PERE Returning To The Office?

Renewed private equity interest in discounted office REITs implies further take-private opportunities ahead for public equities

Disclaimer

Value Situations is NOT investment advice and the author is not an investment advisor.

All content on this website and in the newsletter, and all other communication and correspondence from its author, is for informational and educational purposes only and should not in any circumstances, whether express or implied, be considered to be advice of an investment, legal or any other nature. Please carry out your own research and due diligence.

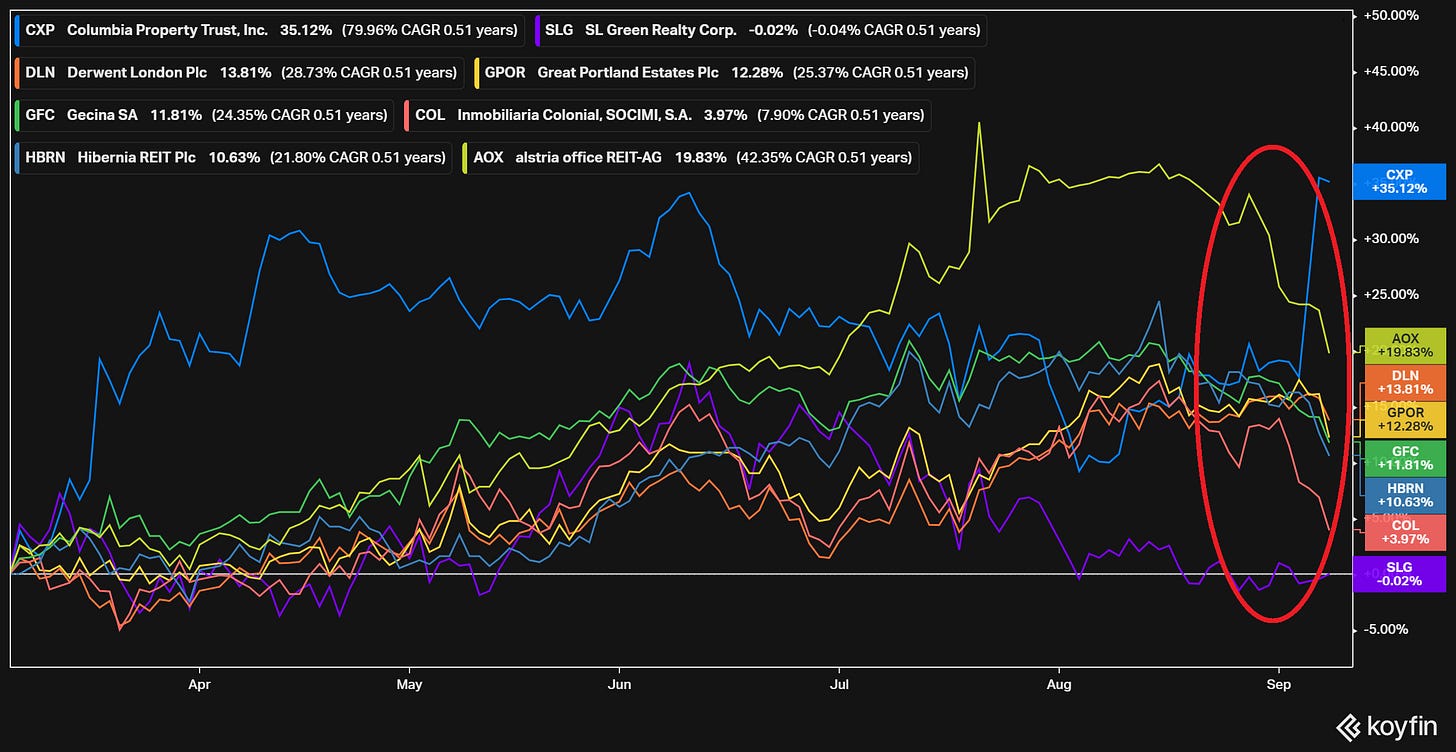

With the expected September return to the office delayed due to the spread of the COVID Delta variant, office REITs have come under pressure again in recent weeks, with some commentators questioning employers ability to get staff back into the office when COVID eventually subsides. Essentially the view is that the longer people work remotely, the more difficult it will be to revert to office-based work practices, as staff have settled into new routines over the last ~18 months and will be more reluctant to former work routines the longer office reopening is delayed.

This sentiment can be clearly seen in recent share price action for a cross-section of some of the largest office REITs in the US, UK and Europe, with a notable decline in share prices since mid-August when the “Delta Delay” became apparent:

Despite the office sector outlook souring in recent weeks, private equity real estate (PERE) players are becoming more active in the space again. Office real estate has historically vied with mutlifamily residential as the most invested segment of the overall real estate market, and following the disruption from COVID, there are signs that the “smart money” is now returning to the office itself by opportunistically targeting discounted office REITs.

The most notable story over the past week in this context was PIMCO’s announcement that it was acquiring US prime office REIT Columbia Property Trust (CXP) for ~$3.9bn (including CXP’s debt). CXP is the clear outlier in the chart above, with its stock rallying ~16% on news of the PIMCO bid. PIMCO’s Head of Private CRE John Murray explained the rationale for the deal as follows:

“We continue to believe that high-quality office buildings in major U.S. cities offer long-term value for our clients and Columbia has assembled a modernized, well-located portfolio of assets that we expect will perform well in the years ahead."

In acquiring CXP, PIMCO is essential getting a fairly discrete office portfolio comprising ~6.2 million sq. ft. across 15 office properties and 4 development sites. The portfolio is spread across 4 cities – New York, San Francisco, Washington DC and Boston - with New York and San Francisco accounting for ~80% of the portfolio in terms of income. Interestingly New York and San Francisco were the two worst hit office markets in the US during the pandemic, but PIMCO clearly sees these markets rebounding in time. (Notably, the indications in Q2 were that despite high vacancy rates, NYC and SF were starting to see an increase in demand for office space again).

PIMCO are bidding $19.30/share of CXP, representing a premium of ~17% vs. CXP’s share price prior to the announcement, and ~12% below CXP’s pre-COVID share price back in Jan-20. From an initial review, if PIMCO are correct in their outlook for prime offices and current rents and valuations hold over time, they are getting a good deal.

Firstly, CXP owns modern, well invested prime office assets in locations that should benefit from a wider market and economic recovery post-COVID (according to the US government’s Bureau of Economic Data, the NY and SF metro areas account for ~11% of US GDP) .

Secondly, the portfolio is ~94% leased to blue chip tenants (e.g. Twitter, Amazon, DocuSign, Wells Fargo), with rent strong collection rates (98% collected in Q2), reflecting its asset quality and tenant covenants. With the emerging view that large corporate occupiers will retain prime city centre HQ buildings while allowing some form of hybrid or flexible working practices, CXP appears to be well positioned with its core office offering.

Thirdly, the valuation itself seems attractive from PIMCO’s perspective – the $3.9bn deal value equates to ~0.83x GAV of $4.7bn (including CXP’s share of assets owned in unconsolidated JVs). This implies PIMCO is buying the portfolio at an overall cap rate of ~5.7% based on CXP’s annualised H1 cash NOI, close to a ~1% spread over the current market cap rates of 4.6% - 5% for NYC and SF offices based on recent CBRE data. Similarly on a P/NAV basis (and noting that NAV reflects historic cost rather than market value), the deal looks like good value for PIMCO, with the bid price equating to a multiple of ~0.86x book value.

Finally, CXP’s portfolio is conservatively levered at ~32% net debt/GAV, which suggests there is scope to lever up the portfolio given the strong asset backing and stable income profile. Very crudely, if PIMCO can secure ~65% LTV debt secured on the $4.7bn of GAV and priced at ~3.5% (broadly in line with Blackstone Mortgage Trust financings of office assets in NYC/LA/Boston as a comp-example), this implies PIMCO needs an equity cheque of just ~$825m (vs. the $3.9bn deal value), which would drive cash yield on equity to ~13%+ (assuming the 3.5% interest cost, on an interest-only basis). Not a bad return from prime assets in NYC and other major US cities that are now reopening.

PIMCO’s positive view for office real estate is shared by other PERE players, such as Brookfield Asset Management, who are reportedly exploring the takeover of Alstria Office REIT (AOX), the largest office REIT in Germany, and of which Brookfield already owns ~8%. Prior to Brookfield’s interest becoming public, Alstria was trading at a ~12% discount to NAV and was lowly geared with a net LTV of ~30%. Brookfield’s interest is perhaps not that surprising given this combination of undervaluation with an asset-backed balance sheet that can be levered up, both attributes of obvious appeal to PERE players.

Of course, as I’ve written about before, there is a clear motivating factor here beyond a bet on cities reviving and workers returning to offices, and that is the record levels of PERE dry powder. The PIMCO and Brookfield deals and the increasing PERE interest in the office sector is just further market evidence of this in my view, with $368 billion of dry powder for real estate sitting in opportunistic and distressed funds as of June this year. Office REITs trading at discounts to NAV and GAV clearly fall into the opportunistic category in the current environment and with pressure building to put dry powder to work amid ongoing distressed and opportunistic fundraising, I believe this will present opportunities in office and CRE-related equities.

Against this backdrop, the takeover catalyst continues to stack up for two RE-backed names I’ve highlighted previously, namely Hibernia REIT (HBRN) and Dalata Hotel Group (DHG). With respect to these two names, HBRN trades at a ~30% discount to NAV with its share price having recently suffered a pull back with delayed office returns hanging on sentiment. Notably its most comparable UK and Irish peers continue to trade at ~1x NAV suggesting HBRN’s discount is unwarranted. Similarly, while not an office stock, being a hotel group with meaningful exposure to corporate travel and which directly owns hotel RE, DHG is a relevant mention here. It’s current share price implies it is trading at 7.7x pre-COVID EBITDA vs. 11.5x for it’s closest peer Whitbread Plc, which is a clear mispricing by the market in my view.

Looking beyond HBRN and DHG, British Land Plc (BLND) is perhaps another name that fits into this dry powder-motivated take-private category. BLND is a UK-listed REIT with a market cap of $4.8bn that owns a CRE portfolio valued at £9.1bn, comprising ~£6bn of prime office assets (~66% of portfolio) across 3 central London campuses and retail assets valued at ~£2.6bn (28%) consisting of shopping centres and out-of-town retail parks, with the balance of 6% of it’s portfolio in residential and CRE development land.

BLND currently trades at 0.8x NAV, reflecting the COVID-induced negative sentiment towards its office portfolio due to WFH trends, as well as the obvious “retail apocalypse” narrative hanging over its retail assets, which struggled severely through COVID. (BLND took a ~£1bn+ writedown to its portfolio earlier this year, with the market pricing in further possible writedowns on the retail side).

New CEO Simon Carter BLND is leading a new strategy to diversify away from traditional high street retail to out-of-town retail parks and logistics warehousing, which forms part of a recovery story for the stock, combined with an expected return to offices for it’s core office portfolio (readers might recall BLND being mentioned in last Monday’s newsletter in my discussion of the repositioning of retail space, regarding its recent acquisition of a central London for conversion to a logistics hub).

BLND has a consensus Hold rating due to its retail repositioning being in the early stages and continued uncertainty around future office work practices. However, it clearly possesses a number of attributes that are appealing to a PERE acquirer, and make BLND an obvious take-private candidate in my view :

Perception of being undervalued, trading at a meaningful discount to NAV at 0.8x vs. ~1x for listed London office peers

New CEO with a diversification strategy to reposition the portfolio

Core London office portfolio with strong rent collection (99% in FY20) and stable income profile from blue chip tenant base (e.g. Facebook, UK government, Visa, Dentsu Aegis, Microsoft)

London remains a global city, and post-Brexit and post-COVID is still one of the most liquid real estate markets in the world; as such it remains an attractive location for investment, providing clear upside for an office real estate market recovery

Low LTV, at ~34% offering an acquirer scope to leverage up

Significant development pipeline providing embedded value to an acquirer on developing out.

Financial engineering / break-up potential – an acquirer could divest BLND’s retail assets to achieve a re-rating of the remaining core office portfolio on a follow-on exit; assuming BLND’s retail portfolio was sold at Mar-21 carrying value, holding all else equal and assuming a 1x NAV exit multiple (in line with London office direct peers Derwent London and Great Portland Estates), this could unlock ~£1bn of value on a re-rating and implies a re-rated value equivalent to ~£6.50/share currently (+25%) assuming no other balance sheet optimisation, re-leveraging or value creation from the existing assets.

There are “ifs” with much of the above, but interestingly, Brookfield Asset Management already own ~9.2% of BLND’s stock having built up this stake last year, which fueled takeover rumours previously. Indeed BLND’s portfolio seems a highly complementary fit to Brookfield’s own portfolio of prime offices and retail parks and malls. It’s quite plausible that Brookfield takes a leaf out of its recent CXP playbook and takes BLND private in due course.

From my perspective, while the 0.8x NAV valuation does offer downside protection, the potential upside from the current share price to an assumed 1x NAV take-out is only ~25% so this does not fit with my minimum 50%+ upside for a value situation, but I do think it’s one worth monitoring.

To conclude, I see these latest examples of PIMCO/CXP and Brookfield’s targeting of AOX as further confirmation of my “forced purchaser” theme playing out. This renewed interest in office assets by private capital suggests that if the public markets continue to impatiently undervalue quality office names, then PERE acquirers with record dry powder to deploy will most likely step in and take advantage. Given the strong asset-backing in these names, the downside would appear to be well covered, implying attractive risk-adjusted returns for shareholders on any take-privates playing out.