Disclaimer

Value Situations is NOT investment advice and the author is not an investment advisor.

All content on this website and in the newsletter, and all other communication and correspondence from its author, is for informational and educational purposes only and should not in any circumstances, whether express or implied, be considered to be advice of an investment, legal or any other nature. Please carry out your own research and due diligence.

Model Portfolio Updates

There are two updates from last week with respect to Model Portfolio names Pantheon Resources Plc (PANR) and Willis Towers Watson (WTW):

PANR

PANR provided a testing update for its Talitha #A well last Monday which was very well received by the market, with the stock rising ~55% initially (it has since pulled back a little, but remains up ~48% on the pre-update price).

In simple terms, the testing update proved the movability and quality of oil at Talitha, which has very significant and positive implications for PANR’s enormous Theta West zone. With an NPV estimate of ~$5.4bn for the Alkaid Shallow SMD zone (~400m BO recoverable) at $90 oil, upon further validation at Theta West (which is now currently being tested), the value implication for Theta West’s estimated 1.2 bn BO recoverable is clearly very significant as oil approaches $100/barrel.

PANR is up ~110% since I first highlighted it last September, and I expect any positive update from Theta West to drive the stock price substantially higher.

WTW

WTW reported Q4 and FY21 full year results last Tuesday confirmed a positive trajectory for WTW and that the value thesis remains intact in my view.

Organic revenue growth YoY was +6%, and Revenue and EBITDA were in line with my model at ~$9bn and $2.4bn respectively (excluding the now divested Willis RE business). Furthermore, underlying FCF (excluding the impact of Willis RE disposal and AON merger termination fee receipt) was ahead of my number at ~$1.5bn (vs. $1.2bn in my model).

WTW sold off after the earnings announcement, dropping over 7% at one point to sub-$220/share, before rising back to ~$222. This price drop seemingly reflects the market’s disappointment with lower YoY organic growth vs peers AON and MMC, with WTW’s 6% growth falling short of AON’s and MMC’s growth rates of 10% and 9% YoY respectively.

However, this needs to be put in context. WTW’s business was disrupted by the proposed merger with AON, with increased staff attrition earlier in FY21 due to perceived employment uncertainty post-merger (recall that AON had identified some $800m worth of synergies). As a result, FY21 was really about re-positioning the business for standalone growth following the merger collapse (as per management’s new growth plan announced at last September’s Investor Day). So it’s really not that surprising that growth was below AON and MMC in FY21. It’s also worth highlighting that even against this backdrop, WTW’s FY21 growth rate of 6% was still ahead of its historic growth rate, and with staff retention levels improving the growth outlook now looks positive. Furthermore, core operating margins improved by ~1.9% YoY, further evidencing management’s plan is being implemented.

WTW currently trades at 11.6x LTM EBITDA vs. 16x for MMC and ~17x for AON, which just seems like too wide a discount when there’s more ground for WTW to recover in terms of growth as well as the significant capital return programme that should see WTW retire ~30% of its market cap over the next 3 years.

Markets always tend to be short-term focused on CY/NTM numbers so its also worth emphasizing that WTW is really a 2023/24 value creation story, and in my view the thesis remains intact, with nothing in the FY21 results that suggests the company is not on the right trajectory. Finally, WTW’s progress continues under the watchful eyes of Elliot Management and other activists on the share register, which provides further comfort that management should execute on their growth and capital return plans with appropriate focus and discipline.

Situations Monitor

Bunge Limited (BG) reported Q4 and FY21 full year results last Wednesday, which were impressive with revenue ahead of my estimates at $59bn and EBITDA in line with my expectations at ~$3.1bn. While overall volumes were flat YoY at ~158m tons, revenue was up +43% YoY, reflecting a commensurate increase in the average price of BG’s agricultural commodities.

Notably, BG’s EBIT margin for FY21 of 4.5% is in line with larger peer ADM at 4.6%, further indicating the enhanced profitability of BG following management’s operating model turnaround over FY19/20. Additionally, BG’s 43% YoY revenue growth was superior to ADM’s (+32% YoY).

BG now trades at ~7x EBITDA vs. 11x for ADM but with superior growth and comparable margins vs ADM, BG’s valuation discount seems anomalous. Additionally, adjusting for the securitized trade receivables working capital programme, BG trades at ~12x FCF, reflecting robust and improved cash generation.

Regarding outlook, management did offer the following measured guidance for the core Agribusiness segment (~74% of sales, ~85% EBIT):

In Agribusiness, full-year results are forecasted to be down from a record 2021, primarily due to lower results in Merchandising and softseed crushing, which had exceptionally strong prior years.While we are not forecasting the same magnitude of margin enhancing opportunities that we captured during 2021, we do see potential upside to our outlook if strong demand and tight commodity supplies continue.

While management may be conservative in their FY22 forecasts, I think there is plenty of supportive indicators for further upside from continued supply tightness; whether it’s rising fertiliser prices precipitating reduced farm crops or Russia banning fertiliser exports (further stunting crop growth and therefore supply), not to mention the growing threat of conflict in Ukraine disrupting global agricultural markets. With multiple causal factors for supply shortfalls at work, the potential upside scenario has a high probability of playing out here in my view.

Aside from the core Agribusiness segment, management guided a robust outlook in the Refined and Specialty Oils and Milling segments, stating that FY22 results are expected to be up on FY21. Furthermore, the surge in biofuel demand (produced using vegetable oil as a feedstock) is likely to drive further growth for BG in the coming years, with US industry capacity for producing renewable diesel forecast to increase ~5x by 2024 (US EIA).

All told, BG seems particularly well positioned to benefit from the current inflationary outlook.

Developing Situations

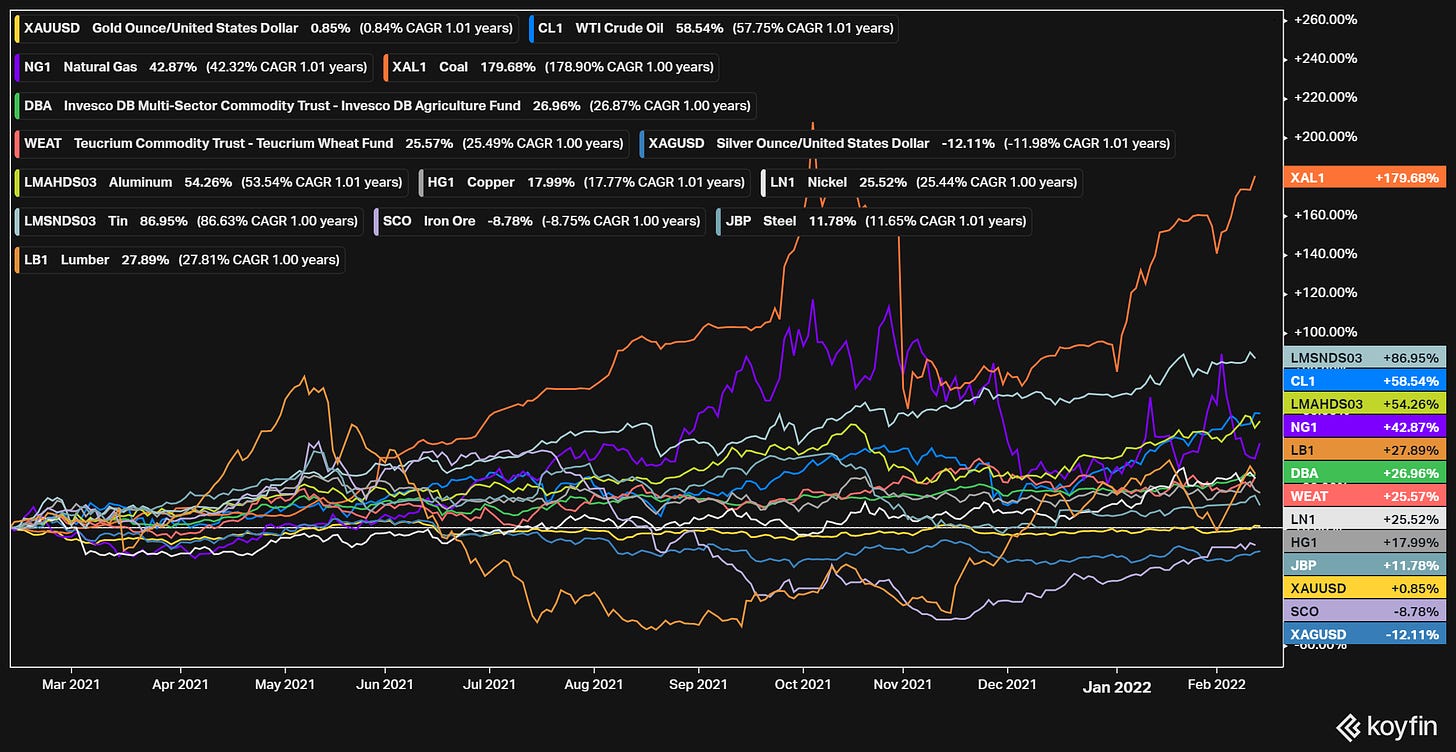

A developing situation that has caught my interest as I’ve been researching various commodity ideas recently is gold (XAU). YTD, gold has not participated in the wider commodity inflation surge:

Over the past 12 months, gold is effectively flat, while the prices of most other major commodities have risen. (Interestingly, silver as both a store of value and one of the most extensively used industrial metals has actually declined over the same period).

This relative under-performance piques my interest in both gold and silver given the wider inflationary backdrop, but gold is particularly interesting to me at this juncture given that inflation is clearly not transitory, running at 7.5%, and real interest rates are -5.5% (with the current US 10 Year treasury yield at ~2%).

Many factors influence the price and performance of gold, however real interest rates are particularly influential, with the price of gold typically moving inversely to real interest rates. When real interest rates are at or below zero, cash and fixed income investments are obviously much less attractive because their real return is negative due to inflation, i.e. purchasing power is eroded. In very simply terms, if we assume the current negative real rate of -5.5% persists through 2022, the value of $1 by year-end will be $0.945 dollars.

Gold is widely regarded as a store of value that hedges against inflation, or at the very least preserves purchasing power, and has outperformed both CPI and money supply growth over the long-term. Therefore as a store of value and given the extent of negative real rates due to non-transitory inflation, gold should be an attractive investment in the current environment.

There are a few nuances to this however. We know that the Federal Reserve intends to raise interest rates this year, and many analysts now expect a more aggressive response to high inflation, with up to seven rate increases of 0.25% this year for a total 1.75% rise in rates. This of course would increase real rates (or make them less negative) and make gold less attractive given the inverse relationship between gold and real rates. However, for this to be truly effective inflation would also need to moderate to below 3.75% (being the current US 10 Year Treasury yield of 2% plus the incremental 1.75% in rate hikes), to tame inflation and achieve positive real rates again.

But is this a realistic outcome? With talk of a “molecule crisis” last week, meaning an unprecedented shortage of all kinds of essential commodities, it seems unlikely inflation will be tamed by a 1.75% rise in rates this year. But a much more pertinent question in my view is whether a 1.75% increase in interest rates is even possible without triggering a major recession (or worse), given that the US (and the world) is more indebted than ever? A crude mathematical exercise might suggest an answer to this question.

Total debt in the US is $85.9 trillion as at the end of Q3 2021, across all public, private/corporate, household and financial sectors. The approximate interest rate on this debt is ~5% based on 2020 FRED data. Current US GDP is ~$24 trillion and this is expected to grow by ~4% this year, and ~2% in 2023 based on Federal Reserve median projections (although many analysts have started to lower 2022 forecasts closer to 3%). But lets assume US GDP grows +4% to almost ~$25 trillion in 2022.

Next lets crudely assume that a 1.75% interest increase trickles through to all the various types of debt outstanding (corporate debt, leveraged loans, mortgage rates, credit card rates, government debt issuance etc.) through the course of 2022 into 2023. Such a rate pass-through implies the total interest cost increases to 6.75%, with the incremental 1.75% on $85.9 trillion of debt equating to an additional interest servicing cost of $1.5 trillion (note this also assumes total debt doesn’t increase further, which it likely will).

What is the significance of this? An additional interest cost of $1.5 trillion represents a 6% hit to (2022 forecast) US GDP (or looking at it another way, a $1.5 trillion increase in debt service costs is ~1.6x greater than the forecast growth in GDP). To put that in context, the Great Financial Crisis of 2007-2009 caused “only” a 4.3% drop in US GDP from peak to trough.

Now I’m not a macro-economist, and admittedly this is a very simplistic analysis but it does beg the question of whether the type of rate hikes being touted are even possible without triggering a severe recession, and perhaps even a crisis. In fact, I think it suggests two things:

The Federal Reserve cannot raise rates to a level sufficient to offset current inflationary pressures, because it could create another credit and economic crisis given the level of debt outstanding; in fact inflation is perhaps the only way to deal with the debt load in that it allows the debt to be inflated away.

If rates cannot be raised sufficiently to combat inflation, then current inflation looks set to continue, which means sustained negative real rates are a genuine possibility. And if negative real rates persist, this would clearly pave the way for gold to shine and appreciate substantially, similar to how other commodities have done over the past 12 months.

How might one play such a scenario? Physical gold is the obvious way, but certain gold equities could provide greater torque to the theme if sustained real rates play out as outlined above. In this context, I believe a number of royalty companies and miners are starting to look very interesting.

Any Other Business

Private-Credit Leverage Is Soaring in Scramble for Tech Deals

A Bloomberg News article from last week highlighted how direct lenders are accepting extremely high levels of leverage (debt multiples) on SaaS deals in order to increase exposure to what is seen as a very attractive sector given its high growth and recurring revenue profile.

How high does the leverage go in these deals?

Take private equity firm Carlyle Group Inc.’s buyout of Swiss industrial software maker AutoForm AG, which closed last week. Total leverage on the debt was about 12 times the company’s 55 million euros ($62 million) in reported earnings." (emphasis in bold mine)

12x! I remember when 7x was deemed aggressive. Furthermore, one quote in the piece got me thinking:

Even when debt multiples reach 7 or even 8 times, “the resulting loan-to-value is often still well below 50% due to the high enterprise values, which lenders take comfort in.

But what if EVs contract? LTV ratios could quickly prove illusory and shoot up, with significant credit market ramifications (particularly combined with rate increases as noted above). Furthermore, the recent rout in tech stocks should provide real pause for thought here.

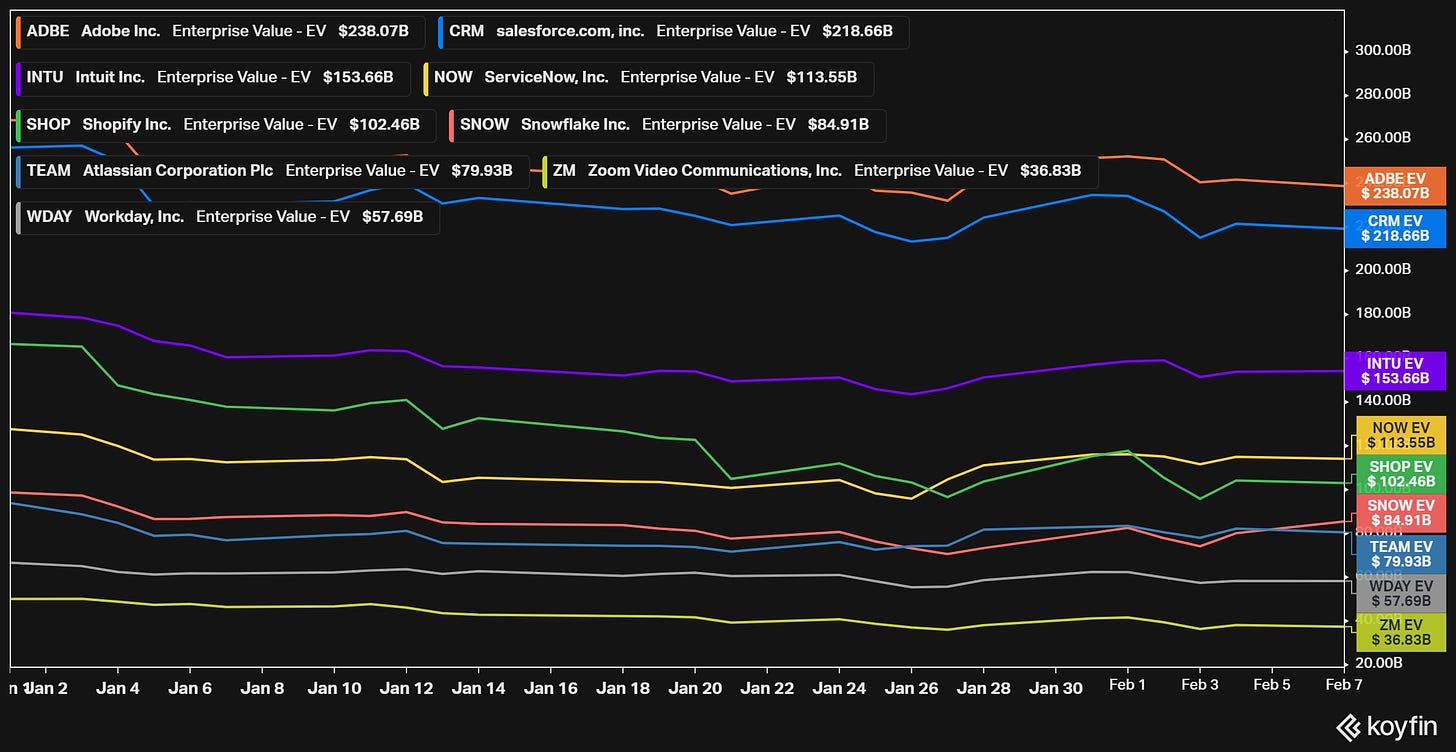

If public market valuations lead private markets by ~6-9 months, and we look at how the TOP SaaS companies’ EVs are trending YTD, this might not bode well for smaller private credit marks - among the top 5 public SaaS companies (Adobe, Salesforce, Intuit, ServiceNow and Shopify), EV’s are down ~10% - 40% so far this year:

Credit markets typically lead equity markets in sniffing out trouble. There is something to watch here I think.

I think you've only discussed the first step in the debt chain. Every debt is also someone's asset. Higher interest payments by debtors implies higher interest received by creditors. What do they do with their increased income?