Weekly Bulletin #7

Portfolio: KMR, PANR, WTW, YCA | Monitoring: BG, HBRN, SLCA | Developing: The Tin Market situation

Disclaimer

Value Situations is NOT investment advice and the author is not an investment advisor.

All content on this website and in the newsletter, and all other communication and correspondence from its author, is for informational and educational purposes only and should not in any circumstances, whether express or implied, be considered to be advice of an investment, legal or any other nature. Please carry out your own research and due diligence.

Model Portfolio Updates

There are four updates with respect to Model Portfolio names this week - Kenmare Resources Plc (KMR), Pantheon Resources Plc (PANR), Willis Towers Watson Plc (WTW), and Yellow Cake Plc (YCA).

KMR

It was reported last week that KMR could benefit from Boeing’s decision to stop buying titanium from Russia, given KMR’s Moma mine is one of the world’s largest largest titanium mineral deposits.

Boeing stated last week that it was suspending purchases of titanium from Russia due to the ongoing invasion of Ukraine. Boeing sources a third of its titanium metal from Russia, primarily from VSMPO AVISMA which is the world’s largest producer of titanium metals. Boeing uses titanium in the manufacture of aircraft and while it has substantial inventory at present due to recent stockpiling, it will need to find a new supplier given the likelihood of continued sanctions and a protracted conflict in Ukraine. It is expected Japanese titanium producers will benefit from this shift, as these are the next largest cohort of producers outside of Russia.

How might this benefit KMR? Titanium feedstocks such as ilmenite and rutile produced by KMR are mainly used in the manufacture of pigments, with just ~10% of feedstocks produced globally used in the manufacture of titanium metal. VSMPO previously sourced much of its titanium feedstocks from Ukraine, which has now effectively been taken out of the supply chain. This is likely to drive a shortfall in an already tight market. Now with Japanese and other producers looking to step in to replace VSMPO production, this should drive increased demand for feedstocks for metal production, in competition with pigment demand which remains robust.

As the world’s largest producer of ilmenite, KMR occupies a key position in the global titanium supply chain. Therefore it stands to reason that it should benefit in what is yet another example of a commodity squeeze as a result of Russia’s invasion of Ukraine, against a backdrop of already constrained supply.

As of the time of writing, KMR is up ~15% since I first published the idea in November.

PANR

PANR announced last week that it has elected to pay the quarterly principal and interest due on it its convertible bond by issuing new shares, as permitted under the bond agreement (PANR has the choice of paying quarterly repayments in cash or by issuing new shares).

The total cash payment due for the quarter is $3.3m, comprising $2.75m of principal and $0.55m in interest.

The exact number of shares to be issued is TBC but based on my initial calculations, PANR will issue ~3.2m shares to bond investor Heights Capital Ireland, with negligible dilution of ~0.4%, as follows:

Under the bond terms, if PANR elects to pay in shares, the number of shares to be delivered will be calculated by dividing the payment due by the conversion price prevailing on the coupon payment date

In this instance the conversion price is defined as the Initial Conversion Price, which is the previous equity fundraise issue price of £0.65 plus a 20% premium, or £0.78, which equates to $1.022 at current FX

A total repayment of $3.3m divided by $1.022 share price equals 3,229,595 new shares to be issued

With a current ordinary share count of 753,743,733, the new issuance to the bondholder will result in ~0.4% dilution to existing shareholders.

We can probably expect future bond repayments to be via shares also, given the focus on funding and proving PANR’s assets with a view to a sale. In any event, this has little bearing on my previous valuation analysis which estimated a risked value of ~£3.44/share on a fully diluted basis, after full conversion of the convert bond.

PANR is up ~98% since I first published the idea last September.

WTW

The FT reported last week that WTW CEO Carl Hess is committed to turning around the business “at speed” in line with its growth and capital return strategy, and that management are largely aligned with activist investors Elliot Management and Starboard Value.

WTW’s recent results are encouraging and indicate management is already delivering on its turnaround plan, with improving operating margins and reduced employee attrition following the busted merger with AON.

Separate to this, a further point worth considering given the current inflationary market backdrop is that WTW is an inflation beneficiary and so offers a hedge against inflation. Insurance pricing tends to rise with inflation, and given WTW’s brokerage/advisory model, its fee income is tied to rising gross premiums for insurance. Furthermore, as a capital-light intermediary business, it doesn’t have significant capex or asset replacement costs that would rise in an inflationary environment.

In my view, WTW should benefit from inflation and increased economic and geopolitical uncertainty as follows:

Rising real asset values to drive higher insurance premiums - rising inflation implies that hard assets such as real estate, aircraft, infrastructure etc. will become more expensive to replace or hold, and therefore command higher insurance premiums to insure; as a result WTW’s broking fee income should rise correspondingly.

With the Ukrainian conflict now succeeding COVID as another new source of global risk, it could be argued that the world has not been this unstable for a very long time. Such increased economic and geopolitical risk means increasingly complex and costly insurance requirements for corporates, which will in turn drive further demand for WTW’s expertise and therefore drive fee income higher.

WTW is down -9% since I published the idea last October, but I believe this inflationary tailwind plus its $10bn+ capital return plan suggest its investment prospects are very positive over the next 2-3 years.

YCA

Last week was the week that the spot price of uranium really started to move, prompted by the news that the Biden administration is considering imposing sanctions on Russia’s state-owned atomic energy company, Rosatom Corp. Rosatom is a major supplier of fuel and technology to nuclear power plants around the world and is estimated to account for ~ 35% of global uranium enrichment and ships nuclear fuel to numerous European countries. Furthermore, Russia’s nuclear industry accounted for 16.5% of the uranium imported into the U.S. in 2020 and 23% of the enriched uranium needed to power the fleet of U.S. nuclear reactor fleet.

The implications of sanctions here are clear - if Russia (once again a key global supplier of an essential commodity ) cannot supply uranium feedstocks, US and European nuclear energy producers will have to scramble to find alternative supply in a market already in a chronic supply deficit that is widening (global uranium demand is ~180m lbs vs. available supply of ~150m lbs at present).

The nuclear/uranium thesis was also helped by this tweet from Elon Musk, also prompting the potential for another meme stock-like catalyst for uranium equities:

At this point, it’s not clear if Rosatom will be sanctioned, however the very thought of this is enough to drive sentiment - and it’s always possible Putin could ban uranium exports in retaliation at some point to damage his US and European adversaries. If nothing else, this may finally compel utilities to stockpile new supply, particularly as their existing supply contracts start to roll-off this year and into next.

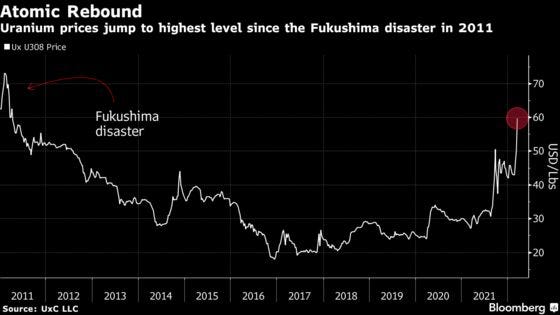

The spot price of uranium touched $60/lb last Thursday, up ~19% on the week (Numerco) and up ~42% YTD, and is now at the highest level since the Fukushima nuclear disaster back in 2011:

The uranium price peaked at ~$136/lb at the peak of the previous cycle when there was no supply deficit, but given the supply/demand imbalance this time around many market analysts are now projecting spot uranium could rise to $150 or even $200/lb.

Of all the commodity/energy market plays at present (and there are many), I see uranium as the most compelling, offering the most asymmetric upside.

YCA is up ~40% since I first published the idea last September.

Situations Monitor

There are brief updates on three names I’m monitoring this past week, namely Bunge Limited (BG), Hibernia REIT Plc (HBRN) and US Silica Inc (SLCA):

BG

The United Nations Food and Agriculture Organisation’s (FAO) Food Price Index reached a new all-time high in February, driven by large increases in vegetable oil and dairy, as well as cereals and meat prices.

As with every commodity story at present, a major catalyst for the continued food price inflation has been Russia’s invasion of Ukraine, known as the “breadbasket of Europe.” I’ve highlighted in last week’s bulletin how Russia and Ukraine (and also Belarus) are major producers of grains, food crops and fertiliser and the disruption to supply from the present conflict suggests a potentially catastrophic outlook for the global food supply, with the world’s next food emergency seemingly underway.

The price of wheat has risen ~50% in the last two weeks alone and has now surpassed the highs experienced during the 2008 global food crisis. Some concerning developments this past week include:

Growing concerns in Egypt (the largest buyer of Russian and Ukrainian wheat) for food security, where the government subsidises bread to feed the population (recall Egypt was the second country after Tunisia to see protests during the Arab Spring of 2011, which was in part prompted by food inflation similar to the current situation)

Protests about food prices in Iraq, where the price of cooking oils and flour have skyrocketed as part of the fall-out from the Ukrainian conflict

Wheat shortages and flour rationing in Lebanon, again attributable to the Ukraine crisis

The food crisis scenario that I outlined in my Food for Thought series from January now appears to be playing out. With such a grim outlook, it must firstly be said that on a societal level, this is clearly a very negative situation for humanity. On an economic or market level, food price inflation and scarcity is surely now the base case and in this environment BG is likely to continue to perform strongly following its record FY21 results.

At the time of writing, BG is up ~17% since I published it as a food inflation-hedge idea in January.

HBRN

After I highlighted last week how the private markets are telling us that HBRN is substantially undervalued, it’s share price subsequently fell as low as €1.06 during the week, equating to valuation of just ~0.61x NAV. Two words spring to mind here: stupid cheap.

As at the time of writing, it has traded up to €1.15/share, still a quasi-distressed valuation at 0.66x despite it being very lowly leveraged (~20% LTV, and all debt fully unsecured).

At this low ball public valuation, I continue to believe HBRN is a prime takeover target, particularly given the scale of PE-RE dry powder available and the clear appetite in private markets for office RE (as evidenced by other similar REITs being acquired recently). A PE-RE acquirer could take HBRN private at over €1.50/share and still generate a very attractive IRR for what would be a core RE strategy. This implies ~35% upside vs. HBRN current’s price with almost no downside as I see it given the undervaluing real estate value ( and noting HBRN is trading close to its 2020 pre-vaccine lockdown average price).

HBRN is down -8% since I highlighted it as a quick idea in June last year.

At this point the only reason that HBRN is not in the Value Sits Model Portfolio is that I’m targeting at least 50% upside on any name that goes into the portfolio; my estimate of a take-private price means HBRN falls short of this hurdle, but on the other hand it’s asymmetry is so pronounced (I estimate a 5x reward vs. risk profile), that I could well make an exception to this rule if it dips again.

SLCA

SLCA continues to rally, rising +12.6% last week, as calls grow from the Biden administration for US oil producers to increase oil production to offset consumer price inflation. Increased production will mean higher demand for frac sand, of which SLCA is the largest supplier in the United States.

Notably, one of SLCA’s major customers is Pioneer Natural Resources (PXD), which is the largest shale oil company in the US. Last week PXD CEO Scott Sheffield made a very interesting comment as it relates to SLCA’s business as he discussed the suggestion that US shale could replace sanctioned Russian oil exports (bold emphasis mine):

“We can’t change this year,” Sheffield said, referring to shale operators’ output plans. Highlight text “I’m talking about a two- to three-year plan,” he said. “Because US shale, even if somebody adds a [drilling] rig . . . it takes six to eight months to get first production. There’s labour shortages, there’s frack fleet shortages, there’s rig shortages, there’s sand shortages.”

With the robust demand outlook for oil and a market characterised by constrained production capacity and sand shortages, this bodes well for sand pricing and SLCA’s prospects - and this is all before factoring in any sale of it’s Industrial & Specialty Products (ISP) division. As I’ve written before, the disposal of ISP would likely achieve a strong multiple in the current market and transform the balance sheet from its highly leveraged position currently to a net cash one.

SLCA’s stock is up ~60% since I highlighted this idea last October.

Developing Situations

In these highly inflationary times, another obscure commodity sector has caught my attention recently.

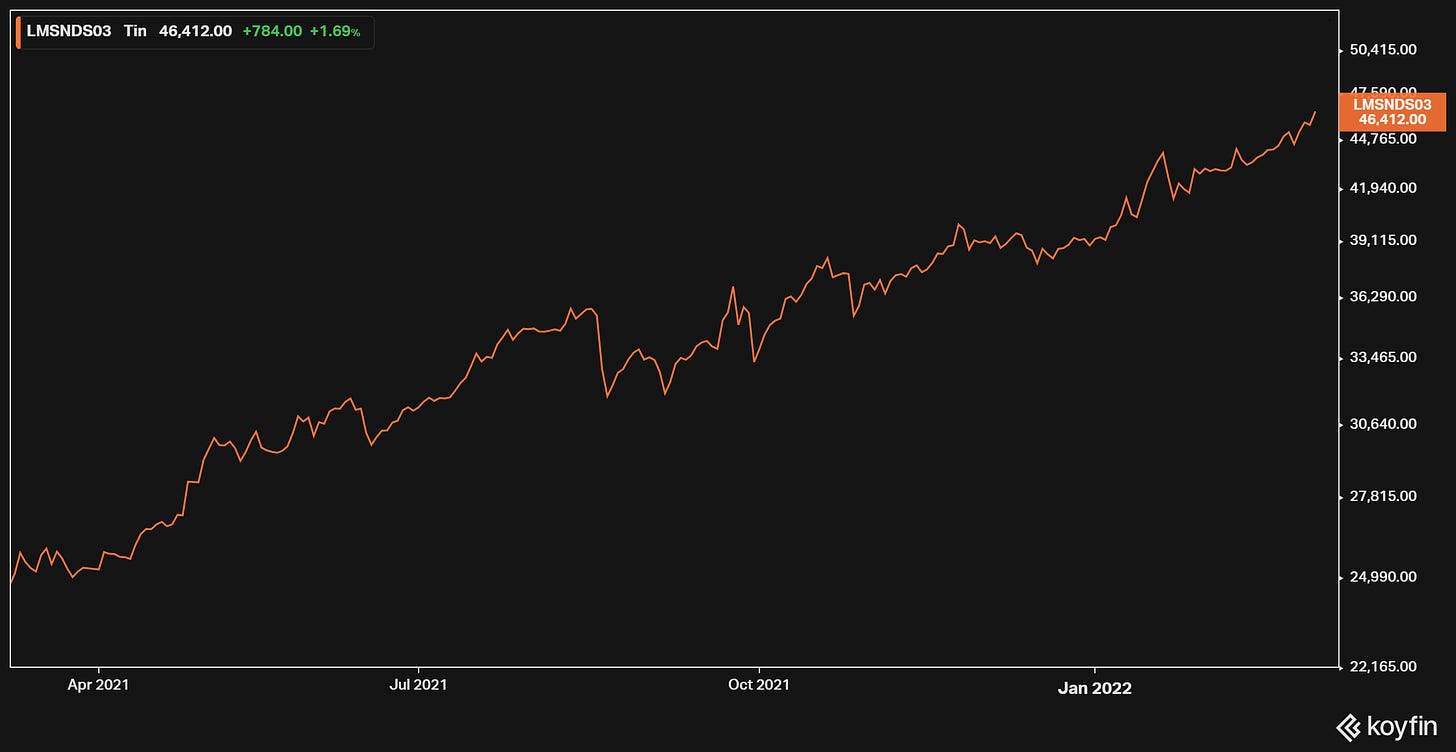

Over the past year the price of tin has risen nearly 90%, making it one of the strongest performing commodities over this period, ahead of US natural gas, oil, copper, wheat or lumber for example (European natural gas, coal and nickel are among the few commodities that have outperformed tin over this period).

Within the metals mining complex, tin is a very small and niche market, with ~306k tonnes produced annually - to put this into perspective, annual copper production is ~20 million tonnes.

I find the tin market very interesting in two respects:

Supply - tin is a constrained supply commodity, with existing tin mines depleting and very few new projects coming on-stream. Furthermore, the tin market is in deficit (306k tonnes produced vs. 361k tonnes consumed in 2020), which is expected to widen as future demand is forecast to increase significantly due to electrification and technology requirements (see point #2);

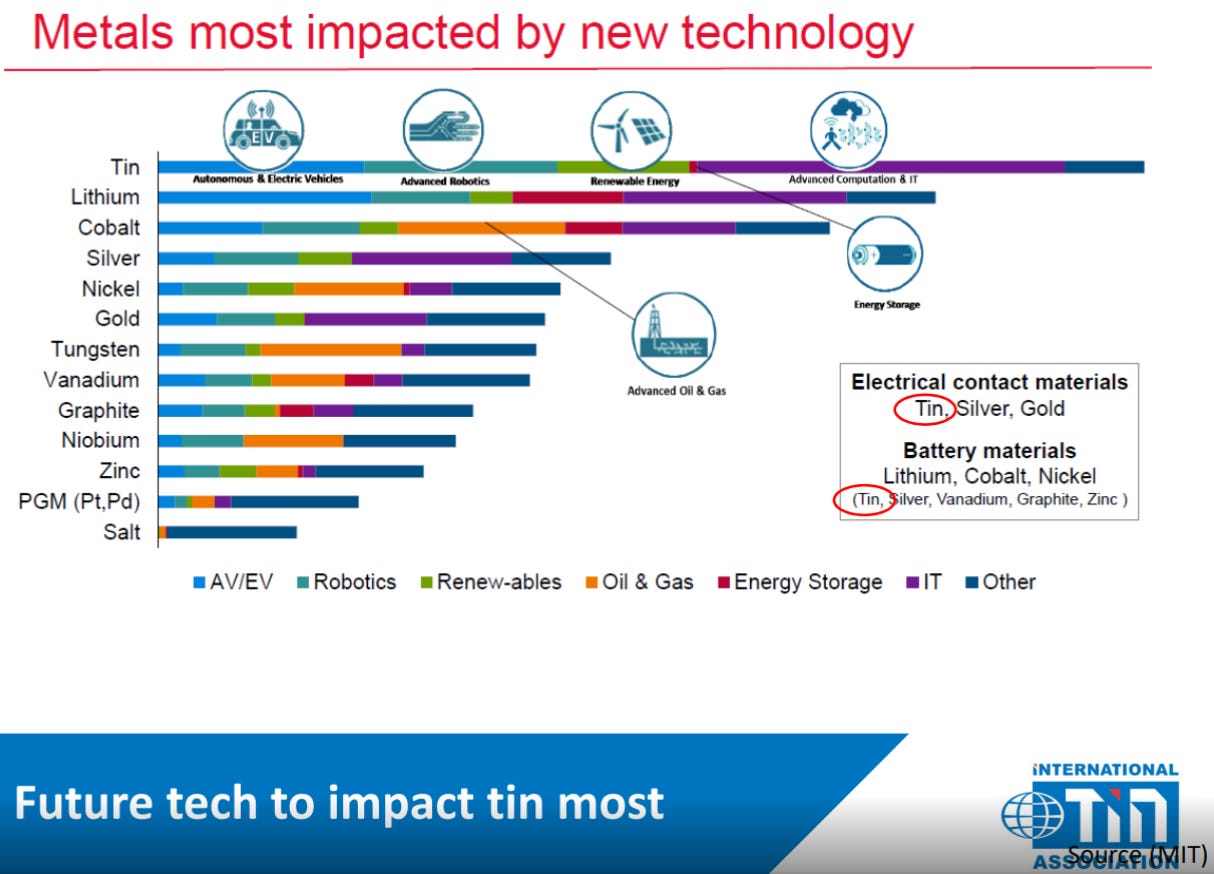

Essential Commodity - tin is an essential commodity, and to date has primarily been used for soldering circuit boards in the semiconductor industry. More recently it has been identified by MIT as benefiting more than any other metal (including lithium, cobalt, nickel etc) from four mega-trends - electric vehicles, renewable energy, advanced robotics and advanced computation and IT (Internet of Things):

Source: MIT; International Tin Association.

All of these new technologies will require an enormous supply of semiconductors to function, and with tin’s main use in soldering it is essentially the “glue” that holds all of these electronic components together.

So the tin market appears to constitute a somewhat unique and compelling situation - an overlooked, niche commodity in supply deficit but which is absolutely essential to structural growth mega-trends in energy, electrification and technology.

This is a situation I’ll intend to delve into further in the coming weeks.

Any Other Business

Early subscribers may recall a piece I wrote in the very early days of this newsletter in June last year in which I discussed the record amounts of private equity dry powder as being a potential catalyst for public equities.

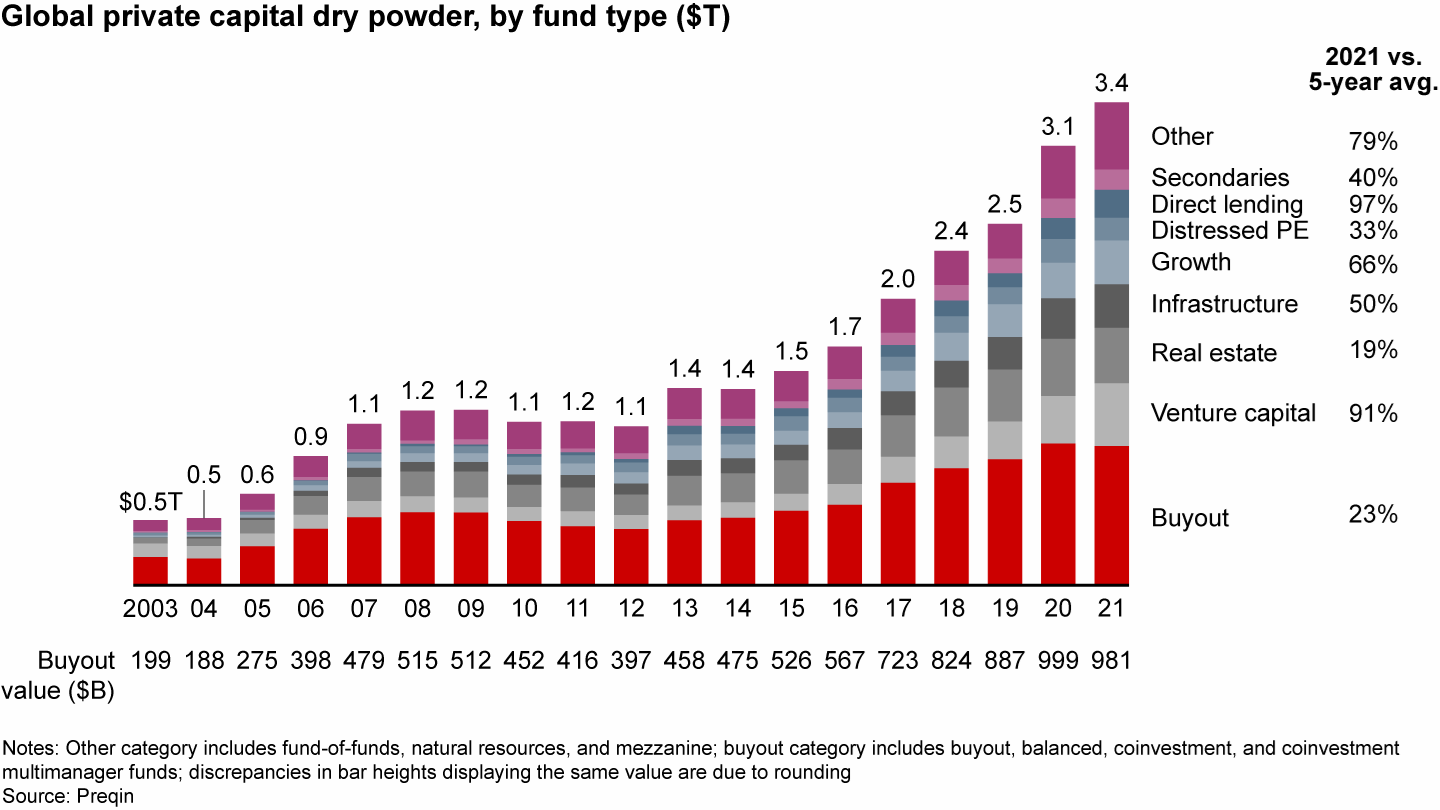

Last week I reviewed the latest Bain & Company’s 2022 Global Private Equity Report, and noted that global PE dry powder has risen by almost ~10% YoY, and now stands at $3.4 trillion:

Source: Bain & Company 2022 Global Private Equity Report .

As I theorised in my original Forced Purchaser article, this dry powder must be deployed for the following reason:

Very simply, if this uncalled capital isn’t put to work, a lot of highly motivated and financially-driven people won’t get paid bonuses or carry.

The current inflationary environment has also got me thinking there is now an added impetus for PE to put this capital to work, and quickly, as the value of limited partners’ capital is eroding at the fastest rate in 40 years with inflation running at close to ~8%. Put another way, the opportunity cost of committing this capital is steeper than it has ever been for the current generation of LPs, so there is added urgency for PE to deploy and generate a return on it. Sitting on a $100m dollar commitment for a year and then realising it represents only $92m of buying power in real terms 12 months later hardly justifies the (often rich) fund management fees.

This leads me to conclude that despite widespread macro uncertainty, PE takeover activity remains a major catalyst for certain public equities (the type I often cover in this newsletter). I believe this will provide plenty of attractive event-driven situations and opportunities over the next year or so, independent of the wider direction of stock markets.

Thanks ! Looking forward to your thouhts on TIN going forward. Also, the private equity capital is also subject to inflation so i guess it would deploy sooner than later, given there are opportunities out there.