Disclaimer

Value Situations is NOT investment advice and the author is not an investment advisor.

All content on this website and in the newsletter, and all other communication and correspondence from its author, is for informational and educational purposes only and should not in any circumstances, whether express or implied, be considered to be advice of an investment, legal or any other nature. Please carry out your own research and due diligence.

Q1 has closed and so in the spirit of market convention I thought I would again present an end-of-quarter review of the Value Situations Model Portfolio performance. This review is consistent with the previous end-of-year review published in January, in which I set out the performance since inception and share my current thinking on each name in the portfolio.

End of Quarter Situations Review

As I’ve emphasised previously, I don’t place any great store in quarterly performance numbers as such a short time-frame by definition reflects a short-term orientation, and it is this type of perspective that often creates the mispriced value situations that I seek out.

However, an analysis of performance since inception of this newsletter is useful for me in two respects:

It serves as a sense-check on the various theses for each name in the portfolio, and forces me to re-assess whether I’ve missed something, or new information or events have transpired that may change my views; and

It allows me compare the Portfolio against the wider market to assess whether the Portfolio’s performance is uncorrelated to the overall market - put another way, does the intended idiosyncratic nature of the Portfolio hold up to scrutiny?

A further and very pertinent point in the current market environment is real return, with inflation running at almost ~8% in the United States and 7.5% in Europe. Ultimately I am focused on achieving positive absolute returns with the Portfolio regardless of the market environment, and so that also means achieving positive real returns after factoring inflation.

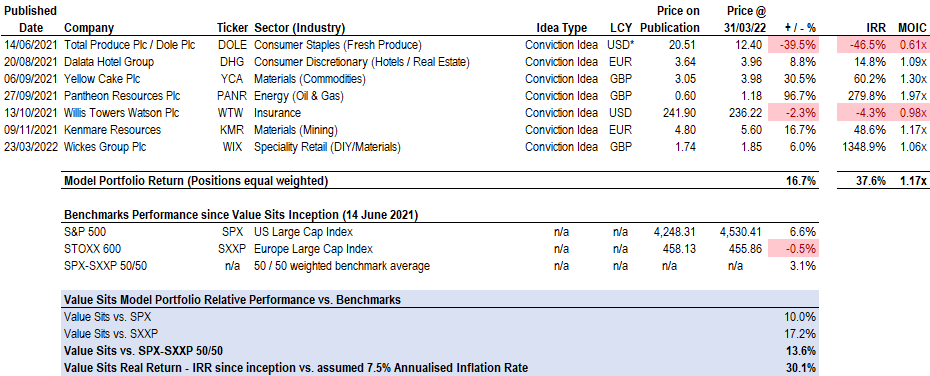

The summary table below sets out the performance of each of the seven names in the Model Portfolio since inception, meaning when these ideas were first featured in this newsletter:

Source: Value Situations analysis; Closing market prices as at 31 March-22 per Koyfin. IRR calculation based on date of first publication of idea to closing price on 31 March and inclusive of dividends paid during period where applicable. Overall portfolio IRR reflects equal weighting across all names and assumed investment made for each name on date of first publication of idea.

Before discussing each of the names, I’ll start this review by commenting on the overall performance since inception:

The Model Portfolio assumes an equal weighting across the names held. On this basis, the Portfolio is up +16.7% since inception of the newsletter on 14 June 2021, which equates to a return of 37.6% IRR / 1.17x MOIC over this period assuming investment in each name occurred on date of first publication of each idea.

In addition to achieving this pleasing level of absolute return, on a relative basis the Portfolio has outperformed my chosen benchmarks of the S&P 500 (SPX) and the European STOXX 600 (SXXP) by a wide margin, returning +10% ahead of the SPX and ~17% ahead of the SXXP since 14 June 2021 inception date.

On a simple 50/50 weighted benchmark average comparison, the Portfolio has outperformed the broader US and European equity markets by 13.6% overall.

Assuming the current annualised inflation rate of 7.5% here in Europe, the Portfolio is running at a ~30% annualised real rate of return based on the IRR since inception.

Driving this performance to date are two big winners thus far - PANR (+97% since I first published the idea) and YCA (+30% since idea published). Outside these two, KMR is the next most significant contributor, up +16.7% since publication - it is also perhaps not surprising that these winners are all part of the wider commodity complex that has performed strongly within the current inflationary regime over the last ~12 months.

In terms of detractors, DOLE has been the main loser to date, down ~40% based on the pre-merger/IPO equivalent price of Total Produce Plc at €2.54/share back in June 2021.

Moving on to the individual names themselves, my current thoughts are set out below.

DOLE

DOLE’s stock price continues to disappoint in contrast to the actual business and management’s performance. As I’ve discussed DOLE’s FY21 results release and FY22 outlook recently, I won’t repeat myself here other than to say I believe my DOLE thesis remains intact after reviewing the latest results and guidance - there is nothing to suggest that DOLE’s business is challenged. Rather, it remains fundamentally mispriced by the market for lack of clean historic financials, a misperception regarding DOLE’s ability to manage cost inflation, a lazy projection by the market of peer FDP’s weaknesses onto DOLE and a lack of familiarity with DOLE’s management team (i.e. they are not David Murdock’s people).

As the global market leader in an essential staple business (2x bigger than nearest peer) with its own vertically-integrated supply chain and inflation-offsetting price increases agreed with customers for FY22, I suggest DOLE should trade at a premium to peers. Yet it’s currently valued at 6x EBITDA vs. 9x - 15x for US listed peers on a NTM basis. DOLE is just too cheap.

DHG

DHG’s stock price has oscillated around the €4/share level YTD, valuing it at ~8.5x its pre-COVID EBITDA which compares to 11x - 12x for its peer group, and it is currently valued at ~7.5x stabilised FY24 EBITDA. As such it remains significantly undervalued considering a post-pandemic recovery is now taking hold, with occupancy rates at 80% - 90% of pre-COVID levels, as reported in their recent FY21 results release (which I discussed in Weekly Bulletin #6 ).

It’s also worth highlighting again that DHG is valued at just 0.87x EV/IC, so the business is valued by the market at a meaningful discount to its 6.2k room hotel real estate portfolio with ZERO VALUE ascribed to its ~3.7k room leasehold portfolio AND it’s pipeline of ~2k new rooms! This valuation translates to a value of sub-€120k/room for DHG’s portfolio, which compares to a range of €155k - €180k+ per room in recently completed private market deals involving broadly comparable assets.

Clearly the private market is telling us that the public market is undervaluing DHG, and as with Hibernia REIT Plc should this unwarranted discount to both hard RE value and listed peers persist, a take-private of DHG is likely in my view.

YCA

YCA has been a strong performer YTD, tracking the price of physical uranium upwards as the outlook for new investment in nuclear power becomes increasingly supportive. Nuclear energy is now seen as being part of the solution to the clean energy transition and the ongoing energy crisis in Europe (note the EU’s labeling of nuclear power as “green” under its Taxonomy on Sustainable Activities), while most recently the Russian invasion of Ukraine has prompted fresh calls to onshore uranium production and supply in the United States.

In addition to these policy shifts, the current market fundamentals have perhaps never been more compelling - the uranium market is in a structural supply deficit to the tune of ~30m lbs or so (equating to ~17% of annual demand) and widening, as the global nuclear reactor fleet continues to grow. Furthermore this deficit comes at a time when utilities’ future supply coverage rates are dipping below 100%, meaning their contracted supply of uranium is falling below their requirements for generating nuclear power. Utilities typically contract 100%+ of their uranium supply needs a number of years in advance to ensure security of supply. Given the current market position, it is increasingly likely that utilities will soon need to urgently compete for new supply regardless of price in order for their reactors to continue to generate power (idled reactors for want of uranium is an unthinkable scenario in an energy crisis as we have today). The likely outcome here is a dramatic spike in uranium prices as utilities rush into the market to secure new supply.

It’s also interesting to note that at the peak of the previous cycle in 2007, the uranium price topped out at ~$136/lb but notably there was no supply deficit back then; given the supply/demand imbalance combined with much greater supply insecurity today it is conceivable that the spot price of uranium breaks $150+/lb this cycle (vs. ~$59 currently). Conversely, given the market set-up a decline in the price of uranium is highly unlikely given the clear and growing demand profile.

Finally, despite this compelling set-up, YCA continues to trade at a discount to NAV (0.86x at quarter-end) based on the spot uranium price. Of all the commodity/energy market plays at present I see uranium as the most compelling and offering the most asymmetric upside, with YCA offering a clean and discounted way to play the thesis.

PANR

PANR continues to progress through its 2022 drilling campaign and during Q1 provided a series of positive updates to the market that I’ve previously commented on (here, here, here and here). Most recently, PANR published its interim (half-year) results on the final day of the quarter last week which did not contain any material new information following the recent updates.

PANR has made significant progress towards unlocking the value of its enormous oil resource of ~17 billion+ BO on the North Slope of Alaska over the past 4-5 months, with key takeaways being that the $96m capital raise in December has de-risked the equity and likely fully funded the company to an exit/liquidity event, while the Winter 2022 campaign achieved the pre-drilling objectives in proving the presence and movability of high quality oil, with the scale of the resource possibly exceeding management’s estimates (management will be providing updated estimates in due course).

In summary, PANR is on track to unlock one of the largest oil discoveries since the 1960’s, but remains priced like an option despite the proving of resources to date. At the current enterprise value PANR’s estimated recoverable reserves of ~2.2bn BO (which is conservative) are valued at just $0.35/barrel - recall that this compares to a value of $3.10/barrel for Oil Search’s acquisition of the Pikka-Horsehoe oil assets back in 2017 when the oil price was ~$50 - $60/barrel. Against the current backdrop of geopolitical risk and high (and likely persistent) inflation, I’d argue PANR’s assets are worth comfortably more than $3.10/barrel now.

Indeed, management estimate that on an industry standard NPV10 basis assuming a $90 oil price, the Alkaid Deep asset is worth $13.60/barrel, while the Alkaid Shallow horizon is worth $10.60/barrel - together these two assets comprise ~481m BO recoverable of PANR’s total of ~2.2bn+ BO recoverable and so it should be clear that in applying a similar NPV to the enormous Theta West asset (estimated at ~1.4bn BO recoverable) there is substantial upside to PANR’s equity value today.

Management will host a webinar in late April that will provide greater detail and their conclusions following the recent drilling and testing campaign. I remain very positive on PANR’s prospects and the likelihood of further substantial upside ahead.

WTW

WTW reported solid FY21 results recently (discussed here) which confirmed to me that the value thesis for this situation remains intact. Management are progressing with the turnaround (post-AON merger collapse) and capital return plan and FY21 results were in line with my model - notably YoY growth for FY21 was ahead of WTW’s historic average and operating margins improved by nearly 2% in a sign that management are executing on the plan.

It’s again important to emphasise that WTW is a 2023/24 value creation story and nothing in the FY21 results that suggests the company is not on this trajectory. With activist investors Elliot Management and Starboard Value on the shareholder register I’m comfortable that management will stick to the plan and a re-rating will follow as the business returns to growth and ~30% of WTW’s market cap is returned to shareholders over the next 2-3 years.

Finally, I think its worth mentioning again that I see WTW as something of an inflation-hedge given that insurance pricing tends to rise with inflation and as a brokerage WTW’s fee income is tied to rising gross premiums. This inflation-linked model is further supported by the capital-light nature of the brokerage model and so WTW’s strong cash generation will not be absorbed by heavy capex requirements in an inflationary environment. I believe this is a further support in driving a re-rating of WTW’s stock price within the next 2-3 years.

KMR

From reading over KMR’s recently published FY21 results (discussed here), it’s clear that the business has truly inflected. As I discussed KMR’s results just last week, I won’t repeat my conclusions here in detail, but I’ll summarise this situation as follows:

KMR is valued in the market at just 2.9x LTM EBITDA, and ~2.7x NTM EBITDA on current strip pricing for KMR’s mineral products, while on a FCF basis, the stock is valued at ~4x NTM FCFF, or a 24.5% FCFF yield on EV.

Thanks to its inflecting free cash generation, KMR’s balance sheet will transition to a net cash position this year ($82m net debt vs. run-rate FCF of ~$150m+ for FY22)

KMR owns a unique and strategically valuable asset in the Moma titanium mine, and is the world’s largest supplier of ilmenite (~10% of global supply), with a highly supportive supply/demand outlook for its commodity products in a supply-constrained market.

Most recently, Western sanctions have impacted Russian exports and corporates such as Boeing have suspended purchases of titanium from Russian suppliers. As the world’s largest producer of ilmenite (a key input in titanium metal production) KMR occupies a key position in the global titanium supply chain and so should benefit from a potential commodity squeeze related to titanium.

In this highly inflationary and supply-constrained world for commodities, KMR is a unique, globally important and financially sound company that is completely overlooked and simply too cheap. If public markets do not appreciate this, private markets will and at a substantial premium in my view.

WIX

WIX is my most recent high conviction name and addition to the Model Portfolio, and is a classic Greenblatt-style spin-off situation. I won’t repeat the thesis here since I’ve published it so recently and discussed the company’s FY21 results just last week but I will comment on how I think about the growing cost-of-living crisis in the UK impacts the WIX thesis.

Certainly, WIX should see some impact from squeezed consumer incomes but I believe it is more insulated than conventional retailers in the following respects:

The DIFM order book is 2x larger than last year, which should support that segment through FY22 (20%-30% + of total revenues).

WIX’s DIY segment is focused on providing essential, in-demand products at the value-price end of scale which allows it price very competitively vs. competitors. This should mitigate some consumer spending pressures.

UK housing stock remains quite aged and certain levels of repair and maintenance will continue regardless, supporting both DIY and local trade segments.

WIX’s track record (and the DIY market itself) has proven to be resilient through previous recessions - through the GFC and UK housing market crash in 2008/09 (UK GDP - 4.5%, UK house prices -18.7%) WIX grew revenues +5% and grew market share; similarly post-Brexit and through the COVID pandemic (UK GDP -9.4%) WIX continued to grow, becoming the #2 player in the UK.

The combination of WIX’s highly-efficient, lower-cost operating model and its proven resilience through previous down-cycles gives me comfort that it will successfully navigate through any challenges in the current environment.

Outside the Model Portfolio

Outside the Portfolio names, I also want to highlight the performance of some of my other ideas from among the ~12 other names that I’ve written about in the newsletter to date, either as “quick ideas” or more brief developing situations.

Firstly I’ll comment on some noteworthy positive performers from among these:

HBRN

As I discussed in last week’s bulletin, it was pleasing to see my thesis for one of my early newsletter “quick ideas” play out.

Assuming one bought into HBRN at the €1.25/share price last June when I published the idea and held through to quarter-end last Thursday, the return on the idea marked to quarter-end was 43.5% IRR / 1.32x MOIC over approx. 9 months.

Assuming one holds until the deal closes in say three months time, the indicative return on the HBRN idea is ~34.8% IRR / 1.35x MOIC including dividends over a ~12 month hold.

SLCA

I first wrote about SLCA as an overlooked commodity play last August, and again revisited it last October following the announcement that management had initiated a strategic review of its Industrial & Specialty Products (ISP) segment with a view to a possible sale.

Since first highlighting it, SCLA is up ~104% since last August (+88% since the October write-up) as the price of oil has surged above $100/barrel.

With growing calls for US shale producers to increase production to offset inflation and an announcement on what will happen with ISP still to come (a sale would transform SLCA’s balance sheet) I see the potential for significant further upside here.

BG

Bunge Limited (BG) was the name I identified in January as a way to play a potential food crisis that has since come to pass following Russia’s invasion of Ukraine. BG is up +18% since I wrote about it in January as part of my Food for Thought series.

With no end in sight to the conflict in Ukraine or the wider energy crisis, pronounced food inflation and scarcity is likely to persist, meaning that BG as a key player in the global food supply chain will continue to benefit from the volatility. Furthermore, its relative undervaluation and strategically attractive South American assets make it a potential takeover target, adding a supportive event-driven catalyst to the macro thesis.

It would be remiss of me to only comment on the positive performers and imply all my ideas work out. I’ve also had some notable misses among my quick ideas (so far at least), of which the main laggards are as follows:

MLKN

Office furniture manufacturer MillerKnoll (MLKN), which was previously Herman Miller when I wrote about it last June, is down ~28% since I published it as a quick idea.

I originally presented Herman Miller/MLKN as a way to play the post-pandemic return-to-the-office theme with the added event-driven catalyst of its now-completed merger with Knoll to form the #1 office furniture player. My thesis was that as corporate employers transition their employees back to offices post-COVID, a great reconfiguration of office space would see MLKN benefit from surging demand for new office design and furniture. This hasn’t occurred (yet), hampered by subsequent strains of COVID stalling office re-openings but its most recent Q3 results published last week indicated some encouraging signs for rising demand (orders rose +31% YoY across the combined business).

With employers now focused on activating their return-to-office plans, MLKN may start to see increasing demand flow through to earnings and its stock price over the next 12 months.

WG

Similar to SLCA in some respects, Wood Group (WG) is another situation related to the energy space with an interesting segment divestment catalyst that I presented as a quick idea last November. Since then it has declined ~22%, largely due to the announcement of a $100m impairment on a legacy Polish project and the subsequent delay in publishing its full year FY21 results.

While this recent news is disappointing, there is an argument to say that the latest sell-off may have provided a more interesting entry point, given the following:

The impairment is a once-off exceptional charge on a legacy project - it’s not a permanent impairment to forward earnings power.

The robust FY22 outlook remains unchanged from previous guidance, as per the recent update from the company.

In this light, WG represent a more attractive value situation today should it succeed in divesting of its Built Environment consulting unit at the reported ~$2.7bn valuation being touted recently (which equates to ~84% of WG’s current enterprise value!). The remaining business offers exposure to a resurgent oil & gas sector as well as renewable energy and decarbonisation which are both structural growth markets.

ATO

ATOS SE (ATO) is down ~25% since I wrote about it as a quick idea turnaround situation in February this year. With the stock down ~60%+ over the last 12 months, it’s fair to describe the company’s recent performance as disastrous, but the various recent reports of a takeover/segment divestment/break-up of the business are what have piqued my interest in the company.

In a nutshell, ATO’s big data/cyberecurity division (referred to as BDS) is a target of Thales, a listed French defence company. Media reports indicated that BDS could fetch up to €2bn - €3bn in a sale vs. ATO’s market cap of ~€3.6bn when I wrote about it, implying BDS accounted for ~70% of ATO’s market cap at the time assuming the midpoint value for BDS. This clearly ascribed very little value to ATO’s remaining businesses which still generate ~€9bn+ in revenue.

ATO’s management rejected Thales interest and announced a turnaround plan to reposition the company. However, since my February analysis ATO’s shares have declined a further ~25% to ~€25/share currently following disappointing FY22 guidance. Following this decline, ATO now is trading at a ~13 year low with a market cap of ~€2.7bn, suggesting the market is valuing ATO entirely on the reported valuation of BDS and assigning a nil value to everything else. In this light, I think ATO remains a situation worth monitoring.

Concluding Thoughts

To conclude, I’m pleased with the performance of the Model Portfolio as it is behaving exactly as intended so far - recall how I described the Portfolio upon announcing it in January:

… against the backdrop of an expensive and speculative equity market environment I see the Value Sits Model Portfolio as an eclectic basket of idiosyncratic situations that are well positioned to realise substantial upside regardless of what the wider market does in the coming year. Time will tell if I’m right.

With the Portfolio up ~16%+ since inception to March quarter-end, it has outperformed both the wider equity markets and inflation despite a host of macro headwinds occurring over this period, and I believe there is substantial further upside embedded in the names it holds.

Conor, what do you think the catalyst is for Dole to find ground? At end of Feb/March it looked like the company was going to get the respect you were looking for only to get slapped down to lows where it continues to dance around... The Salad recall is impacting the 2022 numbers but you would hope it is priced in now...

What's your take on vertu motors currently?