Weekly Bulletin #16

Wood Group Plc | Passive vs. Active and Avoiding Bubble Risk

Disclaimer

Value Situations is NOT investment advice and the author is not an investment advisor.

All content on this website and in the newsletter, and all other communication and correspondence from its author, is for informational and educational purposes only and should not in any circumstances, whether express or implied, be considered to be advice of an investment, legal or any other nature. Please carry out your own research and due diligence.

Situations of Interest

1. Wood Group Plc Selling Built Environment Unit to WSP

Previous Quick Idea name Wood Group Plc (WG) last week announced it has agreed to sell its Built Environment Consulting (“BEC”) business to Toronto-listed engineering consultancy WSP Global Inc (WSP) for $1.9 billion. The deal values the BEC unit at 16x EBITDA, and the outcome is broadly in line with the 17x / $2bn deal terms I envisaged in my original analysis of the situation back in November.

As I outlined in my previous analysis, the deal is a transformative one for WG, transitioning its balance sheet from a leveraged 3.3x to a net cash position following the BEC divestment.

The stock is up ~15% since I originally published this idea, and WG ex-BEC is now valued on a PF basis at ~5.4x LTM EBITDA, compared to its historic average multiple of ~9x and ~7x - 8x for listed peers. It should also be noted that LTM EBITDA reflected some challenges in WG’s Projects segment which are likely temporary and so the LTM number is not representative of WG’s forward earnings power.

With a healthy order book of $7.7bn (equating to 121% of FY21 revenues, and up +19% YoY) and a net cash position, WG’s outlook is positive given its focus on key growth areas such as energy security, industrial decarbonisation, resourcing the energy transition and low carbon/renewable energy development.

2. Passive fund ownership of US stocks overtakes active fund ownership

On Monday the FT reported that passively managed index funds have overtaken actively managed funds’ ownership of the US stock market for the first time, with ~16% of US stocks held by index-tracking funds and ETFs, vs. 14% owned by actively managed funds.

Reading this I was reminded of a warning from Dr. Michael Burry (of The Big Short fame) from back in 2019, which suggested that the rise in passive investing in recent years is reminiscent of the subprime collateralised debt obligations (CDO) bubble that burst in 2008, leading to the Great Financial Crisis. As Burry articulated:

Central banks and Basel III have more or less removed price discovery from the credit markets, meaning risk does not have an accurate pricing mechanism in interest rates anymore. And now passive investing has removed price discovery from the equity markets. The simple theses and the models that get people into sectors, factors, indexes, or ETFs and mutual funds mimicking those strategies -- these do not require the security-level analysis that is required for true price discovery.

The essential point of concern here is that index fund inflows distort prices for stocks in a similar manner to CDO purchases of subprime mortgage bonds, in that the pricing of assets in that market was dictated by enormous capital flows from the CDO machine rather than by fundamental security-level analysis. In a similar vein, Burry’s concern is that passive flows into equities have inflated stock prices and divorced them from their underlying fundamentals. For example, for an ETF that mimics an underlying index, e.g. the S&P 500, as capital flows into the ETF, it has to purchase more of the stocks in the underlying index regardless of valuation or any fundamentals, in order to continue to track the underlying - in a sense, index funds and ETFs are value-agnostic, price-takers.

Furthermore, as widely-followed indices such as the S&P 500 and NASDAQ are market cap-weighted, the stocks with the greatest weightings within these indices are by definition the stocks that have already been bid up the most; this further implies that as more capital flows into a corresponding ETF, the already overweight stocks in the index are bid up ever further, creating a feedback loop - buying begets more buying, regardless of any price/value relationship. The converse is also true, in that as underlying stocks are sold off, the ETF similarly has to sell into a declining market, meaning selling also begets selling, resulting in a “doom loop” that accelerates mass liquidation in down markets.

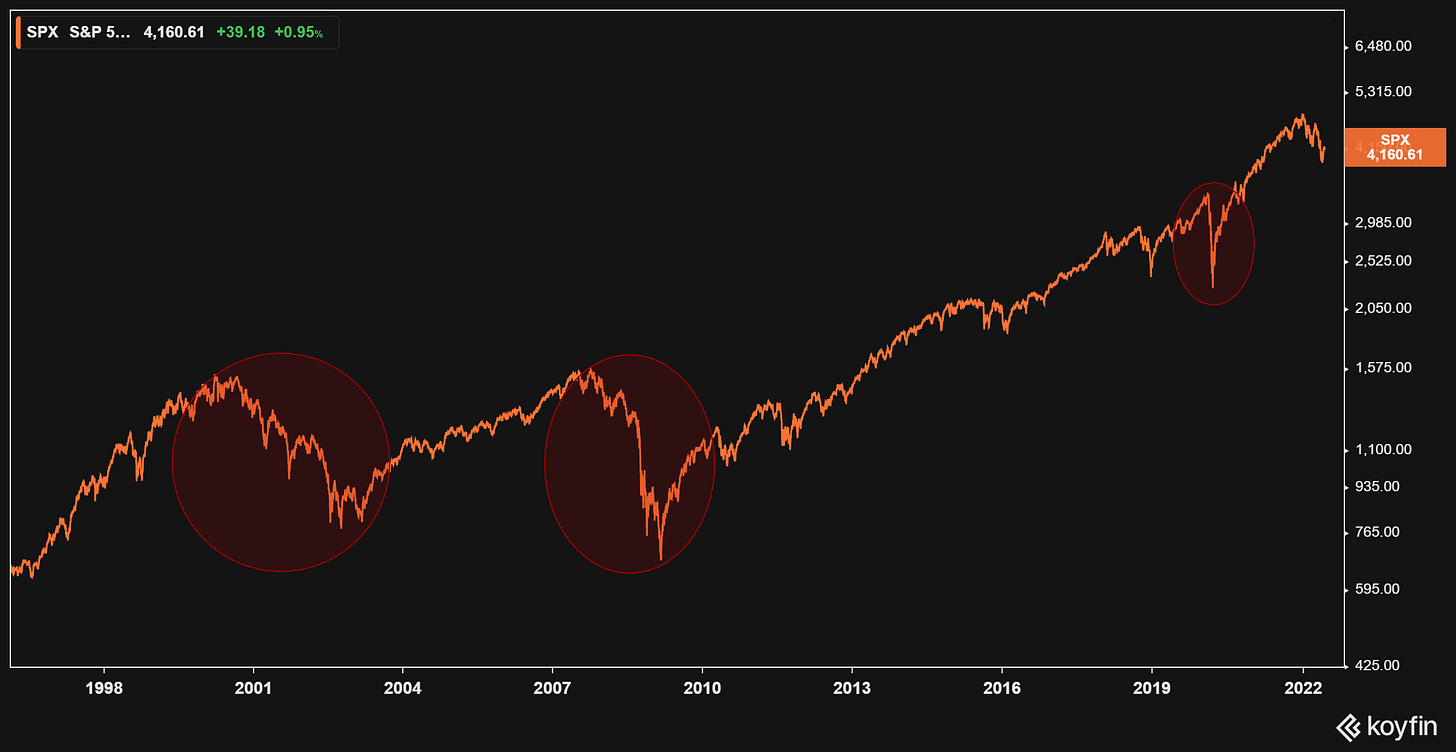

I think a quick glance back at how the COVID market crash in March 2020 compared to the previous subprime and dot.com market collapses illustrates how the feedback loop implicit in passing investing was an accelerant on both the downward plunge and the subsequent rebound:

When the dot.com bubble burst in 2000, it took the S&P 500 929 days (~30 months) to bottom from the market peak in March 2000 to the trough in October 2002

In the 2008 financial crisis, it took the S&P 517 days (17 months) to bottom from the market peak in October 2007 to the trough reached in March 2009

In the COVID crash of 2020, the S&P bottomed from peak to trough in just 33 days.

Of course, other factors such as investor margin calls also contributed to the COVID market crash being the quickest ever (before central bank intervention created a floor and paved the way for the subsequent, sharp rebound), but it seems clear to me that the passive investment machine’s feedback loop played an undeniable part in the accelerated collapse in stock prices in March 2020.

So what does one do given this “mindless” buyer/seller market structure combined with still-elevated valuations that are at risk from rising rates, inflation, leverage and geopolitical tensions? (note the S&P 500 is only ~13% off its all-time closing high). I believe unique, overlooked situations that sit outside the general market indices offer some insulation from passive bubble risks - my latest conviction idea (available to Paid Tier subscribers only) is one such situation.

I also see other Model Portfolio names such as spin-off idea Wickes Group Plc (WIX) and niche commodity play/takeover target Kenmare Resources Plc (KMR) as further examples of idiosyncratic special situations that offer substantial, asymmetric upside independent of what the wider equity indices do. Outside the Model Portfolio, I continue to monitor in-play tin miner Alphamin Resources (AFM), which I view as another event-driven special situation that is not dependent on the wider market environment or index performance, in that it is currently in play and likely to be acquired at a significant premium as I’ve written about previously.

Any Other Business

For this week’s AOB, I thought I’d share an interesting chart that shows just how strongly traditional energy equities have outperformed this year.

The chart below shows the US energy sectors’s very strong absolute and relative performance YTD vs. previous market darling the ARK Innovation ETF (ARKK, whose largest holdings Tesla and Zoom Video combined account for ~18% of AUM), and the previously in-favour tech sector as represented by the Technology Select Sector SPDR Fund (XLK):

The two most widely followed energy ETFs, the Energy Select Sector SPDR Fund (XLE) and the SPDR S&P Oil & Gas Exploration & Production ETF (XOP) are up ~68% and ~77% respectively YTD while Berkshire Hathaway’s chosen oil/inflation play Occidental Petroleum (OXY) is up ~138% YTD - that’s ~188 bps of outperformance vs. ARKK.

I think this sums up the thematic shift in equity flows this year, and offers clear evidence that a great rotation has occurred, with capital flowing out of the previously popular growth/tech names into traditional energy stocks, reflecting a view that inflation and higher energy prices are likely to persist for some time.

Why Not Subscribe to the Paid Tier?

If you find the ideas in this newsletter interesting, please considering signing up to the newly launched Paid Tier.

You can read more about the paid offering here.

This newsletter is 100% reader supported and free from conflicts of interest or other commercial considerations. In writing Value Situations my job is essentially to generate ideas for subscribers that supplements their own idea origination process.

Furthermore, I believe the value proposition for paying subscribers is compelling. I am a former private equity/special sits investor that has worked with one of the largest alternative investment firms in the world, and so paying subscribers will be getting thoughtful, buy-side quality ideas and analysis for a very small fraction of the cost of employing a buy-side analyst full-time.

If you find this newsletter interesting, please also consider sharing it with friends and colleagues by clicking the Share button below.

Here’s what other investors are saying about Value Situations:

Value Situations was named as one of the Top 100 Must Follow Stock Research accounts by Edwin Dorsey of The Bear Cave Newsletter: