Value Sits Weekly Bulletin #1

Model Portfolio Updates, Situations I'm Monitoring, Developing Situations

Disclaimer

Value Situations is NOT investment advice and the author is not an investment advisor.

All content on this website and in the newsletter, and all other communication and correspondence from its author, is for informational and educational purposes only and should not in any circumstances, whether express or implied, be considered to be advice of an investment, legal or any other nature. Please carry out your own research and due diligence.

This week’s newsletter is the first issue in a new weekly bulletin format. This format change will apply to the regular weekly newsletter and follows from the recent subscriber survey, where the overriding feedback was that readers want more high conviction ideas with supporting, detailed analysis, such as DOLE, DHG and WTW.

When I started this newsletter, the intention was to publish a quick idea every week, and high conviction ideas every 4-6 weeks. To date, I’ve probably spent too much time on weekly quick ideas and thought pieces, at the expense of finding compelling and actionable ideas. My objective (and interest) really is in finding more conviction ideas to share with subscribers and add to the Model Portfolio, while tracking interesting situations as I go about this search. Of course, in an expensive market such as this it’s more difficult to find truly compelling ideas and so this search necessitates turning over lots of rocks as I’ve discussed before.

I’m pleased to say the subscriber base continues to grow, now at over 3,300 subscribers, many of whom are institutional investors (including portfolio managers, family office investors, traders etc). With this readership profile in mind and given my own PE/special sits background, it takes time to find high quality ideas, do the proper work and then build the conviction. So in order to maintain and improve the quality of ideas and analysis for subscribers, I believe a more concise weekly bulletin will free up my time each week to ultimately provide more value for subscribers in the form of more actionable ideas.

The new weekly bulletin will comprise three sections as follows:

Model Portfolio Updates - Any relevant updates on the names in the Value Sits Model Portfolio.

Situations Monitor - Updated thoughts on previously published Quick Ideas and Idea Bench names.

Developing Situations - Idea leads on potentially interesting situations or equity ideas from news flow and other sources.

Please do share any feedback on this new format via conor@valuesits.com.

Model Portfolio Updates

There are two updates of note from last week with respect to the Model Portfolio names Pantheon Resources Plc (PANR) and Yellow Cake Plc (YCA):

PANR

Pantheon produced an operations update and hosted an almost 2 hour shareholder webinar discussion last Monday. Regarding the operational update, management confirmed that testing has commenced at the Talitha #A well (est. 1 billion+ BO recoverable) and drilling has commenced at the Theta West #1 well (est. 1.4 billion BO recoverable, of est. 12 billion BO in place). The webinar itself was very detailed as usual, with perhaps the most notable takeaway being the following statement by Justin Hondris regarding the recent farm out discussions:

… we were working on a structure where the party would earn a very small percentage working interest and they would have the opportunity to, by spending significantly larger investments, to gross that up over three stages to what would have been a 10 digit investment in our company for quite a modest percentage.

The statement is significant as it implies the farm out partner PANR had been engaging with throughout H2 last year was seeking to invest at least $1bn for a “modest percentage,” i.e. a minority stake. What this modest percentage might be is guess work at this stage but it’s certainly much lower than 50%.

Relative to the scale of an investment of at least $1bn, it’s plausible to assume modest here could mean in the range of 20%-40%. Ignoring the incremental phasing and simply taking the midpoint of 30% on a $1bn investment, this implies a value of ~$3.3bn for 100% of PANR vs. current market cap of ~$810m / £600m. On these terms, after accounting for dilution from the 30% coming in, this equates to a share price to current PANR shareholders of ~£2/share, or ~2.5x PANR’s stock price as at the time of writing.

If the $1bn investment was for a more modest 20% interest, this would break back to a ~$5bn valuation for 100% and a value of £3.44/share or 4.3x the current stock price - the sensitivity table below sets out a range of potential outcomes for a 10 digit investment between $1bn - $2bn:

Source: Value Situations analysis.

Upon successfully proving the assets through the current drilling and testing programme, I expect the baseline value for a farm out deal will increase considerably. Alternatively, an outright sale to a major will catalyse the value of PANR’s enormous oil resource.

YCA

YCA shareholders voted 99.99% in favour of a fresh $100m capital raise to exercise its annual purchase option for this year with Kazatomprom to acquire another 2 million+ lbs of uranium (U308 uranium oxide). As management explained in the Notice to shareholders earlier this month:

Yellow Cake believes that the uranium market fundamentals are such that purchasing additional physical uranium could be done on a value accretive basis. The recently launched Sprott Physical Uranium Trust's ability to raise capital and purchase spot market uranium and the ongoing supply side constraints are likely to continue to put pressure on the spot market in the near term. The directors believe the Company's contract with Kazatomprom has significant value, particularly in the current tight spot market and having the ability to fully exercise its 2022 option as soon as market conditions permit would be value accretive for shareholders.

This new purchase would bring YCA’s total uranium holdings to ~21 million pounds, which at the current uranium spot price of ~$44.50/lb would be worth ~$935m vs. YCA’s post-fundraise adjusted market cap of ~$875m (YCA has negligible other assets and liabilities apart from its U308 holdings).

Again YCA seems like the best risk-adjusted way to play the uranium theme in my view, as it provides exposure to the commodity at a discount - it currently trades at a discount to both its NAV (~0.9x) based on the spot uranium price, and to the recently launched Sprott Physical Uranium Trust which trades close to ~1x NAV.

Situations Monitor

There are updates for two names I’m monitoring from this past week, Bunge Limited (BG) and US Silica (SLCA):

BG

Within a day of publishing BG as my public equity idea to play the potential looming food crisis, Glencore-controlled grain trader Viterra announced that it was acquiring Gavilon’s grain trading business from Japanese trading house Marubeni.

There are two notable aspects to this deal that support my thesis for BG.

Firstly, the deal provides a live, current market comp that supports my 11x valuation multiple for BG. Viterra have stated the agreed purchase price is $1.125 bn plus working capital, which isn’t quantified. However Marubeni have stated in their own presentation for the sale that they expect to receive a total of ¥300bn to ¥400bn, or $2.6 bn - $3.5 bn, including group loans.

We can infer from this that the implied EV for Gavilion is therefore ~$2.6 bn - $3.5 bn, with a midpoint value of ~$3bn. Marubeni don’t break out the EBITDA for Gavilon’s grain business in their financial statements, however from parsing through various quarterly and annual filings cover the LTM period (which do disclose operating profit and net profit numbers for Gavilon), I guesstimate the grains business has an LTM EBITDA of ~$250m - $260m. So just taking the low-end receivable amount of $2.6bn implies a deal multiple of ~10x, while the $3bn midpoint is closer to ~12x multiple. So my 11x multiple for BG, a much larger business than Gavilon feels about right.

A second noteworthy point is that this deal signals renewed M&A in the agri-commodity complex, which really only comprises 7 major players, of which Viterra was the smallest. With this deal it will be better positioned to compete with the larger players (and it is already the world’s largest wheat trader), stoking some competitive tension within the ABCCDGW club at a time of rising food prices and concerns around food scarcity (optimum conditions for trading profitability).

The obvious question then is whether the sector will consolidate further, and with BG being the smallest of the three listed players (ADM and WIL being the others) it could become a target itself again. Both Glencore and ADM previously sought to acquire BG, in 2017 and 2018 respectively. Interestingly, it’s pertinent to highlight here that current BG CEO Gregory Heckman was the CEO of Gavilon when he led its sale to Marubeni in 2013. So he has previous form in doing deals like this, which I think enhances the prospects of a deal for BG (at the right price).

With BG trading at sub-7x LTM EBITDA, the Viterra/Gavilon deal sets a clear mark for any bid for BG at 10x or higher and therefore is highly supportive of my thesis for the stock.

SLCA

A piece in the Wall Street Journal this past week about Wall Street’s case for $100 oil prompted me to check in again on SLCA, a previous quick idea. Towards the end of the WSJ article a bullish outlook for oil services businesses was articulated as follows:

Investors are expecting gangbuster years from the firms that sell services and equipment to oil producers. There is less competition since the oil bust wiped out weaker players and aging equipment was scrapped.

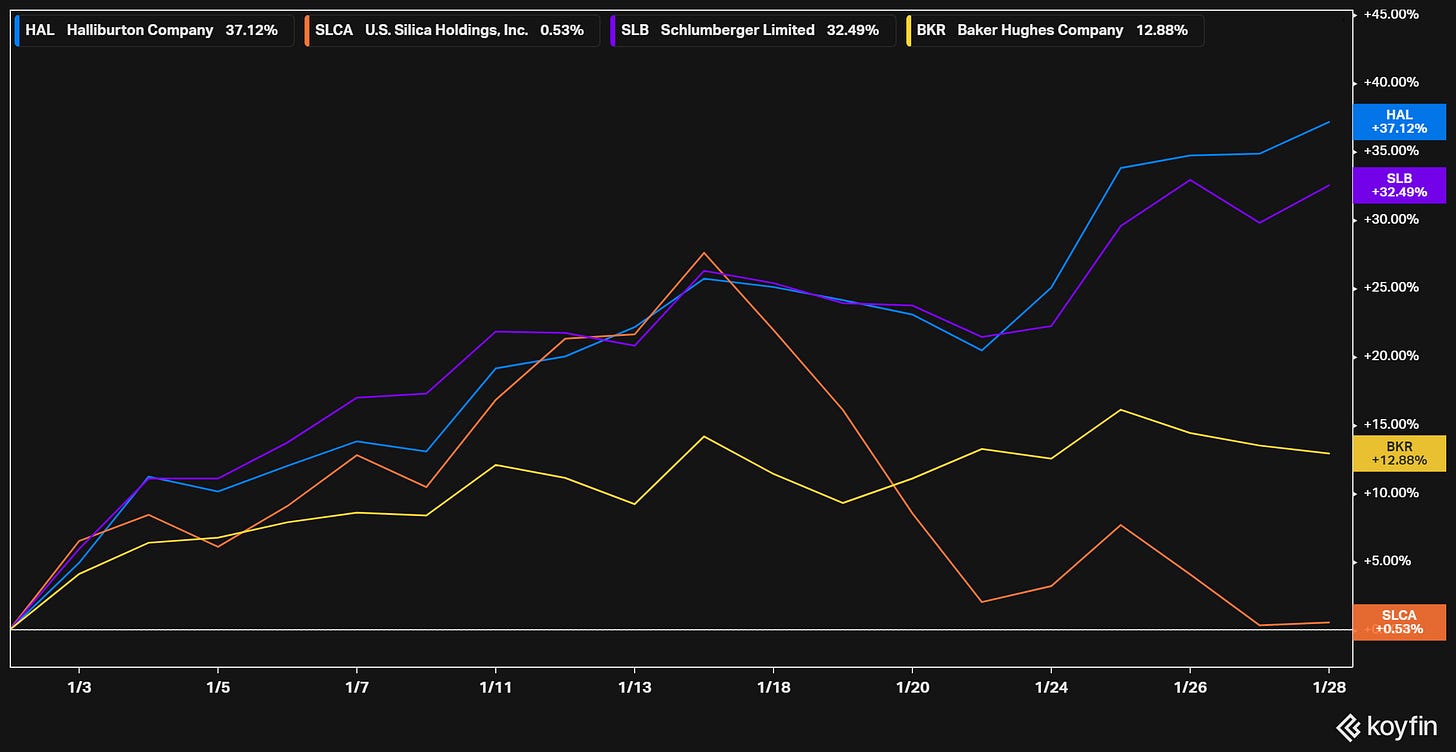

It then highlighted that Halliburton (HAL) and Schlumberger (SLB) are both up ~35% and ~30% respectively YTD, with HAL leading the S&P 500 in terms of performance. The article then went on to report that:

High prices have producers racing to open up wells that have been drilled but not yet completed, and the market for equipment needed to get the oil flowing is already tight, with roughly 90% utilization, Chief Executive Jeff Miller told investors this week.

“Halliburton is sold out,” he said.

This last quote from HAL’s CEO is what really piqued my interest, as HAL is one of SLCA’s major customers. It makes sense with the robust outlook for oil again that services companies should start to outperform, and perhaps even offer greater torque to the cyclical upswing in oil than producers - a case of investors betting on the companies “selling pickaxes during a gold rush.”

SLCA’s share price has done nothing since I first wrote about it last August (up just ~ 3%), But now with clearly robust fundamentals AND bullish sentiment driving oil stocks higher, I think SLCA is worth another look. I find it interesting that SLCA is virtually flat YTD vs. the major oil services players HAL, SLB and Baker Hughes (BKR), while noting that SLB and HAL are among SLCA’s largest customers:

I also find it interesting that despite SLCA being the largest pure play frac sand business in the US market, it is also the worst performer YTD vs. an array of smaller peers:

I am a fundamental-value analyst and I’ve said before I am not a chartist or proponent of technical analysis, but I do think that charts can sometimes throw up some interesting observations that can help identify inflection points when combined with proper fundamental analysis.

With that in mind, one further chart of SLCA presents an interesting picture against the current backdrop for oil and oil services businesses:

The above shows SLCA’s share price since its IPO back in 2012, and two things strike me about it:

Parking H2 2019 and the market meltdown during COVID in 2020, SLCA’s stock is at its lowest price since July 2012, just ~5 months after its IPO; and

SLCA appears to have broken out of a multi-year downtrend at the end of 2020 and at ~$9.45/share (as at the time of writing), SLCA remains ~84% below its previous high of $59.98 in February 2017, at time when the price of oil was ~$53/barrel, vs. ~$87/barrel today (with an expectation that it will rise above $100/barrel this year).

For now it seems that whatever positive sentiment is being priced into oil services stocks, it is not filtering through to SLCA. This makes it an interesting situation in my view, particularly with the potential sale of SLCA’s Industrial & Specialty Products (ISP) division in the works. As I outlined before, a sale of the ISP business would transform SLCA into a debt-free pure play frac sand business (already the largest in the US) at a very opportune time in the oil cycle, so there’s both event-driven and cyclical catalysts here.

For now my sense is SLCA’s share price is held down by a lack of visibility on whether a sale will occur and the company’s highly leveraged balance sheet. However, I suspect any kind of positive news flow on this front could trigger a sudden, sharp rise in the stock. This is a situation I’m keeping my eye on.

Developing Situations

In this section, I highlight potential new ideas and situations of interest that may make it on to my Idea Bench for further research.

Further Food for Thought?

As readers will know I’m very interested in the food inflation theme and in the course of researching it, I came across two other small cap food-related names that I think are potentially interesting:

The Andersons (ANDE) - NASDAQ-listed $1.3bn market cap agri company operating in grains trading, ethanol and plant nutrient sectors in the United States and internationally. ANDE’s stock is up ~61% over past 12 months, yet trades at just ~6.5x LTM EBITDA vs. its historic (10 year) average of ~10x. ANDE is one of the five largest grain traders in the United States and given the supportive outlook for food and crop prices and the growing tailwind for biofuels and renewable diesel, the stock looks interesting at the current valuation.

Origin Enterprises Plc (OIZ) - OIZ is an Irish, Euronext-listed small cap (~€435m market cap) agri-services business operating in Ireland, the UK, Belgium, Brazil, Poland, Romania, Ukraine, and Latin America. The stock is up just ~8% over the last 12 months and trades at ~6x LTM EBITDA vs. its historic average of ~8x - 9x. OIZ’s model is different to BG or ANDE in that it provides specialist agronomy advice and services to farmers, as well as digital agricultural services/ag-tech solutions (e.g. analytical software) and crop technology and inputs (fertilisers, animal feed etc). This looks like an interesting situation given its valuation and the challenges facing global food supply, which are supportive of increased demand for OIZ’s services.

On first look, both these names appear cheap and well positioned against the wider food inflation backdrop. Furthermore, given their relative size and low valuations, I believe these could also be potential acquisition targets.

im super horny for PANR for obvious reasons. Love your blog and weekly email.

Thanks Conor.

Re YCA: "Estimated net asset value as at 31 December 2021 of £3.31 per share 1 or US$818.6 million, comprising 15.83 million lb of U 3 O 8 valued at a spot price of US$42.00/lb 2 and cash and other current assets and liabilities of US$153.6 million."

Currently trading at £3.21, so isn't the discount to NAV more like 3%?