Weekly Bulletin #26

Hedge Funds & Energy vs. Tech | Commodity Shortages | Nuclear Renaissance | DOLE Plc Activist Aboard?

Disclaimer

Value Situations is NOT investment advice and the author is not an investment advisor.

All content on this website and in the newsletter, and all other communication and correspondence from its author, is for informational and educational purposes only and should not in any circumstances, whether express or implied, be considered to be advice of an investment, legal or any other nature. Please carry out your own research and due diligence.

Top Hedge Fund Holdings & Energy vs. Tech

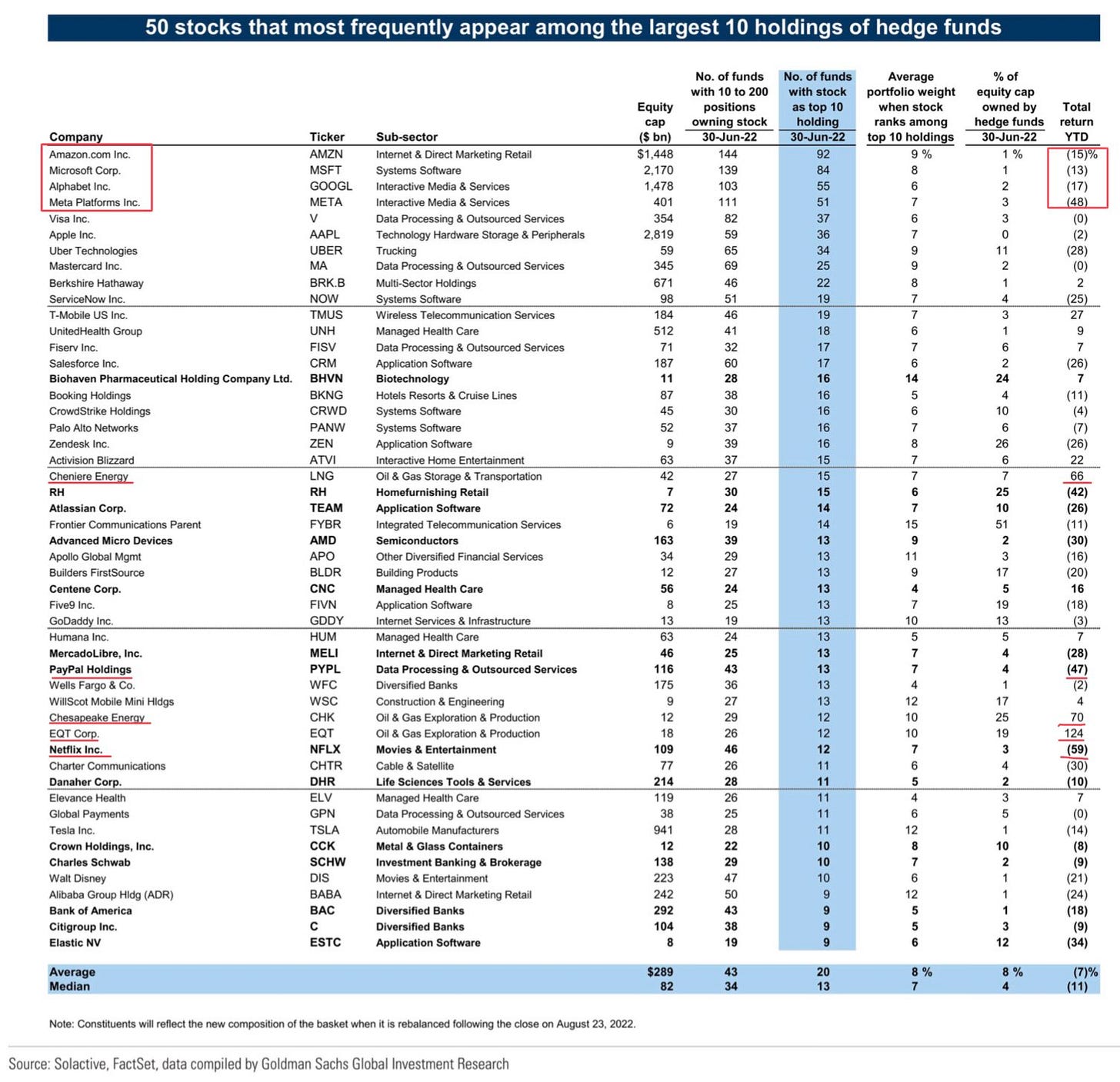

I read with interest a recent Goldman Sachs list (as of 23 August) of the top 50 largest stock positions held by hedge funds. The main takeaway for me is that the FAAMG complex remains strongly held despite the post-COVID tech bubble bursting this year:

Source: Goldman Sachs Investment Research (h/t Wasteland Capital).

The list covers the top holdings based on Goldman’s list of 589 hedge funds. The average return across the top 50 is -7% for the YTD period with the top FAAMG names all posting double-digit negative returns within this. By contrast, the top 3 performers on the list are all energy names - EQT Corporation (EQT) up +124%, Chesapeake Energy (CHK) up +70% and Cheniere Energy (LNG) up +66% in the period.

Looking at sectoral performance vs. the broader market YTD, tech (as denoted by the NASDAQ and XLK) has been a losing bet all year, while energy has strongly outperformed:

What is also interesting is that even with the rollover in energy and commodity prices approaching the June quarter-end, the energy sector has still outperformed the broader market and tech since then, yet the top hedge funds still hung on to their large-cap tech positions:

Holding onto the tech names was most likely done on the assumption of a Fed pivot on interest rates tightening further, yet as last week’s Jackson Hole meeting indicated, there will be no pivot anytime soon, and rates will continue to rise higher.

As I’ve written before, while higher rates will certainly hit demand for commodities to some extent, they will also limit capital investment into already-constrained supply too. This implies further under-investment in essential commodities on top of ongoing supply disruption due to adverse weather and the Russian invasion of Ukraine impacting everything from energy, to fertilisers, to crops, to manufacturing.

On this basis, it is difficult to see how higher rates solve the inflation conundrum when financing is only one variable, and central banks and capital markets have no control or influence over these other variables.

Commodity Shortages

On the topic of key commodity shortages, there were a number of concerning headlines over the past week relating to the European energy crisis and the knock-on effect on supply of essential products such as fertiliser and CO2 for the food industry:

To my point above, it is hard to see how higher rates will resolve or even cool inflation that is itself a product of collapsing production.

Nuclear Renaissance Continues?

The nuclear power/uranium thesis gained further traction over the past week at both the political / energy policy level and in the equity markets.

Firstly, Japanese PM Fumio Kishida announced the restart of idled nuclear plants and that the Japanese government was looking at developing new next-generation reactors. This is a significant policy u-turn for Japan and comes ~11 years after the Fukushima disaster led to the idling of Japanese nuclear plants. The move is motivated by the Russian invasion of Ukraine and the need for greater energy security, as well as climate targets.

On this news, both Dr. Michael Burry and Elon Musk tweeted about the need for increased nuclear power, generating further interest in the theme and contributing to a rally in nuclear names in recent days - Burry’s tweet from last Wednesday:

Musk also subsequently tweeted the following:

The equity markets duly reacted with uranium names rallying strongly - the Sprott Uranium Miners ETF (URNM) is up ~25% since then, well ahead of the US energy sector (XLE) and compares to negative performance for the SPX, and tech benchmarks XLK and ARKK:

Currently the spot price of uranium is ~$49/lb, approaching the long-term incentive price of $50 - $60/lb for many producers; with Japan now representing another source of new, incremental demand while the market remains in structural deficit, the outlook for uranium is very bullish in my view.

Dole Plc - Activist Aboard?

Some notable news emerged with regard to Dole Plc (DOLE) yesterday, with the disclosure that Czech investor Jan Barta has acquired a 5.2% holding in the company, according to a 13D filing.

There are some notable aspects to this latest development:

Jan Barta has acquired this stake personally, but is a partner with Pale Fire Capital, a Czech investment firm that recently won board seats as part of an activist campaign at Groupon (GRPN)

Barta’s lawyer is Ryan Nebel of Olshan Frome Wolosky LLP, who specialises in shareholder activism; most interestingly, Nebel is also Ryan Cohen’s lawyer for RC Ventures - recall that RC Ventures was involved in both the GameStop and Bed, Bath & Beyond meme stock episodes.

Finally, it is clear that Barta intends to engage with DOLE management (and others) to “enhance” shareholder value following it’s disappointing performance to date since the IPO - as per the 13D filing:

The Reporting Person [Barta] purchased the Shares based on the Reporting Person’s belief that the Shares, when purchased, were undervalued and represented an attractive investment opportunity….. The Reporting Person intends to engage in communications with the Issuer’s Board of Directors (the “Board”), management team and other third parties regarding means to enhance shareholder value. [emphasis in bold mine]

This is certainly an interesting development for DOLE.

Barta has invested in the region of ~$45m in the stock, which is a substantial individual investment. I don’t expect he will have the same impact at board level at DOLE as his firm had at GRPN given the level of insider ownership at DOLE and the fact that it is a much larger company than GRPN. However, his investment and the choice of lawyer should at least draw attention to the stock, which is so obviously cheap now at ~7x EBITDA. Perhaps this is the first step to catalysing DOLE’s fundamental value over the coming months.

Any Other Business

For this week’s AOB I’m sharing a quote from Stanley Druckenmiller from his speech to the USC Student Investment Fund in 2021. I’ve been mulling over this in the context of the recent recession/inflation-stagflation debate and where corporate earnings are at present.

Speaking about his early investment career while working at Pittsburgh National Bank, Druckenmiller stated that one of the lessons he learned there was:

… never, ever think in the present. That’s a good way to lose money… if you can envision the world 12-18 months ahead, and not look at historic earnings or where we are now, you’ll make money.

This quote also reminded me of something Dr. Michael Burry wrote in a letter to his investors in 2006, which I had also previously referenced in my write-up of Dalata Hotel Group last year:

I have often repeated the mantra that a company’s worth is determined largely by its earnings starting three years from now.

This idea of future earnings power is particularly relevant in the context of input costs and commodity prices today; given my view of inflation and supply constraints, I see prices of essential commodities remaining elevated for the medium term at least. Therefore equities that are most likely to benefit from this are where I am focusing much of my attention on today.

Why Not Subscribe to the Paid Tier?

If you find the ideas in this newsletter interesting, please considering signing up to the Paid Tier.

You can read more about the paid offering here.

This newsletter is 100% reader supported and free from conflicts of interest or other commercial considerations. In writing Value Situations my job is essentially to generate ideas for subscribers that supplements their own idea origination process.

Furthermore, I believe the value proposition for paying subscribers is compelling. I am a former private equity/special sits investor that has worked with one of the largest alternative investment firms in the world, and so paying subscribers will be getting thoughtful, buy-side quality ideas and analysis for a very small fraction of the cost of employing a buy-side analyst full-time.

If you find this newsletter interesting, please also consider sharing it with friends and colleagues by clicking the Share button below.

Here’s what other investors are saying about Value Situations:

Value Situations was named as one of the Top 100 Must Follow Stock Research accounts by Edwin Dorsey of The Bear Cave Newsletter:

Good as always, Conor ... if you've read Doomberg's latest piece the association between Jan Barta and Steve Cohan via the same lawyer is not necessarily positive given what happened at Bed Bath & Beyond. Cheers John.