Disclaimer

Value Situations is NOT investment advice and the author is not an investment advisor.

All content on this website and in the newsletter, and all other communication and correspondence from its author, is for informational and educational purposes only and should not in any circumstances, whether express or implied, be considered to be advice of an investment, legal or any other nature. Please carry out your own research and due diligence.

I’m pleased to report the Value Sits Model Portfolio delivered strong performance in both relative and absolute terms for Q3 and the YTD.

The Portfolio appreciated +8.8% in Q3, outperforming the S&P 500 (SPX) by +12.4% (SPX -3.6% in Q3), and outperforming the European STOXX 600 (SXXP) by +11.3% (SXXP -2.5% in Q3.

On a YTD basis, the Model Portfolio is up +24.2%, outperforming the SPX by +12.5% (SPX +11.7% YTD to Q3-end), and significantly outperforming the SXXP by +18.2% (SXXP +6.0% YTD). [note all YTD returns are to the 30 September for purposes of end of Q3 review].

Reflecting on markets at Q3-end, my sense is that this year is setting up to be a proverbial game of two halves, with the “Reverse 2022” trade being the winning strategy in H1, only for this to have very clearly reversed again in Q3.

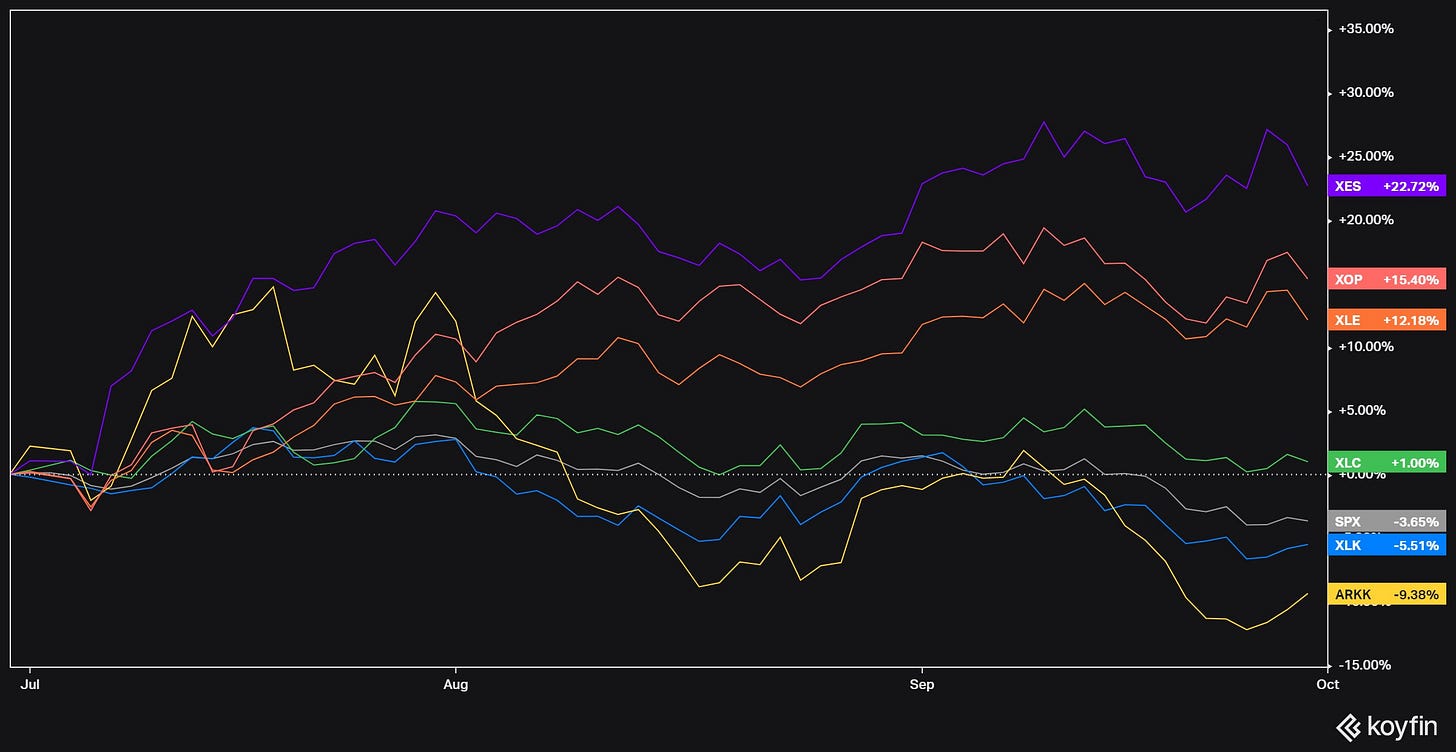

To recap, as I wrote in my Q2 review, the Reverse 2022 trade that worked so well in H1 was a simple rotation out of energy and into all things tech, expressed as long tech XLK / XLC / ARKK and short energy XLE / XOP / XES:

However this winning trade notably reversed course in Q3, with only XLC remaining positive for the quarter:

As I also highlighted in the Q2 review, a major driver of SPX performance in H1 was the outperformance of the Megacap 8 names, comprising the FAANGs / FAAMGs complex (Facebook/Meta, Amazon, Apple, Netflix, Google/Alphabet and Microsoft) plus Tesla and Nvidia.

Given these names account for ~25%+ of the SPX index by weighting, their fall from favour in Q3 also explains in part the -3.65% fall in the SPX in Q3:

Source: Yardeni Research.

In particular, AI hype name and H1 market darling Nvidia (NVDA) looks like it has started to flatline (relative to its H1 performance at least), suggesting that AI exuberance may now be fading as more tangible, real assets find favour again:

In a similar manner to AI / NVDA being the stand-out tech theme of H1, uranium was the standout energy theme in Q3 (much to the benefit of the Model Portfolio):

Uranium looks set to continue its trajectory through to year-end based on the supply/demand set-up and a growing realisation that nuclear energy can play an essential role in an age of energy insecurity and a desire to transition away from fossil fuels. Furthermore, uranium’s performance in Q3 again reflects a rotation out of intangible tech into tangible real assets that the world needs.

The recent resurgence in energy and related commodities has also coincided with a market realisation that inflation, while having cooled compared to the heights of last summer, remains persistent and is unlikely to fall back to the sub-target 2% “comfort zone” despite 500bps+ of rate increases over the past ~18 months.

Against this market backdrop, the Model Portfolio performed as intended in the quarter and delivered strong outperformance - of the 9 names held in the portfolio at quarter-end, 6 produced strongly positive returns, with 3 positions down for the quarter. Similarly on a YTD basis, 6 positions have generated positive returns, up an average +33% for the YTD period.

I outline my latest thoughts on each name below, starting off with a review of how the overall Portfolio was positioned as at the end of Q3.