found. Furthermore these also reflect attractive fundamental attributes that help mitigate the risk of no bids transpiring – if a takeover does not realise the value, then some other catalyst or simple mean reversion will often drive a re-rating in time.

Case Study – Green REIT Plc

To illustrate the thesis, its useful to consider a brief case study that reflects a number of the above target criteria:

Green REIT was an Irish prime office REIT taken private by real estate PE firm Henderson Park in 2019

At the end of 2018 Green was trading at a discount to NAV of ~25% vs. peers trading at ~1x at the time, despite Green having arguably the best commercial RE portfolio in the Irish market

Green’s value was depressed for two main reasons:

It was a small-cap in an immature REIT market – REITs only came into existence in Ireland in 2013 as a way to stimulate investment in Irish RE following the domestic property collapse in 2009. As such it was overlooked despite its quality assets and improving market conditions at the time; and

Management had consistently provided very cautious guidance at a time when the Irish market was strengthening and valuations were rising, as international capital came into the market and the economy rebounded out of recession post-GFC.

My view at the time was that in reality insiders were positioning the company for sale, and had form in this regard – founder and chairman Stephen Vernon had previously led a take private of predecessor entity Green Property Plc in a 2002 LBO, when it had traded at a similar discount to NAV.

Furthermore, management were the largest shareholder block in Green REIT via an external investment manager structure which allowed them to participate in a liquidity event such as a buy-out - recalling Charlie Munger’s advice on incentives, Green REIT management were clearly highly incentivised to drive a sale of the company, and were confident of expecting strong bids given the dry powder coming into the Irish market in search of assets and Green’s wide discount to NAV.

Aside from the above position, Green possessed many of the characteristics that appealed to PE acquirers looking to deploy capital – prime assets, supportive market backdrop at the time, growing income yield, very low leverage (~14% LTV vs. European REIT sector norm of ~40%- 50%), embedded future upside from a logistics land bank, and crucially it was fundamentally undervalued. In my view it was inevitable that it would attract a take-private offer.

In April 2019, management announced they were putting the REIT up for sale, and after a competitive process it was taken private by Henderson Park at €1.91/share in November 2019, implying a 36% gain (or ~45% IRR / 1.36 MOIC) in ~11 months for anyone who bought into Green at the end of 2018 when it hovered at €1.40/share

A Possible Current Target

Some might argue that it’s easy to say in hindsight that Green REIT was an obvious take-private, so I’ll outline another idea that could be a possible takeover candidate in today’s market.

Returning to the Irish REIT playbook, Green’s peer Hibernia REIT Plc (HBRN, listed on Euronext Dublin and the LSE) is another Dublin-focused prime office REIT whose valuation looks anomalous vs. its peers who have re-rated post-COVID, as markets have started discounting the reopening of city centres and a return to the office.

HBRN currently trades at ~0.73x NAV vs. ~0.96x for peers, London office REITs Derwent London and Great Portland Estates. Notably its only true domestic peer, IPUT Plc (an unlisted umbrella investment company) trades at 1x NAV, despite being a much less liquid vehicle whose units are traded only once a quarter:

Source: Koyfin; Value Situations analysis

A summary thesis for HBRN is as follows:

Strong asset backing, with a high quality portfolio of largely prime Dublin City Centre offices, let to blue chip covenants including Irish-state backed tenants, US tech companies and other multinationals and professional services firms;

Most recently in May it won the mandate to deliver KPMG’s new Dublin campus comprising ~340k sq. ft. of prime office accommodation, which in itself is a hugely encouraging sign for the Dublin office market post-COVID.

Stable income profile, with contracted rent of ~€67m with visibility to ~€90m over next 5 years, and a current dividend yield of ~4.3% with scope to grow this to 5% (this compares to current dividend yields of ~2% for UK peers Derwent London and Great Portland Estates)

Despite COVID triggering rent deferrals and concessions across the commercial RE sector, Hibernia had the one of the strongest rent collection rates in Europe among office REITs, collecting 99% of rents in FY21 (March y/e), further highlighting the quality of its tenant base.

At a ~20% LTV, HBRN has a balance sheet that could take significantly more leverage to drive returns for a private real estate fund (Hendersen Park obtained 74% LTV senior debt financing on Green REIT as an example).

Despite its obvious quality, HBRN trades at a ~30% discount to NAV while its peers trade at ~1x currently, in a post-COVID market where a return to office working is now expected.

Without launching into a disquisition on the remote working vs. return to the office debate here, while work practices will inevitably change post-COVID the likelihood of prime office take-up resuming is high – to date, the indications from the Dublin office market post-COVID are supportive for an investment case for HBRN, with a number of strong lettings and transactions by institutional capital indicative of a positive outlook for the market, particularly in the prime office segment.

As the economy re-opens and employees return to the office, should HBRN’s undervaluation persist while its peers have already re-rated I believe this increases the likelihood of a take-private transaction, much like Green REIT before it.

So what does the prospective return profile look like for a buyer of HBRN’s stock at the current share price in this take-private scenario?

Assuming one buys HBRN shares today at ~€1.25/share and sells into a take-private bid at €1.50+, the indicative return profile is a 26% IRR / 1.26x MOIC over an assumed 12 month investment period (including dividend):

Source: Value Situations analysis

In the above, I assume a take-private catalyst at €1.52, applying the current peer multiple of 0.95x (as per compset analysis above) to the tax-adjusted NAV/share of €1.60.

This tax adjustment is an important factor in the economics of a take-private for HBRN. This reflects a change in the Irish tax code implemented at the time of the Green REIT buy-out, whereby capital gains that REITs are ordinarily tax-exempt from are clawed back and crystalised if a REIT is ceases to be a REIT within 15 years of listing. A take-private of HBRN by a private RE fund would trigger this claw back and I estimate tax leakage of €88m or ~€0.13/share, reducing the reported NAV/share from €1.74 to ~€1.60. However even on this basis, HBRN still remains undervalued at ~0.8x the tax-adjusted NAV.

If a take-out does not materialise, I see the downside at ~€1.22, or just -3% to the current share price, which assumes HBRN remains publicly listed and trades at a stagnant 0.7x multiple on the reported NAV. It’s important to note here that this reported NAV reflects the independently appraised value of HBRN’s portfolio post-COVID. Given vaccine roll-outs and the economic re-opening underway together with the value accretion ahead from HBRN’s development portfolio (e.g. the KPMG mandate) I would see such a stagnant downside scenario as a low probability one.

While the indicative upside here falls short of my target 50% threshold, the downside protection and resulting asymmetry of returns makes this a particularly compelling situation in my view. It’s almost impossible to lose money on HBRN at the current price given the margin of safety on offer from the discount to NAV and prime asset-backing, while the indicative upside is ~8x the downside risk. It’s rare to find such asymmetry in an asset-backed stock such as a REIT.

But do the economics work for an acquirer on a take-private at €1.52/share? A back-of-the-envelope buy-out analysis would suggest yes:

Source: Value Situations analysis

A buy-out at €1.52 indicates an equity value of ~$1bn for HBRN (vs. ~€830m currently) which incurs total tax leakage of ~€99m comprising stamp duty tax at 1% of the equity value plus €88m (as noted above) in deemed capital gains on the buy-out.

Similar to the Green transaction, given the quality of the assets and income profile, a take-private of HBRN should secure very favourable leverage terms, and I assume debt finance of ~€1bn (75% LTV, first secured against HBRN’s €1.4bn portfolio) priced at 3.25% which I think is conservative (this compares to a 74% LTV senior-secured loan priced at L+2.50% for the Green take-private).

Rental income declines in 2023 as HBRN redevelops two existing office sites, driving a net rent reduction of ~€7m; these sites are developed into new Grade A campuses (including the KPMG campus) which come onstream in 2026, generating an incremental ~€31m in rent, assumed at current market rents. The delivery of these projects is funded by a senior debt development facility, as part of the overall corporate financing package, with the LTV falling to sub-70% on completion of the development assets.

The analysis also assumes ~€2m of opex cost-savings, bringing opex in line with peer IPUTs cost base on a % of net rent basis, given cost-savings are likely from no longer being a public company, as well as from plugging the portfolio management function into an institutional acquirer’s RE platform.

An exit is assumed at 1x NAV in 2026 with the portfolio sold at a 4.25% yield (in line with current market yields for prime Dublin offices) generating net proceeds of ~€560m after repayment of debt and tax, or ~1.9x the Day 1 equity cheque.

Given the prime quality and relatively dry nature of HBRN’s portfolio with ~90% of it comprised of completed income generating assets, an acquirer is likely to be a Core-plus RE fund rather than an opportunistic PE acquirer.

The analysis indicates a buy-out at €1.52/share generates a return profile of 14.7% IRR / 1.9x MOIC, which is comfortably above the typical Core-Plus return hurdles of 10% - 12% IRR. Furthermore, the portfolio generates a stabilised cash-on-cash yield of 7.7% after delivery of the development assets, making it an attractive portfolio for a Core-Plus buyer or long-income fund seeking a steady yield.

Finally its worth noting that the above assumes nothing happens with the ~155 acres of land in Dublin owned by HBRN with potential for future industrial/logistics and mixed use development, currently carried at ~€59m (or ~€0.09/share). The development potential here could provide further upside that is not factored in above.

While this is only a high level analysis, it does suggest a take private catalyst for HBRN is plausible, with strong returns available for acquirers in search of quality assets and who need to deploy capital. Should HBRN’s share price remain depressed as the local economy re-opens, the possibility of a take-private over the next 12 months increases in my opinion. If not, the shares should re-rate towards NAV, in line with peers.

Interesting idea. I think the key risk to consider is that Dublin has one of the largest office supply pipelines in Europe. The question is whether vacancy goes to 10% - 12% and rents fall 5% - 10% like management thinks or whether vacancy goes to 15% - 20% like the GFC and rents fall 30% - 40%... That being said, thinking about it in your framework of forced purchasers and someone buying this due to its relative value to other European office REITs - I can see that. Kennedy Wilson, Blackstone, German capital - I could see all of them making a bid for this. How did you get to your estimate of the tax leakage on delisting?