Weekly Bulletin #23

TAM-Out Time & the Precarity of Supply

Disclaimer

Value Situations is NOT investment advice and the author is not an investment advisor.

All content on this website and in the newsletter, and all other communication and correspondence from its author, is for informational and educational purposes only and should not in any circumstances, whether express or implied, be considered to be advice of an investment, legal or any other nature. Please carry out your own research and due diligence.

I’m a little later than usual in publishing this week’s Bulletin as I’m on vacation, but I wanted to set outline my current thinking on the ongoing commodity-demand destruction story as it is perhaps the most debated aspect of financial markets at present.

There will be no Weekly Bulletin next week, but it will return to your inboxes the following week when I return from vacation.

TAM-Out Time & The Precarity of Supply

Amid the ongoing headlines about demand destruction due to commodity inflation and recession fears, it strikes me that many analysts and commentators are overly focused on demand-side economic forces, and ignoring serious and likely structural supply constraints. As regular readers will know, with regard to key commodities it is my view that constrained supply (due to both disrupted supply and physical supply deficits) is likely to persist for some time. On that basis I believe certain essential commodities (and equities levered to them) represent an attractive opportunity set for investment over the medium term.

Upon reflection, the market’s current fixation on demand is perhaps not that surprising; after all, investors have been conditioned to focus on demand under the guise of Total Addressable Market or TAM over the past 10 years or so. One of the best examples of the market’s erstwhile TAM-obsessed mindset was the Uber IPO in 2019. Uber listed at an initial market cap of ~$76bn despite being consistently loss-making (averaging -$2.3bn in negative EBITDA over the previous three years). Nevertheless the cumulative ~$12.3 trillion TAM opportunity cited in Uber’s Prospectus was enough for the market to ascribe enormous value to it’s business.

Of course, much has happened since Uber’s IPO and the market environment is very different today; last year saw the sharp decline in Cathie Wood’s ARK Innovation ETF (ARKK), which has continued into this year, followed by the tech wreck in Q1 and the disastrous performance of TAM-focused investors such as SoftBank and Tiger Global. Indeed the performance of a cross-section of the top disruptive/growth/tech names with exciting TAM narratives as held by ARKK, Tiger Global and SoftBank has been horrendous YTD:

So while investors have seemingly come to realise that the promise of implied demand (i.e. TAM) doesn’t necessarily equate to great investment prospects, I believe many are still looking at the market solely through the demand lens in assuming recent commodity inflation will lead to demand destruction and a sustained slump in the price of key commodities.

Given the extent of disruption across global markets and geopolitics today, I find it curious that the reality of the supply side outlook is now receiving less commentary compared with demand side factors. Clearly recession risks have been rising and a global recession in 2023 now seems likely in my view, which of course will inevitably lead to some decline in demand. However I believe there a host of challenges on the supply side that suggest even with a recession, commodity prices will remain elevated even in a recessionary environment, which seems to be a non-consensus view at present.

Firstly, it’s worth remembering that a major driver of recent energy price inflation and the ongoing energy crisis is the years of under-investment in new production following the US shale bust of 2015-2016 and the rise of ESG mandates deterring new investment by energy producers. The extent of this under-investment has been laid bare post-COVID as economic activity resumed with the lifting of pandemic restrictions.

In this context, it is interesting to note that while US energy sector capex is forecast to increase ~25% YoY in 2022 to ~$105bn, this actually represents just ~5.8% of sector revenues, still well below the trough level of the previous cycle in 2008:

Source: Refinitiv - Lipper Alpha Insight.

The takeaway here is that in the midst of an energy crisis with producers making record profits, and before the US economy has even entered a recession (officially at least), US energy sector capex is already below previous cycle trough levels. There is clearly no supply glut and with no meaningful investment in new production, it is difficult to foresee how energy prices can decline significantly, particularly when energy security is now driving energy price inflation beyond traditional supply/demand dynamics.

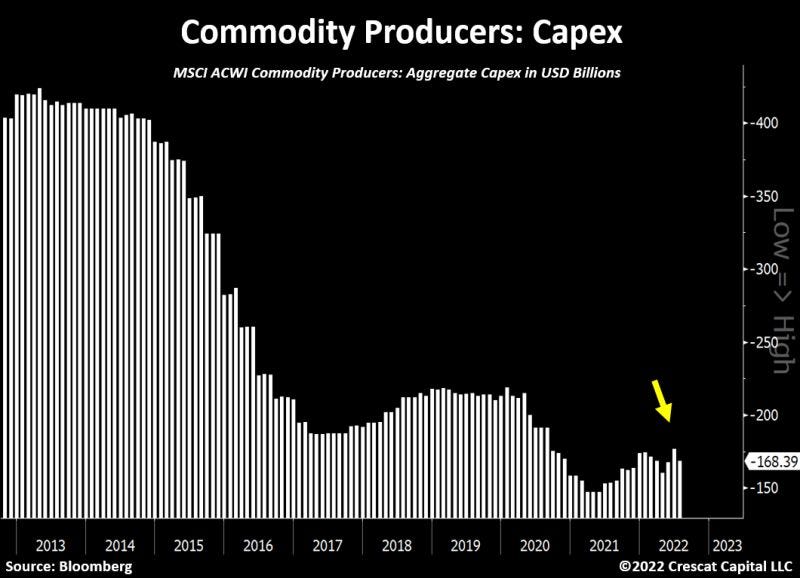

Across the wider commodity sector, the capex picture is similarly restrained - overall capex levels for commodity producers remain well below historic levels and rising interest rates will only further limit the availability of capital to fund new supply at a time of energy and food scarcity:

Source: Otavio Costa, Crescat Capital LLC.

In this light, again it is difficult to see how commodity prices can decline materially across the board when supply is already constrained and investment in new supply just hasn’t been there in the first instance. Raising interest rates to cool inflation and bring about demand destruction does not resolve the structural issue of historic under-investment nor does it increase the supply of key commodities that are still needed amid a global energy and food crisis.

Beyond capex, there are a host of other variables across the broader commodities space that suggest to me that the supply side is much more complex and precarious than the current demand-destruction view understands.

As a result of the Russian invasion of Ukraine, the push by the West to reduce and ultimately abandon Russian oil and gas supplies has profound and far-reaching consequences across the broader commodity complex, and the supply of manufactured goods in Europe and beyond. Russia’s cutting of gas supplies to Germany via Nord Stream 1 represents a weaponising of gas that is likely to persist for some time (possibly years, if the conflict is to be a protracted one). This in turn means that the price of gas is likely to remain elevated for years as competition for alternate gas supplies intensifies. This has already impacted the supply of fertiliser, with a fertiliser crisis exacerbating a food crisis as well as raising the prospect of an industrial shutdown in Germany and other parts of Europe if gas supplies run out. While a recent grain deal might offer some hope of an easing of the food crisis, the situation remains very precarious and uncertainty is likely to persist meaning elevated food prices, similar to gas, due to food supply/security concerns.

In addition to these geopolitical factors, weather is another virtually unhedgeable factor that impacts supply regardless of higher interest rates or demand destruction. Extreme weather in the form of heat waves and droughts in both Europe and the United States this summer have further exacerbated the global food supply, and with the La Niña weather system and a hurricane season looming in the United States, there is potentially further significant disruption ahead for both energy and food supplies. Most recently, the news in Europe that the Rhine River may have to close due to low water levels highlights is yet another unforeseen supply chain challenge (the Rhine is a key channel for the shipment of commodities) that is completely independent of interest rates, the Russia/Ukraine conflict or inflationary forces.

Another factor that suggests the current rollover in commodity prices is being misinterpreted as an indicator of fundamental or physical demand destruction is the exit or unwinding of speculative positions in energy and agricultural commodity markets by hedge funds and other speculators, reflecting near-term tactical trading on recession fears (based on perception of demand-side risks). This would suggest recent commodity price action reflects paper market trading activity rather than actual physical supply/demand fundamentals. This tweet from Tracy Shuchart of Intelligence Quarterly captures well what I believe is a misguided recession-fear trade on commodities that ignores the fundamental supply-side set-up:

Note I haven’t even touched on the severely constrained supply outlook for key commodities for electrification and the energy transition, such as copper and electric battery metals, which is a whole other discussion in itself. But the backdrop is a similar one, with constrained supply and long lead times to sourcing and extracting copper, lithium and other metals meaning that it is unlikely climate policy-driven demand can be physically met. It is therefore hard to see how sustained price inflation of key metals isn’t the eventual outcome here.

This is an evolving situation but my current thinking when I weigh the above is that the recent rollover in commodity prices will prove to be temporary. On the demand side, we already know what can go “wrong” from an economic perspective - higher interest rates and commodity inflation leads to slowing growth, some demand destruction and recession; but on the supply side things are much less clear and much more uncertain - there are so many things that can go (and are going) wrong, and in highly unpredictable ways. I believe supply-insecurity and constraints are being overlooked amid the current commodity-recession narrative.

In short, supply is precarious and in a world of increasing and sustained scarcity, key materials and commodities that are needed the most will be prized the most, and I see the companies that operate within the supply chains of these as standing to benefit from this set-up in the coming years.

Any Other Business

In keeping with the above commodity supply theme, for this week’s AOB I’m sharing an excellent podcast discussion from the Smarter Markets podcast series with Robert Friedland, founder of Ivanhoe Mines, the Canadian-listed metals mining company.

In this discussion, Friedland outlines the commodity, resource and geopolitical requirements for the global energy transition. I highly recommend listening to the podcast, which can be found here.

Why Not Subscribe to the Paid Tier?

If you find the ideas in this newsletter interesting, please considering signing up to the newly launched Paid Tier.

You can read more about the paid offering here.

This newsletter is 100% reader supported and free from conflicts of interest or other commercial considerations. In writing Value Situations my job is essentially to generate ideas for subscribers that supplements their own idea origination process.

Furthermore, I believe the value proposition for paying subscribers is compelling. I am a former private equity/special sits investor that has worked with one of the largest alternative investment firms in the world, and so paying subscribers will be getting thoughtful, buy-side quality ideas and analysis for a very small fraction of the cost of employing a buy-side analyst full-time.

If you find this newsletter interesting, please also consider sharing it with friends and colleagues by clicking the Share button below.

Here’s what other investors are saying about Value Situations:

Value Situations was named as one of the Top 100 Must Follow Stock Research accounts by Edwin Dorsey of The Bear Cave Newsletter: