Weekly Bulletin #17

Countryside Partnerships In Play | Capricorn/Tullow Merger | HY Credit Spreads & Equities

Disclaimer

Value Situations is NOT investment advice and the author is not an investment advisor.

All content on this website and in the newsletter, and all other communication and correspondence from its author, is for informational and educational purposes only and should not in any circumstances, whether express or implied, be considered to be advice of an investment, legal or any other nature. Please carry out your own research and due diligence.

Another UK Homebuilder In Play

Following my recent commentary on UK homebuilders, Countryside Partnerships Plc (CSP) announced on Monday that it was putting itself up for sale. This news follows CSP’s recent rejection of two unsolicited takeover bids from US investment fund Inclusive Capital Partners (InCap). InCap had built a ~9.2% stake in CSP prior to announcing their interest, with their most recent offer of £2.95/share valuing CSP at £1.47bn, and reflecting a ~25% premium to the pre-bid trading price. In-Cap’s bid could be viewed as opportunistic however, given that CSP traded at ~£5.50/share in August last year, but has since declined ~50% attributable to operational issues and a profit warning in January that led to the departure of the previous CEO.

The current sale process is something of a victory for another activist investor on CSP’s share register, Browning West, who own ~15.3% of CSP and have been calling for a break-up of the business since 2020, including a sale of CSP’s private housebuilding unit to focus on its Partnerships business with affordable housing providers.

Following the sale process announcement, In-Cap has informed CSP’s board that it wants to be involved in the process, which is likely to attract bids from PE and other homebuilders.

Value Sits View

With the sale process now formally announced, CSP is very much in play and is likely to attract competing PE bids given the following market factors:

“UK Plc” is perceived as on sale, with UK assets constituting an attractive value play for US-dollar based funds given GBP/USD FX and the fact that UK listed companies are trading at a discount to both their historic valuations and vs. US public company valuations. Furthermore, with PE sitting on near-record amounts of dry powder, UK companies represent an attractive value proposition for funds that need to be deployed.

Within the UK Plc value theme, the UK building sector itself appears to be in play, given recent PE takeover activity in the space such as Apollo’s acquisition of Miller Homes, Blackstone’s acquisition of St. Modwen Properties and Lone Star Funds’ acquisition of McCarthy & Stone.

Real estate and housing has historically performed well in inflationary and stagflationary periods (see Weekly Bulletin #15 on this point) and given the current highly inflationary regime, UK housing would appear to offer some inflation protection for PE with undeployed capital, as evidenced by the recent takeover activity noted above.

So what is the potential value situation here?

In-Cap’s rejected offer of £2.95 is ~4% above CSP’s current share price, and equates to ~1.6x NAV. This at the low end of the range set by recent comps at 1.33x for St. Modwen and 2.4x NAV for Miller Homes. Assuming a midpoint of ~1.9x for CSP would imply a bid value of £1.7bn, or £3.41/share, a premium of ~21% to CSP’s current price. However, given Browning West’s original entry price into CSP in 2020 was ~£3.30/share, a higher bid will likely be needed to satisfy them - at say 2x NAV, the implied share price would be ~£3.63/share, a 28% premium to the current price but still only 10% above initial Browning’s entry price (Browning subsequently added to their original 2020 position so their blended entry price may now be lower than this).

Browning are the largest shareholder with ~15%+ of CSP’s stock and so will clearly influence (along with In-Cap) the outcome of a sale process. Given this existing shareholder base and likely PE bidder interest, this situation should benefit from healthy competitive dynamics and I’d expect a bid offering 30%+ upside within 12 months. As for downside, should a sale or other liquidity event fail to materialise (unlikely in my view given Browning and In-Caps involvement), I’d expect CSP’s share price to drop back towards the ~£2.40 level prior to In-Caps recent offer, implying a not spectacular but decent reward/risk ratio of ~2x (30%+ upside vs. ~16% downside to £2.40/share) within a 12 month term.

In a highly volatile and dysfunctional market such as we have today, special situations like this offer much better risk/reward than equities generally in my view.

Capricorn Energy / Tullow Oil Merger

In what is probably one of the worst deals I’ve ever seen for shareholders, Capricorn Energy Plc (CNE, formerly known as Cairn Energy Plc) recently announced that it has agreed to sell itself to Tullow Oil Plc (TLW) in an all-share combination. The stated rationale for the deal is the creation of a leading African energy company with a scaled and diversified portfolio of assets with strong production growth potential, along with a robust balance sheet and capital return programme. However, digging into the deal financials, it seems to me that the combination is a both a quasi-bail out for the overleveraged TLW (~2.2x EBITDAX) and an inexplicably discounted sale of CNE below market value, and well below the value of its assets.

The deal is being touted as a merger or equals based on the share-exchange structure, whereby CNE shareholders will receive 3.8068 new TLW shares for every 1 share held in CNE. The net effect of this based on the fully diluted share counts for both companies is that post-combination TLW shareholders will own 53% of the newly combined company (I’ll call this “New TLW”) with CNE shareholders owning the other 47%. But here’s where my first issue with the deal arises - currently TLW’s shares are trading at ~£0.55/share, and 3.8068 x £0.55 equals £2.09 of value which represents a discount of ~6% to CNE’s current share price of £2.22; in market cap terms, CNE is currently worth £773m (fully diluted) but the CNE board have agreed to sell the entire company in exchange for new TLW shares worth £726m (based on TLW’s current £0.55 share price). So this isn’t even a nil premium deal, it’s an openly discounted one!

This makes no sense, but this isn’t even the worst aspect of the deal. Digging into the numbers and CNE’s balance sheet it seems that CNE’s board are effectively giving the company away almost for free, or ~$10m to be exact based on my initial numbers as I outline below (note that while both CNE and TLW are UK-listed, they report in USD and so all analysis that follows is in USD based and assumes FX at ~$1.20 : £1.00 where applicable).

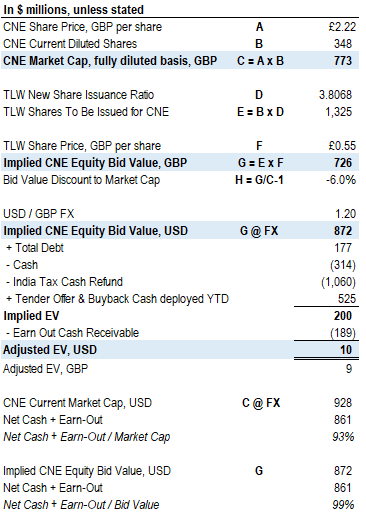

The table below outlines the effective consideration and valuation under the deal terms:

Source: Value Situations analysis.

As mentioned above, the share consideration for 100% of CNE is £726m or ~$872m at current FX, but CNE’s current EV is significantly lower at $200m after accounting for cumulative net cash of $672m comprised of the following:

Reported net debt of ~$137m ($177m gross debt - $314m cash)

An Indian tax refund of of ~$1.06bn received in cash in February, following the resolution of a legacy tax dispute with Indian authorities.

Adjustment for the $500m tender offer completed in April and a $25m share buyback programme implemented by CNE following the receipt of the Indian tax refund and funded out of the refund cash

This nets out to a current EV of $200m for CNE. However, CNE is also due a further $189m in earn-out payments relating to the sale of its interests in the Catcher and Kraken oilfields, two UK producing assets disposed of in November 2021. Including earn-out cash receivable, CNE has total cash/cash receivable of $861m, and including the earn-out component CNE’s adjusted EV is just ~$10m / £9m. This adjusted EV (based on TLW’s paper bid value) compares to CNE’s LTM EBITDAX of ~$72m and invested capital base of $2.1bn. In other words, TLW are effectively acquiring CNE for 0.14x EBITDAX and 0.005x IC !

Looking at this another way, the bottom section of the above table shows that CNE’s current market cap is ~93% covered by the ~$861m of cash plus earn-out receivable, but given the 6% discount under the bid, TLW’s offer is 99% funded by CNE’s cash/cash receivable - TLW is effectively paying $0.01 on the dollar to acquire CNE, and all in shares, not actual cash! And in return for this nominal, bankruptcy-esqe price, TLW is getting 100% of CNE’s ~$2.2bn in total assets!

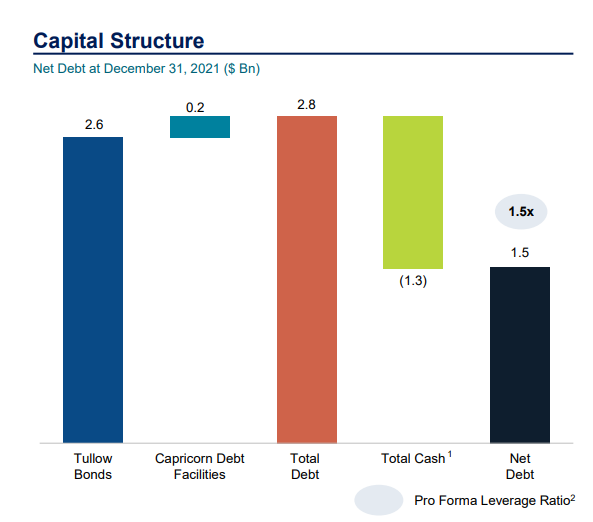

The obvious question is how can CNE’s board justify this deal to shareholders? The deal makes no sense for CNE while it makes plenty of sense for TLW, in that it provides it with a platform for production growth but most importantly it allows TLW to deleverage by combining with CNE’s net cash balance sheet. Post-merger, the New TLW will have a more sustainable net debt position of $1.5bn / 1.5x PF EBITDAX:

Source: Tullow Oil - Capricorn Energy Transaction Presentation.

This is surely one of the most egregious decisions by the board of a public company in quite some time, and particularly when one looks at the relative performance of CNE vs. TLW over the past 10 years and seeing what CNE is merging into:

TLW has lost ~95% of its market value over last 10 years; while CNE’s record isn’t all that great having lost ~63% of its value since peaking in August 2012, it at least is in a more stable position today prior to any TLW combination.

Value Sits View

My initial view is that although this appears to be a horrible deal for CNE shareholders, it is a very interesting value/special situation. To unlock the value and capture upside here, the situation needs an activist to step in and build a blocking position in CNE to pursue one of the following outcomes:

Push for a better offer from TLW and allow deal to complete - in a world where oil and gas prices are likely to remain elevated for some time, the prospective earning power of the combined business is significant, and substantial upside may be captured in time (note the TLW and CNE management teams project combined PF FCFF of $2.4bn at $75 oil and $3.6bn FCFF at ~$100 oil over FY22-FY25).

Block deal and return a portion of excess cash on CNE’s balance sheet to shareholders via special dividend or further backback, and oversee standalone production growth. The subsequent cash generation in this scenario should drive a re-rating of CNE on standalone basis and/or lead to a sale of the company at premium price once production comes online and substantial cash-flow materialises.

This is a situation I’ll be monitoring with interest.

US Silica Retains ISP Division

Finally, previous quick idea name US Silica Holdings Inc (SLCA) announced on Monday that it is retaining ownership of its Industrial & Specialty Products (ISP) commercial silica division after running a strategic review process over the past ~7 months. In the press release, the company explained this decision as follows:

…the Board unanimously determined that retaining ownership of the ISP segment represents the best path forward for U.S. Silica and its shareholders. In making its determination, the Board determined that a transaction would fail to provide superior value to shareholders as compared to the Company's standalone strategic and financial outlook, which has improved substantially since the review began. The Board also considered and is pursuing a refinancing of the Company's debt at more attractive terms than previously available.

CEO Bryan Shinn further commented:

"Since announcing the strategic review, the macro environment has improved dramatically. North America experienced a substantial rebound in energy prices and demand for our products and services has grown, fueling increased profitability, cash generation and a more robust overall financial profile. We continue to see strength across both business segments and remain focused on the execution of our strategy to drive growth and generate substantial cash flow while creating shareholder value.

In my view this is a disappointing outcome. It is true that the outlook has improved for oil and that the ISP business has demonstrated some pricing power with at least 4 price increases implemented over the past 18 months which is certainly appealing in the current inflationary environment. But SLCA remains highly leveraged at ~5x and a sale of the ISP division would have been a transformative event/catalyst for the company, allowing it to clear its ~$1.2bn of debt and providing excess cash to return to shareholders.

Furthermore, an ISP disposal would have resulted in a debt-free pure play frac sand player at a very opportune point in the cycle for oil and oilfield services. To me, this decision reflects either one of two things:

SLCA couldn’t find a buyer or achieve a satisfactory price for the ISP business; or

Management’s history of capital allocation is not good and they levered up to acquire EM Materials in 2018, which is the core of the ISP division today, leading to the overleveraged current position - perhaps seeing the improvement in the macro environment for commodities has prompted them to retain ISP as a means of saving face and not conceding defeat on the original EM deal?

In any event, SLCA’s stock is up +52% since I first wrote about it last August, and was up as much as 129% in April as the wider oil and oilfield services sectors rallied, before paring back recently. In my original thesis, the transformative sale of ISP was the key catalyst for unlocking value here and given that this is no longer in play I believe SLCA is a lot less interesting now.

Any Other Business

For this week’s AOB, I’m highlighting a chart of the S&P 500 (SPX) vs. yields on US 10 Year government bonds and US high yield (junk) debt over the last ~25 years:

The chart shows that historically the equity market has declined substantially when high yield (HY) debt yields start to rise - this is clearly evident in the three well known busts of past ~25 years, namely the 2000-2002 dot.com bust, the 2008 subprime collapse/GFC and the COVID market crash in March 2020. The other notable time this occurred was in late 2015/early 2016 when a confluence of macro factors (Greek debt default, Chinese stock market collapse, Brexit vote) resulted in a ~15% decline in the SPX that was ultimately short-lived, thanks to central bank supports.

Interestingly the SPX’s 20% drop into a new bear market this week was again presaged by rising HY credit spreads as the chart shows. However, this current situation is different in that unlike the previous market declines, the US 10 Year yield has risen in tandem with junk debt yields. The obvious explanation here is that in the historic crash episodes, the 10 Year yield went lower due to Fed intervention and buying of bonds to stabilise the markets. However, this Fed backstop isn’t available this time due to inflation running at a 40 year high of nearly 9%. So with no similar Fed support possible now given inflation (and indeed a surprise 75 bps interest rate hike possibly to be announced later today), further rate increases will happen meaning HY spreads will widen further. This suggests equities generally will decline similar to previous episodes in response to rising rates if the historic relationship charted above is to be maintained.

Why Not Subscribe to the Paid Tier?

If you find the ideas in this newsletter interesting, please considering signing up to the newly launched Paid Tier.

You can read more about the paid offering here.

This newsletter is 100% reader supported and free from conflicts of interest or other commercial considerations. In writing Value Situations my job is essentially to generate ideas for subscribers that supplements their own idea origination process.

Furthermore, I believe the value proposition for paying subscribers is compelling. I am a former private equity/special sits investor that has worked with one of the largest alternative investment firms in the world, and so paying subscribers will be getting thoughtful, buy-side quality ideas and analysis for a very small fraction of the cost of employing a buy-side analyst full-time.

If you find this newsletter interesting, please also consider sharing it with friends and colleagues by clicking the Share button below.

Here’s what other investors are saying about Value Situations:

Value Situations was named as one of the Top 100 Must Follow Stock Research accounts by Edwin Dorsey of The Bear Cave Newsletter: