Weekly Bulletin #2

Portfolio: YCA, DHG, KMR | Monitoring: BG, SLCA | Developing: KAPE, ATO

Disclaimer

Value Situations is NOT investment advice and the author is not an investment advisor.

All content on this website and in the newsletter, and all other communication and correspondence from its author, is for informational and educational purposes only and should not in any circumstances, whether express or implied, be considered to be advice of an investment, legal or any other nature. Please carry out your own research and due diligence.

Model Portfolio Updates

There are three updates of note from last week with respect to Model Portfolio names - Yellow Cake Plc (YCA), Dalata Hotel Group (DHG) and Kenmare Resources Plc (KMR):

YCA

YCA released its Quarterly Operating Update last Monday, in which the company provided an updated estimate of current PF NAV at £3.40/share, which reflects the contracted transactions with Kazatomprom to acquire a further ~3m lbs of uranium (U308), of which ~2m lbs is being purchased under the existing option agreement with Kazatomprom, and a further 0.95m lbs being funded from the remaining proceeds of the ~$150m share placing last October. Delivery of these lbs is expected in April and June respectively.

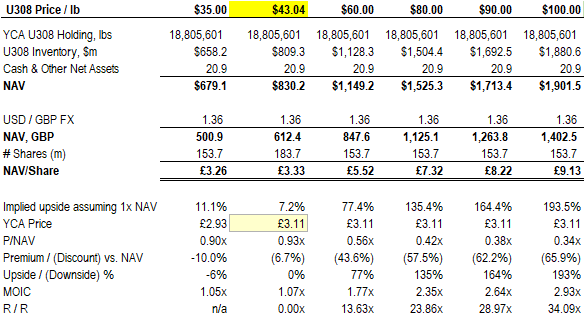

This PF NAV estimate reflects a uranium price of $43.25/lb and implies a P/NAV for YCA of 0.91x based on the YCA share price of £3.11/share at the time of writing.

Regarding the market outlook for nuclear power and uranium prices, it remains decidedly bullish. The case for nuclear power as part of the solution to the ongoing energy crisis in Europe is strengthening, with the EU now set to propose new rules to allow nuclear power plants to be labelled as green investments under the EU Taxonomy on Sustainable Activities. Last Wednesday, the EU Commission reached political agreement on including nuclear power in its Taxonomy, concluding that there is a role for nuclear power (as well as gas) as part of the energy transition to achieve climate neutrality goals:

Taking account of scientific advice and current technological progress, the Commission considers that there is a role for private investment in gas and nuclear activities in the transition. The gas and nuclear activities selected are in line with the EU's climate and environmental objectives and will allow us to accelerate the shift from more polluting activities, such as coal generation, towards a climate-neutral future, mostly based on renewable energy sources

This effectively endorses nuclear power as a green energy source going forward, making financing for the development of new nuclear reactors more feasible. The likely consequence of this is an increase in the nuclear reactor fleet as the world transitions away from fossil fuel power generation (which still accounts for ~80% of the global energy mix). This will drive a significant increase in demand for uranium in a market characterised by a chronic supply deficit that is projected to widen further:

Source: Yellow Cake Plc Investor Presentation, January 2022.

Coming back to YCA, updating the NAV for the current uranium spot price per Sprott Physical Uranium Trust (U.U / SRUUF) of $43.04 (as at the time of writing) and current GPB/USD FX implies a P/NAV of 0.93x, which is both a discount to NAV and to U.U / SRUUF, which curently trades at 0.98x (and has tended to trade at a premium to NAV compared to YCA):

Source: Value Situations analysis.

Given the favourable supply/demand set-up, many market commentators expect the price of uranium to rise dramatically, to at least above $60/lb which is the marginal price required to incentivise producers to ramp production and re-start mines currently not operating (under care and maintenance). It’s conceivable that as utilities start a new contracting cycle to secure multi-year supply, uranium prices will overshoot the $60/lb level, and I believe $80 - $100/lb is not implausible (still well below the previous cyclical peak of ~$140/lb in a market that at the time was not marked by the same supply/demand imbalance as today).

As is clear from the valuation range above, at a 1x NAV and $80/lb - $100/lb, YCA is a 2x - 3x opportunity vs negligible downside risk - given the supply/demand situation and the market backdrop, it is hard to conceive how uranium prices could drop to $35/lb or lower. I continue to believe that YCA remains the optimum way to play the uranium situation, as it is a discounted, unleveraged vehicle that offers direct exposure to the commodity and offers the best risk/reward in my view.

DHG

DHG announced its first foray into continental Europe last Tuesday. DHG has agreed to a 20 year lease with Art-Invest Real Estate and will operate the Hotel Nikko Düsseldorf. The hotel is expected to open in February and is DHG’s first step into the Continental European market. The hotel itself is a 393 room, 4 star asset close to Düsseldorf’s Central Business District (CBD), the Retail Quarter and the city's main train station.

DHG’s stock price is up ~11% since I published it as a conviction idea, but remains very cheap at ~8.6x pre-COVID EBITDA vs. ~12x for UK and European peers, and at ~7x stabilised (post-COVID) EBITDA.

KMR

KMR recently provided its Q4 2021 Production Report and FY 2022 Guidance and it makes good reading for the company’s prospects. KMR hit its FY 2021 production guidance, and achieved record annual production volumes of 1.23m tonnes (+46% YoY), and record shipments of finished products of 1.28m tonnes (+51% YoY).

Following completion of the share buy-back of 13.5% of KMR’s stock, net debt is at $82.8 million.

KMR achieved higher average prices for all products in FY 2021, with pricing momentum continuing into H1 2022 due to strong demand and low inventories of ilmenite within the global supply chain.

Regarding guidance, FY 2022 total production guidance of up to 1.35m tonnes is ~10% ahead of FY21 levels and the demand outlook is very positive, with management providing the following colour (bold emphasis mine):

Global supply of ilmenite increased in FY 2021, primarily from Kenmare, and producers in China and Norway. There was also an increase in the export of low-quality ilmenite bearing concentrates from other producers in Mozambique to China. However, the increase in supply was insufficient to meet increased demand.

Furthermore, the pricing outlook for FY22 is robust:

The robust market for ilmenite continued through Q4 2021, with demand for Kenmare’s ilmenite exceeding the Company’s ability to supply. Consequently, average received prices increased by 13% compared to the previous quarter. This pricing momentum has continued into 2022, driven by demand for Kenmare products and low ilmenite inventories in the supply chain.

On my preliminary numbers, ilmenite prices for FY22 will likely exceed $300/tonne (vs. ~$256/tonne in H1 FY21). I’m in the process of updating my model and await full year results (due 23 March) but my expectation is KMR’s FY22 EBITDA is ~$200m on this level of pricing and after allowing for guided cost inflation. This implies that KMR is now trading at 3x FY22 EBITDA (and ~0.6x EV/IC), vs. its historic multiple of ~6x and peers at 7x - 8x.

On the topic of KMR, on Thursday I participated in an hour long discussion on KMR on Twitter Spaces with Twebs, which is available to listen to on his excellent Single Stock Spaces podcast series. Twebs is a very smart and thoughtful investor with a focus on asymmetric situations, and he writes the Asymmetry Infantry newsletter on Substack. I highly recommend following him on Twitter and his podcast, and subscribing to his newsletter.

Situations Monitor

There are updates for two names I’m monitoring from this past week, US Silica (SLCA) and Bunge Limited (BG):

SLCA

While there is no news as of yet on the potential sale of its Industrial & Specialty Products (ISP) division, SLCA did announce that it was implementing a further round of price increases on certain ISP products, specifically the majority of its non-contracted engineered clay products used primarily in edible oil, industrial oil and petrochemical processes.

SLCA are increasing prices here by up to 15%, effective from March 1. This is the fourth such round of price increases SLCA has implemented over the past 15 months, implying SLCA has a degree of pricing power in its ISP business and so is clearly a commodity-inflation beneficiary. I believe such pricing power in the context of the current market environment will bolster any disposal value SLCA achieves on a sale of ISP.

BG

The Russian government announced last week that it has banned the export of ammonium nitrate fertiliser from 2nd Feb to 1 April in order to ensure affordable supplies for domestic farmers following the recent spike in global fertilizer prices. The news was not unexpected, and adds further weight to the prospect of food scarcity and shortages later this year, as the ban coincides with the European Spring planting season. Less fertilizer will mean less crops are planted and ultimately lower yields at harvest time.

This news comes at the same time as what was expected to be a record soybean crop in Brazil (the world’s largest soybean producer) now looks to be far smaller due to adverse weather conditions. This is contributing to further food price inflation with soybean prices now at eight month highs. Soybeans are a vital commodity in the global food supply chain as an input for animal feed. The impact of higher soy costs means it will be more expensive to feed pigs, chickens and other livestock.

Both the above are emblematic of the unhedgeable political and weather risk factors that I outlined in my initial Food for Thought piece, and which are playing out now in real time. These are highly supportive of BG’s prospects, being a major agricultural commodity house at the centre of global food supply, and as the world’s largest oilseeds processor it stands to benefit from this situation in my view.

Developing Situations

Returning to two previous Idea Bench names KAPE Technologies (KAPE) and ATOS (ATO), recent developments have put these companies back on my rader.

KAPE

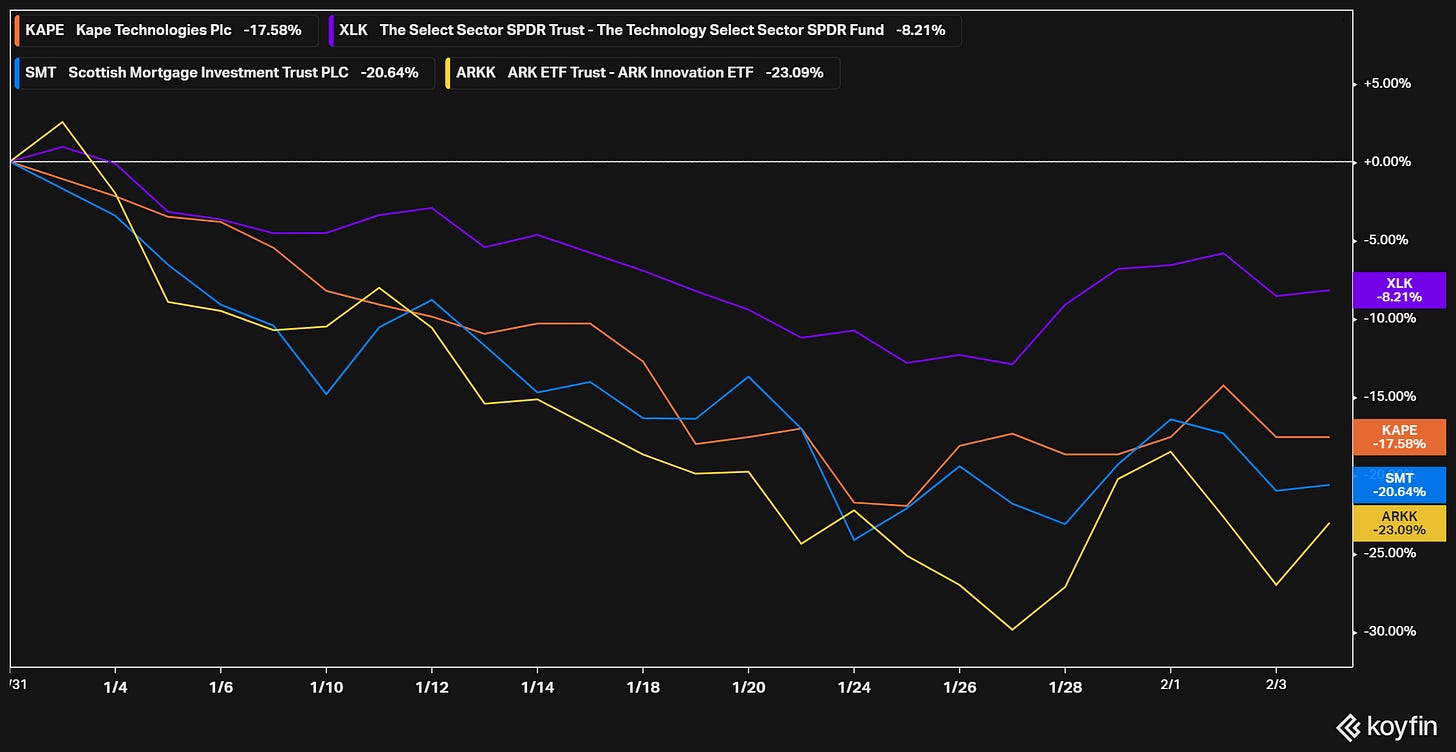

KAPE’s shares are down 20% YTD and ~15% since I last wrote about the stock in an Items of Interest issue last November. The decline doesn’t appear to be related to any specific negative news around the company. In fact, KAPE recently provided a trading update with improved guidance for FY21 results, reporting that revenue will be ahead and EBITDA in line with prior guidance. Perhaps the recent sell-off in KAPE is attributable in part to the sell-off in all things tech:

With no new negative news and a cheaper price than when I previously looked at it, KAPE again seems interesting in three respects:

Last September it announced it was acquiring US peer ExpressVPN, which represents a transformative acquisition as I outlined previously. This deal completed in December.

Recent consumer cybersecurity sector M&A suggests to me KAPE may become a takeover target - NortonLifeLok’s (NLOK) deal to acquire Avast PLC (AVST) for ~16x and a PE buy-out of McAfee Corporation (MCFE) for almost 18x indicate continued appetite for consumer cybersecurity assets, and given KAPE’s above-average growth vs. peers and PE interest in UK assets the likelihood of KAPE coming into play is reasonably high in my view.

KAPE’s valuation is particularly curious - after the recent share price decline, on a headline basis KAPE is currently valued at ~15.8x FY21 EBITDA (full year results release due on 22 March 2022). However this ignores the post-merger earnings power of the combined business with ExpressVPN - adjusting for debt and share dilution as part of the deal, at the current share price KAPE is valued at ~11.5x PF EBITDA, a significant discount to AVST and MCFE, which although are bigger businesses in revenue terms, are also slower growth ones.

Finally, controlling shareholder Teddy Sagi (owns ~55% of the company) has successfully grown KAPE via an impressive build-and-build acquisition strategy over the last ~5 years and the ExpressVPN deal feels like the really transformative one from a value perspective. In this context a liquidity event/exit via a sale of the company to a PE or strategic acquirer would seem a logical next move.

ATO

ATO is a previous Idea Bench name that I highlighted last July, but which I subsequently parked to work on other ideas. However, some very interesting news last week has prompted me to look at it again however.

Firstly some context. ATO’s stock is at a ~10 year low, and down ~51% in the last 12 months, after a failed acquisition of US peer DXC Technologies (DXC) 12 months ago, followed by an accounting irregularity disclosure and two subsequent profit warnings, the latest of which was last month. So its fair to say sentiment towards the stock is quite negative.

However there was an interesting turn last week with news that French defense-electronics company Thales SA (HO.FP) is interested in acquiring ATO’s Big Data & Cybersecurity (BDS) business. BDS is the fastest growing segment within ATO (+25% YoY in Q3 FY21) and generated ~€1.2bn in revenue, and €173m in EBIT in FY20 (~11% of total ATO FY20 revenues).

Thales confirmed their interest, while ATO responded to the news to say BDS was not for sale and that the company was pursuing its turnaround plan following its recent challenges. Based on media reports, Thales are exploring a bid with PE, whereby ATO would effectively be broken up with Thales acquiring BDS and the PE partners taking out the remaining business which in part comprises legacy IT services and outsourcing units.

Media reports indicate that Thales could bid ~€2bn - €3bn for BDS, which equates to a ~10x multiple for the unit and is in line with recent comparable deals (Thales acquired Gemalto at 10x, Bain Capital acquired Inetum ~10x). BDS accounted for ~11% of total revenue in FY20, and I estimate it’s EBITDA is ~€250m, so the midpoint of the reported bid range at €2.5bn makes sense here relative to the comps. What is really interesting though is that ATO’s current market cap is just €3.6bn, implying BDS accounts for ~70% of its current market cap and 53% of its EV (based on the midpoint €2.5bn value), with very little value ascribed to the remaining businesses which accounted for ~€10bn of revenue in FY20.

Based on management’s latest guidance I estimate total group FY21 EBITDA (reflecting the recent issues) is ~ €1.08bn (-35% YoY) on revenue of €10.8bn. On this measure, ATO is trading at 4.4x FY21 EBITDA. Furthermore, if BDS accounts for ~€250m of this, it implies ATO “RemainCo” will generate trough EBITDA (assuming a turnaround in the future) of ~€830m. Backing a BDS sale out of ATO’s current EV and FY21 EBITDA implies a post-sale valuation of just 2.7x EBITDA for RemainCo (assuming €2.5bn of proceeds nets against its €1.1bn of net debt:

Source: Value Situations analysis.

Assuming a successful turnaround and a substantial net cash balance sheet position following receipt of BDS divestment proceeds, it’s not unreasonable to think ATO would re-rate to 6x in line with its historic average multiple, with the potential for a special dividend to shareholders from excess cash. Such a scenario implies potential upside of ~75%+ to the current share price.

To be clear, the above is just an illustrative exercise for now - clearly there are some real hurdles to the above value unlock/re-rating, namely ATO doesn’t want to sell and secondly ATO is a politically sensitive target given its work for the French government and military. But if nothing else, the Thales interest helps to shine a light on what is an obscured and valuable asset within ATO. This fact, combined with a management turnaround in time could see ATO re-rate meaningfully without a break-up. I also see this as a situation that is very ripe for an activist to get involved and force a sale and special dividend, or even press for a full break-up of the company, given the poor recent performance, low valuation and obvious underlying value of BDS. ATO is a developing situation that is worth watching in my view.

Any Other Business

Finally, some items that that I felt worth sharing with subscribers this week:

Podcast - Grant William’s new podcast series with Doomberg, This Week in Doom. This kicks off with a very thoughtful and wide-ranging discussion between Grant Williams and Doomberg

Book - The World For Sale, Javier Blas & Jack Farchy - this is an excellent read in the context of the current market view that a commodities supercycle is underway.

Conor - looking at 2022, it looks like consensus is now 240mm of EBITDA. So people are already there. What do you think is the catalyst at this point as would have believed the upside surprise to consensus for 2022/2023 should have served as a catalyst?

Thank you Conor. Can't wait to hear your thoughts on the recent PANR developments too.