Kenmare Resources Plc: Inflection Point

An essential commodity miner transitioning to a net cash position but priced for distress at just ~4x EBITDA / 0.63x EV/IC.

Disclaimer

Value Situations is NOT investment advice and the author is not an investment advisor.

All content on this website and in the newsletter, and all other communication and correspondence from its author, is for informational and educational purposes only and should not in any circumstances, whether express or implied, be considered to be advice of an investment, legal or any other nature. Please carry out your own research and due diligence.

In this week’s Quick Idea edition of the newsletter, I’m returning to the commodity space following my recent analyses of US Silica (here and here) and Pantheon Resources Plc, to outline what I believe is an interesting situation with regard to Irish-listed mineral sand miner Kenmare Resources Plc (KMR).

Business Overview

KMR is one of the world’s largest miners of mineral sands products, which are key raw materials used in the production of everyday “quality-of-life” items such as paints, plastics, paper and ceramic tiles, as well as in titanium metal.

KMR is listed on the Euronext Dublin and the London Stock Exchange, and has a current market cap of ~€537m and an EV of ~€600m.

KMR produces two main mineral sand products:

Titanium feedstocks - the minerals ilmenite and rutile which are predominantly used for the manufacture of titanium dioxide (TiO2) pigment which accounts for around 90% of global titanium feedstock consumption.

TiO2 pigment is used in the manufacture of paints and other coatings, plastics and paper as well as a number of other applications, including cosmetics, food additives, ceramics and textiles. TiO2 is an essential material, in that there is no economic substitute or environmentally safe alternative to it, as it replaced lead oxide in consumer products such as paint, due to lead’s toxicity and related health issues.

Titanium metal and welding electrodes largely account for the remaining 10% of global TiO2 feedstock consumption. Titanium metal’s unique properties make it the preferred metal for a number of demanding applications including the manufacture of airframe and jet engines for the aerospace industry. It is also widely used in chemical and power generation plants, as well as a number of growing applications for the electronics, medical and leisure industries.

Titanium feedstock production is a ~$4.5 billion per annum industry and the TiO2 pigment industry which KMR supplies into has annual revenues of over ~$15 billion.

Zircon - a mineral produced as a co-product of titanium minerals mining, zircon is an important raw material for the ceramics industry, which accounts for ~52% of global zircon consumption. A further 27% of global zircon production is consumed in the foundry and refractory industries, with zircon also becoming increasingly used in a range of chemical applications. The zircon sand supply sector is a ~$1.7 billion per annum industry with Europe and Asia being the largest markets.

KMR Revenue Breakdown - H1 2021:

Source: Kenmare Resources Plc H1 2021 Results Presentation

KMR is the world’s fourth largest producer of titanium feedstocks (ilmenite and rutile), and the world’s largest producer of ilmenite (which now accounts for ~85% of revenues following production capacity expansion completed in H1 2021).

KMR has historically produced ~7%-8% of the global supply of titanium feedstocks, and this is now projected to rise to ~10% following the recent capacity increase. KMR also produces ~4% of global zircon supply.

KMR Competitive Position:

Source: Kenmare Resources Plc 2018 Capital Markets Day Presentation. Note while market share data above references 2017, market positions among top 4-5 players has not changed materially since then.

KMR was previously the target of two takeover attempts by larger Australian-listed peer Iluka Resources, initially in 2014 and again in 2015. Iluka’s bids were opportunistic in nature at a time when KMR was overleveraged and struggling during a period of excess market supply and declining commodity prices. Iluka’s 2015 bid valued KMR’s equity at €0.094/share, or €262m ($294m) which implied an EV/IC multiple of just 0.65x, and an EV/EBITDA multiple of 65x on depressed FY14 EBITDA (or ~6x previous peak FY12 EBITDA). Both of Iluka’s bids were rejected by KMR shareholders at the time on valuation grounds.

KMR supplies customers in more than 15 countries, ranging from global leading producers of TiO2 pigment such as the Chemours Company and Tronox (also a competitor and currently subject to a buy-out offer from Apollo ), as well as zircon millers and smaller specialised manufacturers supplying various niche markets.

Key Asset

KMR’s key asset is the Moma Titanium Minerals Mine in north-east Mozambique. Moma is a world-class Tier 1 mining asset and is one of the largest titanium mineral deposits in the world. The Moma mine has a 100+ year life, with total proved and probable ore reserves estimated at 1.54 billion tonnes as at 31 December 2020, which is sufficient to support annual production at 1.2 million tonnes of ilmenite over 100 years.

Source: Kenmare Resources Plc H1 2021 Results Presentation

KMR’s total mineral resource (excluding its reserves) held via a combination of exploration licences and mining concessions is estimated at 6.4 billion tonnes as at 31 December 2020.

Recent Results & Trading Update

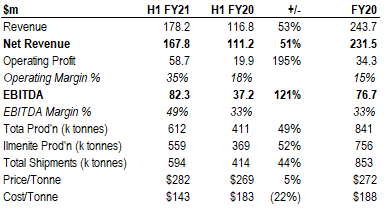

Source: Kenmare Resources H1 2021 Results; 2020 Annual Report

(Note: While KMR is Irish headquartered and its main listing is on Euronext Dublin, the company reports results in USD, therefore all financial analysis, projections etc that follow are in USD unless otherwise stated).

KMR’s H1 FY21 results reflect a significant increase in production volumes and sales following the completion of a ~$160m three year capital investment programme in FY20, which has increased annual ilmenite production capacity by ~35% from ~900k tonnes to ~1.2m tonnes per annum.

Aside from the COVID disruption, FY20 was a year of transition for KMR as its capital programme was substantially completed, and H1 FY21 results reflect a fully-ramped production run-rate going forward. Overall H1 revenues (net of freight costs) increased to ~$168m (+51% YoY), driven by higher production and sales volumes and increased prices for KMR’s main commodities of ilmenite and zircon. With KMR’s cost base being relatively fixed, production cash cost/tonne has decreased by ~22% to $143/tonne as its cost of production of ~$175m is spread over higher production output. As a result of the ramp-up, KMR is now seeing the benefits of operating leverage kick in, as evidenced by the 121% YoY increase in EBITDA and expansion in EBITDA margin from 33% to ~50%.

The FCF impact from both the completion of the capital programme and operating leverage is significant. In FY20, FCF was -$68m, reflecting $139m in capex related to the production expansion programme. I estimate FCF (EBITDA-capex) for FY21 will be ~$95m, net of ~$83m in capex, which includes ~$60m of remaining development capex relating to the final costs of the capacity expansion programme.

Looking forward to FY22 however, FCF should increase dramatically - I estimate FCF of ~$145m for FY22, which will enable KMR to move to a net cash position from current net debt of ~$74m as at the end of June H1 period. Notably, this will result in KMR becoming debt-free for the first time.

The significant increase in EBITDA and FCF in H1 FY21 allowed KMR to pay down ~€20m of debt as well as increase its dividend 3x to $0.0729/share, implying an annualised dividend yield of ~3% at the current share price.

KMR recently provided a further Q3 FY21 update, which reported the following highlights:

Ilmenite production of ~314k tonnes in Q3 FY21, +87% YoY vs. Q3 FY20 - this was the first full quarter’s production at nameplate capacity of 1.2 million tonnes per annum of ilmenite, setting a new record

Zircon production of 15.7k tonnes, +44% YoY vs. Q3 FY20,

Total shipments of finished products of 322.6k tonnes, +173% YoY

Guidance for FY21 reiterated at 1.1-1.2 million tonnes of ilmenite, plus associated by-products

Demand for KMR’s products remained robust in Q3 , supporting strong sales volumes and further price increases, as the market continues to be tight with demand increasing again in China.

Outlook for Q4 is positive, with strong order book - despite recent uncertainty in the Chinese real estate market (related to developer Evergrande), demand remains strong from KMR’s Chinese customers while global titanium feedstock inventories remain at low levels.

With regard to zircon, demand from the ceramics and foundry industries has recovered particularly quickly, and coupled with supply disruptions, the strong demand has resulted in an undersupplied market. Prices for zircon are expected to increase again in Q4 following increases in Q2 and Q3.

KMR shares are up ~50% YTD as the market has started to price in an earnings inflection for the business given the increased capacity, and the stock is up ~200% since the COVID market lows of March 2020. However, KMR still appears very cheap at ~6x LTM EBITDA which doesn’t reflect its fully-ramped earnings power. On a forward basis, KMR is valued at just 3.9x FY21 forecast EBITDA and 3.6x FY22 EBITDA based on the current share price and EV. As I outline below, this just seems too cheap given KMR’s unique Moma asset and its enhanced earnings power post-expansion programme.

Business & Market Outlook

As should be clear from the above overview, with the Moma mine KMR owns a unique, world class asset that supplies key commodities essential to industry and the modern economy (again recall that there is no substitute for TiO2 pigments). Furthermore, as one of the largest mineral sand miners globally, KMR occupies a critical place in the global industrial and manufacturing supply chain. It’s worth noting that in FY20, a year of both transition (with KMR’s capital programme still in progress) and disruption (due to the COVID pandemic), KMR’s revenues were down just 10%, while the average price/tonne (blended across all KMR’s commodities) increased +10% on FY19 (within which the price of ilmenite increased +20%). This price action contrasts sharply with that of oil for example (being another major industrial commodity) which declined by ~20% during 2020. I believe this serves to further highlight the essential “quality of life” nature of KMR’s commodity products.

In addition, the outlook for titanium feedstocks such as ilmenite and zircon is very positive. As KMR reported in Q2 and Q3 this year, market supply is tight and demand is rebounding in China and globally as economic activity recovers post-COVID. On a more structural level, the supply/demand balance is favourable with demand forecast to continue to exceed available supply out to 2025, even assuming potential new supply comes on-stream:

Source: Kenmare Resources 2021 AGM Presentation, May 2021

Against this backdrop, commodity pricing is expected to hold up as KMR’s Q3 outlook indicated, attributable to constrained supply and rising demand:

Source: Kenmare Resources Plc H1 2021 Results Presentation

Notably, KMR’s view on outlook is also corroborated by peers Iluka, Tronox and Base Resources, in their recent trading updates:

Iluka Resources H1 FY21 Interim Report -

Demand from the titanium dioxide market was robust, with numerous requests received for additional volumes of high-grade feedstock. Sales of rutile and synthetic rutile were 280 thousand tonnes in the first half of 2021, up 72% compared to the prior period... The announcement of the potential suspension of operations at Sierra Rutile, coupled with violence at a major feedstock producer in South Africa, has created additional concern around future supply of feedstocks heading into the second half and beyond. As a result, pigment producers are seeking additional volumes ahead of any potential disruptions to supply. The welding market continues to perform well, with demand outstripping supply of feedstocks. Iluka announced a 9% price increase in this market for Q3 and is allocating volumes to welding customers.

While KMR produces only a small amount of rutile relative to ilmenite, Iluka’s comments regarding pigment producers and concerns around supply offer a positive read across for KMR.

Tronox indicated a robust pricing outlook specifically for ilmenite during its recent Q3 earnings call in part driven by power supply issues in China -

– those power interruptions and the extra effort on the environment has had a very important limiting production impact on the ilmenite production in China. And that's why the price of ilmenite remains very high. And we don't expect that trend to change with that pressure on this. And the other thing is, ilmenite production in China is highly linked to iron ore production. And with the reduction in iron ore price, there's less incentives to produce more ilmenite for those mining company, and that also push the price of ilmenite high and maintain it high.

Finally, Australian-listed peer Base Resources reported a supportive outlook in its latest Q3 update:

… overall global pigment demand remained very strong through the quarter leading to ongoing robust demand for titanium feedstocks. As a result, pigment prices maintained upward momentum with further price increases expected in coming months. Demand for ilmenite as a feedstock for Chinese pigment producers was again very strong in the quarter, enabling further ilmenite price gains. Increased ilmenite supply from some African sources, Vietnamese exports and Chinese domestic production through 2021 is not yet sufficient to meet demand and ilmenite prices are expected to continue their upward trend through the December quarter…. Zircon demand continues to be very strong due to recoveries in all end use sectors and regions, which, when combined with limited supply and minimal inventories, has resulted in a tightening zircon market and significant upward price pressure.

The above comments from leading producers of titanium feedstocks all indicate a highly supportive outlook for KMR’s products and that similar to other commodities with a constrained supply/robust demand dynamic, KMR should benefit from further commodity price inflation.

The Investment Thesis

Essentially the thesis here is that KMR has been fundamentally repositioned relative to its recent history and is now at an inflection point following the completion of its three year-long capex programme. FY21 will see it complete its transition from operational ramp-up phase to a fully-ramped and highly cash generative miner.

I estimate KMR could be worth ~€10/share or ~2x its current share price by FY24, driven by a market re-rating of the stock in line with listed peers and/or a takeover given its strategic value as owner of the Moma mine.

In summary, the investment thesis for KMR comprises 6 key considerations as follows:

Ramped Production Capacity - earnings power and FCF set to increase substantially, with EBITDA to more than double from FY20 levels by FY22.

Debt-free Balance Sheet Transition - enhanced FCF generation will see balance sheet shift to net cash position by next year.

Unique & Valuable Asset - the Moma mine is a valuable strategic asset with a 100 year mine life, producing commodities that are essential to industry and the modern economy.

Favourable Market Backdrop - KMR should benefit from a favourable supply/demand dynamic and continued commodity price inflation (further bolstering FCF).

Fundamentally Cheap - at 3.9x FY21 EBITDA / 3.6x FY22 and 0.63x EV/IC, KMR is fundamentally cheap now given the earnings inflection brought about by the production capacity increase. It also trades at a meaningful discount to listed peers.

Takeover target - given the above attributes and it’s competitive position as the largest producer of ilmenite globally, KMR seems an obvious takeover target by PE or another strategic acquirer such as peers Iluka or Tronox.

Given the above, I see KMR as a somewhat unique value situation at the current price.

Valuation & Returns Analysis

Valuation Multiple

At the current share price of €4.80/share, KMR has a market cap of €537m and an EV of €600m, which equates to a valuation of 6x LTM EBITDA and 3.9x FY21 / 3.6x FY22 EBITDA. This compares to its historic average multiple of ~6x over the last ~5 years

Relative to public comps, KMR also trades at a discount to larger peers Iluka Resources and Tronox Holdings, which both trade at ~7.4x LTM EBITDA. With regard to comparable private market transactions, there are few relevant comps, but the following are relevant reference points in gauging potential private market value for KMR in a takeover scenario:

Iluka previously tried to acquire KMR in 2015 at 6x prior peak earnings

Tronox Holdings acquired the mineral sands business of Exxaro Resources in 2012 at an implied EV of $1.6bn, or ~8.8x EBITDA

Apollo Global Management are currently in discussions to acquire Tronox at an EV of ~€6.9bn, or 8.4x EBITDA / ~17x LTM FCF / 1.26x EV/IC.

Triangulating KMR’s valuation from the above, an appropriate multiple seems to be in the 6x - 8x EBITDA range. While KMR is smaller than Iluka and Tronox, it has a number of attributes which I believe merit it a valuation in line with larger peers:

Higher margins - KMR’s LTM EBITDA margin of ~49% compares to 41% for Iluka and 24% for Tronox

Balance sheet transitioning to net cash position (allowing it to be levered up by an acquirer).

Unique strategic asset at Moma should warrant a market multiple

Projected Earnings Power

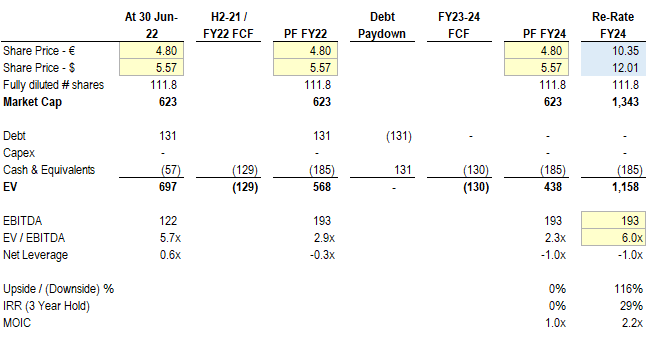

Moving onto KMR’s forward earnings power, my high level model below indicates stabilised EBITDA of ~$193m by FY22 (vs. $76.7m in FY20 and $122m over LTM period):

Source: Value Situations analysis.

Key assumptions are as follows:

FY21 production runs at midpoint of management guidance to 1.15m tonnes of ilmenite / 1.26m tonnes total production in FY21 (in line with annualised H1 FY21 run-rates of 591k tonnes of ilmenite / ~643k tonnes total production); FY22 onwards assumes ilmenite production rises to max nameplate capacity of 1.2m tonnes

Post-FY21, rather than get into forecasting ilmenite and other commodity prices and costs per tonne, I simply assume revenues and costs flatline at current levels;

For revenues, I assume an average net selling price of $282/tonne (as per H1 FY21 price achieved) throughout the projected period, which is conservative in context of trading updates provided by both KMR and its peers recently regarding supply constraints and robust demand.

On opex, I assume average cost/tonne declines from current year $141/tonne to $134/tonne reflecting operating leverage benefit from fixed cost base and increased ilmenite production from FY22 onwards.

These assumptions result in EBITDA margin increasing from ~50% in current year to ~52%. In reality, should opex costs rise with inflation, it is likely this would be offset by the market price/tonne for KMR’s commodities increasing accordingly given the supply/demand dynamic.

Price and cost assumptions result in stabilised EBITDA of $193m by FY22, implying KMR is valued at 3.6x at the current EV and sub-3x on FY22 EV, which reflects KMR’s shift to a net cash position by that time.

The increased EBITDA flows through to strong FCF generation, resulting in net debt falling to just $8m by FY21 year-end and facilitating the full repayment of all debt outstanding during FY22.

Maintenance capex is assumed at ~$48m / 13% of revenues, based on H1 FY21 depreciation charge %, given that historic capex levels reflected the large capital investment programme undertaken through FY18 - FY20 and so are not reflective of maintenance capex going forward. I believe this is conservative, and maintenance capex could actually be lower given the well-invested nature of KMR’s facilties.

Nataka capex totalling $127m is assumed to be incurred and funded from FCF over FY22 - FY24. This relates to the cost of relocating one of KMR’s wet concentrator plant (WCP) facilities to the Nataka ore zone at Moma by 2025. This move is necessary to maintain production at 1.2m tonnes of ilmenite and is a very similar process to the relocation of KMR’s WCP B facility to the Pilivili ore zone successfully completed during FY20. The Nataka cost is based on the Pilivili project cost of $127m (this was the final part of the overall $160m capital programme undertaken over the last 3 years).

For simplicity, I ignore forecasting dividend payouts but given KMR’s dividend policy (25% of profits after tax going forward) management are likely to increase cash dividends going forward.

The model implies KMR will be running at an underlying FCF yield of ~21% (ex-Nataka capex) by FY23, rising to a 30%+ yield by FY25.

Summary Valuation & Returns

Combining my estimate of KMR’s post-FY21 stabilised EBITDA of ~$193m with a valuation multiple range of 6x - 8x implies KMR could be worth €10 - €13/share by FY24, implying upside of ~116%-178%, or 2.2x - 2.8x to the current share price (excluding dividends).

For the sake of conservatism in a Base Case, I’ll assume 6x is an appropriate multiple in line with KMR’s historic average multiple and to allow some market discount to its larger listed peers (despite its strong investment attributes). This implies a valuation of $10.35/share or 116% upside by FY24:

Source: Value Situations analysis. € / $ FX conversion assumed at €1 : $1.16.

My high level valuation analysis assumes the stock re-rates through 3 stages as follows:

Cumulative cash of $129m is generated through H2 this year to year-end FY22, moving KMR to a net cash position of ~$55m and implying a valuation of just 2.9x at that time based on the current share price.

The surplus cash is used to fully delever the balance sheet at end of FY22, with a further ~$130m in cumulative FCF generated through FY23-24 (net of Nataka capex). By end of FY24, KMR’s implied value is ~2x EBITDA based on the current share price and net cash position at that time.

Market re-rates KMR to a 6x multiple following completion of Nataka capex and production capacity is sustained at 1.2m tonnes for ilmenite, implying a value of $10.35/share.

This high-level analysis implies returns of 29% IRR / 2.2x MOIC over an assumed 3 year investment hold period (excluding dividends).

If the market were to re-rate KMR’s stock to 7x, the implied value by FY24 increases to €11.84/share, with indicative returns of 35% IRR / 2.5x MOIC.

If a re-rating to 8x were achieved, the implied value increases to €13.33, with an indicative return profile of 41% IRR / 2.8x MOIC (again excluding dividends).

Downside Analysis & Asymmetry

As with any situation I look at, I also consider the downside risk here in order to assess whether this is an aysmmetric opportunity.

For an indicative Down Case I assume the following:

Average selling prices/tonne fall 20% to ~$226

Opex costs hold in line with Base Case levels of $134/tonne

Capex is maintained in line with Base Case

Result is stabilised (FY22 onwards) EBITDA falling to ~$119m along with much lower FCF generation and reduced deleveraging as a result.

Assuming a stagnant 4x multiple (i.e. no re-rating from current 3.9x FY21 forward multiple), this implies a value of €3.76/share or downside of -21% vs. the current share price:

Source: Value Situations analysis.

This downside analysis indicates that KMR is a highly asymmetric situation, with the Base Case upside being more than 5x the downside risk here.

Alternative Asset Valuation

As a cross-check on my Base Case valuation of €10+/share, I also consider a asset-based valuation using EV/IC.

As at end of H1 FY21, KMR has total invested capital of $1.1bn (which I define as total assets - non-interest bearing current liabilities), indicating the market values the business today at just 0.63x IC based on the current EV of ~$697m (€600m).

This current 0.63x multiple is in line with Iluka’s opportunistic / distressed bid for KMR back in 2015 at 0.65x, which reflected KMR’s overleveraged balance sheet and oversupplied market conditions at that time. Today, KMR’s position is fundamentally different, with it operating a fully ramped and producing mine, strong FCF generating ability and the business on cusp of being debt free by next year.

In this context, for it still to be valued at such a distressed multiple makes no sense at all, and indicates that market is mispricing KMR as a distressed asset.

So what is a reasonable asset valuation for KMR today? The current Apollo bid for Tronox offers a good reference point here. Apollo is bidding $27/share for Tronox, which equates to a total EV of $6.9bn, or 1.26x Tronox IC of ~$5.5bn.

Applying this 1.26x multiple to KMR’s IC implies an EV of $1.4bn for KMR, which equates to a value of $10.16/share, indicating 112% upside vs. the current share price:

Source: Value Situations analysis.

This alternative asset-based valuation clearly supports my Base Case value of $10.35 and further indicates that KMR is an undervalued situation relative to its asset value as well as its earnings power and future prospects.

Why Is KMR Mis-priced?

There are several reasons why KMR is mispriced:

1. Historic track record - KMR has been a frustrating investment for investors historically, and as with many mining and commodity-related stocks with leveraged balance sheets, it has come close to going bust, particularly around the time of the 2014 and 2015 bids from Iluka. At that time, it had restructure its debt and raise new equity from the State General Reserve Fund of Oman to save the business from bankruptcy. (The Oman Fund remains the largest shareholder, owning 29% of the company’s stock).

Indeed some broker commentary from the time of the Iluka bids gives a good sense of market perception around the stock historically:

On the one hand, you could argue that Michael Carville [Managing Director] and his team should bite Iluka’s hand off. Everyone in the London market knows Kenmare and I’ve yet to talk to anyone who’s made money holding it, although I suppose plenty of proprietary traders have made bucket loads trading in and out of the volatility,” the broker said in a note that was released before Kenmare confirmed the bid approach.

Kenmare has been in most people’s funds at one time or another and no one really has anything positive to say about it. In many respects, this is a shame. While many a junior mining company like to put the somewhat meaningless phrase ‘world-class’ at front and centre of their presentations to describe their deposits, in the case of Kenmare Resources’ Moma deposit, this is genuinely true,” the broker added.

Looking at the historic price chart from 2014 to today also may explain the lack of enthusiasm for investing in KMR - the stock has not really recovered from its troubles in 2014 and is down ~90% since then:

In this context, it feels like KMR continues to suffer from the perception of it being a volatile boom-to-bust stock. Furthermore, the protracted, capital intensive ramp-up of operations over the last 3 years may also have dampened interest among investors who perceived the business as being still in transition.

However, with operations now fully ramped, a balance sheet deleveraging in sight and earnings inflecting upwards, this perception does not seem justified.

2. Nataka WCP Move - in order to maintain the 1.2m tonne production capacity beyond FY25, KMR needs to move one of its WCP facilities to the Nataka ore deposit over FY22-FY25. This project is at the feasibility study stage and is estimated to cost ~$127m in line with the Pilivili WCP move completed (on time and budget) last year.

Given the time and cost involved in this move, the market may be discounting the risk of this running into trouble and/or production capacity declining as a result - indeed the indicative forward valuation of ~4x FY22 EBITDA suggests this is the case here, as it effectively implies the market ascribes no value to KMR beyond the next 4 years of earnings when the Nataka move will need to have been completed.

Again this view seems misguided in two respects:

The Nataka move is similar to the Pilivia move already completed, and so there is a precedent in management successfully completing such a large project while maintaining and enhancing operations.

Even if there were delays with the Nataka move, a 4x valuation with no deemed value beyond the next 4 years totally ignores the $1.1bn of invested capital behind the Moma mine.

3. Commodity Price Declines - the market may also be discounting declines in the price of ilmenite and zircon, with the forward valuation of ~4x EBITDA implying price declines per tonne of ~20%+.

While commodity price volatility is certainly possible, it is more likely that prices will continue to increase given the inflationary outlook, and the favourable supply/demand dynamic which has been corroborated by several of KMR’s peers.

4. Small Cap with Limited Analyst Coverage - KMR is a ~€537m market cap stock with only 3 analysts covering the name, and as such it is not well known among the investment community. Furthermore, it operates within a more obscure segment of the commodity/mining industry that generally has lower analyst coverage vs. other segments.

Catalysts

The catalysts for this situation are pretty clear in my view:

Primary catalyst is a market re-rating in recognition of the KMR’s imminent earnings inflection, its favourable prospects with exposure to commodity price inflation, and it’s substantial asset value.

A secondary catalyst is a takeover by PE or a strategic acquirer such as Iluka or Tronox. The fact that it has been in play before as well as the current Apollo bid for Tronox suggest it could come into play again, particularly given its compelling investment fundamentals as outlined above.

Conclusion

Based on this initial analysis, KMR appears mispriced based on its fundamentals and business prospects, with clear mitigants to the perceived risks around the Nataka move and commodity price declines.

As such, I believe this represents an interesting value situation that offers a highly asymmetric risk/return profile with clear catalysts to value realisation.

Further Information & Background

For those interested in learning more about the company, I’d suggest listening to the following recent interviews:

EY Interview - CFO Outlook: Exploring the rise of Kenmare Resources, with Tony McCluskey, CFO of KMR

Hello, did you see their recent share buyback? The stock didn't respond that much, only a 1% gain. Also, do you know when their next earnings is? I looked online but there wasn't much information except sites that showed earnings to be "N/A."

This is a very detailed analysis. What bothers me a lot is the history of massive dilution. Why do you think it's not gonna happen again?

There will also be a discussion about Kenmare at the London Value Investing Club at 5th December. Definitely, I want to learn more from people that follow the company.