Weekly Bulletin #25

Things Not Seen At A Market Bottom | Low Inflation Is Over | Industries Buckling, Supply Next? | Berkshire/OXY | BHP and Mining M&A

Disclaimer

Value Situations is NOT investment advice and the author is not an investment advisor.

All content on this website and in the newsletter, and all other communication and correspondence from its author, is for informational and educational purposes only and should not in any circumstances, whether express or implied, be considered to be advice of an investment, legal or any other nature. Please carry out your own research and due diligence.

For this week’s Bulletin, here’s a round up of news items that I found interesting over the past week.

Things Not Seen At A Market Bottom

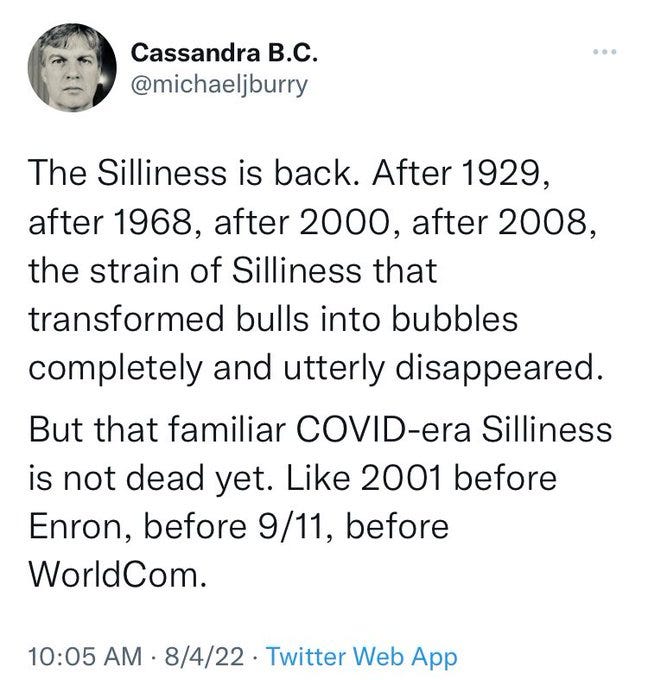

Despite recent talk of inflation peaking and a possible Fed pivot staving off recession and driving a new bull market in equities, there remains clear signs of market silliness, as Michael Burry recently highlighted:

What kind of silliness might Burry be referring to? Two news items from the past week perhaps illustrate this point best.

Firstly, there was the news that major VC firm Andreessen Horowitz (AH) has invested $350m in WeWork (WE) founder Adam Neumann’s latest start-up. The new business is named “Flow” and there are limited details on it so far, other than it is another “disruptive” real-estate play aimed at addressing the US housing crisis. It’s reported that Flow will create serviced apartment communities, initially using ~3,000 apartment units that Neumann owns across various US cities. On initial reports, it seems to me that Flow is really just WeLive 2.0, an update on WE’s previous attempt to expand into co-living that it exited last year, with the added benefit (for Neumann) of creating a rental market and equity value for residential units he acquired with his “winnings” on his departure from WE.

What is most remarkable (or silly?) about this new venture is that AH’s $350m investment is reportedly the largest single round VC cheque ever written, and values Flow at over $1bn, on what appears to be a conceptual rehash of a previously failed venture. On reflection, a quote often attributed to Albert Einstein springs to mind here:

Insanity is doing the same thing over and over again and expecting different results.

Flow - silly, or insane?

Separately, the latest meme stock episode involving furnishing retailer Bed, Bath & Beyond (BBBY) provided further evidence that the extreme silliness of the meme stock frenzy of last year has not been fully flushed out of the market just yet. The FT published perhaps the most comprehensive coverage of the story of how 20 year old student Jake Freeman made a ~$110m profit (a ~5x MOIC) on a highly concentrated bet on BBBY.

My interest in both these stories is not in the particular companies themselves but the fact that these events occurred at all in the current market, after equities fell into a technical bear market earlier this year, and with rates to rise further and persistently high inflation.

To put it simply, the Flow deal and the latest BBBY episode are not the type of things that happen at (or near) market bottoms. This suggests to me that the market may not have truly bottomed when it fell ~23.5% from its January peak to the most recent trough in mid-June. Given that numerous market risks abound, a further broad market decline is quite possible, and indeed would rhyme with history as I’ve written about previously.

That said, while market risk at the general level remains high, I see several idiosyncratic situations in certain corners that should perform well over the next 12-24 months, regardless of wider market direction.

Low Inflation Era Is Over?

On the topic of inflation, another story that caught my interest earlier this week was a Bloomberg report that a number of large institutional investors including PIMCO now believe that the era of low inflation is over. One quote that stood out for me in the article was from PIMCO’s North American economist Tiffany Wilding:

“The last twenty years of the great moderation -- that’s fully behind us now,” said Tiffany Wilding, North American economist at Pimco … She anticipates a period of highly volatile inflation as the world adjusts to changes that will “lead to higher input costs in general that should result in a multi-year price level adjustment.”

The combination of geopolitical tensions, deglobalisation, disrupted supply chains, high energy prices and a currently tight labour market are cited as the major drivers for continued elevated prices over the medium term from here.

Most interestingly the article noted that institutional investors have been buying commodities (as well as inflation-protected bonds) as a means of mitigating inflation risk, which aligns with my view that selected commodities and equities offering torque to these represent an area of opportunity in the current market.

Industries Are Buckling - Is Supply Next?

Sticking with the inflation/commodity theme, another Bloomberg report from last week - Five Vital Commodity Industries Are Buckling Under the Energy Crisis - provided a timely follow-up to my discussion of the precarity of supply in Weekly Bulletin #23.

The piece outlines how five essential sectors are now compromised by high energy prices (which look unlikely to fall any time soon) - industrial metals (aluminium, zinc), steel, green metals, fertilisers and sugar are all under pressure with reduced production likely and the closure of facilities due to uneconomic power costs.

The result of this will be further supply constraints and shortfalls, and given the essential nature of these commodities to the global economy, I expect their prices to move higher, i.e. inflation will persist, regardless of where interest rates go.

Thinking of this another way, COVID supply chain disruption caused the first wave of commodity inflation, and now structurally higher energy prices will drive a second wave of inflation in my view. In this light, as an equity investor I think it makes the most sense to focus on the areas of the market that now stand to benefit from this second wave.

Buffett Buys More OXY

Back in Weekly Bulletin #13, I concluded the following with regard to Berkshire Hathaway’s position-building in Occidental Petroleum (OXY):

The scale and sector concentration of these investments clearly indicates Buffett and his investment team at Berkshire have a high degree of conviction in the energy inflation theme, and specifically rising O&G gas prices.

The news last week that Berkshire has been granted approval to acquire up to 50% of OXY clearly signals just how high Buffett’s conviction is now on the energy-inflation theme (Berkshire currently owns ~27% of OXY, including warrants). While it is reported that it is unlikely that Berkshire will acquire OXY outright, an increased 50% holding provides two obvious capital allocation benefits for Berkshire’s portfolio:

The increased 50% stake would allow Berkshire to account for a greater proportion of OXY’s earnings in its financial statements, thereby providing an attractive inflation hedge with upside exposure to higher energy prices for Berkshire’s portfolio and earnings power; and

Given Berkshire holds ~$105bn in cash, the value of which is currently eroding at a rate of ~8.5% according to the latest US inflation reading, a further ~23% investment in OXY at current prices would equate to a ~$15.6bn incremental investment. This would represent ~15% of Berkshires’ cash pile and as such would constitute an attractive way of deploying capital given OXY’s exposure to higher energy prices.

Again it seems the smart money is betting on sustained inflation, which I think is instructive in searching for opportunities in the current market.

BHP on M&A Hunt

The news that mining major BHP Group (BHP) had its offer to acquire Australian copper and nickel miner OZ Minerals Ltd (OZL) rejected on valuation grounds (despite a 32% premium) is noteworthy in the context of the recent dip in commodity prices and recessionary fears.

BHP had previously built up a sub-5% stake in OZL, and is actively looking to grow via acquisition in key commodities tied to clean energy and the energy transition. I suspect BHP is not finished in its pursuit of OZ, and furthermore this situation also reminded me of Rio Tinto Plc’s (RIO) recently rejected offer to buy-out the 49% that it doesn’t already own of copper-and-gold miner Turquoise Hill Resources (TRQ) (again at a similar 32% premium).

In the case of BHP, it recently reported record FCF of $24.3bn, implying a LTM FCF yield of ~16%. This performance on higher commodity prices over the past 12 months, combined with what I see as a very bullish medium outlook for commodities and copper prompted me to consider a further source of idiosyncratic opportunities in the coming months - as the large miners continue to print cash in a supply-constrained market, this should lead to the creation of substantial warchests for strategic M&A in the mining sector. On this basis, the equity of strategically valuable and niche miners should open up another event-driven opportunity set over the next ~12 months.

Any Other Business

For this week’s AOB I’m sharing a conversation from April that remains very relevant today amid an ongoing food crisis and continued meme stock chicanery.

The discussion is AMC Is As Crazy As Soaring Food Prices With Doomberg, from Michael Gayed’s excellent Lead Lag Live series, which he hosts on Twitter Spaces.

As always, Michael is an excellent facilitator of discussion and Doomberg is a deeply insightful analyst and speaker, and I highly recommend listening to it.

Why Not Subscribe to the Paid Tier?

If you find the ideas in this newsletter interesting, please considering signing up to the newly launched Paid Tier.

You can read more about the paid offering here.

This newsletter is 100% reader supported and free from conflicts of interest or other commercial considerations. In writing Value Situations my job is essentially to generate ideas for subscribers that supplements their own idea origination process.

Furthermore, I believe the value proposition for paying subscribers is compelling. I am a former private equity/special sits investor that has worked with one of the largest alternative investment firms in the world, and so paying subscribers will be getting thoughtful, buy-side quality ideas and analysis for a very small fraction of the cost of employing a buy-side analyst full-time.

If you find this newsletter interesting, please also consider sharing it with friends and colleagues by clicking the Share button below.

Here’s what other investors are saying about Value Situations:

Value Situations was named as one of the Top 100 Must Follow Stock Research accounts by Edwin Dorsey of The Bear Cave Newsletter: