Disclaimer

Value Situations is NOT investment advice and the author is not an investment advisor.

All content on this website and in the newsletter, and all other communication and correspondence from its author, is for informational and educational purposes only and should not in any circumstances, whether express or implied, be considered to be advice of an investment, legal or any other nature. Please carry out your own research and due diligence.

In this week’s newsletter, I examine how WeWork’s recent going public transaction suggests a potential value situation with respect to its larger, London-listed peer IWG Plc (IWG).

WeWork Inc (WE) finally became a public company last week via its SPAC merger with BowX Acquisition Corp. The merger transaction valued WE at an enterprise value of ~$9.1bn or ~3.5x LTM sales, despite it still being a heavily loss-making enterprise and it’s historic and well-documented troubles even before COVID hit.

Following its failed 2019 IPO and nearly going bankrupt, the “repositioned” WE still managed to raise ~$1.3bn in cash, including ~$800m from some very serious investors in the PIPE component of the SPAC deal, led by investors including Insight Partners, Starwood Capital Group, Fidelity, Centaurus Capital, and funds managed by BlackRock. Given its questionable financials, its widely known chequered past and the sophisticated investors involved in the deal one would have to think that all risks and concerns have been priced into the stock and so it must surely be efficiently priced?

Since going public on the NYSE last Thursday, WE has been very positively received by the market - its stock closed up ~13.5% on the first day of trading, and closed yesterday at $13.18, or up ~27% since going public. At the current stock price, WE has an EV (excluding almost $20bn in lease obligations) of $11.7bn, which values the business at 4.5x LTM sales, or 4.4x FY21 forecast sales.

As WE is loss-making on every measure of profitability down through the income and cash-flow statements (gross profit, EBITDA, net profit, OCF, FCF are all negative) and given its significant debt obligations, EV/S is the only real way to appraise it at present. If we assume that it is efficiently priced at ~4.5x sales (excluding leases), then this has a very interesting read across to its main competitor, IWG which trades at just ~1.6x LTM sales, despite IWG having a very similar business model and exposure to the same growth prospects as WE.

Before getting into a comparative valuation analysis of WE vs. IWG, I’ll preface this with a general assumption that is now widely accepted - as corporate employees prepare to return to the office, hybrid and flex working is here to stay with numerous examples of corporates adopting hybrid office models, which clearly bodes well for both IWG and WE. Indeed, in August IWG reported that office space inquiries had reached pre-COVID levels as demand for office space is increasing for shorter, more flexible lease terms. This was also corroborated by Workspace Group Plc (a London-listed flexible office REIT) in its recent July trading update in which it reported that customer demand was running at pre-Covid levels.

IWG vs. WE - A Headline Comparison

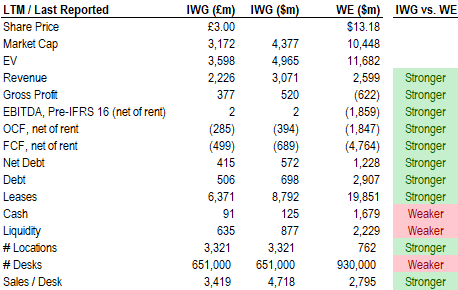

I’ll start this analysis with some observations based on a headline comparison of the current financial picture for IWG and WE:

Source: Company financials; Value Situations analysis

Notes: IWG converted at GBP: USD FX rate at time of writing for comparative purposes. WE EBITDA is reported on net of rent basis, therefore IWG EBITDA presented above is similarly presented on a pre-IFRS 16 basis for comparability. WE net debt position is PF based on disclosed merger terms per the Oct-21 investor presentation.

The clear takeaway from the above comparison is that IWG is superior to WE on almost every measure - it has greater scale, is actually profitable at the gross profit level (and impressively EBITDA breakeven on LTM basis as it emerges from the pandemic disruption), has less debt, significantly lower lease obligations (and therefore less operating leverage risk) and generates greater sales dollars per desk than WE.

The only area where WE appears stronger is with liquidity, but that’s simply due to the cash contribution on Day 1 from the SPAC merger and I’d expect WE will burn through this as it will likely remain gross-profit negative for some time.

It’s also worth highlighting one other relevant factor that is not captured in the above comparison - corporate track records. WE’s troubled history contrasts starkly with IWG’s, which has a ~30+ year corporate history (previously known as Regus) and was consistently profitable pre-COVID, unlike WE.

Valuation Comparison

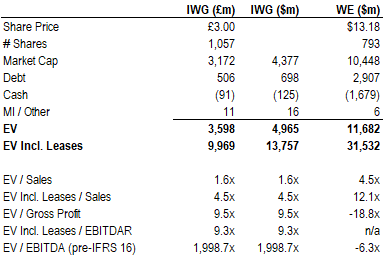

In light of IWG’s superior financial profile, the valuation ascribed to WE seems truly anomalous:

Source: Company financials; Value Situations analysis

Whether one looks at market cap, EV or EV including leases the market is valuing WE at ~2.3x IWG despite IWG’s clearly superior financial profile on almost every measure as outlined above.

In terms of value ratios, EV/sales and EV+Leases/sales are the only meaningful ones for comparative purposes, given IWG's depressed profitability coming out of the pandemic and WE’s loss-making operations. On an EV/S basis, WE is valued at 4.5x sales (or 12.1x including lease obligations) vs. 1.6x for IWG ( or 4.5x including leases).

Why is there such a valuation gap, given the similarity in business models and exposure to the same theme, namely increased corporate hybrid / flex office demand post-COVID?

If one accepts the thesis that a return to the office will see a significant increase in flex office demand (as the bullish reception WE received on going public clearly indicates the market does), IWG should have a headstart over WE. WE will need time to adjust to being a public company, while management are still trying to reposition the business and brand following its failed IPO and the fall-out from the departure of former CEO Adam Neumann. Furthermore, WE’s pathway to profitability is still unclear given the enormous fixed lease costs it carries, and it is still in the process of restructuring its cost base. By contrast, IWG’s lease obligations are structured much more advantageously compared to WE’s, as IWG’s 2020 Annual Report states:

95% of our leases are ‘flexible’, meaning that they are either terminable at our option within six months and/or located in or assignable to a standalone legal entity, which is not fully cross-guaranteed.

Indeed IWG has even taken on former-WE buildings that WE needed to exit as part of its cost restructuring. IWG also has the advantage of not having the same historic reputational or governance baggage that hangs over WE following the Neumann era. As such, IWG seems like the much better bet on the flex office theme as occupancy and profitability should improve significantly post-pandemic. In this light, WE feels more like a highly-leveraged turnaround situation with limited visibility to profitability compared with IWG.

Why The Valuation Gap?

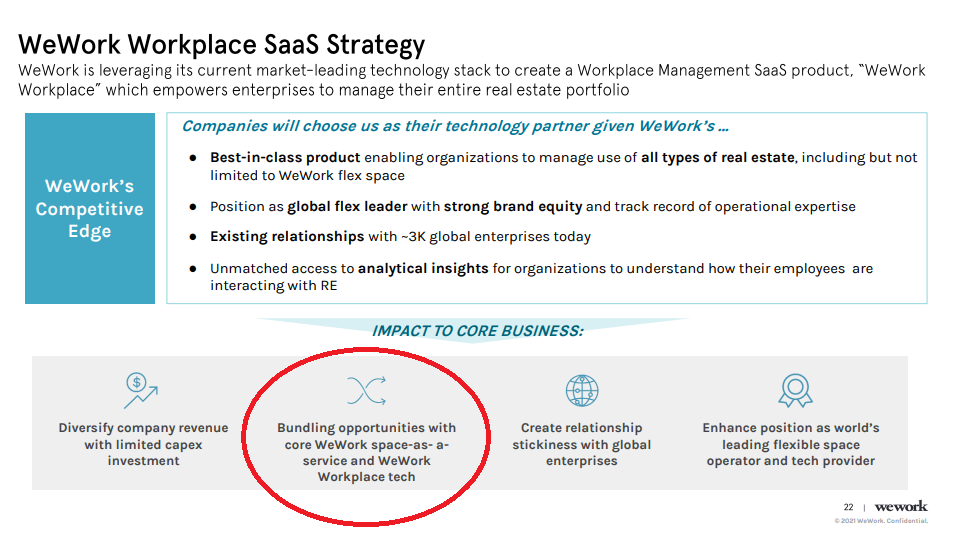

My sense as to why WE is priced at a significant premium to IWG is down to one thing - marketing. WE is still pitching itself as a high growth, real estate/tech platform, with the dubious claim of providing “Space as a service” which seems to resonate with investors:

Additionally, WE is projecting very strong (and perhaps unrealistic) growth, with revenue projected to grow at ~40% CAGR to FY24 from its revised FY21 forecast of ~$2.7bn (notably revised down from its previous forecast of $3.2bn earlier this year).

Compare this with IWG which grew revenues at a CAGR of ~10% over the 5 year period from 2014-2019 before COVID, and perhaps different growth rate expectations also explain the value gap. But again, in a post-pandemic world where flex office space is expected to experience strong growth and with both companies having similar business models, growth expectations for both businesses should be very similar, so if the market believes WE can grow at 30% or 40%, IWG in a post-COVID world should reasonably be expected to grow at a similar rate (and with less balance sheet risk). With IWG’s greater scale and stronger financial position, there is even an argument that it should trade at a premium to WE.

Valuation Analysis - WeWork-ing IWG

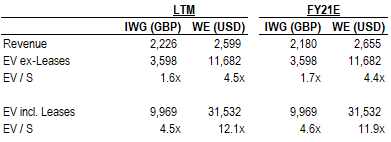

The obvious question here is if WE is efficiently priced at 4.5x sales excluding leases / 12.1x including leases, then IWG as a larger, less leveraged and actually profitable business must be mispriced at only 1.6x excluding leases / 4.5x including leases:

Source: Value Situations analysis

As the table above shows, the valuation multiples and their divergence hold whether one looks at LTM actual or current year forecast revenues. [Note WE recently reduced down its FY21 forecast revenues from $3.2bn to $2.7bn, a ~17% reduction, so its SaaS growth story will not begin this year].

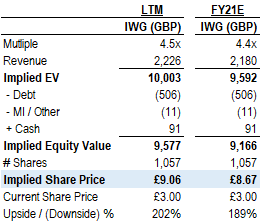

So if WE has been correctly priced by the market (and its smart money PIPE investors), what valuation does this imply for IWG if it was to re-rate in line with WE given its superior financial position, scale and track record? Firstly, excluding leases and including only financial debt in the EV calculation (in line with how WE presents its capitalisation in its investor materials) IWG could indicatively be worth ~£9/share, offering ~200% upside vs. the current share price:

Source: Value Situations analysis

If we include the lease obligations in debt on a post-IFRS 16 basis, the implied valuation for IWG offers significantly more (and perhaps less plausible) upside of ~500%+ vs the current share price, attributable to WE’s lease-adjusted EV/S multiple of ~12x reflecting its enormous lease obligations within EV:

Source: Value Situations analysis

I should point out that IWG’s pre-COVID closing high was £4.69/share, so for the above implied valuations to be achieved, some structural change in market perception and/or a transformative catalyst would need to materialise. Perhaps post-COVID flex office growth drives this change in sentiment and provides the catatlyst for such a re-rating in time.

To be clear, I’m not saying that I fundamentally believe IWG is worth £9/share or £19/share today, but the key takeaway here is that *IF* WE is priced correctly by the market and reflects all relevant information, risks etc., then this must imply that IWG is worth substantially more than its current share price, and therefore constitutes a potential value situation.

Possible Catalysts

If WE is valued correctly by the market and IWG benefits from the same prospects, what are the catalysts that might close the valuation gap ?

The obvious one is a structural change in the office market with the increased adoption of and demand for flexible office space, which IWG is optimally positioned to capitalise on. As it converts client enquiries to leased up space, operating leverage should kick in driving earnings and its stock price higher.

A secondary catalyst could be a re-listing of IWG in the US equity markets, which historically have traded at premiums to UK and European equities (and indeed UK equities are currently among the cheapest in developed equity markets, as evidenced by the surge in PE bids for UK-listed companies this year). IWG is a global business, with ~40% of revenues from the Americas region and a US-listing would make a lot of sense with greater liquidity and US analyst coverage helping to drive a re-rating towards WE’s levels.

A final catalyst for IWG may be a takeover or take-private. Interestingly, IWG has long been the subject of takeover speculation, most recently by private equity firm CC Capital in June this year. Prior to this, around the time of WE’s ill-fated IPO in 2019, private equity firms Brookfield Asset Management and Onex had their bids rejected by IWG. As I’ve written about previously, with private equity real estate (PERE) funds sitting on record amounts of dry powder that must be deployed, a buy-out of IWG even at a strong premium to the current share price could deliver attractive returns for PERE acquirers if an eventual exit valuation in line with WE’s valuation is achievable. Notably, IWG founder and CEO Mark Dixon owns ~28.5% of IWG and it’s conceivable he could lead a take-private with a PE backer if the market continues to value IWG at a discount to WE as the office market recovers from the pandemic.

Conclusion

Looking at the financials, I can’t see why anyone would want to own WE (at least not yet), but I can see an investment case for owning IWG given the hybrid/flex office tailwinds, it’s established market position and track record.

Of course, it’s also possible that WE is simply mispriced (i.e. wildly overvalued) and IWG is actually fairly valued. But I think it’s not unreasonable to assume that WE is priced efficiently now given its well documented troubles and the scrutiny it has received following these and through the SPAC process. On that basis and given IWG’s superior fundamentals it therefore seems reasonable to assume that IWG should be valued in with WE (and certainly above its current price), yet the market prices it at an anomalous discount to WE. In my view, this represents a mispriced situation that is worth monitoring.

Nice analysis and thank you. I believe WE is benefitting from a combination of marketing and post-Covid trend towards hybrid work. It is show me story and looks like a lot of volatility ahead. Agree, IWG is a better bet. I’m more perplexed by SFTBY. Stock price continues to flounder and has not benefitted from the WE turnaround. Additional catalyst of ARM sale to NVDA or if that fails, spin-out/IPO, appears to be discounted. Have you looked at SFTBY - massive discount to NAV?