A New Value Situation

Announcing A Paid Tier and Why It's Worth Subscribing To.

Disclaimer

Value Situations is NOT investment advice and the author is not an investment advisor.

All content on this website and in the newsletter, and all other communication and correspondence from its author, is for informational and educational purposes only and should not in any circumstances, whether express or implied, be considered to be advice of an investment, legal or any other nature. Please carry out your own research and due diligence.

After nearly 12 months of writing the Value Situations newsletter, I have decided to launch a paid tier. In that time I’ve published 44 issues covering ~30 stocks in varying degrees of detail, and I’ve thoroughly enjoyed finding and sharing what I believe are interesting public equity ideas with readers. I’m delighted with the traction the newsletter has achieved to date - from a standing start with no online profile or following, Value Situations has grown to ~4,800 subscribers, adding new subscribers at a rate of approximately 100 per week since inception. I take this as some validation as to the quality of my ideas and analysis and I am extremely grateful to all who have signed up as free subscribers to date.

However, I’m now at the stage where I want to grow Value Situations into something greater than a free weekly newsletter. I want to dig deeper for ideas and provide greater value to readers, and in order to do this I believe a paid offering is the logical next step.

Why I’m Launching A Paid Tier

Based on a reader survey I conducted last December and from my continuous engagement with subscribers, the overwhelming feedback I’ve received has been subscribers want actionable, high conviction ideas rather than general market commentary or quick ideas.

We are living through a unique time for financial markets, and numerous complex risks abound. As such, creative thinking and thoughtful analysis combined with the old fashioned practice of turning over as many rocks as possible is in my view the best route to finding actionable ideas that offer attractive risk-adjusted returns. As a former buy-side investor I can say it is a challenge to come up with compelling ideas on a weekly (or even monthly) basis, something I believe many of my readers on the buy-side can also attest to. Absent periods of extreme market dislocation, I do not believe it is possible to produce quality, conviction ideas on such a frequent basis. Weekly “quick takes” risk veering into superficial stock tips, and often the results of such an approach are commensurate to the quality of effort that goes into it.

Offering a paid tier will allow me to improve the quality of conviction ideas for readers, and will ensure my analysis remains 100% independent and free from conflicts of interest or other commercial considerations. Since inception, this newsletter has been a serious and full-time endeavour for me and I pride myself on the originality and independence of my ideas. With a paid offering supported by subscribers I will be able to focus my time and efforts on only my best ideas, which will ultimately be to the benefit of readers. Essentially, my job will be to generate actionable ideas for subscribers that supplements their own idea origination process.

Why Subscribe? - What Paying Subscribers Get

The new paid tier of Value Situations will cost $500/year or $50/month, for which subscribers will receive the following:

2 - 3 actionable public equity ideas per quarter, presented in the same buy-side investment memo format as previous conviction ideas (e.g. Total Produce/Dole Plc, Dalata Hotel Group Plc, Wickes Group Plc).

Access to the Value Situations Model Portfolio, including details of new additions or other updates to the Portfolio as I make them - recall that the Model Portfolio comprises my very best conviction ideas that I believe offer the best risk/return opportunities using my own original analytical framework.

Occasional thematic pieces on areas of the market where undervalued equity situations may be unfolding (e.g. The Real Asset Ownership Complex, Food For Thought two-part series).

Comments Section access for all articles.

I believe the value proposition for paying subscribers is compelling. I am a former private equity/special sits investor that has worked with one of the largest alternative investment firms in the world, and so subscribers will be getting thoughtful, buy-side quality ideas and analysis for a very small fraction of the cost of employing a buy-side analyst full-time.

I also think it’s important to clearly state here what Value Situations is not - this is not a stock tips newsletter or stock-picking service, and I do not provide recommendations to buy or sell securities. The purpose of this newsletter is to share the public equity ideas that I find most compelling and which may be of interest to readers in the course of doing their own investment research. Additionally, the conviction idea write-ups are not intended as exhaustive deep-dive or due diligence reports, but rather are the presentation of my best investment ideas under my own investment criteria.

I should also point out that Value Situations typically does not cover large cap names or “media darling” stocks - unless there is some extreme market or corporate event, you are unlikely to ever read about names such as Apple, Microsoft or Starbucks in this newsletter. Rather the focus has been and will continue to be on underfollowed, unpopular or misunderstood equities that fit within my analytical framework and which usually have special situation characteristics that will unlock value.

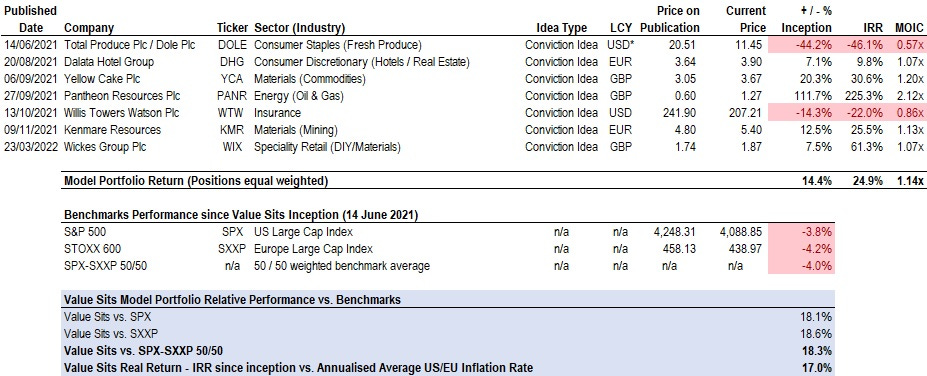

Regarding Model Portfolio names, while these are predominantly underwritten with a 2-3 year investment term in mind, their collective performance in the relatively short life of the newsletter to date has been pleasing - as at the time of writing the Model Portfolio is up +14.4% since inception on 14 June 2021, which equates to a return of 24.9% IRR / 1.14x MOIC. This compares to a negative -3.8% return for the S&P 500, a negative -4.2% for the European STOXX 600, and is comfortably ahead of US and European headline inflation rates of 8.3% and 7.5% respectively, implying a real absolute return of ~17.0%:

Source: Value Situations analysis; Closing market prices as at 17 May 2022 per Koyfin. IRR calculation based on date of first publication of idea to closing price on 17 May and inclusive of dividends paid during period where applicable. Overall portfolio IRR reflects equal weighting across all names and assumed investment made in each name on date of first publication of idea.

The Model Portfolio’s outperformance to date reflects it’s composition as an eclectic basket of idiosyncratic situations that are well positioned to realise substantial upside regardless of what the wider equity market does. I believe this demonstrates the benefits of my analytical approach to finding attractive ideas.

Finally, in further making the case for signing up for a paid subscription, I’ll highlight another idea from one of the early issues of this newsletter that recently played out as I expected - Hibernia REIT Plc (HBRN). At the end of March, it was announced that funds managed by Brookfield Asset Management had agreed to acquire HBRN for a total cash value of €1.634/share, comprising a €1.60/share bid price plus a 3.4 cent dividend. The bid was ahead of my target take-private price of €1.52/share, but in line with my tax-adjusted NAV valuation of ~€1.60, as I published in my original piece.

In terms of “idea performance,” any readers who were interested in my HBRN idea and made their own investment decision to buy in at the €1.25/share price when I published it will have done well, both in absolute and relative return terms - assuming the deal closes by the end of June this year, the indicative return will be ~35% IRR / 1.35x MOIC including dividends over a ~12 month timeframe, well ahead of both wider equity indices’ performance and inflation. HBRN is a good example of the type of catalyst-driven value situations that I seek for this newsletter (for those interested, you can read my recent synopsis of the HBRN take-private result here).

If all of this sounds of interest to you, I’d invite you to sign up for a paid subscription.

What Free Subscribers Get

I’ll continue to publish a Weekly Bulletin, although this will be in a much reduced form in which I’ll collate and highlight news articles, ideas or other items that I believe are interesting from my Value Situations investment perspective.

The Weekly Bulletin will not feature any discussion of Model Portfolio names or individual stocks analysis post-launch of the paid tier. However, free subscribers will continue to have access to the archive of articles published prior to the launch of the paid tier.

What Others Have Said About Value Situations

As highlighted on my About page, this newsletter has received numerous endorsements and recognition online over the past year, including the following:

Value Situations was named as one of the Top 100 Must Follow Stock Research accounts by Edwin Dorsey of The Bear Cave Newsletter:

The Next Step

Finally, I would like to thank all of you who have subscribed to the free version of this newsletter to date - your support and engagement in getting me to this point is sincerely appreciated. I hope that if you’ve found the ideas presented in Value Situations helpful to your own investment endeavours you will continue to read it by signing up the for paid tier.

If you are looking for overlooked, unconventional and undervalued public equity situations, I think you will find ideas of interest in this newsletter.

The paid tier will launch next Wednesday 25th May with the publication of a new, actionable idea. This idea and all future ideas will only be available to paying subscribers after this date.

Hi Conor, the subscribe button seemingly does not work? When I click it returns me to my profile where it shows I already subscribe to your weekly?

Your substack has been a blessing so far, Conor. All the best for your future!