Revisiting US Silica

Recent announcement indicates a transformative event and re-rating ahead

Disclaimer

Value Situations is NOT investment advice and the author is not an investment advisor.

All content on this website and in the newsletter, and all other communication and correspondence from its author, is for informational and educational purposes only and should not in any circumstances, whether express or implied, be considered to be advice of an investment, legal or any other nature. Please carry out your own research and due diligence.

US Silica - A Quick Recap

I previously wrote about US Silica Inc (SLCA) at the end of August, highlighting it as an interesting potential play on the sand commodity theme. To recap, SLCA operates across two segments - (1) Oil & Gas Proppants, its frac-sand business, and (2) Industrial & Specialty Products (ISP), its commercial silica business.

In my original analysis I saw SLCA being a beneficiary of both the cyclical recovery in oil (now an increasingly bullish theme with the current energy crisis), and commodity inflation and scarcity, supported by the expected boom in construction and infrastructure spending under President Biden’s infrastructure plan and ESG tailwinds.

SLCA currently trades at $9.91/share, or 6.6x LTM EBITDA (vs. its long-term average of 9x - 10x), and is up ~8% since I wrote about it at the end of August. In my original “quick idea” analysis, I estimated SLCA to be worth ~$16.50/share (+80% upside) in a Base Case, which assumed an equity offering (see below) and a market re-rating scenario to a 9x multiple based on the supportive fundamentals for both segments. Furthermore, I also outlined the potential for additional upside to $25+/share, based on a re-rating on growing EBITDA to $350m driven by $90m of incremental earnings power from the commercialisation (already underway) of new products in its ISP business.

I also flagged two risk areas which have weighed on the stock:

Leverage - SLCA is highly geared at 3.7x LTM EBITDA (net debt basis), a factor Barclays had previously flagged as a concern, given the volatile commodity nature of the business, particularly in the historic boom-to-bust fracking industry which its Proppants business depends on (~50% of LTM revenues).

SLCA recently filed a Form S-3 Registration Statement for a mixed shelf offering, which likely indicates an equity offering may occur in the near future, the result of which could be meaningful dilution for existing shareholders.

On balance, I concluded new equity issuance would ultimately be a positive for the stock as proceeds could be used to delever the balance sheet and position the business to capitalise on the oil market recovery and and invest in the growing ISP business at the right time in the cycle for both, and thereby accelerate a re-rating of the stock. In my previous analysis, I estimated a new offering of 20m shares would result in ~20% dilution, but importantly bring leverage below 3x before any EBITDA growth, and towards a very manageable 2x with incremental earnings from the ISP business (and assuming Proppants earnings remained flat, a very conservative assumption at this juncture). On that basis, I viewed SLCA as a situation worth monitoring.

Recent Developments

While there has been no update from the company regarding an equity raise, earlier this month it announced it was exploring “strategic alternatives” for its ISP division, which may include a sale or separation of this business. In my view the ISP business is the more interesting (and valuable) of SLCA’s two business segments -it’s future growth prospects are supported by structural tailwinds in areas such as renewable energy, filtration and infrastructure, and it has demonstrated clear pricing power ( 3 x price increases announced in the last ~12 months) which only highlights the essential nature of its products for industrial applications while also providing an inflation hedge.

On further consideration, a sale or separation of the ISP segment now actually makes a lot of commercial sense from a value creation perspective. Historically, SLCA has been viewed as an O&G play with its valuation strongly correlated to the price of oil. This has effectively penalised the stock and obscured the value of the ISP segment in recent years given ESG-motivated negative sentiment towards oil and energy-related stocks. In addition, the significant debt load has further weighed on SLCA’s valuation.

While this latest announcement mentions a sale or other separation (presumably a spin-off), a sale seems like the more attractive option given that it would realise substantial cash proceeds to clear the legacy debt and fund a value-accretive share buyback programme. Essentially, a sale of the ISP segment could recapitalise and reposition the remaining Proppants business at a very opportune point in the cycle, thereby driving a re-rating of SLCA’s stock and creating significant value for shareholders.

What Is the ISP Business Worth?

So what would the ISP business sell for, and what would SLCA be worth post-divestment?

Firstly, looking at recent comparable M&A transactions in the wider specialty materials sector, which includes SLCA’s own acquisition of EP Minerals in 2018, it’s reasonable to assume the ISP segment could sell for 12.5x EBITDA:

Source: Corporate filings; Value Situations analysis.

Of the above transactions, its worth noting that privately-held Standard Industries has been particularly acquisitive and could be a logical buyer for the ISP business. I’d also highlight that the ISP segment’s historic EBITDA margin has averaged ~38% over the last 3 financial years and the LTM period, well above the precedent transaction comps’ average of ~24%:

Source: Company filings; Value Situations analysis.

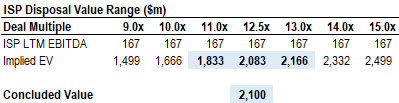

Combining ISP’s superior margins with its growth prospects, it’s entirely plausible that SLCA could achieve a higher multiple in a sale to a strategic buyer, so a 12.5x value multiple may be conservative. However, for the purposes of this exercise I’ll assume 12.5x as a fair multiple here. Applying the 12.5x to ISP’s LTM EBITDA results in an indicate valuation of $2.1bn for the segment (or ~1.23x SLCA’s current EV, and 2.8x its current market cap):

Source: Company filings; Value Situations analysis.

With SLCA having ~$1bn in net debt, its clear to see that such a divestment would constitute a hugely transformative event for the company, and would create a very compelling value situation given the current share price.

SLCA Valuation Post-Sale of the ISP Business

A sale of the ISP division for ~$2bn+ implies significant value creation and a highly asymmetric risk/reward profile for SLCA.

Post-divestment, I estimate a debt-free SLCA could be worth $23/share in a Base Case before any re-rating or stock buybacks, implying ~134%+ upside from the current share price, with a return profile of 33% IRR / 2.3x MOIC over a 3 year investment term (or a 53% IRR over a shorter 2 year investment period):

Source: Value Situations analysis.

This post-sale PF valuation of ~$23/share assumes the following:

$2.1bn of disposal proceeds is used to clear the existing debt of $1.2bn, resulting in net cash position of $1.1bn.

Remaining Proppants segment EBITDA of $89m, after the following adjustments:

Stripping out ISP EBITDA of $167m from total LTM EBITDA following disposal.

Deducting ~$49m in non-recurring settlement fees earned from historic customer dispute included in Q2 FY21 Proppants earnings.

Adding back $48m of central opex, equating to ~50% of total LTM central costs, on assumption that these central costs are no longer incurred and cost effiiciences are achieved with the effective disposal of half the business.

Remaining SLCA is a pure play Proppants business, and holds its current 6.6x multiple, which is conservative given cyclical upturn expected for the oil market, and is well below SLCA’S long-term average multiple of 9x - 10x.

In a Re-Rate scenario, I estimate SLCA could be worth $30/share post-buyback and market re-rating, implying upside of ~200% and a return profile of 45% IRR / 3.1x MOIC over a three year investment period in this scenario (IRR increases to 75% if scenario plays out over a 2 year investment period). This assumes the following:

The company buys back ~45m shares at the Base Case share price of $23/share following the ISP sale using ~$950m of proceeds (or ~1.3x the current market cap), and leaving $100m in surplus cash available for corporate purposes.

Market re-rates stock to 9x PF Proppants EBITDA of $89m .

Finally, in a Growth-upside scenario, SLCA could achieve a valuation of ~$38/share, implying upside of almost 290% / 57% IRR / 3.9x MOIC over a 3 year investment term (with IRR rising to 97% over a 2 year hold), assuming the following:

Proppants business grow EBITDA ahead of LTM levels, which is reasonable given oil market outlook today.

Proppants revenues grow at a CAGR of 2.5% from LTM level of $502m to $527m by FY23.

EBITDA margin runs at 32% (vs. 37% for LTM period, and in line with historic average margin over FY18 - FY20 and LTM periods), resulting in pre-central opex EBITDA of ~$169m.

Central opex runs at ~10% of revenues in line with historic trends, resulting in FY23 company EBITDA of ~$116m ($169m segment EBITDA - $53m in central opex).

Valuation multiple of 9x, in line with SLCA’s historic average multiple.

So in summary, this scenario analysis indicates upside of ~130% - 290% for SLCA assuming it completes the sale of its ISP segment in line with comparable precedent transactions, suggesting a very compelling set-up here.

As a further point, some historical context is perhaps helpful here in considering the extent of this indicative upside. SLCA re-rating to a share price of $23 - $38 does not imply the stock breaks new all time highs - in fact these price levels would actually be well below its previous peak valuations across share price, market cap and EV achieved through the previous cycle:

So with a indication of valuation upside, lets move on to assessing the downside risk and the potential risk/reward involved in this situation.

Potential Downside, Risk/Reward & Asymmetry

An indicative downside analysis (post-ISP sale and a share buyback) suggests there is very little downside here. Assuming a trough 4x multiple and a 50% decline in Proppants EBITDA to ~$45m implies a downside share price of $9, or -8% vs the current share price:

Source: Value Situations analysis.

Given the fundamental set-up in the oil market with the need for increased oil production to meet rising demand, the outlook for frac sand volumes and pricing is positive and so such a downside seems unlikely, which further implies a highly asymmetric return/risk profile.

As the above analysis shows, SLCA offers upside of 16x the downside risk under my Base Case assumptions, and 25x - 35x upside vs. downside risk in the Re-rating and FY23 Growth scenarios respectively.

Of course, this analysis rests on a successful divestment of the ISP business at the 12.5x valuation assumed AND that management completes a share buyback programme as outlined with the sale proceeds. I think both these assumptions are reasonable based on the current facts however, given:

A disposal of ISP is likely to a achieve a strong valuation given current market dynamics, recent M&A activity in the broader sector and the specific attributes and growth outlook for the ISP business itself; and

Regarding capital allocation/return, it’s worth highlighting management’s stated intention here:

Both our ISP and O&G segments are industry leaders, and it is from this position of strength that we believe a separation or sale of ISP has the potential to unlock significant value and maximize returns for all of our stakeholders.

(CEO Bryan Shinn, Company Announcement, 6th October; emphasis is mine)

To conclude, management’s decision to dispose of the ISP business is being made at a very opportune time both in terms of cycle timing for the Proppants segment and price maximisation for the ISP segment. The updated analysis following management’s announcement indicates SLCA constitutes a highly asymmetric value situation that is worth monitoring.

This is a very well articulated thesis. Kudos

Nice post and interesting idea. The transaction is a bit odd in that they seem to want to part with the crown jewel on the cusp of a supposed inflection. Why is that a good idea?