Weekly Bulletin #9

Portfolio: KMR, PANR, WIX | Monitoring: HBRN | Developing: Supply Chain Re-set

Disclaimer

Value Situations is NOT investment advice and the author is not an investment advisor.

All content on this website and in the newsletter, and all other communication and correspondence from its author, is for informational and educational purposes only and should not in any circumstances, whether express or implied, be considered to be advice of an investment, legal or any other nature. Please carry out your own research and due diligence.

Model Portfolio Updates

There are updates for three of the Model Portfolio names from last week:

KMR

Kenmare Resources Plc (KMR) announced its full year FY21 results last Wednesday, which made for impressive reading. Key highlights:

Record production and shipments in FY21, with 1,285,300 tonnes shipped (+51% YoY) driving record revenues of $455.9m (+87% YoY)

EBITDA of $216.1m (+182% YoY, 51% EBITDA margin vs. 31% in FY20) attributable to increased production, higher commodity pricing and lower unit costs

OCF of $162.5m, +86% YoY reflecting ramped production and strong commodity pricing, with FCF of $87.5m, which reflects some now-completed development capex - on a maintenance capex basis, FCF of ~$118m.

Net leverage of 0.4x EBITDA

Approx. $100m of capital returned to shareholders in FY21 (including $82m share buyback), while full year FY21 dividend of $0.327/share equates to a dividend yield of ~5.6% at the current share price (dividend increase of +227% YoY)

Outlook is positive, with management stating that “positive pricing momentum for all our products has continued into 2022” with a supportive market backdrop characterised by global ilmenite demand exceeding supply and global inventories remaining low.

Regarding guidance, ilmenite production is forecast to increase by up to ~9% YoY to ~1.225m tonnes, while total production (including ilmenite, zircon, rutile and other concentrates) is forecast to increase by ~10% overall.

The FY21 results show that KMR’s inflection has well and truly occurred - it is now a $200m+ EBITDA miner, with strong cash conversion and a modest $82m in net debt. Furthermore, on my numbers, KMR should generate ~$150m of FCF (net of some development capex) in FY22, meaning its should transition to a net cash position this year, providing further scope for returning capital to shareholders.

KMR is now trading at just 2.9x LTM EBITDA, and ~2.7x NTM EBITDA on current strip pricing for KMR’s mineral products. On a FCF basis, the stock is valued at ~4x NTM FCFF, or a 24.5% FCFF yield on EV. This just seems too cheap given KMR’s unique and strategically valuable Moma mine asset, its position as the world’s largest supplier of ilmenite (~10% of global supply now fully ramped) and it’s strong fundamentals.

PANR

Pantheon Resource Plc (PANR) provided a testing update on Theta West last Thursday, with the #1 test well flowing high quality oil, which “likely exceeds” management’s pre-drill resource estimate of 1.2 bn BO for Theta West.

The test well flowed high quality oil at rates that averaged over 57 barrels of oil per day (BOPD), with peak rates exceeding 100 BOPD over 2.5 days. Encouragingly, the flow rates meet pre-drill expectations, and the test achieved all three of management’s objectives of confirming oil quality, movability and deliverability at Theta West.

While Theta West’s ultimate commercial viability is still to be confirmed by further testing, this is a significant positive for PANR, with an upward revision in resource estimates (and ultimately value) now likely.

The next area of focus is proving the deliverability of production wells, starting with the Alkaid #2 well which is estimated for July 2022. If this next phase is successful, it will result in oil production, meaningful PANR becomes revenue generating and which further de-risks the equity.

Technical Director Bob Rosenthal perhaps best summarises the current position following this positive update:

We are now on the path to unlocking an enormous basin play.

WIX

Last Wednesday I published my latest high conviction idea on Wickes Group Plc (WIX), and upon publication I’ve added it to the Value Sits Model Portfolio.

Subsequently on Friday, WIX published its full year results for FY21, which were very good in my opinion. Key highlights were as follows:

Revenues increased to £1.53bn YoY, or +14%.

EBITDA (post-IFRS 16) increased to £218.7m, or +18.5% YoY (pre-IFRS 16, EBITDA rose +45% YoY to ~£109m).

FCFF was £107.9m (on post-IFRS 16 equivalent basis) which is down ~55% vs. FY20, but which reflects a prudent and deliberate inventory build by management to mitigate future potential supply chain disruption and inflation, and to assure product availability as the key Spring trading season for DIY and home improvement projects approaches.

Net debt on an IFRS 16 basis (consisting entirely of lease obligations, noting WIX has zero financial/bank debt) was £618.7m, with net leverage of 2.8x broadly in line with target level of 2.75x. Excluding leases, balance sheet is in a ~£123m net cash position, equating to ~26% of WIX’s market cap.

Regarding current YTD performance, management reported that trading in the first 11 weeks is in line with PY period, with core sales down -6.7% YoY (but +26% vs. comparable FY20 period) - this YoY decline is attributable to the tough comparative of the DIY boom during the lockdowns of early FY21.

The DIFM segment has had a positive start to the year, with an order book level more than 2x that of last year, and the order pipeline continuing to grow. This should support sales ahead of pre-COVID FY19 levels for this segment in FY22.

With a stated 40% dividend pay-out ratio on profits after-tax, management have proposed a final dividend of £0.088/share, taking the full year FY21 dividend to £0.109/share, which equates to a ~6% dividend yield.

Notably, with regard to its significant cash balance and surplus cash, management also stated the following regarding the possibility of a share buyback in the future:

there is currently a preference to return this surplus cash to shareholders via share buybacks or special dividends.

In terms of outlook for FY22, management are positive on WIX’s prospects with CEO David Wood offering the following assessment:

Looking ahead, we expect to continue outperforming the market and are well-placed to capitalise on the ongoing requirement for home improvement – namely an ageing housing stock, favourable consumer trends, and the increased focus on insulating and retrofitting homes. While we recognise the pressure that consumers will be facing in 2022, we have the right model, a strong pipeline and order book, and remain confident of making further progress in the current year driven by a material increase in DIFM revenues.

A further point that’s worth highlighting post-results is WIX’s superior performance vs. larger peer Kingfisher Plc (KGF, owner of B&Q and Screwfix chains) - WIX’s underlying LfL sales growth was +13% YoY vs. 11.8% for KGF, and its EBITDA margin of 14.2% was also ahead of KGF’s 12.4%.

Post-results, WIX’s shares are up over 6% as at the time of writing, and the business is valued at 5x EBITDA on a post-IFRS 16 basis, and just 3.2x on a pre-IFRS 16, net of all rental expenses.

WIX’s annual results presentation is available here, and the Annual Report is published here.

I am excited about WIX’s prospects and see it as a worthy addition to the Model Portfolio - it possesses all the investment characteristics I seek and given its neglected share price post-spin off, it fits well with the idiosyncratic profile of the portfolio.

Situations Monitor

The notable update from last week with respect to situations I’ve been monitoring was the announcement that funds managed by Brookfield Asset Management have agreed to acquire Hibernia REIT Plc (HBRN) for ~€1.1bn / $1.2bn.

HBRN was the very first “quick idea” I wrote about in this newsletter last June, and I’m pleased to see my thesis for HBRN play out as part of the wider “forced purchaser” and PE-RE return to the office themes that I’ve written about previously as catalysts for selected public equities.

Brookfield are acquiring HBRN for a total cash value of €1.634/share, comprising €1.60/share bid price (equating to 0.93x EPRA NAV) plus a 3.4 cent dividend. The bid is at a ~35% premium to the pre-announcement share price and is ahead of my target take-private price of €1.52/share, but in line with my tax-adjusted NAV valuation of ~€1.60, as I published here back in June.

Brookfield’s move is timely, in that I’ve been recently calling out HBRN’s situation in successive issues of the Value Sits Bulletin since the end of February (Issue #5, #6 and #7), following recent M&A activity in the European/UK REIT sector - here’s my take from Issue #7:

After I highlighted last week how the private markets are telling us that HBRN is substantially undervalued, it’s share price subsequently fell as low as €1.06 during the week, equating to valuation of just ~0.61x NAV. Two words spring to mind here: stupid cheap.

...

At this low ball public valuation, I continue to believe HBRN is a prime takeover target, particularly given the scale of PE-RE dry powder available and the clear appetite in private markets for office RE (as evidenced by other similar REITs being acquired recently). A PE-RE acquirer could take HBRN private at over €1.50/share and still generate a very attractive IRR for what would be a core RE strategy. This implies ~35% upside vs. HBRN current’s price with almost no downside as I see it given the undervaluing real estate value ( and noting HBRN is trading close to its 2020 pre-vaccine lockdown average price).

The fact that it is Brookfield acquiring HBRN following its very recent acquisition of Belgian prime office REIT Befimmo (Issue #5) adds further credence to both my Forced Purchaser and Return to the Office investment theses - at its most recent Investor Day last September, Brookfield disclosed holding $78bn of dry powder, and is looking to raise a further $17bn for its fourth Strategic RE Fund, while this (and others’) recent takeover of office REITs again demonstrates appetite among PE/RE firms for quality office REITs discounted by public markets post-COVID.

HBRN's high quality office portfolio has been consistently undervalued in the public markets and this deal is a great outcome for shareholders in my view, particularly following the office market dislocation of the last two years.

Regarding idea performance, assuming one bought into HBRN at the €1.25/share price last June when I published the idea and assuming the deal closes in say three months time (there are a number of closing process steps involved), the indicative return on my HBRN idea is ~34.8% IRR / 1.35x MOIC including dividends over a 12 month hold.

Furthermore, if one had bought in at the recent low of ~€1.08/share earlier this month, one would be sitting on a 50% gain currently in the space of just 18 days (and an indicative ~57% gain if held to deal closing in three months time):

As I wrote before, I believed there was never any real downside to owning HBRN at a mid-0.6x NAV mulitple backed by prime real estate, and so this was a highly asymmetric situation and one emblematic of the type of idiosyncratic risk/reward situations I'm seek. My only regret was not adding it to the Model Portfolio recently, on the basis that my assessment of upside was sub-50% (my minimum hurdle) based on my take-private target price of €1.52, whereas Brookfield pushed to €1.60 in their bid.

Nevertheless, any readers who were attracted to my original idea and made their own investment decision will have done well here both in absolute and relative return terms - on a marked-to-market basis today vs. some European benchmarks over the last 12 months, HBRN is up ~30% vs. the Euronext Dublin (Irish stock exchange benchmark) down ~14%, the FTSE 250 down ~1.6%, and the Stoxx 600 which is up ~7%.

This idiosyncratic out-performance again shows the benefit of catalyst-driven value investing in such an uncertain and noisy macro-environment as today.

Developing Situations

A new theme I’m currently exploring is the apparent reversal of decades of globalisation and the onshoring of supply chains following Russia’s invasion of Ukraine and the COVID pandemic.

A piece in the FT print edition last week entitled Onshoring gains ground as globalisation grinds to halt (digital version published under amended title here) highlighted how “investors are betting that the war in Ukraine will prompt companies to pull production closer to home in a significant reshaping of global supply chains.”

In the piece, Larry Fink of Blackrock is quoted as saying that “a large-scale reorientation of supply chains will inherently be inflationary,” which suggests to me that the pricing of many commodities essential for production and infrastructure across metals and energy are likely to remain elevated for quite some time.

Some takeaways from the piece that I’m currently mulling over are:

1. The Russian economy is effectively doomed and headed for collapse (as long as Putin remains in power), given US, UK and Germany/EU decisions to already block or wean-off Russian energy exports over the next 24 months, given that O&G exports are the lifeblood of the Russian economy. By extension, other new and/or under-invested sources of energy will need to step in and replace this excommunicated supply. It is interesting to think about what these might be.

2. Another fund manager in the piece stated the following:

We need to learn to invest again in an inflationary environment … It’s injecting dispersion into asset prices, compressing multiples and putting pressure on corporate profits. It can only be overcome by asset managers positioning themselves to take advantage of these mega trends: energy transition, cyber security and digitalisation. It’s going to be a much trickier environment for investors.

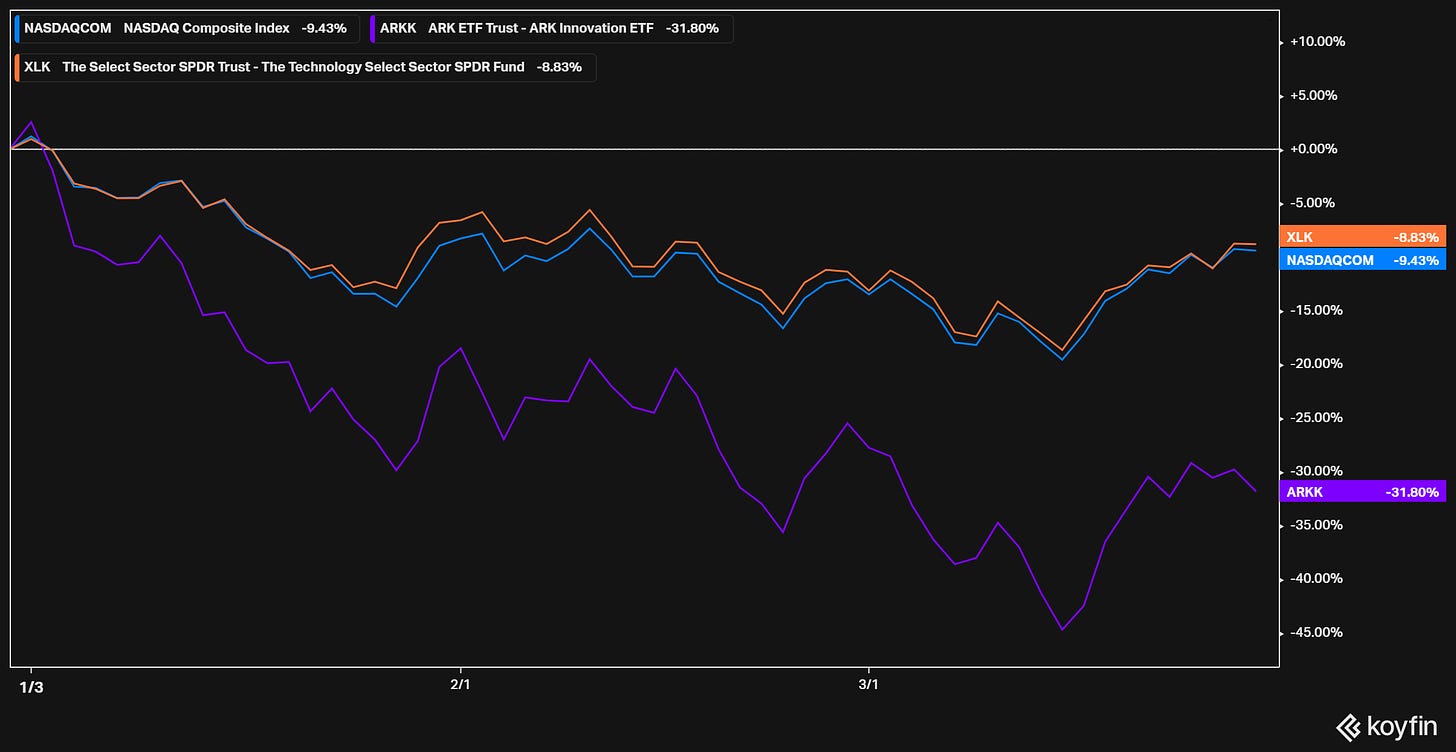

On this topic, energy transition, cybersecurity and digitalisation are not the first places my mind goes to in thinking of new sources of opportunity in an inflationary, commodity and capital constrained regime shift - after all electric vehicles, cybersecurity software companies and other digital/tech innovation names that underpin the NASDAQ/ARKK/tech complex have now clearly fallen out of favour as their fundamentals come under greater scrutiny in a rising rate environment:

To my mind, certain commodities and providers of essential products or services with favourable pricing dynamics and supported by specific internal catalysts seem a more obvious general field to consider.

3. One final quote from the article resonated with me much more than the view in point 2 above about mega-trends:

There will be a lot of opportunities for stock pickers because there will be a lot of fragmentation within sectors.

This makes a lot of sense to me. Energy and defense are two sectors referenced in this respect (for obvious reasons), and just taking the example of Germany’s decision to increase defence spending to more than 2% of its economic output (or €100bn+), it’s interesting to think of the potential areas of opportunity that will stem from this policy-driven capital allocation.

The way I’m initially thinking about this theme (initially at least) is that it constitutes new, incremental demand that is not once-off in nature, for an awful lot of steel, titanium and other hard “stuff.” And this is just one country’s defence policy - the wider Western rebuilding of supply-chains is an even larger and more extensive, multi-year undertaking, covering shipping, logistics, infrastructure, energy among other sectors. This prompts me to think who are the suppliers to the builders of supply chain infrastructure for example.

This is a large and evolving theme, and one which I believe will present many interesting equity situations over the next 12-24 months.

Any Other Business

Sticking with the topic of supply chains and globalisation, Howard Marks of Oaktree Capital recently published his latest memo entitled The Pendulum in International Affairs, which is an interesting read.

In the memo, Marks’ gives a thoughtful overview of recent market events and the interplay between globalisation, politics, resources and supply chains and posits that new investment opportunities may arise as security of supply is prized over lowest-cost supply, which I tend to agree with.