Food for Thought Part II: Bunge Jump

A public equity play on food inflation.

Disclaimer

Value Situations is NOT investment advice and the author is not an investment advisor.

All content on this website and in the newsletter, and all other communication and correspondence from its author, is for informational and educational purposes only and should not in any circumstances, whether express or implied, be considered to be advice of an investment, legal or any other nature. Please carry out your own research and due diligence.

Who controls the food supply controls the people.

Henry Kissinger.

The commodity traders are arbitragers par excellence, trying to exploit a series of differences in prices. Because they’re doing deals to buy and to sell all the time, they are often indifferent to whether commodity prices overall go up or down. What matters to them is price disparity – between different locations, different qualities or forms of a product, and different delivery dates.

The World For Sale, Javier Blas & Jack Farchy

In last week’s newsletter, I set out my thesis for how the ongoing energy crisis could lead to food supply disruption and possibly a food crisis over the next 12 months, similar to the crisis of 2007-08 and 2011-12. In this Part II of that analysis, I outline a public equity situation that I believe offers a way to play this next leg of the energy-to-food crisis theme, which I believe is mis-priced relative to it’s market position and the macro backdrop for agricultural commodities: Bunge Limited.

Business Overview

Bunge Limited (NYSE: BG) is a global agribusiness and food company, and is the world’s largest oilseeds processor and a leading grain crop trader. It is a member of the global agricultural trading oligopoly commonly referred to as “ABCD” comprising Archer Daniel Midland (ADM), Bunge, Cargill and the Louis Dreyfus Company.

BG operates an integrated model across the agricultural value chain, buying grains (wheat and corn) and oilseeds (primarily soybeans, rapeseed, canola, and sunflower seeds) from farmers, then storing, transporting and processing them through to packaging and distribution to domestic and export customers globally.

Source: Bunge

BG also provides financial, risk management and logistics services to customers and operates a global distribution and infrastructure network of facilities across six continents that includes grain elevators, oilseed processing plants and strategically located port terminals at key crop-growing locations including Brazil, Argentina, the United States, Canada and Russia.

Given its integrated model and entrenched position within the global agricultural oligopoly, BG is an essential cog in the global food supply chain alongside its ABCD peers and a small number of other major commodity trading firms (see Market & Competition section below).

Following a re-alignment of operations, BG operates across three core segments:

Agribusiness (~74% YTD revenues / ~90% YTD volumes) - comprises Processing and Merchandising operations; Processing consists of oilseed origination and processing activities, trading and distribution of oilseeds, fertiliser production and distribution, and biodiesel production (partially via JVs). Merchandising consists of global grain origination activities, principally involving purchasing, cleaning, drying, storing and handling of corn, wheat and barley, grain trading and distribution, and related services including logistics and freight (via transportation network and port terminals) and financial services.

Refined & Specialty Oils (~23% revenues / ~6% volumes) - involves buying of softseed and tropical oils (palm, coconut and shea) and sourcing of plant-based oils from BG’s Processing business segment and refining these into oils and fats for use by food manufacturers, restaurants and the food service industries. BG’s oil and fat products are used in a wide range of applications, from bakery and confectionery to culinary and infant nutrition. BG’s oils and fats are also used in the production of biofuels such as renewable diesel, and in plant-based proteins and meat production.

Milling (~3% revenues / ~4% volumes) - buying of corn and wheat from farmers and milling these crops into flours and milled wheat, corn and rice products for supply to food processors, bakeries, brewers, food service companies and snack food producers.

BG also reports two other segments - Sugar & Bioenergy, classified as a non-core segment, and its Corporate & Other cost centre:

Sugar & Bioenergy (0.4% revenue / 0.2% volumes) - this segment primarily comprises BG’s 50% interest in BP Bunge Bioenergia, a JV with BP Plc (BP) that was formed in December 2019 via the combination of BG’s Brazilian sugar and bioenergy operations with BP’s Brazilian biofuels business. BP Bunge Bioenergia operates on a stand-alone basis and produces and sells sugar and ethanol derived from sugarcane, as well as energy derived from the sugar and ethanol production process. While a negligible contributor to revenue and earnings currently, this JV represents a growth opportunity given the increasing importance of biofuels to the energy transition.

Corporate and Other - this segment covers salaries and overheads for corporate functions that are not allocated to the individual reporting segments above, as well as certain other activities.

In terms of geographic spread, BG has a global footprint with ~ 34% of its Agribusiness processing capacity located in South America, 27% in North America, 26% in Europe and 13% in Asia-Pacific. With regard to geographic sales mix, Europe accounts for ~36% of total revenues (based on FY20 reporting), followed by the US (25%), Asia-Pacific (21%) and Brazil (11%). The remaining 7% is spread across Argentina, Canada and ROW.

Regarding its business model, agricultural commodity trading is a low margin business, and BG’s historic EBIT margin has averaged at ~2%. Given its position as the world’s largest oilseed processor, a key driver of BG’s earnings is the crush margin. Oilseeds such as soybeans are crushed to make the key byproducts of soybean meal and soybean oil, and the crush margin is the spread between the cost of the raw soybeans and combined selling price of the crushed products.

In FY19 BG underwent an operational restructuring under a new management team led by CEO Gregory Heckman, following a challenging trading period marked by oversupply, low grain prices and the US-China trade war. This turnaround programme progressed into FY20 and involved the implementation of a streamlined new operating model, cost efficiencies equating to ~5% of total SG&A expenses, optimisation of BG’s portfolio via divestment of non-core and unprofitable assets (realising ~$1.1bn in proceeds) and the formation of the Sugar & Bioenergy JV with BP.

A key component of the turnaround was an overhaul of BG’s operating model which was excessively costly and inefficient, as CEO Gregory Heckman describes:

We were operating like disconnected, smaller regional players, not leveraging our global scale. We were slow to act, and we lacked accountability and transparency across the organization, and our costs were high.

Management streamlined BG’s previously inefficient operations into a single value chain model:

Source: Bunge Virtual Business Update Meeting, June 2020

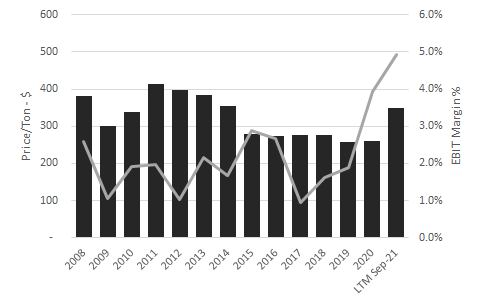

Management successfully executed on the turnaround plan, and began implementing the new operating model in FY20. This resulted in a dramatic improvement in operating margins - EBIT doubled to ~4% margin in FY20 (despite the COVID pandemic disruption), vs. BG’s long-term average EBIT margin of ~2%:

Source: Company 10-K filings; Value Situations analysis.

It’s also worth highlighting that margins did not widen simply as a result of commodity price increases - in fact the blended $ price per ton achieved across all BG’s commodity products in FY20 was flat vs. FY19 and LOWER than FY15-FY18 prices, at $258/metric ton:

Source: Company 10-K filings; Value Situations analysis.

This indicates that management achieved a structural jump in BG’s operating margins by optimising the business model and the various turnaround initiatives.

Recent Performance

BG’s LTM performance to Sep-21 has seen the business achieve record performance in profitability:

Source: Company 10-K filings; Value Situations analysis.

LTM EBIT to Sep-21 of ~$2.7bn is +66% ahead of the $1.6bn in EBIT reported in FY20, reflecting the margin improvement from the new operating model and a ~34% increase in the average selling price/ton for BG’s commodity products:

Source: Company 10-K filings; Value Situations analysis.

As the chart above shows, the last time BG’s price/ton was at current levels, EBIT margins were sub-3% vs. the LTM margin of ~5%, indicating that the increased level of profitability is not solely attributable to increased crop prices/ton. Rather LTM EBIT reflects the first full 12 month period of performance under the new operating model, as well as recent commodity price inflation.

As I discuss with regard to BG’s valuation below, I believe the market does not yet fully appreciate the structural jump in BG’s earnings power from the combination of its new, higher margin model plus likely sustained higher agricultural commodity prices given the supportive market factors outlined in Part I, which include the potential for a food crisis in 2022-23.

Recent Price Action and Valuation

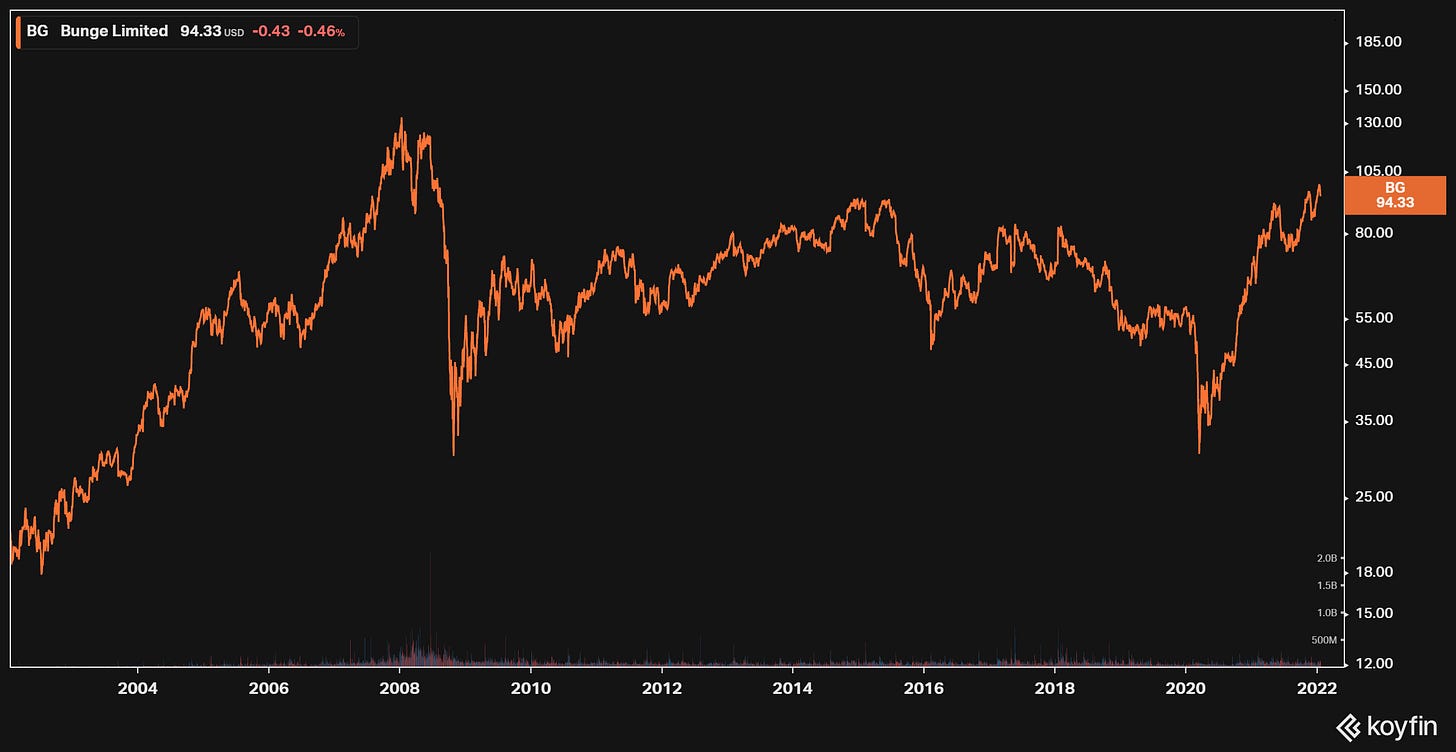

BG’s share price is up +~36% over the past 12 months and recently hit a 10 year high of ~$98/share, driven by the turnaround in profitability in FY20 and more recently food price inflation as part of the wider inflationary outlook:

Despite BG’s record profitability and positive share price performance, it trades at a discounted valuation at just 6.6x LTM EBITDA, vs. its historic average multiple of ~10x (which remember reflected its pre-turnaround lower margin operating model). Furthermore its current valuation is also at a significant discount to closest listed peer ADM at 10x and comparable private market transaction multiples, also at ~10x.

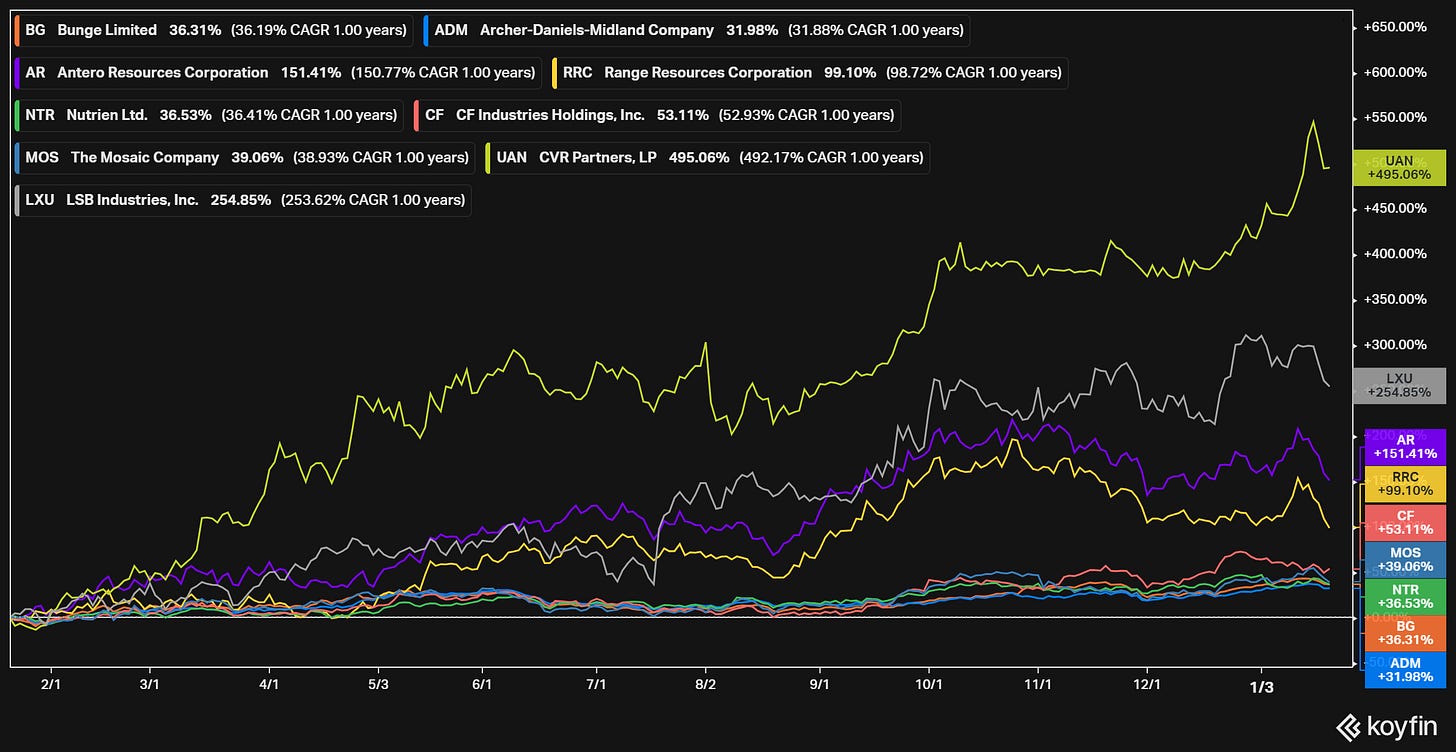

It’s worth noting that while BG’s +36% price return over the last 12 months (as at time of writing) might seem impressive (vs. +~14% for the S&P 500) it has oddly underperformed vs. the energy/natural gas and fertiliser winners over this period, despite the strongly inflationary outlook and concerns around food prices:

Given the clear relationship across the energy-natural gas-fertiliser-food value chain, it would seem that BG has not (yet) participated in what seems like the perfect set-up for sustained, higher food prices and scarcity concerns.

As one of only three publicly listed names among the ABCCDGW oligopoly, BG is an obvious way to play the food inflation/crisis theme, as an extension of the fertiliser winners’ performance. The fact that it has not performed as well as these names to date seems unusual and indicative of a value situation in my view.

Competition & Market Outlook

BG is a member of the agricultural commodity trading oligopoly referred to as ABCD, comprising Archer Daniel Midland (NYSE: ADM), BG, Cargill (privately held) and Louis Dreyfus Company (privately held). The ABCD acronym is incomplete however, as it omits three other major trading houses - COFCO International (Chinese state-backed), Singapore-listed Wilmar International (WIL) and Viterra (owned by Glencore, CPP Investments and British Colombia Investment Management Corporation).

Together these 7 companies, which I’ll refer to by the expanded acronym of “ABCCDGW” are estimated to control ~50% of the world’s grain and oilseed trade. To put that in context this effectively means that anything you eat or drink today will contain something bought, stored, transported, processed, shipped, distributed or sold by one of ABCCDGW complex. As such these companies play a systemically important role in the global food supply chain, and operate within an entrenched market oligopoly.

In terms of competitive position, BG is the fifth largest player globally by revenue, behind Cargill, COFCO and ADM and the fourth largest by oilseed and grain revenues:

Source: Company filings; Value Situations analysis.

Among the most notable market developments in recent years has been the rise of COFCO. It emerged to become the #2 player having acquired a number of grain trading businesses including Noble Group and Nidera and is seeking to challenge Cargill and ADM to become market leader.

BG is one of only three publicly listed companies within the ABCCDGW complex (along with ADM and Wilmar) and as the fourth largest trader of staple oilseeds and grain crops is a systemically important player in terms of global food supply.

In terms of market outlook, I’ll refer readers back to the macro thesis set out in Part I for an overview of the various factors and market forces that I believe will see food prices remain elevated over the medium term.

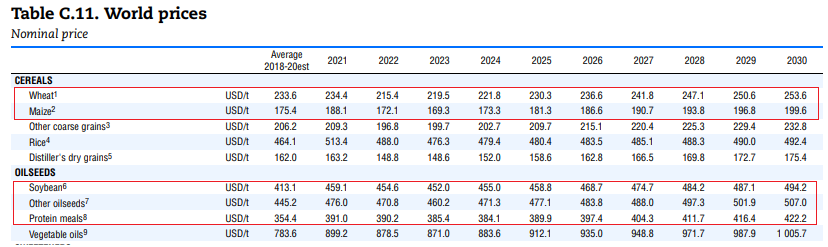

Additionally, the OECD and the UN’s Food & Agriculture Organisation (FAO) project that the prices of grains and oilseeds will remain elevated out to 2030, with key crop prices largely exceeding 2018-2020 levels throughout the forecast period:

Source: OECD-FAO Agricultural Outlook 2021-2030

Furthermore, in the nearer term the futures markets indicate prices for BG’s key crops will remain elevated in 2022 through to 2024, assuming no further disruption to supply (with a potential Ukraine/Russia conflict, fertiliser shortages and further adverse weather events all being plausible additional risks at present):

Source: CBOT; Barchart.com

Investment Thesis

The investment thesis for BG is simple - food inflation, leading to food scarcity and a possible food crisis is the logical next phase of the ongoing energy crisis for the reasons outlined in Part I. Against this backdrop I see BG as the best positioned public equity opportunity within this theme for the following reasons:

Valuation - at 6.6x LTM EBITDA, BG trades at a substantial discount to its historic average multiple of ~10x and that of listed peers ADM (~10x NTM) and Wilmar (11.5x). Furthermore, the market values BG at a discount to its private market value based on comparable transactions, notably Glencore’s 2012 acquisition of Viterra (10x) and its subsequent sale of a ~50% stake in Viterra to two Canadian pension funds in 2016 at an implied multiple of ~13x. Given the extent of the undervaluation combined with the inflationary outlook for food and staple crops, I expect the market will re-rate BG in line with comps as its earnings power and the food inflation theme becomes better understood in 2022.

Advantaged Business Model - as a global commodity trader, BG captures the spread between the cost of crops and the market price of processed byproducts (e.g. soybean meal, wheat flour etc) without incurring growing/farming risk (e.g. adverse weather, crop failures, poor harvests). Furthermore, its global scale and position within the ABCCDGW oligopoly confers it with leverage over growers as a major offtaker of crops and provides security of sale for farmers. It is also worth highlighting the quote from The World For Sale at the top of this newsletter, in which authors Blas and Farchy note that its not solely higher crop prices that commodity houses like BG benefit from, but price disparity - the prospect of food inflation and resulting concerns over scarcity can drive further price dislocations in a reflexive loop that in turn drives further price inflation and increased trading volumes as countries and importers stockpile foodstuffs. As a key trader of oilseeds and grains, BG directly benefits from this dynamic.

Market Position - BG sits at the nexus of the global food supply chain as a leading processor and trader of essential staple foodstuffs within a market oligopoly. As such it benefits from an entrenched market position that is both difficult to replicate and has a very high barrier to entry.

Downside Protection - BG has $6.5bn in readily marketable inventories (RMI), which are agricultural commodity inventories that are highly liquid and easily convertible to cash (indeed credit ratings agencies deduct RMI balances from net debt to determine an adjusted leverage metric when assessing the credit profiles of commodity traders). Deducting BG’s RMI balance from its net debt of $5.4bn implies a liquidity-adjusted net cash position of $1.1bn, which provides substantial downside protection. Including RMI balances in cash reduces BG’s LTM EV/EBITDA multiple to 4.6x.

Market Outlook - commodity pricing for staples such as oilseeds and grains is expected to remain elevated over 2022 into 2023, supporting BG’s current level of earnings power as maintainable.

Takeover Target - BG is a plausible takeover target within the the core ABCD group of traders and has twice been in play before; Glencore unsuccessfully bid for BG in 2017 at an indicative multiple of ~13x, followed by a bid from ADM in 2018 at an implied valuation of 14.5x at the time. Given its low valuation, leading market position in oilseeds and the wider inflationary outlook BG is a credible target for larger peers such as ADM or COFCO.

Excellent Management - BG’s management team have delivered very impressive results since taking over in FY19, successfully executing a turnaround that has transformed BG’s profitability and doubled EBIT margins. It’s worth highlighting that BG was more profitable than market leader Cargill in FY21 - while Cargill does not disclose financials publicly, Bloomberg reported Cargill achieved net profit of $4.9bn on revenues of $134bn for a net margin of 3.7% in its financial year to May 2021. By comparison in the LTM period to June 2021 BG’s LTM net profit margin was 3.9% (and this has risen to 4.3% in the LTM period to Sep-21).

Earnings Power - As outlined above and as indicated by BG’s relative undervaluation the market is not pricing in BG’s higher margins and increased earnings power following the recent turnaround, which is further bolstered by the inflationary outlook for key crops such as soybeans, corn and wheat.

Further Growth Opportunities - BG is well positioned to benefit from increasing popularity of plant-based meat products, which are made using plant-based proteins and vegetable oils from crops such as soybeans and canola. Furthermore the IEA projects that biofuel demand will grow by 28% by 2026 as part of the energy transition, and again Bunge is well positioned to benefit from this shift via its JV with BP and another recently announced JV with Chevron to produce renewable fuel feedstocks from some of its oilseed facilities.

Valuation & Returns Analysis

Earnings Power

BG has generated average “through-the-cycle” EBITDA of ~$1.5bn over the 13 year period from 2008 -2020, before experiencing a jump in earnings in 2020 following management’s operational turnaround:

Source: Company filings; Value Situations analysis.

While agricultural commodities markets tend to be cyclical, I believe that BG’s LTM EBITDA of ~$3.1bn is more representative of forward earnings power for the following reasons:

Highly supportive macro backdrop, with a perfect storm of factors to drive sustained food price inflation and elevated commodity prices in the coming years.

The historic EBITDA does not reflect the new, higher margin operating model implemented by management. Furthermore, BG’s most direct peer ADM has achieved historic EBITDA margins of ~5.5% vs. BG’s 5% EBITDA margin in FY20 and 5.7% in the LTM period to Sep-21, suggesting that BG’s current margins are not unsustainable or abnormal for the industry.

Structurally growing sources of demand from biofuels and plant-based proteins represent new earning streams that are not captured in BG’s historic EBITDA generation.

Given the deep complexity and the number of macro variables impacting BG’s business and earnings, I have purposely chosen not to model out BG’s individual business segments or make assumptions about future crop prices, crush margins, volumes etc. to derive an estimate of earnings power. To model out such a complex business in this manner would just lead to false precision in my view.

Rather as a sense-check on LTM performance I assume BG can maintain revenues of ~$55bn based on volumes of 160m tonnes (in line with FY20 and LTM) at an average price/ton of $345 (vs. $348/ton in LTM) and maintain an EBITDA margin of 5.5% as follows:

Source: Company filings; Value Situations analysis.

On this basis, I am comfortable in assuming forward earnings power of $3bn for BG.

Valuation Multiple

I believe 11x multiple is the appropriate multiple for BG based on a review of its comparable precedent transactions and listed peer valuations.

Firstly, looking at comparable transactions involving large agri-trading businesses, excluding outliers comparable assets have been acquired at an average multiple of 11x:

Source: Company filings; Value Situations analysis.

In the above list, the Viterra and Louis Dreyfus deals are the most directly comparable, involving other members of the ABCCDGW club.

Additionally, it is also interesting to look at the proposed valuations for BG based on previous takeover interest, as indicated by the implied (unsuccessful) bid values at the time of these deals’ discussions:

Source: Media reporting of transactions; Value Situations analysis.

While these deals did not complete, they are indicative of what a strategic acquirer has been willing to pay for BG previously and the value they perceive in owning BG and its assets.

Finally, looking at BG’s publicly traded peers across a range of time horizons - last 10 years average (L10Y, a proxy for a through the cycle multiple), LTM and NTM periods - BG’s peer group multiples average out in the ~10x - 12x range:

Source: Koyfin; Value Situations analysis.

Triangulating on an appropriate multiple across the various valuation data points, I conclude that 11x is an appropriate valuation multiple for BG.

Valuation & Returns

For my Base Case, applying an 11x multiple to my estimate of BG’s $3bn of earnings power in the current environment implies BG is worth ~$173/share, indicating upside of ~85% vs. the current share price:

Source: Value Situations analysis.

This equates to a return profile of 36% IRR / 1.8x MOIC over a 2 year investment term, assuming the market re-rates BG in line with peers within this timeframe as the food inflation theme plays out (IRR falls to a still-robust 23% over a 3 year term).

For an indicative Upside Case, which assumes a full blown food crisis where average prices/ton across BG’s commodity products reaches $400/ton (in line prices during the last crisis in 2011-12), this implies EBITDA of $3.5bn on 5.5% margins. Applying the 11x multiple again in this scenario implies BG' would be worth $200+/share, indicating returns of 49% IRR / 2.2x MOIC should this re-rating occur within a 2 year term (IRR is ~31% over 3 year term).

Regarding downside risk, I estimate BG would be worth ~$75/share or -20% below the current share price in a Downside scenario, assuming a (discounted) 9x multiple on EBITDA of $2bn, in line with FY20 performance which reflects the partial implementation of the new operating model and lower price/ton on volumes, on the assumption that a crop and food prices drop back to pre-FY21 levels at ~$250/ton (vs. $345 in the PF Base Case).

This downside analysis indicates BG offers a highly asymmetric return/risk profile with upside of ~4x the downside risk under the Base Case, and 6x in the Upside scenario.

Alternatively, if the food inflation/crisis thesis starts to play out it’s plausible that BG comes back into play for a strategic acquirer. In this scenario I believe an acquirer would pay 11x for BG given its enhanced earnings power, leading market position, its strategically valuable sourcing and distribution network (particularly its South American operations) and the likely synergies from a takeover. Note again that the indicative strategic bids from Glencore and ADM were at multiples well above 11x its LTM EBITDA back in 2017 and 2018.

Why Is Bunge Mis-priced?

I believe BG is mis-priced for the simple reason that the market does not appreciate the jump in BG’s profitability as a result of the improved operating model following the business turnaround in FY19/20.

On an LTM basis BG now generates a similar EBITDA margin to ADM (5.7%), and is more profitable on a net profit margin basis than market leader Cargill, but the market is missing this as it looks to BG’s historic track record (reflecting a redundant and inefficient cost model) and assumes current margins are not sustainable and will mean-revert.

As the food inflation thesis plays in FY22 into FY23 I expect the market will re-rate BG accordingly as its enhanced earnings power bolstered by sustained food inflation becomes better understood.

Catalysts

As indicated above, I see two obvious catalysts for BG’s valuation to re-rate in line with my Base Case:

1. Food Inflation/Crisis - As outlined in Part I and above, with crop and food prices set to remain elevated and the prospect of food shortages or a crisis becomes clearer, BG’s improved earnings power will become better appreciated by investors who will re-rate the stock accordingly.

2. Takeover/Merger - Given its recent history as a takeover target, BG is a likely candidate to be acquired given its business and financial attributes, and the wider commodity market backdrop.

BG has an extensive global distribution infrastructure that cannot be replicated, and so would clearly be valuable to a strategic acquirer such ADM or COFCO in particular. Amid increasing competition from COFCO, ADM would be the obvious acquirer subject to acceptable divestments to pass antitrust concerns.

Alternatively COFCO itself could move on BG, given its objective of challenging Cargill and ADM, as well as its mandate to ensure security of supply of protein feed, soybean oil and other products for the Chinese farming and food production industry.

Finally, it’s also plausible that CEO Gregory Heckman could lead a take-private of BG with a private equity player to become privately-held (and less scrutinised) similar to Cargill or Louis Dreyfus Company. Heckman’s background is in private equity, being a founding partner of Flatwater Partners, a food/agri and energy focused PE firm which I believe supports this catalyst. More notably as the former CEO of Gavilon, he lead its sale to Marubeni in 2013, also clearly demonstrating his previous form in this regard.

hi, for the profitability, is it comparable to previous year due to the one off gain of disposal (400mil) as well as the income from affiliate(In the past the income from affiliate has been negative)? I believe that if you were to remove the gain as well as income from affiliate, its margin only improve marginally due to price increase as well as cost saving.

Besides, i am just curious on the gain on RMI, based on its accounting policy, changes in fair value of RMI are recognized in earnings as a component of cost of goods sold, does it suggests that the higher profitability is mainly due to changes in inventory value instead of structural change in the company business model? My idea was that the volume didn't change much, so i would presume that their inventory increase was mainly due to revaluation instead of volume, am i right to say so?

Re: past buyout attempts by strategic acquirers

It's likely a strategic buyer knew that Bunge's margins could be improved, so were willing to pay what seemed like a high multiple (14x), which in reality is a low multiple (7x) after improving/doubling the margins. If ADM runs at 5% margins, then buying BG at 14.6x/2% margins would be a great deal.

Which is to say, I think you're right that the market has not recognized the margin improvement and repriced appropriately. ADM saw the opportunity four years ago, and now that opportunity is reality for the public to buy.