Welcome to the inaugural issue of Value Situations. Each week I will share quick ideas or commentary on companies or topics of interest in the public equity markets. Every 4-6 weeks, I expect to publish longer form investment memo-style write ups on actionable ideas depending on the available opportunity set. For this first issue, I’m publishing a memo-style write up of what I believe is a particularly compelling situation with a live catalyst.

Feedback is welcome and if you like this newsletter please share with friends and colleagues.

Disclaimer

Value Situations is NOT investment advice and the author is not an investment advisor.

All content on this website and in the newsletter, and all other communication and correspondence from its author, is for informational and educational purposes only and should not in any circumstances, whether express or implied, be considered to be advice of an investment, legal or any other nature. Please carry out your own research and due diligence.

Irish-listed Total Produce Plc is merging with Dole Food Company via a share exchange to form the global #1 fresh produce player, with the merged entity to IPO on the NYSE in H2 2021 as Dole Pc.

The IPO is subject to achieving a valuation floor equal to €2.17/share for Total Produce shares, which creates Dole Plc’s enterprise value at ~8x EBITDA; this implies significant undervaluation relative to US publicly listed peers (trading at average of ~14x - 15x over last 10 years) and comparable private market transactions (completed at ~10x average).

The probability of the IPO not succeeding is very low given the low entry floor and obvious re-rating upside; I therefore believe TP’s shares currently represent a compelling opportunity to acquire an interest in a leading global consumer staple business at a significant discount to fundamental value.

The merger/IPO is a transformative event that provides a hard catalyst to value realisation, with Dole Plc’s imminent status as the global #1 player and the enhanced liquidity and analyst coverage to come with a US market listing to drive a significant value re-rating.

I expect the market to re-rate Dole Plc in line with US peers within 12-24 months to the equivalent of ~€5.28 per current Total Produce share (14.5x PF EBITDA), implying ~110% upside from the current share price.

I estimate downside risk is limited to -33% vs. the current price, implying a highly asymmetric return/risk profile with upside of ~3.3x the downside.

Indicative returns in my Base Case are 45% IRR / 2.1 MOIC over 24 month investment term, with potential Upside Case returns of 61% IRR / 2.6x MOIC.

Situation Overview

Total Produce Plc (“TP”) is the global #3 player in the fresh produce industry, operating in ~30 countries and achieving revenues of €3.8bn / $4.3bn in FY20. The company is headquartered in Dublin, Ireland.

TP was spun-off from Fyffes Plc in 2007, when it listed on the Euronext Dublin and London Stock Exchanges’ AIM market at an initial market cap of ~€267m (~6.3x EBITDA). TP is controlled by the McCann family (~15.2% shareholding) who previously also controlled Fyffes Plc, which they sold to Sumitomo Corporation in 2016.

TP currently owns a 45% shareholding in Dole Food Company (“DFC”), a privately-held fresh produce business and the #1 industry player by FY20 revenues. DFC is controlled by businessman David Murdock via his Castle & Cooke (“C&C”) holding company. TP acquired the 45% interest in DFC in 2018 for $300m, implying a valuation of 8.9x at that time; as part of the 2018 deal, TP has the option to acquire the remaining 55% interest in tranches subject to certain terms.

In February, TP announced it was fully merging with DFC to form Dole Plc (“Dole”), which will be an Irish incorporated company and will immediately seek a US listing for the new combined company. Post-merger, Dole will be the global #1 player in fresh produce by a substantial margin, with PF revenues of ~$9.7bn, making it ~2x larger than its nearest competitor.

The key steps involved in the transaction are as follows:

Step 1 – Merger:

TP de-lists from the Euronext Dublin and London AIM market, and merges with DFC to form Dole via a share exchange

TP shareholders will own 82.5% of Dole on a fully diluted basis following the share exchange, with DFC shareholders owning 17.5% pre-IPO

Step 2 – IPO of Dole Plc:

Following the merger, Dole will IPO on the NYSE with a targeted equity raise of $500m - $700m to strengthen Dole’s balance sheet

The IPO is subject to a minimum valuation floor of $215m being achieved for DFC shareholders’ 17.5% interest; assuming a mid-point raise of $600m at the floor value, this equates to a value of $2.60 per new Dole share, or €2.17 for TP shareholders (at current USD: EUR FX of $1.20 : €1.00)

On completion of the IPO assuming a $600m raise and the floor value, TP shareholders will own ~55% of Dole, with C&C holding ~9% and new investors holding ~35%.

To support the transaction, TP has secured $1.4bn in new committed debt facilities to refinance existing TP and DFC debt. Post-completion of the IPO the equity proceeds will be used to de-lever Dole’s balance sheet to ~$0.9bn of net debt, with target net leverage at sub-3.0x.

At the floor value, the transaction creates Dole’s EV at $2.9bn, equating to 7.8x PF adjusted EBITDA before synergies - this is significantly below publicly listed US peers who have historically traded at ~14x-15x, and precedent M&A transactions involving comparable companies which have completed at an average multiple of ~10x. This clearly suggests significant valuation upside to the proposed floor value and the current TP share price once Dole commences trading on the NYSE.

Recent share price action suggests investors endorse the deal and believe it will complete successfully - TP’s share price has risen ~73% to ~€2.52 currently since the deal announcement in February, and hit an all-time high of €2.60 in May. Furthermore, TP’s current share price exceeds the implied floor value of €2.17 for the deal, further supporting the upside potential to this situation.

In a Base Case I estimate the combined Dole business has an EV of $5.9bn with the equity worth ~$4.5bn following a market re-rating to ~14.5x post-IPO. This equates to ~$44 per new Dole share or ~€5.28 on a pre-exchange basis for current TP shareholders, indicating ~110% upside.

I estimate downside risk as limited to~$14 per new Dole share, or €1.68 on a pre-exchange basis for TP shares, implying downside of ~33% vs. the current share price. The situation therefore offers a highly asymmetric return/risk profile, with upside of ~3.3x the downside risk.

The overall transaction is a transformative event that provides a hard catalyst to value realisation for TP shareholders. Post-IPO, Dole’s leading competition position, it’s combined scale and the enhanced liquidity and analyst coverage that comes with a US market listing will drive a significant value re-rating within 12-24 months.

The transaction timeline implies a limited window of opportunity to participate in the value creation opportunity; the Transaction Circular document sets out an expected completion date of “Late July 2021” for the merger and share exchange, with the IPO expected to occur by Q3 2021 subject to relevant approvals and satisfaction of conditions, (see Transaction Overview section below). Notably, the first hurdle was cleared on 9 June, with the European Commission clearing the merger to proceed with no competition concerns.

I believe the market has not fully priced in the equity upside into TP’s share price for 2 principal reasons:

TP is simply overlooked given it is a small cap on relatively peripheral exchanges (Euronext Dublin and London AIM), and with very limited analyst coverage (only 2 x domestic Irish brokers cover the name, including TP’s house broker). Additionally, DFC is privately held and so has no analyst coverage, reducing the awareness of the imminent combination and value creation opportunity ahead

Complexity and uncertainty around completion – the transaction is not a simple merger, involving both a share exchange and a subsequent IPO process, which are subject to approvals and satisfaction of certain conditions. There are clear mitigants to the risks around completion, however I believe the market remains cautious for now and perhaps awaits the result of TP’s shareholder vote on 17 June before the valuation gap starts to get arbitraged away.

In summary, TP shares represent a unique and compelling opportunity to participate in the creation of the global market leader in the highly stable fresh produce category at a significant discount to fundamental value. Furthermore this opportunity comes with an imminent catalyst to value realisation within 12-24 months, and a highly positive asymmetric return/risk profile, making this an unusually attractive value situation.

Transaction Overview - Merger & IPO of Dole Plc

Transaction Mechanics

Under the binding transaction agreement between TP, DFC and its shareholders C&C, TP and DFC are combining into a single entity, Dole Plc, to be listed on the NYSE via a 2-step transaction as follows:

Step 1 – Merger:

TP de-lists from the Euronext Dublin and London AIM market

TP and DFC merge via a Scheme of Arrangement, whereby TP shareholders exchange their shares for new shares in Dole Plc, on a basis of 7 TP shares for 1 Dole share

Under the exchange, TP shareholders will receive 55.8m shares in Dole pre-IPO, giving them 82.5% ownership on a fully diluted basis following the share exchange, while DFC shareholders will own 17.5% or 11.8m shares pre-IPO.

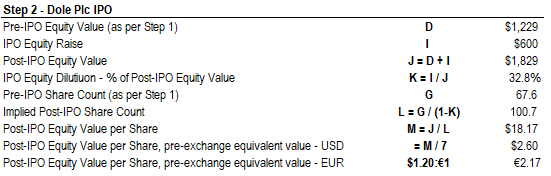

A pre-IPO condition is for C&C’s 17.5% shareholding to achieve a valuation floor of $215m at IPO, implying an IPO price of $18.17/share, equivalent to ~$2.60/€2.17 per TP on a pre-share exchange basis (assuming USD/EUR FX $1.20: €1.00):

Source: Value Situations analysis based on disclosures per Total Produce Plc Transaction Scheme of Arrangement Circular, 19 May 2021.

A second condition to the IPO is that C&C also achieve net proceeds of at least $50 million from a secondary sale of shares in conjunction with the IPO. At the $18.17 implied IPO price, this indicates C&C will sell down ~2.8m shares from their pre-IPO allocation of 11.8m shown above – see below for final cap table ownership.

Step 2 – IPO of Dole Plc:

Following the merger, Dole will list on the NYSE, with a targeted equity raise of $500m - $700m at the indicative share price of $18.17 as per Step 1, with funds raised being used to de-lever Dole’s balance sheet:

Source: Value Situations analysis based on disclosures per Scheme of Arrangement Circular.

Assuming a mid-point of $600m in new equity is raised at the $215m valuation floor for C&C’s 17.5% interest, the IPO will dilute current TP shareholders down to ~55% ownership in Dole. After the secondary sale of ~2.8m C&C shares as part of the IPO, C&C shareholders will own ~9% and new investors will hold the remaining ~35%:

Source: Value Situations analysis based on disclosures per Scheme of Arrangement Circular.

Transaction Rationale

TP’s acquisition of it’s 45% stake in DFC in 2018 was always intended as the first step in a larger transaction involving the two businesses.

The two businesses are highly complementary and the merger combines TP’s global distribution network with DFC’s vertically integrated business model and strong brand to create the global market leader, while simultaneously unlocking value for shareholders and providing a platform for future growth.

The deal has 4 clear benefits for the business and shareholders:

Simplifies Ownership – combining the two businesses ensures a cleaner ownership structure and allows for full integration of operations across a total asset base of ~$4.7bn.

Synergies - the combination will generate meaningful cost efficiencies and synergies in areas such as supply chain, distribution and customer relationships, and provide a greater platform for further growth and revenue opportunities

Stronger Balance Sheet – the IPO will allow immediate deleveraging of the combined balance sheet, and bring PF net leverage to ~2.5x (below US peers’ average of ~5x) and provides a platform for further investment and acquisitions.

Value Creation – with combined EBITDA of $371m before synergies (or ~$406m including expected synergies), the deal creates steady and substantial earnings power, which combined with a #1 market position and the NYSE listing should create significant equity value by enhancing liquidity and attracting a wider investor base.

Furthermore with regard to value creation, it’s worth noting the McCann family’s track record to date in creating significant equity value from the original TP spin-off. TP was spun-out from Fyffes in 2007 at an initial market cap of €267m; the current market cap plus capital returned to shareholders since inception (via dividends and buybacks) is €1.1bn, equating to a total return of ~422% over 14 years (or ~10% IRR); this compares to a negative total return of -11.6% for the ISEQ (Irish stock market index, now Euronext Dublin) over the same period:

This precedent of significant value creation from the original spin-off and the McCann’s astute strategic acquisition of 45% of DFC in 2018 suggests this new Dole transaction will see substantial incremental value created for TP shareholders.

Transaction Timeline

The transaction timeline sets out an expected completion date of “Late July 2021” for the share exchange and merger, with the IPO expected to close by Q3 2021:

17 June 2021 - Shareholder vote on share exchange merger and IPO process

Late July 2021 - Expected completion of merger & de-listing of TP from Euronext Dublin & London AIM

Q3 2021 - IPO completion subject to required approvals and conditions

A backstop date of 15 November has been set, at which point the deal can be terminated by either TP or C&C if the transaction has not completed by that time.

Business Overview

Total Produce Plc

TP is currently the third largest fresh produce business globally by revenue, with FY20 revenues of €3.8bn / $4.3bn, excluding its 45% interest in DFC; including its proportionate share of DFC, other JVs and associates it is the largest fresh produce business globally with “look-through” FY20 revenues of €6.26bn / $7.1bn.

It operates an asset-light, distribution model, having built a global distribution network and partnering with local farmers and growers to provide 300+ lines of fresh produce to retailers, wholesalers and the food service industry. The company operates across 26 countries globally (30 inclusive of its share in DFC), from over 160 facilities (~260 inclusive of DFC) including farms, manufacturing and ripening facilities, cold storage warehousing, packhouses and distribution hubs.

TP operates primarily across Europe with smaller operations in North America and South America, and a single facility in India. On a standalone basis, Europe accounts for ~70% of revenues, with North America, South America and ROW accounting for the balance.

It’s top 5 product categories account for ~70% of revenues - soft and stone fruits (22% group revenue), vegetables & potatoes (18%), bananas (11%), salad (11%) and apples and pears (9%)

Dole Food Company

DFC is the largest fresh produce business globally on a standalone basis, with FY20 revenues of $4.7bn.

The company is controlled by David Murdock via C&C, who retains a 55% ownership interest in the business. Murdock has controlled DFC since 1985 when he acquired C&C, and has taken DFC in and out of the public markets over the last ~20 years; Murdock took DFC private in 2003, then took it public in 2009, before subsequently taking it private again in 2013. A second IPO in 2017 was cancelled after Murdock explored a sale to Belgian peer Greenyard which fell through. Murdock then sold 45% to TP in 2018 as part of an intended phased exit, culminating in the current merger situation.

In contrast to TP, DFC operates an asset-heavy, vertically integrated model, owning ~109,000 acres of farmland and other land holdings, manufacturing plants, containers, packhouses, a fleet of 16 ships, and port and research facilities. DFC also owns the “Dole” brand, which is regarded as an iconic brand within the industry, with strong consumer brand recognition in North America, and supplies retailers, wholesalers and the food services industry.

DFC has historically been a banana and pineapple producer, and is a member of the banana oligopoly that includes Chiquita, Fyffes and Fresh Del Monte; together the four companies’ control ~80% of the global banana trade.

DFC is primarily focused on the North American market, which accounts for ~68% of revenues, with Europe (20%) and ROW (12%) accounting for the balance. In terms of product mix, DFC’s main category is bananas which represent 43% of sales, followed by other fruits (31%) and fresh vegetables (26%).

Dole Plc – The New Entity

The combination of TP and DFC, creates the global leader in fresh produce with PF revenues and EBITDA of $9.7bn and ~$371m (before synergies) respectively.

Revenue mix for Dole will be split approximately 50/50 between Europe and North America, with less reliance on the highly competitive and price-volatile banana category, and offering a much more diversified and growth-oriented product portfolio:

Source: TP transaction presentation, “The Premier Global Leader In Fresh Produce,” 17 February 2021

On an illustrative combined basis, Dole has historically grown revenues and EBITDA at ~1% and 4.3% respectively, with an average EBITDA margin of ~3.7% over the last 5 years:

Sources: Company annual reports for Total Produce; SEC filings for DFC; Total Produce Plc Transaction Scheme of Arrangement Circular, 19 May 2021; Value Situations analysis.

As a wholesale distributor TP is a lower margin business, earning ~2.4% average EBITDA margins historically; DFC has achieved higher margins of ~5% due to its vertically integrated production model and strong brand, enabling economies of scale, low cost production and some pricing leverage.

The combined projections above are presented for illustrative purposes based on the mid-point of TP’s projected long-term growth rate for the business of 2%-3% (in line with industry forecasts – see below), with targeted EBITDA growth of 5% - 7% p.a., supported by synergies, cost efficiencies, acquisitions and other opportunities.

While this historic low growth, low margin profile suggests mediocre business economics, what makes Dole interesting from an investment perspective beyond the obvious value creation opportunity is its undisputed market leading position, business stability given the essentiality of its products, it’s significant competitive scale advantages, and the supportive growth tailwind from the growing consumer focus on health and nutrition globally, as outlined below.

Industry Overview

The fresh produce industry is characterised by low but steady growth of ~2% p.a historically, which reflects consistent underlying consumer demand for fruit and vegetables as essential staples. As such, fresh produce is a non-cyclical business with a relatively stable and predictable growth profile.

Fresh produce is a classic supply-and-demand industry, with the key task for producers to balance supply with consumer demand. Supply is impacted by factors including weather conditions, geography of production, commodity costs (e.g. fertiliser, fuel, packaging materials), seasonality and perishability, while demand is driven by factors such as side population size, consumption patterns and trends, availability and quality of produce, and competition.

The industry is highly competitive and characterised by complex supply chains and a fragmented supplier base; individual fruit or vegetable sub-sectors typically have a large local player or number of local competitors who compete with global multinational suppliers across retail, wholesale and foodservice channels.

The industry is also characterised by low profit margins, with EBITDA margins in the 2% -10% range depending on produce category and business model (e.g. integrated vs. distributor, fresh vs. frozen offering), which reflects a number of factors:

Strong competition among producers

Relative lack of differentiation among products, with lowest price and best quality being the key considerations for end-consumers

Limited leverage over pricing with large retailer/grocery customers who constantly seek to negotiate prices downwards

As a result, fresh produce suppliers primarily compete on price, quality and reliability with the only way to drive incremental margin being via (1) scale and supply chain efficiencies, and (2) differentiation, via brand recognition, product innovation and value-added offerings such as fresh packed produce and meal kits.

Market Size & Growth Outlook

The combined fresh fruits and vegetables segment for Dole’s key markets of Europe and North America generated total sales of $335bn in 2019 (Europe: $196bn; US: $139bn) according to GlobalData. On a combined basis, the market is projected to grow at a 2.7% CAGR over 2020-2025 (Europe: 2.1% / US: 3.4%), vs 1.9% historic growth rate over the 2015-2019 period (Europe: 1.5% / US: 2.5%):

The growth outlook for fresh produce is favourable given rising consumer demand for healthy, fresh and convenient foods and increasing public focus on health, wellness and nutrition. In terms of specific categories, bananas, pineapples and grapes are lower growth categories, while fresh and value-add vegetables, berries, avocados and organic produce are high growth categories and all ones in which Dole holds market leadership positions in.

Competitive Position

The combination of DFC and TP brings together the current #1 and #3 industry players respectively to create the world’s largest fresh produce business by a significant margin. Dole Plc will be ~2x greater than nearest peer Greenyard NV based on FY20 revenues:

Source: Company annual reports; Value Situations analysis. Revenues are latest reported full year revenues converted to USD at average applicable FX rate for FY20.

On a combined basis, Dole will be a diversified producer and distributor with leading market share positions (#1- #3 player) in Europe and the US in core product categories of bananas, pineapples and fresh vegetables. Furthermore, it’s combined scale, branding and vertically integrated operations provide a superior platform from which to pursue higher growth categories such as avocados and organic produce:

Source: Total Produce Plc Transaction Scheme of Arrangement Circular, 19 May 2021.

The merger ensures a number of clear competitive advantages for Dole over peers, specifically:

Immediate and undisputed market leadership by a significant margin

Increased scale and presence in higher growth categories to win market share

High degree of diversification both on supply and demand sides: 300+ product items, direct ownership of farmlands and growing facilities, and a global supply infrastructure ensures ability to meet year-round customer demand and diversifies seasonality constraints for certain products, while also ensuring the business is not dependent on any one geography or grower for sourcing of produce.

Industry leading consumer awareness with the “Dole” brand in the US market

Leading global supply chain infrastructure giving it greater control over all aspects of production and supply of produce to out-compete peers on quality, cost and service.

Greater financial strength from combined balance sheet and operations which also provides a platform for growth via further M&A and organic initiatives.

Investment Thesis

Investing in TP at the current share price represents a compelling special value situation; the imminent merger and IPO is a transformative event that will create the global #1 player at a significant discount to fundamental business value based on US-listed and private market comparables:

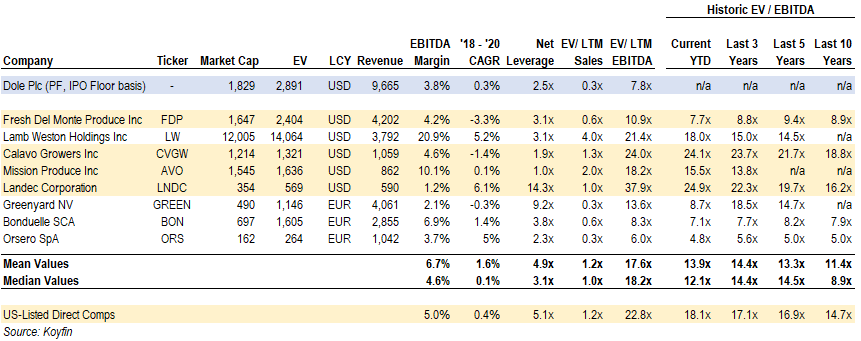

The IPO valuation floor creates Dole’s enterprise value at ~7.8x based on TP’s headline deal valuation calculation, which is a material discount to the current average LTM multiple of ~23x for Dole’s US-listed direct peers and a “through-the-cycle” average multiple of ~14.7x over the last 10 years.

M&A transactions involving comparable companies in the industry have historically completed at an average multiple of ~10x over the last decade.

The merger and IPO provide a clear and imminent catalyst that makes this a particularly compelling opportunity; post-listing on the NYSE, I expect Dole to re-rate in line with US-listed peers to $44/share in my Base Case, which is equivalent to ~€5.28 per TP share on a pre-exchange basis, indicating ~110% upside from the current share price.

I believe a market re-rating of Dole is likely within a 12-24 month time-frame. The recent listing experience of peer Mission Produce (AVO), a much smaller and niche avocado producer, supports this thesis - AVO initially listed on the Nasdaq at $12/share (~11x) in Oct-20, before re-rating to $21/share (~16x – 17x) by Feb-21.

While this is primarily a unique value situation, Dole also possesses a number of attractive investment characteristics that support a valuation re-rating in line with listed peers’ levels:

Competitive Position – post-merger, Dole will be ~2x larger nearest peers Greenyard and Fresh Del Monte, and its global scale, diversified product offering and financial strength provide clear competitive advantages over its peers.

Stable, Predictable Business – as an essential consumer staples business, Dole generates consistent and predictable revenues and earnings, making it less susceptible to wider market volatility, business cyclicality and disruptive trends that impact other industries. This again makes the valuation upside all the more compelling against these defensive qualities.

Consumer Trend Shift – the consumer shift towards wellness including healthier eating and nutrition is well documented, and Dole is well positioned to capitalise on this continued shift as the world’s largest fresh produce group. This also supports a consistent, long-term growth trajectory for the business.

ESG & Sustainability – In tandem with health and wellness, sustainable consumption patterns are being increasingly emphasised as part of the wider ESG theme. The fresh produce category has the lowest ecological, water and carbon footprints compared with other foods and given both TP and DFC’s emphasis on sustainability best practices, Dole is well positioned to benefit from growing ESG-conscious investors and consumers, which is again supportive of future growth.

Finally, a highly compelling feature of this opportunity is the asymmetric return profile, with upside of ~3.3x the downside risk – it is rare to find such an asymmetric return/risk opportunity, particularly for a consumer staple stock.

How Much Can I Make? – Valuation Analysis

Summary Valuation Analysis

Source: Value Situations analysis based on disclosures per Scheme of Arrangement Circular.

In a Base Case I estimate Dole’s EV at ~$5.9bn with the equity worth ~$4.5bn, assuming a 14.5x in line with the long-run average multiple for its US listed peers. This equates to ~€44 per new Dole share or ~€5.28 on a pre-exchange basis for current TP shareholders, assuming USD/EUR FX of $1.20: €1.00.

The 14.5x multiple is applied to earnings power (EBITDA) of $406m, being LTM PF EBITDA of $371m for the combined TP/DFC entity, plus $35m of expected synergies (being midpoint of expected synergy range of $30m - $40m identified by TP management).

In arriving at my equity value, I also include a number of adjustments to EV not factored into TP’s headline deal value calculations as outlined in the Transaction Circular:

Both TP and DFC operate DB pension schemes which are currently underfunded by a combined ~$154m

Share of other JVs and Associates – EBITDA reflects Dole’s share of EBITDA from other JVs and associates, therefore the value of these investments needs to be deducted from the EV in arriving at equity value

Non-Operating RE Assets – TP owns investment properties in Ireland, UK and Czech Republic and DFC owns ~5,000 acres of land for sale in Hawaii. These assets are not used for business operations and so are deducted from EV in determining equity value.

For context, the current TP share price implies a 9.6x multiple for Dole including my additional adjustments to EV, which remains well below peer valuations and indicates there remains significant upside despite the share price increase since the deal was announced in February.

Debt and cash balances of $1.1bn and $0.2bn respectively reflect the post-IPO position with net cash proceeds from a $600m equity raise, and the $1.4bn debt refinancing. See Appendix 1 for the PF Combined Financials for Dole Plc.

My Base Case implies a return profile of ~45% IRR / 2.1x MOIC over an expected 2 year investment term, assuming an entry price at the current TP share price of ~€2.52.

In an Upside case, I estimate Dole’s equity is worth ~$5.5bn, or ~$54/share (equating to €6.48/share on pre-exchange basis for TP shares). This assumes a 17x multiple, more in line with the recent 3 year average multiple for US peers on PF EBITDA of $406m including synergies. This implies a return profile of ~65% IRR / 2.6x MOIC over the expected 2 year investment term.

Valuation Multiple

In concluding on valuation multiples, the below benchmark analysis compares Dole vs. US listed peers on 4 key criteria – Scale, recent growth trajectory, EBITDA margins and Leverage:

Source: Value Situations analysis.

The above benchmarking is based on Dole’s most directly comparable US peers – Fresh Del Monte Produce, Calavo Growers, Mission Produce and Landec Corporation. Refer to Appendix 2 for further detail on peer group financial metrics.

Dole scores better than its direct peer group in terms of scale and leverage, while approximately matching peers on recent growth. Dole’s lower PF margin vs peers shown above is before synergies – including synergies, Dole’s margin improves to 4.2% which improves the comparison.

Given Dole’s scale, market leadership, predictability of revenues and earnings, and it’s competitive advantages over peers, a multiple of 14.5x in line with its peers’ long-term average multiple is entirely reasonable and possibly conservative vs. peers more recent valuation levels.

In an Upside Case, I assume a re-rating in line with the more recent 3 year average peer multiple – again considering Dole’s competitive advantages such a re-rating is not implausible, particularly in light of the stronger expected growth rate of 2% - 3% for the business going forward.

Regarding private market valuations, precedent M&A transactions involving comparable companies have completed at an average multiple of ~10x:

Source: Company filings; Value Situations analysis.

Given the Dole thesis is driven by the imminent US market listing and an expected re-rating in line with valuations ascribed to its peers in the public markets, I see private valuation multiples as less relevant to this situation. However, compared to the headline floor valuation of 7.8x, precedent M&A transactions clearly indicate undervaluation of Dole’s equity at the floor value and support a re-rating thesis.

EBITDA Earnings Power

For both the Base and Upside Cases, earnings power is assumed to be the PF FY20 EBITDA of $371m for the combined business plus synergies of $35m, being the midpoint of TP management’s expected synergies range of $30m - $40m achievable post-merger.

Given that TP already owns 45% of DFC and the fact that the two companies have worked closely together for nearly 3 years now, the groundwork for full integration has effectively been laid already. I therefore see little risk to these synergies not being realised on a full integration of the two companies.

It is also worth highlighting that I am assuming the LTM adjusted EBITDA is representative of normalised earnings power in valuing Dole, which I believe is conservative as it does not reflect the future earnings growth that is likely to materialise for the combined business from synergies, efficiencies and the positive growth outlook for fresh produce.

How Much Can I Lose? – Downside Risk

In a worst case, I estimate downside risk at ~$14 per share post-IPO (equivalent to ~€1.68/share for current TP shares on pre-exchange basis), which indicates downside of ~33% vs. the current TP share price:

Source: Value Situations analysis based on disclosures per Scheme of Arrangement Circular.

A 7x multiple reflects a bottom-of-the-cycle valuation, being based on David Murdock’s IPO of DFC on the NYSE post the GFC in 2009 at 7.1x. As such, 7x represents a market-trough multiple for valuing Dole in a worst case.

The ~33% downside implies upside of 3.3x the downside risk under the Base Case, and almost 5x the downside risk in the Upside Case, illustrating just how asymmetric the returns are for this situation.

Alternative Downside Scenario

It’s also worth considering an alternative downside scenario where the merger and IPO is aborted due to a failure to reach the floor valuation for C&C’s interest.

Given the very low bar for the IPO at the 7.8x floor, an IPO fail scenario seems improbable. However should the merger fail, this could put DFC in play with TP peer Greenyard being a possible buyer of TP’s 45% holding in DFC, as part of wider takeover of DFC by Greenyard itself – notably Greenyard previously tried to acquire DFC outright in 2017 prior to TP’s 45% acquisition in 2018.

In this alternative downside, I estimate downside risk to be €2.20 per TP share, or -12% vs. current TP share price, based on the following assumptions:

TP is valued on a standalone (ex-DFC) basis at 7x (in line with it’s historic standalone average multiple, which reflects its status as an Irish-listed small-cap) and;

Greenyard (or other) acquires DFC at a 9x valuation (in line with TP’s multiple paid for the 45% in 2018), realising ~€314m in after-tax proceeds for TP

Source: Value Situations analysis.

In this alternative downside scenario, the asymmetric return/risk profile is even more pronounced at ~9x upside vs. downside risk under the Base Case, further emphasising how attractive this situation is.

Variant Perception - Why Does This Opportunity Exist?

This opportunity exists simply because the principal shareholders on both sides (the McCann family for TP and C&C for DFC) have pitched the IPO at a floor value well below public US peers in order to ensure the IPO succeeds and creates value for themselves and all shareholders.

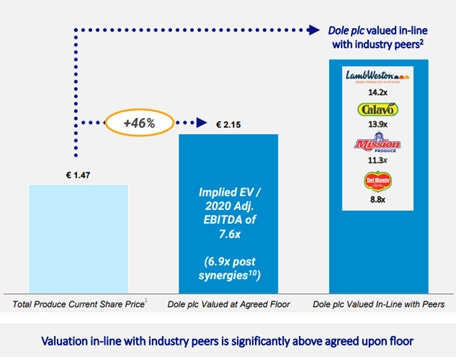

The key shareholders clearly see a subsequent re-rating in line with peers as inevitable given the scale and competitive position of the combined business, and indeed TP explicitly reference this in the transaction announcement materials released in February this year:

The Board of Directors of Total Produce believes there is significant further upside to the value creation potential, assuming that Dole plc can achieve a public trading valuation in line with relevant industry peers.

The Valuation Floor implies a valuation of Dole plc of approximately 7.6x 2020 EV / Adjusted EBITDA (6.9x including synergies), which the Board of Directors of Total Produce believes is meaningfully below the valuation levels observed in public markets for relevant comparable companies.

Source: “Total Produce to Combine with Dole Food Company and become Publicly Listed in U.S.,” Transaction Announcement, Feb-17.

The extent of the value gap between the IPO floor and public peer valuations is even illustrated by TP in the deal announcement presentation from February, from which it is clear the intention is to drive a value re-rating in line with peers:

Source: The Premier Global Leader In Fresh Produce, Transaction Announcement Presentation, February 2021

Note: the 7.6x multiple referenced in the extracts above come from the February deal announcement materials, and differ slightly from the 7.8x referenced earlier in the memo due to FX and some minor adjustments to EV and multiples calculations outlined in the subsequent May 2021 Transaction Circular document.

This implied valuation gap has not been arbitraged away despite the compelling set-up as TP (and the deal itself) remains overlooked by virtue of TP being a small-cap on the peripheral Euronext Dublin and AIM exchanges, with little analyst coverage (2 brokers), while DFC itself is privately held and so has no analyst coverage.

A further reason for this mis-pricing is the perceived complexity and uncertainty involved with the two-step merger and IPO transaction process – the deal is not a simple merger and there are approvals and conditions to a successful completion. However as outlined in the Risk To Thesis & Mitigants section below, there are clear mitigants to these perceived risks which the market has yet to appreciate and re--price into TP’s shares.

Catalysts to Value Realisation

The TP / Dole situation benefits from a live and imminent catalyst to value realisation, being the IPO and commencement of trading on the NYSE in Q3 FY21.

Given the combined attractiveness of Dole’s scale, global #1 competitive position, strong Dole brand in the US market and the low floor valuation, it can be reasonably assumed that the IPO has a high probability of completing successfully.

On the evidence of the most recently listed US food produce businesses, Mission Produce and Lamb Weston, a valuation re-rating for Dole should occur within 12 months of listing:

Lamb Weston listed at 7.5x in Oct-16 and re-rated to ~14x by Mar-17 (~5 months)

Mission Produce listed at 11.1x in Oct-20, re-rating to ~15x by Feb-21 (~4 months)

In addition to Dole’s fundamental investment attributes, the enhanced liquidity, profile and analyst coverage that will come with a NYSE listing will further catalyse a re-rating for Dole’s stock as it becomes eligible for wider investment among US investors and funds.

At the ~$1.8bn market cap implied by the IPO valuation floor, Dole would be eligible for inclusion in the Russell 2000 and S&P Small Cap 600 indices – given how widely followed these indices are by index funds and ETFs, Dole’s share price should be supported by significant capital flows into the stock as a result, thereby contributing to a re-rating towards my Base Case valuation.

A final catalyst that should drive Dole’s re-rating is the likelihood of a steady and growing dividend – like many consumer staple stocks, TP has a long track record of paying regular, consistently rising dividends over time:

Notably, the Transaction Circular for the merger discloses that “Following completion, Dole plc intends to pay quarterly cash dividends on our ordinary shares at a level consistent with Total Produce’s historical dividend track record.” As such, Dole should attract substantial capital inflows from income funds and dividend investors.

Risks To Thesis & Mitigants

I see five key risks to the Dole thesis, each of which have clear mitigants in my view:

Transaction Approvals – the merger is structured as a share exchange under a Scheme of Arrangement, and therefore requires TP shareholder approval and approval of the High Court of Ireland under Irish company legislation. The overall transaction and de-listings will also require TP shareholder approval. There is therefore the risk of the relevant approvals not being obtained and the deal failing.

Mitigants – the risk of shareholder approval not being obtained is low given the clear value creation and increased liquidity that the deal offers. Furthermore, the McCann family and insiders hold ~15.2% of TP’s stock and so control a sizeable block of shares for securing the vote.

Regarding High Court approval, schemes of arrangement are a common means of corporate restructuring, including for M&A transactions. As such, there is nothing controversial or problematic from a legal standpoint in TP implementing such a scheme to facilitate the merger. In order for the scheme to obtain court approval, TP will need to demonstrate that all relevant legal steps have been appropriately taken (e.g. notifying all shareholders of scheme, no coercion of shareholders, scheme might be reasonably approved by shareholders etc). Given the compelling business case for the merger, TP’s clear communication of the deal to shareholders, and TP’s strong corporate governance track record I believe the risk of a court not approving the scheme to be remote.

IPO Fails – completion of the IPO is subject to 2 key conditions, being the floor valuation of $215m for C&C’s 17.5% interest, and a secondary sale of shares by C&C for at least $50m as part of the IPO. The risk is that the IPO pricing fails to achieve the minimum floor level and C&C fail to realise $50m from a secondary sale of shares.

Mitigant – at the headline 7.8x multiple implied by the valuation floor, the IPO is being pitched at a substantial discount to US peers to ensure a successful floatation. This low entry point combined with the clear and obvious value creation opportunity would indicate that the risk of the IPO failing on minimum valuation grounds is highly unlikely.

No Re-rating post-IPO – a key risk to the thesis is that the expected valuation re-rating does not occur for some reason post Dole’s listing on the NYSE.

Mitigant – a failure to re-rate from current implied levels post-IPO seems highly unlikely given the strongly favourable investment characteristics for the combined business as already outlined – global #1 player in a predictable, stable industry, listing at a significant discount to peers, with increased liquidity, analyst coverage and strong prospective dividend.

Value Destruction post-merger – as with all M&A deals, there is a risk of value destruction due to poor integration and a failure to realise expected synergies.

Mitigants – the risk of value destruction and failed integration in the deal is low, given that TP already owns close to half of DFC and the two companies have worked closely together since 2018.

In addition, these two businesses are highly complementary from an integration standpoint, and a strong understanding of operations and how to fully integrate the two companies is already in place. Essentially, the groundwork for integration has already been laid and therefore this risk would appear to be remote.

Input Cost Inflation and Margin Erosion – the business is exposed to commodity cost inflation, as it depends on inputs such as fuel, containerboard, fertilizers, plastic resins and other commodity costs used in growing, packaging, manufacturing and distributing produce. Commodity cost increases could therefore erode margin and reduce the earnings power underpinning fundamental value.

Mitigant – given the essential staple nature of Dole’s products and the increasing demand for fresh quality produce, the business is well positioned to pass cost increases on to consumers to mitigate margin erosion. Furthermore, commodity cost inflation would impact all industry players, however with its scale advantage Dole is best positioned to outperform peers given its greater economies of scale.

Notably, as volumes of certain products declined due to the COVID-19 pandemic during FY20, both TP and DFC were able to increase prices across all segments to offset volume declines, enabling revenues to grow by 1.7% YoY for TP, and by 3.5% for DFC.

Appendices

PF Financials for Dole Plc

Source: Total Produce Plc Transaction Scheme of Arrangement Circular, 19 May 2021

Peer Group Trading Metrics

Source: Koyfin; Value Situations analysis

DFC is the largest on a standalone basis based on FY20 EUR/USD FX; Greenyard NV is marginally the #2 player with reported revenues of €4bn for FY20, equating to $4.6bn using average FX rate for FY20 of ~$1.14.

Guess the revised IPO range doesn't change your thesis much? you initially estimated TP shareholders' ownership in Dola at ca 55% it's now being reduced from 61.5% to 57.1% using the new range? thank you

Thanks for sharing! Nice write up. Is there a time gap between the de-listing and US IPO that we cannot trade the stock?