Disclaimer

Value Situations is NOT investment advice and the author is not an investment advisor.

All content on this website and in the newsletter, and all other communication and correspondence from its author, is for informational and educational purposes only and should not in any circumstances, whether express or implied, be considered to be advice of an investment, legal or any other nature. Please carry out your own research and due diligence.

This regular weekly bulletin returns after a break last week as I published my analysis of the upcoming Porsche IPO for paid subscribers - for those interested this can be found here.

And now on to this week’s Bulletin.

The Problem Is Next Year

A piece in the FT from last week, After the tech sell-off: will growth investors keep the faith? got me thinking about a potential source of opportunity in the coming months for vigilant and disciplined value-oriented investors.

The FT article was essentially about how growth-tech investors such as Chase Coleman’s Tiger Management, Baillie Gifford’s Scottish Mortgage Investment Trust and others might adapt following the “tech wreck” sell-off earlier this year (and which continues today) as inflation and rising interest rates reduced the attractiveness of growth tech names.

The article suggests the opportunistic pivot for these tech investors now is to step in with what sounds like rescue financing packages for busted venture/tech names following the sell-off, citing “structured equity” transactions as an example of this strategy:

Coatue is raising $2bn for a structured equity strategy, the Tactical Solutions fund, which can lend money to cash-strapped private companies who do not want to raise dilutive equity financing at depressed valuations…

… Atreides Management… is also raising money for an opportunistic venture fund. It will invest in structured equity transactions to take advantage of distressed situations in venture and it will also take public companies private, according to a July investor letter.

There may well be an opportunity in the structured equity space for well-connected institutional investors with technological competence and resources, however I do wonder if there is a simpler and more efficient opportunity amid the great tech sell-off.

One paragraph in the piece prompted me to pull further on this thread:

Yet while some see the sell-off in growth stocks as an attractive entry point, not everyone is jumping in headfirst. “It feels to me like there’s definitely value in the public markets over the next five years,” says Philippe Laffont, founder of the New York-based Coatue Management and one of the so-called Tiger cubs who trained at Julian Robertson’s Tiger Management. “The problem is the next year.” Laffont is among the more bearish voices among the community of growth investors. Following the market sell-off earlier this year, Coatue liquidated positions in its hedge fund. In May, the hedge fund was sitting on more than 80 per cent cash, according to investors.

[emphasis in bold mine]

I think the “problem” of next year may become apparent by the end of this quarter and into Q4, namely heavy redemptions for equity hedge funds due to poor performance. However, I think there is a flipside to this problem, being a wave of value opportunities due to forced selling by “tech-wrecked” hedge funds and other investors.

This “problem” comment also prompted me to recall a recent twitter thread from Harris Kupperman (aka Kuppy) from Q2 this year, which I think is applicable coming into Q4:

After massive redemptions in Q2 on poor performance, numerous reports suggest subsequent performance has not improved for many hedge funds, raising the prospect of further significant redemptions by year-end.

Indeed looking at the YTD performance data from HFR for equity-focused hedge funds, it suggests a difficult final quarter for many funds looking to make back losses and retain investor capital:

Source: HFR.

With the SPX is down ~17% YTD, the relative performance above might not seem as bad for some strategies, except that hedge funds are an absolute rather than relative return asset class.

Furthermore, with inflation running at ~8%+ and thereby providing a baseline return hurdle of more that is 2x the current US 10 Year government bond, such negative performance for high fees is unlikely to see funds retain all their currently invested capital.

By contrast, the extreme out-performance of the energy sector broadly, and selected energy-linked names in particular, puts the above performance into some perspective:

Commodities, specifically energy (oil, gas and particularly coal) and fertilizer have generated extreme and outsized gains as a result of the energy crisis this year as shown in the chart above, while the top 5 names held by hedge funds according to Goldman Sachs have performed horribly, particularly Facebook aka Meta Platforms (META):

Yet despite this underperformance, many hedge funds appear to be doubling down on their tech bet again. If current YTD return profiles continue through to year-end performance (and its hard to see how this poor run can be reversed now), then year-end could well be the “problem” for some hedge funds but a real opportunity for value-focused investors.

My thinking here is to watch for forced selling of names as redemptions hit, but not necessarily in the tech names that some hedge funds may be forced to sell; given that the FAANG complex (Facebook/Meta, Amazon, Apple, Microsoft, Google/Alphabet) still accounts for ~20% of the SPX by market cap weighting, any sell off in these names (which are the most liquid when faced with meeting redemption calls) will likely drag the wider market lower, potentially dragging other names down with them and making these cheaper for entirely non-fundamental reasons.

Furthermore, market structure could further play into this opportunity, with redemption selling being exacerbated by further mindless selling from index funds and ETFs as the indices they mimic are re-weighted and selling begets further selling.

So in summary the problem of poor hedge fund performance may present an opportunity for patient value-focused investors in due course.

Another 40% Down To Go?

It seems I broadly share the same outlook as “Dr. Doom,” Nouriel Roubini with regard to his view that the global economy is facing 1970’s-style stagflation, as Bloomberg reported earlier this week.

Staying true to his moniker, Roubini sees a “long and ugly” recession in the US and globally, with the stock market (as measured by the S&P 500 index SPX, ) falling up to 40%. Such a fall would imply the SPX plummeting to ~2,200 from its current level.

Interestingly this is not far off the 2,400 level I theorised back in Weekly Bulletin #19 should the current market environment “rhyme” with the post-dotcom bust of 2001-2002, noting that there are several parallels today with that period in terms of market conditions.

Roubini cites global debt levels (both public and private), persistent inflation, negative supply shocks and geopolitical factors (including Russia/Ukraine) combined with continued rate hikes to combat inflation as the drivers of his doom-y outlook. His reported advice for investors in light of this outlook? Be light on equities and hold more cash, presumably for capital preservation and optionality as asset prices eventually collapse.

I’m not saying that markets will collapse 40%, and as I wrote previously I cannot predict what markets will do. I do however feel confident holding two views that I do not see as contradictory:

Market risk remains elevated given wider macro concerns, not least rising interest rates meaning that risk assets generally must be repriced downwards; and

Idiosyncratic and niche situations exist where investors can still make money, regardless of market risk at the general level.

With regard to the second point, the challenge of course is finding these situations, which is what I am endeavouring to do in this newsletter, and which I publish for paid tier subscribers.

Any Other Business

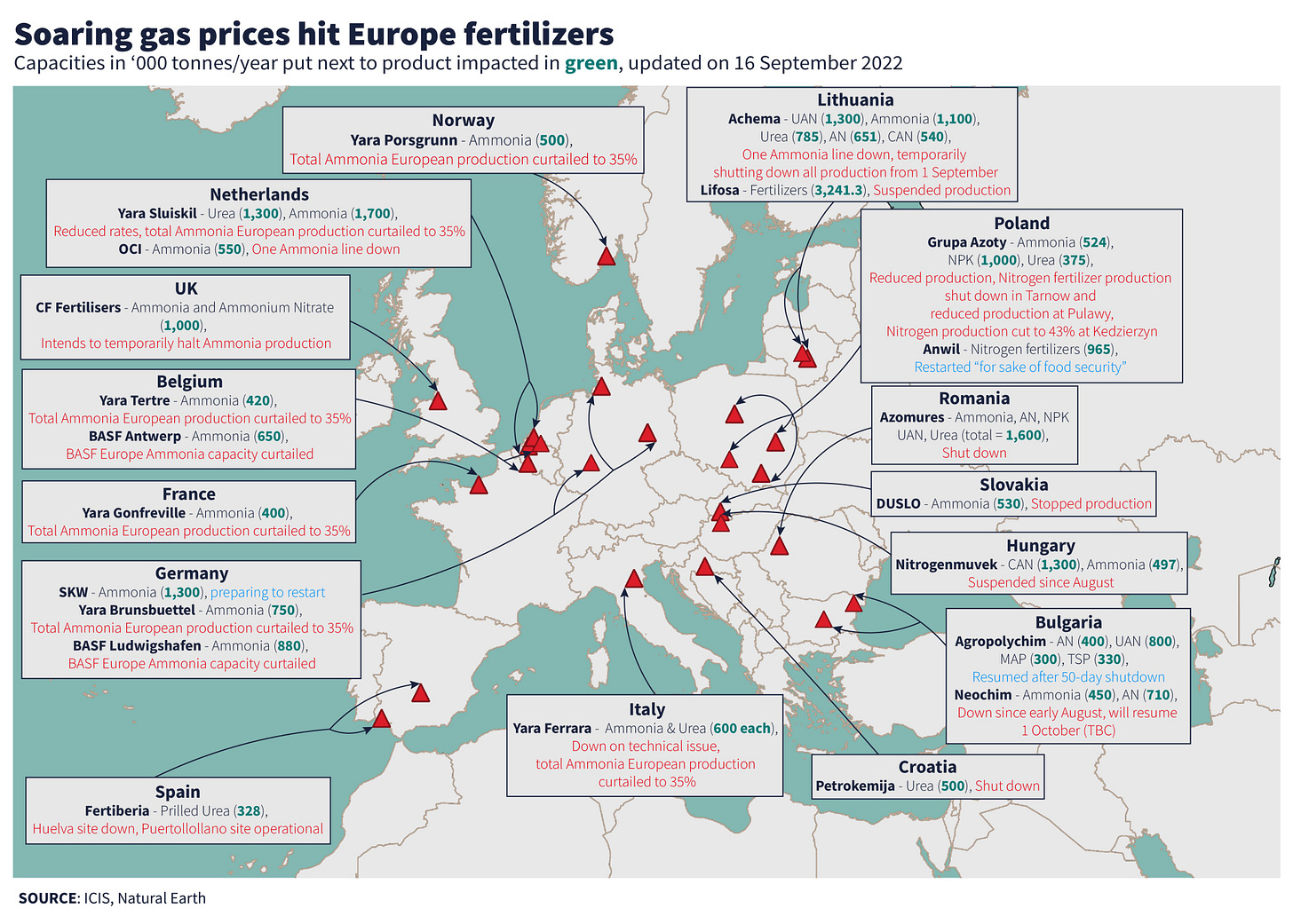

For this week’s AOB I’m highlighting an interesting (and frightening) chart highlighting the impact of recent fertiliser plant curtailments or shutdowns in Europe due to the ongoing energy crisis:

Source: ICIS (Sylvia Tranganida).

Recall that natural gas is the main feedstock in the production of ammonia and nitrogen-based fertilsers, and the surging price of natural gas has made it uneconomical for many fertiliser production facilities to continue operating. Notable cases of closures include CF Industries’ halting of ammonia production at its Billingham plant in the UK, and Yara International’s announcement that it was cutting back on ammonia production earlier this year.

These production shutdowns are further hard evidence of ongoing supply constraints for critical commodities, and which have a major inflationary impact regardless of interest rate hikes and the theoretical demand destruction associated with such hikes.

This trend is also further evidence of my Food For Thought thesis playing out, with the likelihood of further food price inflation and food shortages very high in my view. As such the wider food supply chain complex is a part of the market worth monitoring closely - I believe the market may not be fully pricing in the implications of the above closures for certain public equity names.

Why Not Subscribe to the Paid Tier?

If you find the ideas in this newsletter interesting, please consider signing up to the Paid Tier.

You can read more about the paid offering here.

This newsletter is 100% reader supported and free from conflicts of interest or other commercial considerations. In writing Value Situations my job is essentially to generate ideas for subscribers that supplements their own idea origination process.

Furthermore, I believe the value proposition for paying subscribers is compelling. I am a former private equity/special sits investor that has worked with one of the largest alternative investment firms in the world, and so paying subscribers will be getting thoughtful, buy-side quality ideas and analysis for a very small fraction of the cost of employing a buy-side analyst full-time.

If you find this newsletter interesting, please also consider sharing it with friends and colleagues by clicking the Share button below.

Here’s what other investors are saying about Value Situations:

Value Situations was named as one of the Top 100 Must Follow Stock Research accounts by Edwin Dorsey of The Bear Cave Newsletter: