Weekly Bulletin #11

Portfolio: Snapshot, DHG, KMR, PANR, YCA | Monitoring: BG, IPS, WG | Developing: Alphamin Resources (AFM)

Disclaimer

Value Situations is NOT investment advice and the author is not an investment advisor.

All content on this website and in the newsletter, and all other communication and correspondence from its author, is for informational and educational purposes only and should not in any circumstances, whether express or implied, be considered to be advice of an investment, legal or any other nature. Please carry out your own research and due diligence.

Following a break from publishing the newsletter last week due to the Easter holidays, this week’s bulletin is a bit longer than usual as I catch up on various updates from the past two weeks.

Model Portfolio

Portfolio Snapshot

I’ve written several times that I don’t believe short-term or quarterly performance measurement is all that meaningful, and I think one can modify a line from the FT’s Robert Armstrong that “one day’s trading always means less than you think” to a quarter’s trading (or price action) usually means less than one might think.

Nevertheless, in the spirit of investing convention and transparency in tracking my conviction ideas, I recently posted the March quarter-end performance for the Value Sits Model Portfolio. That update reported the portfolio was up +16.7% since inception of this newsletter on 14 June 2021, a pleasing absolute return performance first and foremost, but also comfortably outperforming the S&P 500 and European Stoxx 600 benchmarks and more than double the current rate of inflation (a particularly pertinent aspect of absolute return in the current environment).

The further (and expected) increases in inflation reported in the US and UK recently, with US inflation running at a 40 year high of 8.5% and UK inflation at a 30 year high of 7%, and growing concerns that interest rate hikes could trigger a recession prompted me to look at take a quick look at how the portfolio is reacting to such an evolving and uncertain market environment.

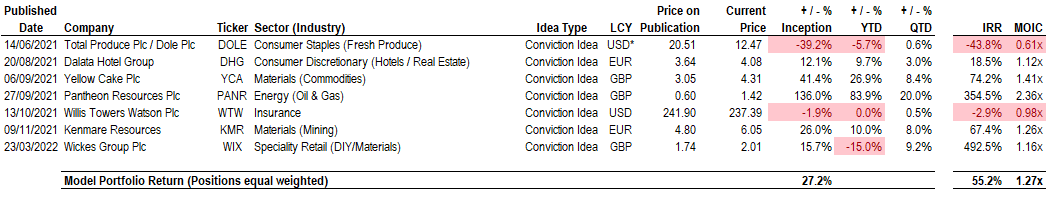

I should emphasise that I tend not to look at prices on a daily or even weekly basis and this latest (and arbitrary) portfolio look was prompted by curiosity more than anything else amid the rising macro and inflation noise. I had expected to see little movement on the previous quarter-end position (apart from Yellow Cake Plc given how the price of spot uranium has continued to rise) but I’ll admit I was pleasantly surprised to see that the portfolio return since inception has increased significantly since March quarter-end to ~27%,and on a current mark basis the Model Portfolio is now running at a ~55% IRR / 1.27x MOIC return profile:

Source: Value Situations analysis; Closing market prices as at 22 April 2022 per Koyfin. IRR calculation based on date of first publication of idea to closing price on 22 April and inclusive of dividends paid during period where applicable. Overall portfolio IRR reflects equal weighting across all names and assumed investment made for each name on date of first publication of idea.

In the QTD period, all names are up vs. previous quarter-end, with PANR, YCA, KMR and WIX being the main movers. It’s perhaps not that surprising to see the hard commodity names (PANR, YCA, KMR) move as they have given the inflationary regime we’re currently in, but interestingly WIX is now up nearly 16% since I published the idea last month despite the UK inflation rate and a consumer squeeze amid a cost-of-living crisis.

Of course, I shouldn’t read too much into such short-term movements (this could all reverse this week!) but I do find the portfolio’s reaction to heightened inflationary concerns encouraging. It is performing as intended, benefiting from the idiosyncratic nature of each position.

And now on to some brief updates for four model portfolio names from the past two weeks.

DHG

The first update is a correction regarding my previous analysis of the Tristan Capital Partners/Raag Hotels Limited transaction and the implied read-across for Dalata Hotel Group (DHG).

I’ve subsequently obtained further market intelligence that the deal valued the overall Raag Hotels/Point A portfolio at £420m for 100% of the group, and not 50% as previously imputed from the (limited) public disclosures and reporting around the deal. The net result of this is that Tristan are buying into the Raag/Point A portfolio at a value of ~£276k/room, and not £658k/room as previously understood.

This nonetheless still implies DHG’s portfolio is valued in the public market at a substantial discount to its private market value - applying the Tristan bid value just to DHG’s freehold (owned) portfolio of ~6,200 rooms implies an equity value of ~€1.8bn (net of financial debt) or €8/share (~2x the current share price), and this ignores any value attributable to DHG’s 4k+ room leasehold portfolio or its ~1.6k room development pipeline.

KMR

Kenmare Resources Plc (KMR) recently published a Q1 production update just before the Easter holidays, with the key takeaways as follows:

Heavy Mineral Concentrate (HMC) production increased 6% in Q1 2022 to 384,700 tonnes (Q1 2021: 361,900 tonnes)

Ilmenite production decreased 7% in Q1 2022 to 256,800 tonnes (Q1 2021: 275,100) and primary zircon production decreased 3% to 12,900 tonnes (Q1 2021: 13,300 tonnes) due primarily to decrease in HMC processed

Rutile production increased 5% to 2,000 tonnes (Q1 2021: 1,900 tonnes), benefitting from higher recoveries, while concentrates production increased 20% to 10,700 tonnes (Q1 2021: 8,900 tonnes)

Total shipments of finished products decreased 33% in Q1 2022 to 231,500 tonnes (Q1 2021: 344,400 tonnes), impacted by poor weather conditions and customer-chartered vessel delays due to tight shipping markets

The markets for all of Kenmare’s products remain strong, with further price increases received in Q1 2022 for the sixth consecutive quarter

Full year guidance is maintained on all stated metrics

While the lower production YoY for Q1 is somewhat disappointing following the successful expansion of operations and record production achieved last year, it was not a surprise having already being flagged in the preliminary FY21 results announcement in March. Furthermore, management’s reiteration of full year FY22 guidance and improving weather conditions expected from Q2 is encouraging.

Also encouraging was management’s update on market outlook and pricing, with the following highlights:

Strong market conditions for all of Kenmare’s products continued throughout Q1 2022. Demand continues to be greater than supply and consequently, ilmenite prices increased for the sixth consecutive quarter,

Inventories remain low throughout the value chain for all products.

Q1 2022 was a record quarter for chloride pigment production in China with intensified demand for imported feedstocks as domestic ilmenite is unsuitable for the chloride production process.

Outside China, pigment demand is robust and a lack of titanium feedstock availability remains a bottleneck to pigment production volumes; additional ilmenite supply is entering the market, but remains insufficient to meet demand.

It is uncertain how the war in Ukraine will impact Kenmare’s product markets, but 4.5% of global titanium feedstocks production is attributable to Ukraine and disruption to this supply has exacerbated tight market conditions.

Outlook for ilmenite remains positive, with received prices continuing to increase in Q2 2022.

Separately, last Thursday KMR announced the date of its AGM (26 May) but also more interestingly that it was implementing an “Odd Lot” Offer, whereby shareholders holding fewer than 200 ordinary shares in KMR (termed as “Odd-lot Holders”) will be offered the opportunity to sell their shares at a 5% premium to the market price. The rationale for the offer is essentially to take-out the large number of legacy shareholders with very small holdings in the company, and who in many instances are inactive (KMR has a total of ~3,800 registered shareholders, of which ~3,500+/ 92% hold fewer than 200 ordinary shares).

This Odd-lot Offer effectively tidies up KMR’s shareholder register, taking out legacy retail holders. One thought I had following this news was that any future takeover of KMR will be made that bit easier (or at least less cumbersome) with a slimmed down register comprising mostly institutional shareholders. Could this be the first step towards a sale of the company following its operating inflection last year?

These updates were well received by the market, with KMR rising to a ~6.5 year high of €6.50 / £5.26 last week, before pulling back towards the end of the week. KMR is now up ~26% since I first published the idea last November.

PANR

Pantheon Resources Plc (PANR) announced it is hosting a a Shareholder Presentation and Q&A webinar on Tuesday 26 April 2022, in which it will discuss the outcomes and conclusions from the recent Theta West and Talitha #A drilling and testing programme, future project development and next steps in its operaitonal programme.

As I mentioned before, I expect management will provide a resource estimate upgrade following the successful drilling at Theta West. In the course of my usual digging, I found it interesting to note that Mike Smith, founder of oilfield services firm AHS and a consultant to PANR (who will be presenting with management on the webinar) posted the following on Linkedin last week:

Check out this Webinar, Tuesday 26 April 1130AM Houston time, on Pantheon’s great accomplishments and plans for the future on the North Slope of Alaska!!! >20 Billion Barrels of oil in place. 4 successful tests of movable high quality oil in 3 reservoirs from 2 wells this winter. High Quality, about API 38 gravity, movable oil was correctly predicted by AHS's cuttings analyses of all tested zones in both wells before testing.

Note the above references more than 20bn BO, which is ~3bn+ BO more than the previous resource estimate of 17bn BO referenced by management in the most recent presentation from the January AGM. An increase in resource estimates of this magnitude is not priced into the stock and would certainly drive PANR’s share price substantially higher.

Update: Post writing the above and just prior to publication, earlier this morning, PANR released a significant resource estimate upgrade, in which management now estimate that the Lower Base Floor Fan (LBFF) at Theta West contains ~17.8 bn BO, +61% increase on previous estimates, and a recoverable resource of 1.78 bn BO as a most likely case, +48% increase on previous estimates. Additionally, following initial analysis of the Slope Fan System (SFS) zone at the Talitha #A well, management now estimates it contains 2.2bn BO. Additional analysis is required at SFS before any recoverable resource estimate can be given, but this is significant in that management previously did not provide an estimate of oil in place for SFS.

All told PANR has an incremental resource of 8.8bn BO, which at even a pessimistic 10% recoverability rate (well below recovery rates across similar assets) implies an additional 880m BO. This clearly implies significant value upside for PANR, and I’ll be upgrading my valuation analysis following the webinar this week.

YCA

Yellow Cake Plc (YCA) progressed its recently announced $3m share buyback programme last week, repurchasing a total of 169.5k over two tranches of 84.5k shares and 85k shares, at an overall average price of ~£4.51/share.

Just prior to the buybacks, YCA traded to an all-time high of £4.85 as the spot price of uranium hit an 11-year high of $64/lb. However last week ended with spot uranium falling to $55/lb on no sector-specific news, and uranium equities including YCA similarly declined, with YCA ending last week below the buyback price level at £4.31.

The sell-off from last week is most likely attributable to broader market concerns around the Federal Reserve increasing rates to combat inflation, renewed COVID lockdowns in China and resulting slowing growth concerns prompting a general “risk-off” trade.

Following the share price decline last week, YCA continues to trade at a discount to NAV (~0.96x) and I see the sell-off as misplaced given that the fundamental thesis for uranium remains unchanged, despite the macro noise of last week.

Situations Monitor

BG

Bunge Limited (BG) last week hit a ~14 year closing high of ~$127/share (vs. $93.69, or +35% since I first published the idea as a food crisis equity play back in January) but has since pulled back to ~$118/share as part of the wider equity market pull-back since last Thursday.

I expect this latest pull-back to be short-lived given the growing global food crisis now underway. One facet of this crisis is a supply squeeze for vegetable and cooking oil, as Bloomberg reported last week with the news that Indonesia is banning exports of cooking oil in a protectionist move given local shortages and soaring prices. Indonesia is the biggest producer of palm oil (the most consumed edible oil globally), and this news sent U.S. futures tied to soybean oil, an alternative to palm oil, soaring to the highest price on record.

This is highly relevant for BG in that its Refined and Specialty Oils segment accounted for ~6% of BG’s total volumes but ~25% of EBIT in 2021, from selling vegetable oils and fats, including cooking oils. Furthermore, BG’s Oils operations are well insulated from the supply disruption caused by Russia’s invasion of Ukraine, being primarily located in North and South America and Western Europe.

Management’s guidance for the Oils segment pre-Ukraine invasion was for another record year up on FY21, driven by strong demand trends from food and fuel in North America and Europe (including biofuel demand). Given BG is the world’s largest oilseed processor, with this latest “cooking oil chaos” I would expect BG to outperform this year.

IPS

Ipsos SA (IPS), a developing situation name highlighted in Weekly Bulletin #10, released its Q1’22 performance update last week, which reported YoY Q1 revenue growth of 17.5% to ~€548m, continuing the FY21 full year trajectory of 17.9% growth. Notably this Q1 performance was also ~30% ahead of pre-COVID levels for Q1 FY19.

Management re-iterated guidance for FY22, with revenue growth of +5% and IPS shares increased +4.5% following the update. IPS is trading at ~6x FY22 EBITDA vs. ~8x - 11x for recent private market comps and continues to look like an interesting situation particularly as increased global uncertainty across the political, consumer and corporate spheres is likely to support demand for its services.

WG

UK-listed engineering services business Wood Group Plc (WG) announced full year FY21 results last week following a previous delay in publishing results due to accounting issues around the legacy Aegis missile project in Poland, which resulted in (an already flagged) $100m write-down.

At a high level, WG reported revenues and EBITDA down -15% and -12% respectively YoY, with negative FCF attributable to working capital outflows caused by reduced activity in WG’s Projects business due to COVID delaying customer project decisions, as well as legacy loss-making contracts and exceptional costs.

Following the results, there is evidence to suggest WG is turning a corner after a difficult year, with the global economy now emerging from the pandemic and a renewed focus on energy security and increased investment in both O&G and renewable energy projects, end-markets which WG has significant exposure to. Furthermore, the business outlook is improving with WG’s order book increasing +19% YoY to ~$7.7bn, of which 60% is deliverable in FY22.

Notably, the sale process for the Built Environment (BE) division is progressing as planned. I previously outlined in my original WG quick idea write-up that this divestment would represent a transformative catalyst for the business; I estimate this could generate ~$2bn+ in net proceeds, and transform WG’s currently leveraged balance sheet (~3.3x EBITDA) to a net cash position. As management summarised:

The sale process of our Built Environment business is progressing well and we continue to expect to announce a sale agreement in the second quarter of this year. A sale will deliver significant value for our shareholders and help move the Group onto its next chapter.

As a quick update on my previous analysis and with the benefit of full year FY21 results, WG is currently trading at 5.9x LTM EBITDA of $554m. Assuming a sale of the BE segment for net proceeds of ~$2bn and stripping out BE division EBITDA of $149m, WG is trading on a PF basis at just 3x EBITDA for the remaining business with a net cash balance sheet position post the disposal. And this 3x reflects depressed LTM results for the residual business, while management’s outlook indicates higher revenue in FY22 supported by the growth in the order book.

Given the supportive tailwinds across WG’s end-markets, this valuation just seems too cheap. On my quick numbers, a re-rate to 6x on LTM residual EBITDA to price in realistic growth prospects indicates ~70% upside from the current price. A higher multiple re-rating is also plausible in time given the net cash position and further upturn in the Projects business (note WG’s long-term average multiple is ~9x while listed peers such as TechnipFMC currently trades at ~7x).

Developing Situations - Alphamin in Play

Back in Weekly Bulletin #7, I discussed the global tin market as another interesting commodity-inflation theme. Since then I’ve been tracking Toronto-listed Alphamin Resources (AFM), which is one of the world’s largest tin miners and owns 84% of the Bisie tin mine in the Democratic Republic of Congo (DRC). The Bisie mine is regarded as the world’s highest-grade tin mine, with AFM’s main mining asset to date being the Mpama North deposit at Bisie.

Much to my frustration, Bloomberg reported last Tuesday that AFM is now in play, with its PE sponsor Denham Capital launching a sale process for the company and initial offers sought by the end of this month (i.e. this Friday). Why the frustration on my part? I had identified AFM as both an inflecting commodity producer and a takeover target much like Kenmare Resources, and had been steadily building conviction in AFM as a possible addition to the Value Sits Model Portfolio. But with the sale announcement its stock price is now up ~19% on the pre-announcement price (CAD$1.37 at the time of writing), possibly eroding a decent chunk of any takeover premium I could have bagged, while the prospective takeover itself may be coming early on in AFM’s inflection, thereby preventing AFM from ever reaching my estimate of fundamental value in the public markets.

My interest in AFM is similar to that of Kenmare, in that it produces an overlooked but essential commodity for industry and society for which supply is constrained, and it owns a unique, strategically valuable mining asset.

Firstly, to quickly recap on the commodity itself, tin has primarily been used for soldering circuit boards in the semiconductor industry but is now viewed as an essential metal underpinning four mega-trends - electric vehicles, renewable energy, advanced robotics and computation and the Internet of Things (IoT). An MIT study in 2018 identified tin as the metal most impacted by new technologies, with the energy transition to electrification and adoption of electric vehicles being among the highest drivers of future tin demand. This is worth considering for a moment - tin is set to benefit more than lithium, cobalt or nickel from future electrification and battery usage, literally being the “glue” that holds together the various electronic components used in these technologies.

Secondly, AFM’s Mpama North mine currently produces ~4% of the world’s mined tin that produces some of the world’s highest grade tin, and recently announced the development of the adjoining Mpama South mine, which is expected to increase AFM’s annual tin production from the current 12,000 tonnes p.a. to ~20,000 tonnes p.a., approximating 6.6% of the world’s mined tin. This is essentially a second mine of similar scale and quality to the existing Mpama North asset, and first production is expected at the end of 2023, with AFM able to self-fund the development capex of ~$116m.

With respect to supply/demand, tin prices have reached record levels this year, currently at ~$42k/tonne on the LME, having been as high as ~$51k/tonne last month - at the current spot price, tin is up ~50% over the past 12 months and up ~6% YTD. The rise in the price of tin reflects constrained supply and a market supply deficit that is widening amid structurally rising demand from new technology, with existing mines depleting and no major new mines in the pipeline (Mpama South being the only notable one from what I can tell). In 2021, production of refined tin totaled 378.1k tonnes, vs. consumption of ~391k tonnes, according to the International Tin Association, with annual consumption expected to break 400k tonnes in the coming years.

So the tin market appears to constitute a somewhat unique and compelling situation, and within it AFM looked to be the most attractive play considering its valuation and unique asset prior to the sale announcement. But even with the recent 19% share price appreciation on the sale news, I think AFM may still constitute an attractive value situation, for the following reasons:

It remains cheap, at ~4.3x EBITDA on spot tin prices at ~$42k/tonne, with a supportive pricing outlook.

The situation has been de-risked somewhat by the fact that the company is now in play - the jurisdictional, mining and other risks matter less if an acquirer is close to taking out the entire company at what should be a substantial premium vs the current price.

Given this set-up, a down case here may be that a bid does not materialise, the stock declines back to the pre-sale announcement price of ~CAD$1/share but the company continues with the Mpama South expansion and benefits from the favourable tin supply/demand dynamic in time (and likely leading to a significantly higher share price by FY24 anyway once Mpama South is fully operational).

Rather than guesstimating that an acquirer will bid for AFM in the coming week, I prefer to first value AFM on its fundamental merits and business prospects today, independent of the sale process, which will then allow me to gauge the fairness of any bid to follow.

On a stabilised basis (post-Mpama South commencing), I estimate AFM will be worth ~CAD$2.87/ US$2.26 or ~2x the current share price by FY24:

Source: Value Situations analysis.

This is a high-level analysis that assumes the following:

Current run-rate EBITDA at spot tin price of ~$42k/tonne is $311m, an incremental increase of $113m on LTM (FY21) EBITDA of $199m

Mpama South is projected to add ~$187m in EBITDA at $40k/tonne tin price

On a stabilised PF basis at ~$42k/tonne tin price, AFM should generate ~$500m in EBITDA - I’m effectively assuming a flat tin price into the future, despite the favourable supply/demand pricing outlook for tin

Mpama South expansion capex of $116m is assumed to be debt-funded above, as AFM will need to conserve available cash to meet future DRC “superprofit” taxes expected to be payable in FY23; given the ramped and cash generative nature of AFM’s current operations (LTM FCFF of ~$137m on EBITDA of $199m) I assume AFM would readily be able to raise necessary debt here (it’s likely PE sponsor Denham Capital could provide also).

At the current share price, AFM is valued at 3x stabilised FY24 EBITDA, and a market re-rating to 6x implies ~100%+ upside from here, to CAD$2.87/US$2.26 per share. (AFM and peers have historically traded at average multiples of ~7x-8x EBITDA)

Under an indicative Downside scenario, I assume the Mpama South capex is incurred and spot tin prices decline to $30k/tonne (-25% decline to current spot prices, which seems improbable given the supply/demand set-up), resulting in stabilised EBITDA of ~$320m at this lower tin price. Assuming a 4x multiple (in line with the current 4.3x on AFM’s spot-run-rate EBITDA), this implies ~14% downside to the current price, putting AFM back to its average trading price of ~CAD$1/share prior to the sale process being launched.

This analysis indicates a highly asymmetric risk/return profile for AFM based on its standalone prospects, with indicative upside of nearly 8x the downside risk.

Perhaps the key qualitative risk aspect that the above does not factor in is the political/jurisdictional risk of operating in the DRC, but similar to Kenmare I believe AFM’s relationship with DRC authorities and its investment in the region over the past ~6 years goes some to mitigating this risk. Additionally, its position as majority owner and operator of such a strategically valuable and unique mining asset provides further downside protection. In any event, I believe the prospective return here probably compensates for the risk.

The above analysis might well reflect AFM’s value in remaining a public company in an alternative future at this point, given a sale of the company seems imminent. So what might we expect an acquirer to pay for AFM?

Market intelligence suggests that the logical buyer will be a Chinese strategic acquirer and this makes sense in the context of existing Chinese investment in African natural resources as part of its strategy to ensure control of its clean energy and metals supply chain. China has been particularly active in DRC, and it is reported that Chinese companies now own 15 of the 17 cobalt operations in the country. Given tin is a strategically important commodity in the global energy shift to electrification, an acquisition by a Chinese buyer would be in keeping with Chinese metals investment activity in recent years and makes the sense here in my view.

In this light, given Chinese mining companies’ ability to pay big prices for strategic-deemed assets with access to state bank credit, plus the fact that the main selling party behind AFM is a financially motivated PE sponsor rather than a weak, corrupt government shareholder (sponsor Denham Capital owns ~58.15% of AFM), I still see scope for a hefty premium to be paid by an acquirer. As a simplistic working, a 7x multiple on run-rate EBITDA of ~$300m (reflecting current spot tin prices) and parking entirely the value of Mpama South implies a sale price of CAD$2.11/share or ~54% upside to the current share price. Given that the Mpama South capex of $116m (which can be internally funded according to AFM management) would generate EBITDA of $187m, adding say a further 1x turn of EBITDA in consideration for this embedded value would imply a sale price CAD$2.40 for AFM, or ~75% upside. Short of my fundamental valuation above, but not materially so.

So perhaps my initial frustration at AFM being put in play is misplaced, and it would seem it remains a compelling, and now actionable value situation. Furthermore, it is a situation that offers an attractive risk-adjusted return profile given that much of the perceived downside is now mitigated by a likely competitive sale process putting a bid value above the current price.

Any Other Business

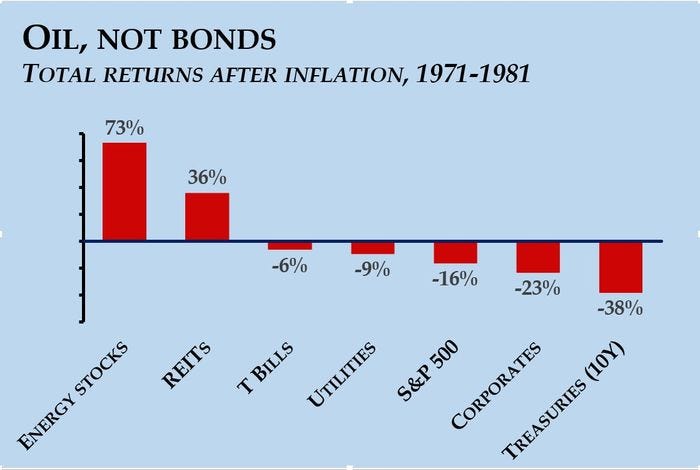

For this week’s AOB, given the current stagflationary concerns in the market I thought I’d share two charts showing which asset classes performed best through previous stagflationary periods since the 1970s.

Firstly Andreas Steno Larsen shared the following chart in his excellent Substack newsletter Stenos Signals recently:

Source: Stenos Signals #5 – How do you trade stagflation?

The second chart below shows a similar performance picture among asset classes (h/t to Josh Young of Bison Interests LLC):

Sources: NYU Stern, National Association of REITs, Kenneth French/Tuck School of Business, Dartmouth College.

The takeaway from the above if you’re concerned about inflation morphing into stagflation? Selected energy, commodities and real estate equities may offer the best capital protection.

Thank you for the nuanced AFM coverage, in particular.