Disclaimer

Value Situations is NOT investment advice and the author is not an investment advisor.

All content on this website and in the newsletter, and all other communication and correspondence from its author, is for informational and educational purposes only and should not in any circumstances, whether express or implied, be considered to be advice of an investment, legal or any other nature. Please carry out your own research and due diligence.

Following my recent preoccupation with all things macro, in this week’s Bulletin I’m returning to the primary focus of this newsletter, namely undervalued public equity situations.

UK Equities Look Cheap

Between the dysfunctional Tory government, UK gilt market volatility and the GBP exchange rate, there are perhaps good reasons for UK equities appearing statistically cheap at present, but amid all this noise there is also a sense that “UK Plc” is now on sale.

In this week’s Bulletin, I highlight what I think are some interesting situations within this theme that I think are worth monitoring.

KAPE

I’ll start with a name I’ve mentioned before, KAPE Technologies Plc (KAPE).

KAPE is a consumer-focused cybersecurity SaaS business specialising in digital privacy (VPN) and security software. It’s stock is down ~48% YTD, perhaps reflecting a “double-whammy” of it being out of favour as both as a duration-tech beneficiary of the previous low-interest rate regime AND a UK-listed stock (note the UK small cap FTSE AIM 100 index is down ~38% YTD, reflective of wider UK macro concerns).

Following its transformative acquisition of privately held US peer ExpressVPN last year, which effectively doubled the size of the business, KAPE is on track to deliver EBITDA of ~$170m this year (despite being UK-listed, KAPE reports in USD). Furthermore, it recently completed a ~$223m equity placing, reducing its net debt to ~$172m on my numbers, implying it is now valued at just 7.6x FY22 EBITDA with this cash now on the balance sheet.

This is an extremely low valuation for this kind of business based on recent market market evidence and noting ~50% of KAPE’s customers are US-based (i.e. its not a pure UK business). KAPE itself acquired ExpressVPN for ~12.5x, while Norton LifeLok acquired Avast Plc for 18.5x, and a private equity consortium led by Advent International and Permira Advisers acquired McAfee Corporation at ~17.8x last year.

Admittedly it is possibly hard to argue that KAPE merits an 17x - 18x multiple today given rising rates and the regime shift in markets with respect to tech-duration names, but a more measured re-rating to 12.5x (either via public or private markets) implies KAPE offers ~75% upside from here.

In this light KAPE seems a very plausible takeover target now, against a favourable backdrop for UK tech targets despite recent macro-concerns - note OpenText’s acquisition of UK-listed MicroFocus International (at a 99% premium) and Schneider Electric’s deal to acquire Aveva. Furthermore, there remains ample dry powder among tech-focused PE firms, with some even recently agreeing to complete acquisitions with 100% equity given the dislocation in leveraged credit markets.

In such an environment, KAPE’s very low valuation make it a genuine takeover target in my view.

DLN

Derwent London Plc (DLN) is a central London-focused prime office REIT, that is down ~40% YTD and is now trading below its COVID pandemic low of ~£23.60/share (valued at ~£20/share at the time of writing). Furthermore, on a fundamental valuation basis, DLN currently trades at a P/NAV multiple of 0.5x, which is again below its COVID valuation trough of ~0.6x during the summer of 2020, at the height of the “death of the office” narrative.

Clearly at these levels the market is pricing in a significant decline in the underlying value of DLN’s office RE portfolio, driven by rising interest rates. DLN has historically traded at a ~280bps spread to the UK 10 Year gilt, which would imply a yield of ~6.7% for DLN in the current rate environment. Applying this to DLN’s stabilised rent which I estimate at ~£268m (including contracted rent increases, pre-lets and completion of its current developments but still allowing a 5% vacancy rate across the portfolio) implies a portfolio value of ~£4bn, or -32% vs. the most recently reported valuation of ~£5.9bn. So the market expects a ~£1.9bn writedown to DLN’s portfolio off the back of rising rates. Backing this re-priced portfolio into DLN’s NAV implies a PF NAV of ~£24/share or ~16% above the current share price (or a current P/NAV of ~0.83x in the new rate environment).

On this high level analysis, the value discount here may not seem that compelling, but there are a number of factors that I think could support valuation above £24/share in the medium term:

Firstly, DLN owns very well located prime assets in central London, one of the most liquid and resilient office RE markets, which should continue to attract blue chip occupiers and capital over time;

Despite current economic uncertainty, London remains a global city and its office market is characterised by limited supply of prime Grade A stock;

The type of high quality, amenity-rich office accommodation offered by DLN remains in demand among occupiers seeking to attract and retain talent;

Being a real asset class, real estate is a beneficiary of inflation as rents rise over time while the replacement cost of the physical real estate also rises as materials costs increase;

DLN is very lowly geared at a ~24% LTV, and 90% of its debt is fixed with only ~£83m (just ~6% of net debt) due for refinance prior to 2025 - this is value accretive to DLN’s equity in real terms as the debt value remains fixed while the real asset value (replacement cost) of DLN’s RE rises with inflation over time.

Finally, at 0.5x NAV, DLN is surely a takeover target for PE-RE capital, given there is currently ~$700bn of dry powder globally for real estate and real assets (Pitchbook data, Q2 2022). Furthermore, recent market activity clearly demonstrates appetite for prime office portfolios among PE buyers, with Brookfield’s recent acquisition spree of a number of prime office REITs in Ireland, Belgium and Germany being a notable example of this.

WG

Energy services/EPC contractor Wood Group Plc (WG) is another name I’ve written about before, and one which I think looks increasingly interesting following recent developments in the UK with regard to energy security and potential renewed oil and gas sector activity.

WG is currently trading at ~3.5x LTM EBITDA, which reflects a depressed level of earnings following write-offs and project delays in FY21, and which compares to a normalised through-the-cycle multiple of ~7x-8x. While EPC businesses have historically been prone to boom-to-bust cycles and as such have made poor investments, when bought into at the right point in the cycle they have substantially outperformed the energy majors as WG’s performance through the previous cycle indicates:

What is interesting about WG now is that it trades at what feels like a trough valuation at what is possibly a very opportune moment in the cycle for UK and European energy investment. Furthermore at the idiosyncratic level, WG has transitioned its balance sheet to a net cash position following the sale of its Built Environment unit, and has meaningful exposure to LNG, decarbonistion and renewables making it well placed to benefit from both the wider energy transition as well as traditional energy security. As such, it looks like a very interesting set-up.

SLP

Amid my concerns around inflation and stagflation, a name that has caught my attention recently is Sylvania Platinum Limited (SLP), a UK-listed, South Africa-based producer of platinum group metals (PGMs, including platinum, palladium and rhodium). The company operates across two business lines: (1) re-treatment of PGM-rich chrome tailings (i.e. waste) material from mines in South Africa and (2) development of shallow mining operations and processing methods for low-cost PGM extraction. SLP is a low-cost producer, operating in the lowest quartile of the industry cost curve.

SLP’s main product is rhodium, accounting for ~56% of FY22 sales, a major use of which is as a catalyst in catalytic converters in cars, which helps reduce nitrogen oxide emissions. Emission targets imposed by various governments in recent years have driven demand from the auto industry for PGMs. However, a widely held view now is that with the proposed phasing out of internal combustion engine (ICE) cars in favour of electric vehicles, the longer-term demand outlook for PGMs such as rhodium is weak.

However this is a misguided view, given that a world of all-electric cars is a long way off (despite policy makers claims and targets) for a variety of reasons, not least the cost and lead time involved in sourcing copper and battery materials to actually make this a reality. Furthermore, hybrid vehicles actually use greater amounts of PGMs than ICE vehicles, meaning that PGM demand is likely to increase in the interim.

Additionally, as with many key commodities, the Russian invasion of Ukraine has a bearing on SLP’s prospects also - Russia accounts for ~80% of global rhodium supply and a possible ban on Russian metals exports could trigger a renewed rise in PGM prices, to the benefit of SLP.

With a supportive backdrop for PGM prices given constrained supply vs. demand and inflationary tailwinds, SLP’s valuation looks compelling - it currently trades at just ~2x LTM EBITDA / 3x LTM FCF with a debt-free balance sheet (cash is ~40% of its current market cap). Furthermore, it currently offers an inflation-matching ~8% dividend yield that is likely to grow further, making it a very interesting value situation in the current market.

Any Other Business

As Warren Buffett has said, investing is simple but not easy.

Amid all the market noise, volatility and uncertainty this year, it is interesting to note that one very simple trade has outperformed the market by a VERY wide margin.

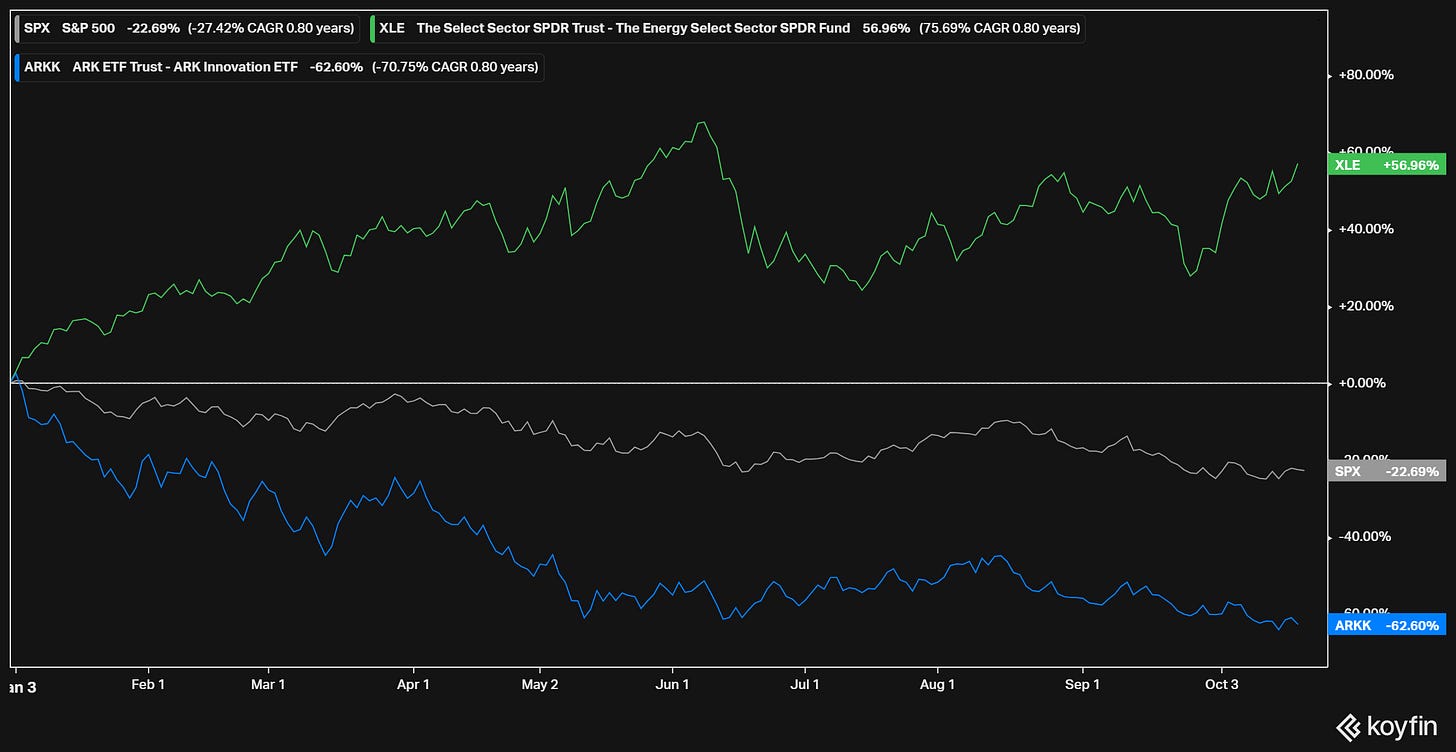

The US Energy Sector, as represented by by the XLE ETF, is the only positive performing sector of the US stock market this year and if you had gone long XLE at the start of the year, you would be up ~57% YTD:

Furthermore, this 57% return YTD compares to a ~23% negative return for the SPX, implying relative outperformance of ~80% vs. the broader US stock market!

Interestingly, an even better trade would have been going long XLE while shorting Cathie Wood’s ARK Innovation Trust (ARKK) which is down ~63% YTD, which perhaps best captures the regime shift in markets over the last ~12 months (new tech economy is out of favour, old real economy is back in):

While hindsight is all well and good here, it is also true that both energy inflation and the post-COVID “tech wreck” were known themes emerging at the end of last year, so this observation is somewhat frustrating to me!

This also begs the question has all the money now been made on the energy trade?

Another chart provides some food for thought here - even after its re-rating YTD the US energy sector still only accounts for ~5% of the SPX in terms of market cap, below its historic average of ~8% over the previous cycle and well below its peak of ~16% during the 2008 energy crisis:

Source: Liz Ann Sonders

In a world short of energy and an ongoing energy crisis, it is surely reasonable to believe the US energy sector could at least revert to its historic mean market cap, and perhaps even exceed it. I actually think it very plausible that the sector could double in value to ~10% of the SPX given the current energy market backdrop, and implications of such a scenario are fairly obvious - a significant further re-rating of US energy stocks is still to occur.

Why Not Subscribe to the Paid Tier?

If you find the ideas in this newsletter interesting, please consider signing up to the Paid Tier.

You can read more about the paid offering here.

This newsletter is 100% reader supported and free from conflicts of interest or other commercial considerations. In writing Value Situations my job is essentially to generate ideas for subscribers that supplements their own idea origination process.

Furthermore, I believe the value proposition for paying subscribers is compelling. I am a former private equity/special sits investor that has worked with one of the largest alternative investment firms in the world, and so paying subscribers will be getting thoughtful, buy-side quality ideas and analysis for a very small fraction of the cost of employing a buy-side analyst full-time.

If you find this newsletter interesting, please also consider sharing it with friends and colleagues by clicking the Share button below.

Here’s what other investors are saying about Value Situations:

Value Situations was named as one of the Top 100 Must Follow Stock Research accounts by Edwin Dorsey of The Bear Cave Newsletter:

How is the Sylvania Platinum situation following their FY results reported on 26th September?