Weekly Bulletin #32

More Food For Thought - Bunge Limited | Greencore Group Plc | Associated British Foods Plc

Disclaimer

Value Situations is NOT investment advice and the author is not an investment advisor.

All content on this website and in the newsletter, and all other communication and correspondence from its author, is for informational and educational purposes only and should not in any circumstances, whether express or implied, be considered to be advice of an investment, legal or any other nature. Please carry out your own research and due diligence.

More Food For Thought

With food shortage concerns in the news again recently, for this week’s Bulletin I thought I’d share some brief food-supply/inflation-related equity ideas.

BG

Firstly, returning to an interesting name that I first wrote about back in January as part of my Food for Thought thesis, leading global agri-commodity trader Bunge Limited (BG) reported impressive Q3 results yesterday, reporting Q3 revenues of $16.7bn and adjusted EPS of $3.45/share, which were +$1bn / 6.5% and +$0.90 / 35% ahead of consensus estimates respectively.

Furthermore, and perhaps most impressively. management raised full year EPS guidance to “at lease $13.50” per share - this is the third consecutive guidance raise from management since Q4 FY21, and this latest $13.50 number is +42% above management’s original FY22 EPS estimate of $9.50 guided at the start of this year.

Management have attributed this continued strong performance to strength in its core Agribusiness segment (oilseed processing and trading, grains trading) as well as its Specialty Oils segment (this market having been disrupted by the ongoing conflict in Ukraine and supply issues in Asia).

The market reaction to this update was suitably positive, with the stock closing up 7% yesterday. Even with yesterday’s price appreciation, BG appears deeply undervalued - it is now valued at just ~6x FY22E EBITDA vs. ~10x for peer ADM and remains at a discount to recent private market valuation multiples of ~10x.

In a world where food scarcity and inflation is likely to persist, BG is worth monitoring as a potential play on this theme.

GNC

Irish-headquartered, UK-listed convenience food business Greencore Group Plc (GNC) is another name that has started to look interesting recently. GNC is perhaps best known as a producer of pre-packed sandwiches, salads, ready meals and similar products, and is a major supplier to supermarkets and convenience retailers throughout the UK.

GNC has endured a difficult year, and its share price clearly reflects this, with the stock down ~47% YTD in what makes for an awful looking chart:

GNC has suffered from a variety of issues, including its exposure to UK retail, COVID lockdowns and reduced office worker attendance post-COVID (office workers being major consumers of convenience sandwiches and salads - although this may now be improving), and most recently weakening UK macro conditions, including consumer sentiment and demand.

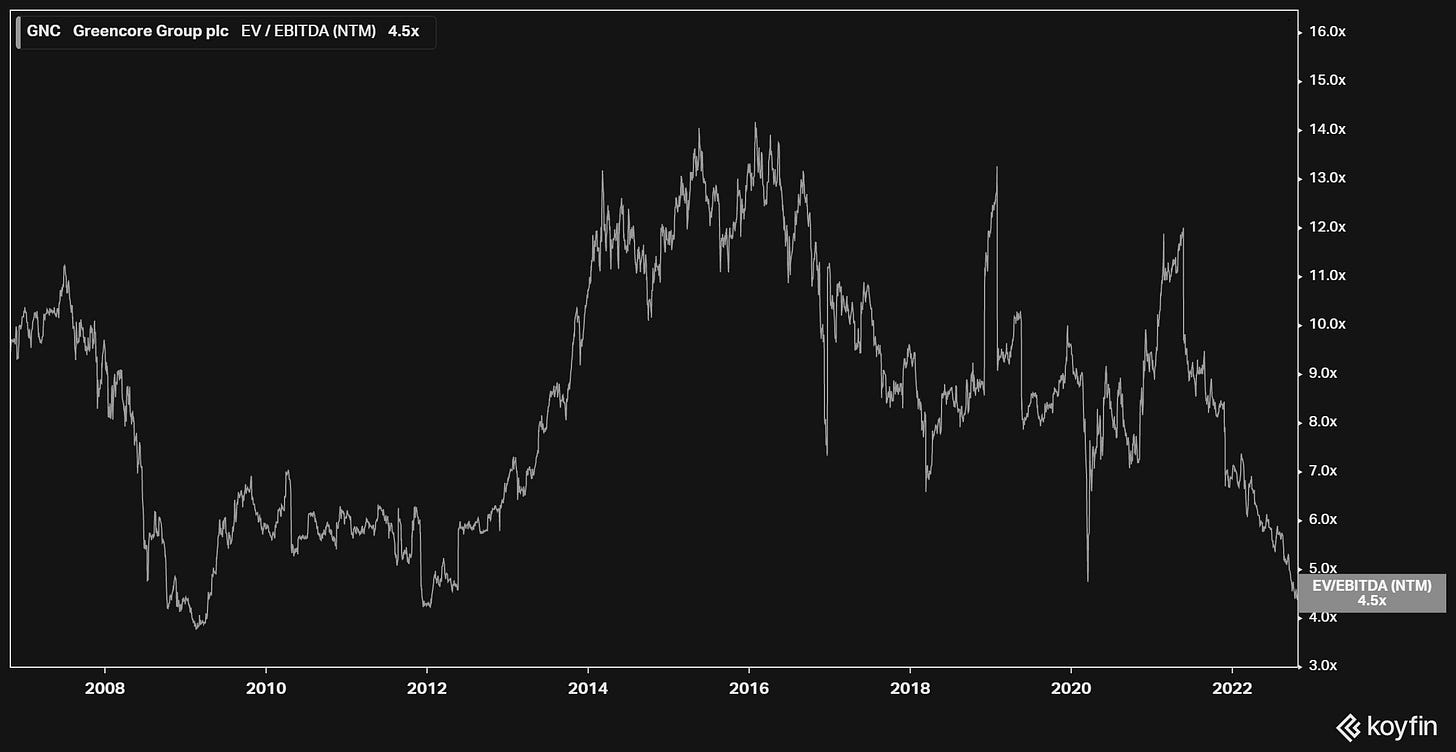

However, on a valuation basis, GNC looks interesting - it is now valued at just ~4.5x NTM EBITDA, below its COVID trough multiple from March 2020 and close to its post-GFC trough valuation of~4x in February 2009:

Despite recent challenges and it being a low margin, low ROIC business, this seems an overly depressed multiple for GNC following it’s Q4 and full year FY22 (September y/e) trading update, which that offered a number of positives - FY22 revenues were up +30% YoY, and while operating profit is now guided to the low-end of previous guidance it will equate to a ~4% operating margin, a ~1% rise on FY21 levels. Additionally, GNC has deleveraged thanks to strong cash conversion, with net debt/EBITDA approaching the company’s target range of 1x - 1.5x.

Furthermore, the company has substantially recovered the cost inflation that has dogged it over the past 12 months, suggesting that it (and operating margins) may be turning a corner (note that GNC has supply contracts with major retailers and ~60% of these contracts allow for pass through of direct material cost increases).

Historically, GNC has traded at an average multiple of ~9.5x over the last 10 years, while it traded at an average of ~6x through the post-GFC recessionary period through 2009. Even allowing for the current recessionary outlook in the UK, GNC looks like a possible value situation here and a genuine takeover target in my view.

ABF

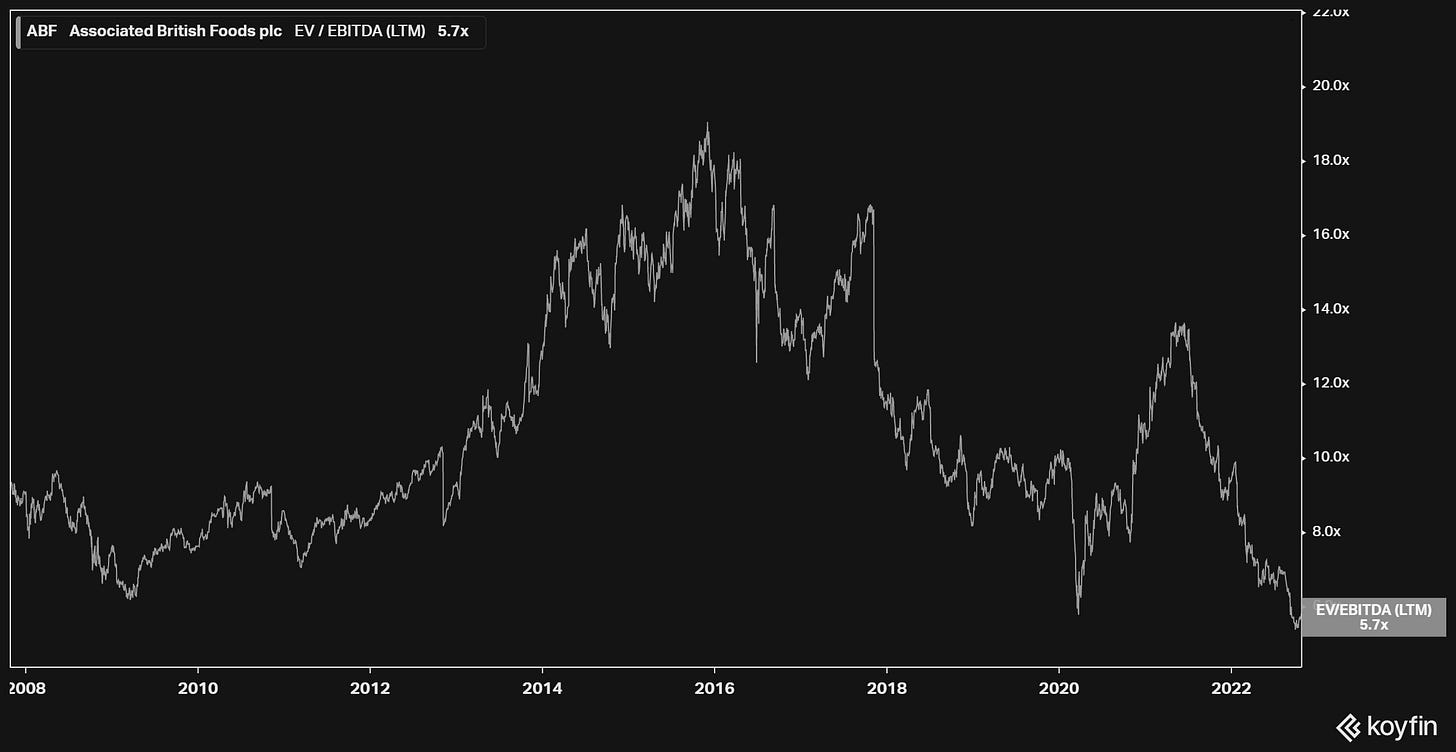

Associated British Foods Plc (APF) is another UK-listed name that currently trades below both its COVID-19 and its GFC recession-era lows, at ~5.7x EBITDA:

ABF is an unusual beast in that it owns a number of disparate businesses - retail (clothing), grocery, sugar, agriculture and ingredients.

To those unfamiliar with it, ABF is perhaps best known for owning the Primark clothing brand, a high street retail peer of clothing/fashion groups such as Zara (Inditex, ITX), NEXT Plc (NXT) and H & M Hennes & Mauritz AB (HM). Primark accounts for ~45% of ABF’s total revenues in the current year, followed by its Grocery segment (~23%) with its Sugar commodity business, Agriculture and Ingredients units each accounting for a broadly similar proportion of remaining group revenues.

ABF’s current valuation reflects a ~32% decline in its share price YTD, with the company recently issuing a profit warning and guiding a weak outlook for next year - rising energy and labour costs, a strong dollar (Primark has expanded into the US), and weakening consumer sentiment all pointing to lower margins in the near-term.

Regarding valuation, Primark’s listed retail peers currently trade at an average of close to ~8x EBITDA, and historically have traded at an average through-the-cycle multiple of ~13x over the past 10 years - applying a midpoint multiple here of say 10x to Primark’s LTM EBITDA implies the brand is worth ~£9.7bn, or ~91% of ABF’s current market cap. On my rough math, this implies ABF’s remaining businesses are worth ~£1bn, or ~1x residual LTM EBITDA, which just seems mispriced, even allowing for some kind of mini-conglomerate discount. Furthermore, leverage isn’t an issue here as (excluding leases) ABF is in a net cash position with ~£1.5bn on its balance sheet.

Against the current macro backdrop, it’s worth noting here that Primark’s “cheap chic” retail proposition has proven resilient in previous recessionary environments, while its exposure to agriculture, sugar and staple foods within its Grocery business suggest that it will benefit from food inflation in time.

ABF has long been touted as a SOTP break-up play, with a spin-off of Primark and possibly the volatile Sugar commodity business as being the most obvious moves here. However, a break-up has consistently been rejected by management. It’s possible this position may change as Primark continues to expand into the US market and inflationary dynamics impact ABF’s other segments in different ways.

ABF is an interesting situation, with any future break-up likely to unlock significant value.

Any Other Business

Speaking at the Singapore International Energy Week conference on Tuesday, Fatih Birol, head of the International Energy Agency stated that the world is "truly in the middle of the first global energy crisis," amid the Ukraine conflict, tightening liquefied natural gas (LNG) markets and supply cuts by major oil producers (OPEC+).

This ominous declaration came after the news earlier this week that European gas prices are falling, dropping below €100/MWh for the first time since June following Russia’s cutting of gas supplies into Europe. But while there may be some near-term relief in terms of gas prices, significant uncertainty remains.

Against this backdrop, the IEA published its latest World Energy Outlook 2022 report this morning, which makes for interesting reading. Among other things, it concludes that Russia’s invasion of Ukraine heralds a tipping point for global energy markets that will accelerate the transition to renewables and see demand for all fossil fuels (including natural gas) peak this decade.

I’m not sure I agree with some of the report’s findings - there are clear technological, cost and timeframe challenges to weaning off fossil fuels while maintaining a 21st century standard of living. Nevertheless, the report is certainly topical and worth reading, and can be found here.

Why Not Subscribe to the Paid Tier?

If you find the ideas in this newsletter interesting, please consider signing up to the Paid Tier.

You can read more about the paid offering here.

This newsletter is 100% reader supported and free from conflicts of interest or other commercial considerations. In writing Value Situations my job is essentially to generate ideas for subscribers that supplements their own idea origination process.

Furthermore, I believe the value proposition for paying subscribers is compelling. I am a former private equity/special sits investor that has worked with one of the largest alternative investment firms in the world, and so paying subscribers will be getting thoughtful, buy-side quality ideas and analysis for a very small fraction of the cost of employing a buy-side analyst full-time.

If you find this newsletter interesting, please also consider sharing it with friends and colleagues by clicking the Share button below.

Here’s what other investors are saying about Value Situations:

Value Situations was named as one of the Top 100 Must Follow Stock Research accounts by Edwin Dorsey of The Bear Cave Newsletter: