Sand, sand everywhere?

A looming shortage of commercial silica and an interesting equity situation on the theme.

Welcome to Value Situations issue #9, and 7th edition of the weekly newsletter. In this week’s newsletter I discuss an overlooked commodity that is essential to economic activity and growth but facing a potential shortage, and take an initial look at an equity situation that may offer a way to play this scarce commodity theme.

Disclaimer

Value Situations is NOT investment advice and the author is not an investment advisor.

All content on this website and in the newsletter, and all other communication and correspondence from its author, is for informational and educational purposes only and should not in any circumstances, whether express or implied, be considered to be advice of an investment, legal or any other nature. Please carry out your own research and due diligence.

When you drive home from a day at the beach, you’ll often find that sand has gotten everywhere. Similarly, sand’s all-pervading nature can be seen in a wider economic and societal sense, in that modern society and industry is effectively built from sand.

When considering the question of what is the world’s most used commodity, most people might think of oil or copper. In fact, sand is the world’s most consumed raw material after water, and the world’s single most mined commodity.

Sand is used in the construction and manufacture of everything from buildings, roads and bridges to glass (including windows, computer and phone screens, solar panels and even storage vials for vaccines), to semiconductors (as used in computing, phones, automobiles etc) to paints and water filtration. Such a wide application across essential uses has made sand mining the largest mining industry in the world.

In this light, sand or commercial silica to use the more correct term, is also perhaps the world’s least appreciated commodity.

Given the market structure and nature of sand mining, it is difficult to measure global sand production and usage, but according to the United Nations Environment Programme (UNEP), the cement manufacturing industry offers a good proxy.

Taking 2019 numbers as a more normal pre-COVID indicator of production, the global cement industry produced ~4.1bn tonnes of cement in 2019 and the UNEP estimates that for every 1 tonne of cement, 10 tonnes of sand is required in its production, indicating ~41bn tonnes of sand is consumed just in the production of cement alone.

Furthermore, the UNEP reports that global rate of sand use has tripled over the last two decades due to growing populations, increasing urbanization and infrastructure development.

To put these numbers in context, global coal production was ~8bn tonnes in 2019, global oil production was ~4.4bn tonnes in 2019, and global copper mine production in 2019 was ~20m tonnes. So taking UNEP’s production estimate for just cement, sand mining for construction purposes alone is ~5x greater than coal, 9x greater than oil and 2,000x copper in terms of volume. So the data clearly shows that sand is by far most extracted natural resource in the world by a wide margin, and much more so than fossil fuels (interestingly, sand is actually a key material, as proppant, for the extraction of oil and gas via the process of hydraulic fracturing or “fracking”).

Against this significant demand backdrop for sand, there is the misconception that sand is in plentiful supply given the vast deserts that can provide seemingly endless quantities of sand, and which can be replenished by wind and weather processes over time. This view is wrong in two respects.

Firstly, it’s important to distinguish between desert sand and commercially useful sand. Desert sand, which has been eroded by the wind rather than water, is too smooth and rounded to bind together to form concrete. In fact Dubai, which has experienced an enormous construction boom since 2002, illustrates this point - despite being situated directly within the Arabian desert, Dubai has had to import vast quantities of sand from Australia to meet its construction demand.

Additionally, desert sand is too fine and does not contain sufficient quantities of quartz or silica for other important commercial uses such as glass-making or for silicon used in semiconductor chips.

The type of sand that is suitable for construction and commercial purposes is typically extracted from seabeds, coastlines, quarries and rivers, as it is rougher and more angular, allowing it to lock together to form stable concrete, and has a higher silica content required for commercial use. However, enormous ecological damage has been caused by excessive dredging of rivers and lakes to extract sand. As a result, sand mining has been banned in numerous jurisdictions, such as China and India, limiting the supply of sand at a time of increasing demand, and leading to a rise in illegal sand mining.

Secondly, the UNEP forecasts a looming sand shortage as the current rate of sand extraction to meet construction and commercial demands far exceeds the natural rate at which it can be replenished by natural weathering processes by wind and water, with sand availability also limited by mining bans. As such UNEP has named sand extraction as one of the greatest sustainability challenges of the 21st century.

So against this backdrop, sand usage at current rates is not sustainable, and as with climate change once this is more widely understood, sand mining is likely to become more regulated as part of the wider ESG initiative. This will have the effect of reducing its availability while continued population growth and increasing urbanisation and industrialisation drive greater demand for silica sand which has no substitute in critical applications such as glass, semiconductors and construction/infrastructure.

Some attempts have been made to alleviate demand such as recycling of concrete and replacing sand with recycled plastic in concrete production, however the sheer commercial demand for silica sand means that to date these alternatives have no meaningful impact in reducing sand extraction.

This supply/demand dynamic looks set to become even more pronounced when one considers the current outlook as the global economy rebounds from the COVID recession, with a number of robust demand drivers:

US Infrastructure Plan - the US Senate has approved a $1 trillion infrastructure plan which will drive a significant demand increase for concrete and therefore silica sand.

ESG – with continued focus on sustainability, wind turbines which use fibreglass and solar panels are continued source of ESG-related demand for silica used in glass production.

Glass shortage - the fall-out from COVID has resulted in supply chain disruption and a global glass shortage, which has been exacerbated by a whole new category of usage in the storage of COVID vaccines in glass vials.

Semiconductor shortage - similar to glass, there is a global semiconductor chip shortage with additional and growing demand from electric vehicles as part of the global energy transition

Energy – with a rebound in oil and gas demand as global economy re-opens, oil and gas demand is forecast to increase which will drive renewed demand for frac sand.

So how does one play this sand shortage theme ?

US Silica Holdings (SLCA) is a leading commercial silica producer that operates across two segments:

Oil & Gas Proppants, which provides fracturing sand, or “frac sand,” which is pumped down oil and natural gas wells to prop open rock fissures and increase the flow rate of oil and natural gas from the wells.

Industrial & Specialty Products, which consists of over 600 product types and materials used in a variety of industries, including container glass, fiberglass, specialty glass, flat glass, building products, fillers and extenders, foundry products, chemicals, recreation products and filtration products.

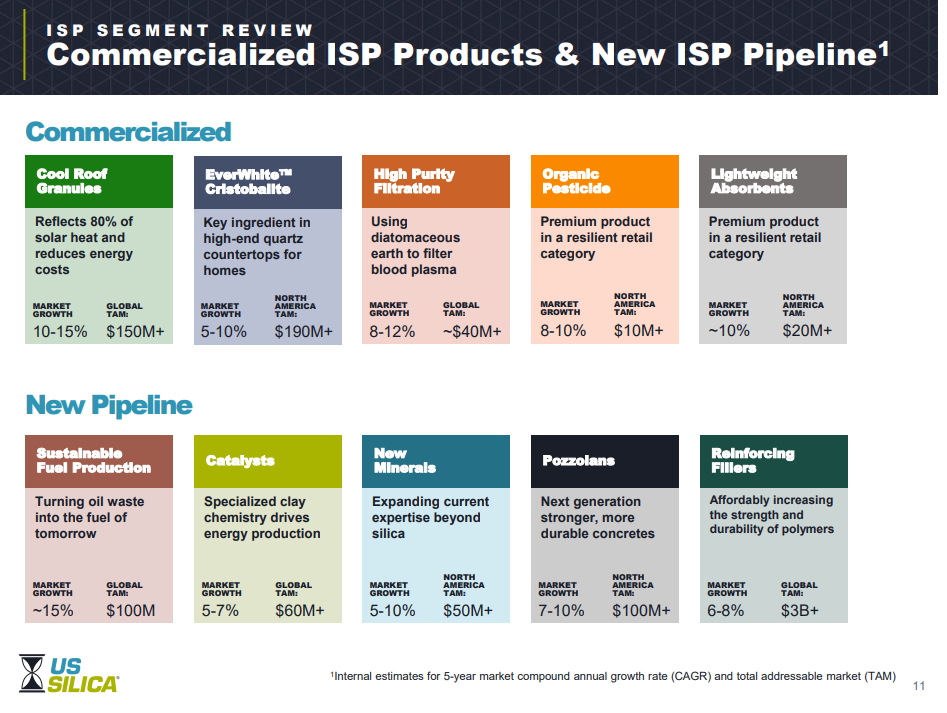

Snapshot of SLCA’s ISP end-markets

Source: US Silica Holdings Investor Presentation, December 2020

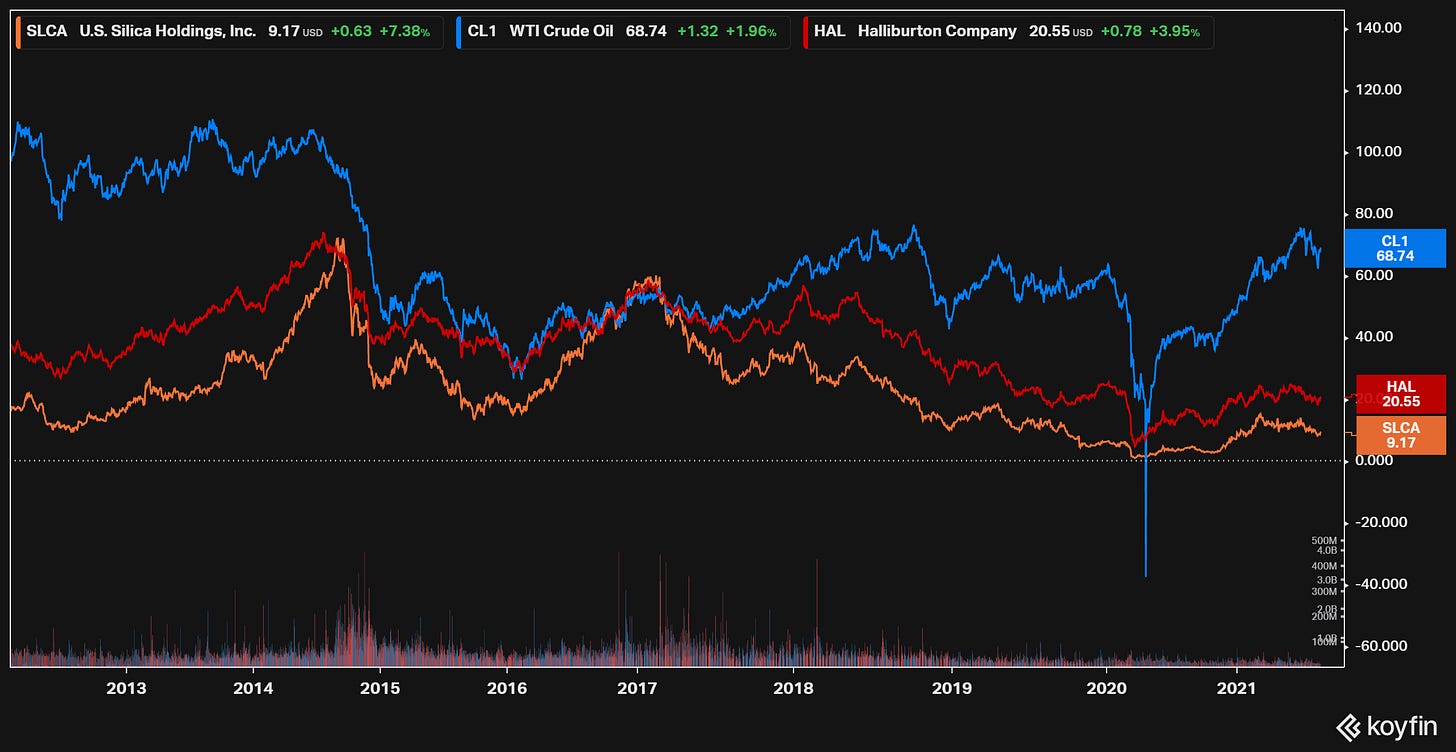

With the rise of fracking and the shale oil and gas boom in the United States over the last ~12 years, SLCA has largely been an O&G play, with it’s O&G segment accounting for ~75% of its total revenues at the peak of the fracking boom. As such, it’s share price has been highly correlated with the price of crude oil and the share price of oil services customers such as Halliburton as the chart below shows:

With a market cap of ~$685m and LTM revenue of ~$955m (pre-COVID FY19 revenues were ~$1.5bn), SLCA is the largest diversified commercial sand producer in the US, and the third largest sand producer overall behind Sibelco of Belgium (industrial silica sand only) and Covia Holdings (frac sand producer) in the US.

SLCA is something of a last man standing among the listed US frac sand producers after a series of bankruptcies in 2020 as COVID and the oil price collapse hit the energy sector. It’s two largest frac sand competitors Covia Holdings and Hi-Crush Inc both filed for Chapter 11 bankruptcy last year, leaving SLCA as the largest producer to survive as a listed company, with Covia and Hi-Crush both de-listing and currently under control of their respective lenders. SLCA’s next nearest listed competitor is Smart Sand Inc, which is a ~$100m revenue business with a similar market cap.

[As a side note to provide some market context, Covia itself was 65% owned by Sibelco before going into bankruptcy; Sibelco lost control of Covia to lenders in the Chapter 11 process, and is now a purely industrial sand focued business, while Covia remains a frac sand producer].

So after weathering the COVID storm, when it’s share price collapsed from ~$5 - $6/share at the beginning of 2020 pre-COVID to sub-$1 during the teeth of the market panic in Mar-20, SLCA has rebounded to $9/share currently, and is up ~30% YTD, largely reflecting expectations of a recovery in demand for oil and construction activity as the US economy recovers post-COVID.

SLCA’s stock had traded close to $15/share earlier this year, before a downgrade note was issued by Barclays on the basis that it remained exposed to an uncertain O&G outlook while having a highly levered balance sheet (leverage at time of Barclay’s note was ~5.6x), while Barclay’s also expressed doubt’s over management’s plan to diversify further into ISP products to reduce its O&G exposure.

Since then, SLCA’s recent Q2 Jun-21 results have been positive with the following highlights:

Q2 FY21 revenue of $317.3 million + 84% vs. Q2 2020 and +35% vs. Q1 2021

Overall tons of sand sold of 4.1 million in Q2 FY21 +116% vs. Q2 FY20 and +15% vs. Q1 FY21.

Q2 FY21 adjusted EBITDA of $103.3 million + 170% vs. $38.3 million in Q1 FY21

In addition, during the Q2 earnings call management made a number of interesting comments on the business that are worth noting as one thinks about the market’s O&G-reliant perception of the business and future growth prospects for the ISP segment:

Management estimate that SLCA silica products are used in approximately 50% of U.S. solar glass production, and in over 80% of U.S. produced fiberglass composites for wind turbine blades.

The company’s “Min-U-Sil” ultrafine silica product is used in the production of gas and diesel particulate filters that help vehicles meet stringent European and Asian emission regulations.

Management expect SLCA to be benefit from the Biden Administration’s infrastructure spending plans through the company’s commercial construction, foundry, concrete additives and highway construction product offerings.

SLCA has a new product development pipeline with more than $200 million in estimated annual contribution potential, and expect new products to contribute $20 million to FY21 2021 run rate contribution, growing to $90 million by FY24,

Overview of new ISP product lines:

Overview of new ISP products contribution margin:

Source: US Silica Holdings Investor Presentation, May 2021

Lastly, in July, SLCA announced their third price increase for this year for ISP products, with price increases ranging up to 15% depending on the product and sand grade, and from 1 September. These price increases will help offset recent significant cost increases in energy, transportation, materials and manufacturing costs.

There are two notable takeaways from the above comments.

Firstly, the ISP business is growing in terms of product offering, with a wide range of new products that are either essential or important for key industrial applications, such as construction and infrastructure (high performance concrete), renewable energy (solar panels), blood plasma filtration, and sustainable fuel production.

Secondly, SLCA has been able to repeatedly raise prices on its ISP product lines which supports both the view that its products are of an essential nature to customers and has pricing power in this regard, but also indicates it is a beneficiary of inflation as it can pass on cost increases to customers, as evidenced by the Q2 FY21 ISP contribution margin of $45.9 million increasing by 15% vs. Q1 FY21 and +31% vs. Q2 FY20.

A Variant Perception?

There is a variant perception here that the market might be missing - contrary to the market view that SLCA is an O&G-reliant frac sand supplier, it is in fact a play on a number of trends with significant tailwinds behind them:

ESG – via its wind and solar energy products, SLCA is part of the clean energy supply chain, providing specialty products that are essential components for solar panels and wind turbines. SLCA is therefore a seemingly unlikely ESG play.

Resource scarcity – commercial silica is set to become more scarce given environmental concerns combined with booming demand from technology, glass, and infrastructure/construction.

Inflation – as a producer of an essential commodity with pricing power in a world of rising costs, SLCA should benefit from inflation.

Construction & Infrastructure – with the Biden administration’s $1 trillion infrastructure plan now passed, SLCA is directly positioned to benefit from this new source of demand for its commercial silica as the largest US producer.

Furthermore, in the O&G side of its business, SLCA should also benefit from a cyclical recovery for oil demand and production, amid tight supply from producers combined with growing demand as global economies recover.

With these seemingly positive tailwinds ahead, SLCA appears to be undervalued at ~6.4x LTM EBITDA vs. its long-term average since 2012 of ~9x – 10x.

But there perhaps two catches here.

Firstly, there is SLCA’s high leverage. While Barclay’s cited this as an issue back in May, it’s worth highlighting that current net leverage has decreased meaningfully from ~5.6x to ~3.7x currently from a combination of EBITDA growth and debt paydown.

Furthermore, there is another more recent issue hanging over the stock – last month, SLCA filed a Form S-3 Registration Statement for a mixed shelf offering to issue a range of new securities. While the amount and type of securities to be issued are TBC, my sense is that it will most likely be for new equity. Since the S-3 filing, SLCA’s share price is down ~15% (and was down ~24% at one point), reflecting the market’s expectation of meaningful dilution as a result of new equity issuance.

I actually see any new equity issuance as a positive for the stock if it is for the purpose of deleveraging the balance sheet. The timing of this makes sense and could prove to be a catalyst for the stock to re-rate considering the following:

Deleveraging from new equity issuance should be further aided by EBITDA growth in the ISP segment given the increased pricing and supportive demand profile from infrastructure and ESG-related demand (solar panels, fuel recycling, wind turbines etc) as well as rising oil demand with a recovering US economy.

Reduced competition given competitors’ recent bankruptcies and the closure of smaller private competitors and mines following COVID, all at a time of strengthening market conditions and increasing demand for SLCA’s products.

I would argue that the recent decline in SLCA’s share price already prices in meaningful dilution, and so the downside from here is limited at ~6x EBITDA in a recovering market.

So what could SLCA be worth based on the current situation and outlook?

To be clear, the following analysis is high-level and more of a thought exercise, but it does suggest SLCA represents a potentially very interesting value situation.

Firstly, let’s consider its prospective earnings power.

LTM EBITDA is ~$256m which reflects 6 months of depressed demand from the “COVID year” that was FY20, and 6 months of improving demand in H1 FY21 from the early stages of economic recovery. So LTM is not representative of normalised earnings or the future growth prospects highlighted above, but is perhaps a good proxy for maintainable earnings in an uncertain market. Adding the $90m of incremental margin contribution from its new ISP product lines to be achieved by FY24 to the LTM number (assuming this all drops to EBITDA) indicates PF EBITDA of $346m before any cyclical uptick in O&G business or further growth in existing ISP business over the next ~3 years.

So as a baseline, $350m in EBITDA does not seem an unreasonable expectation in a market recovery, driven by a management team that steered the business through the weather COVID while it’s largest competitors failed.

Taking this one step further, if we were to assume modest inflationary growth in O&G revenues of 2.5% out to FY24 and a segment EBITDA margin of ~32% (vs. 37% in LTM), and 10% revenue growth in the ISP segment (being the low-end of management’s projected CAGR range of 10% - 15%) and an ISP segment EBITDA margin of 38% (in line with average margin over last ~4 years) this implies consolidated EBITDA of $308m (after corporate central costs) by FY24 before any contribution from new products:

Source: Value Situations analysis.

Again, if we add management’s $90m estimate in new product contribution to projected FY24 EBITDA above, this implies potential earnings power of almost $400m or +55% vs. LTM EBITDA. So SLCA has potential earnings power of ~$350m - $400m over the next 3-4 years based on what we know today.

Using the low-end of $350m, I map out below the possible value evolution for SLCA assuming new equity issuance occurs:

Source: Value Situations analysis.

Given the nature of a shelf offering, I would assume SLCA would wait for its share price to increase again above the $11/share average it traded at YTD pre-shelf filing (on the basis that its growth prospects become better appreciated by the market during H2 FY21).

In this scenario, it could issue 20m new shares (~20% dilution) at say ~$11/share to raise $220m of cash to pay down debt. Assuming all else equal, leverage would decrease to sub-3x on LTM EBITDA, and the implied share price remains around current levels (~$9.50 above) assuming a constant 6.4x valuation multiple and the equity value increasing by the cash raised reducing the debt.

Following this, given the stronger balance sheet, let’s assume the market re-rates SLCA in line with its long-term average multiple of 9x supported by a robust outlook including US infrastructure tailwinds, ESG exposure and O&G recovery in an improving economy – in this scenario, the stock re-rate to $16.50/share, or 80% above the current price at a 9x multiple.

Finally, lets further assume the low-end of its earnings power of $350m becomes visible to the market sometime by FY24 and it holds on to its 9x multiple (supported by further potential growth to $400m+) - this gets to an implied share price of ~$25, or 2.8x the current price. Note that during previous cyclical upturns, SLCA traded well above 10x (as high as 20x), so a 9x multiple in this scenario does not appear that demanding.

It’s also worth putting the current market cap of $685m and my implied future market cap of $2.4bn in context here.

SLCA Historic Market Cap since 2012 IPO:

I’m not a proponent of technical analysis or charting but I do believe charts can tell a story over extended periods of time.

The chart above shows SLCA traded at its all time low last year following the shale-oil decline coming in 2020 and then COVID hitting. It is notable that SLCA started to break out of this decline pattern towards the end of 2020 around the time of the COVID vaccine announcement when the market started to price in an economic rebound and inflation. Yet SLCA is currently valued approximately the same as it was at the bottom of the US shale market bust of 2015/16 despite the supportive tailwinds that we are now aware of.

While I would not bet on a rebound to previous peak market caps of $4bn+ reached in 2015 and 2017 (which equates to $44 - $48 per share / 14x - 15x under my FY24 analysis), in this context my $2.4bn valuation does not seem outlandish given the fundamental backdrop and demand forces outlined above.

My analysis here is purely fundamental-value focused, but it is interesting to think that a chartist (again which I am not) might interpret the chart break-out coming into FY21 as the start of another cyclical uptick for the stock, suggesting significant upside from here.

To conclude, the above analysis is a thought exercise on an interesting and overlooked commodity theme, and future value upside clearly rests on a number of “ifs” occurring - SLCA today remains a somewhat speculative and highly leveraged stock in which shareholders will likely be diluted in the coming months.

But it also constitutes a potentially very interesting value situation with multi-bagger potential and a catalyst in the form of a shelf offering to remove debt concerns, and supported by positive demand drivers for both its ISP and O&G segments. As such, I see this as a situation worth monitoring.

Where do they get the sand? Do they own mines? How long will the mines produce and where are they?

Thanks for the interesting article. does your 21 EBITDA include the one off gains from customer payments of $47 mn? Does it make sense to include it? Does that mean you anticipate around 30% EBITDA growth in 22? What multiple do you think their isp business would trade on if they didn't own the frac sands business? Is 10-12x EBITDA reasonable?