Disclaimer

Value Situations is NOT investment advice and the author is not an investment advisor.

All content on this website and in the newsletter, and all other communication and correspondence from its author, is for informational and educational purposes only and should not in any circumstances, whether express or implied, be considered to be advice of an investment, legal or any other nature. Please carry out your own research and due diligence.

The Stagflationary Cycle Is Turning

Wednesday morning’s FT report that the Bank of England (BOE) may extend its emergency bond-buying programme past the Friday deadline (today) is the latest chapter in what has been an extraordinary couple of weeks in the UK’s financial markets. It is also perhaps instructive for wider global markets as risks continue to mount.

On Tuesday, BOE governor Andrew Bailey ruled out continuing the BOE’s £65bn bond-buying market programme to support the UK pension fund system, telling UK pension funds rather bluntly they’ve “got three days left” to ensure they’ve sufficient liquidity to withstand any further market shocks. UK gilts duly sold off, with 30 year yields topping 5%, close to the level that originally prompted the BOE to intervene in UK gilt markets in the first instance last month. The BOE’s intervention was required after the UK’s mini-budget effectively led to a potential systemic risk event, triggering massive margin calls and panic among UK pension funds using liability-driven investing (LDI) strategies to hedge interest rate and risk as part of their asset-liability matching programmes.

Following the FT report suggesting an extension was possible, the BOE insisted that its bond programme will finish today. Whether the BOE will ultimately need to intervene again at some point is unknown, but I suspect it will if the recent history of systemic risks is any indication. What is known however is that the BOE’s intervention to backstop the UK gilt market is truly extraordinary.

What’s most striking to me about the UK situation is it has again demonstrated that at the very first sign of a major risk event, a central bank immediately stepped in to stabilise markets. Furthermore, this is entirely consistent with what market participants have been conditioned to believe ever since the Great Financial Crisis (GFC), from “too-big-to-fail” financial institutions in 2008-2009, to the Euro’s “whatever it takes” episode in 2012, to more recently the ~$19.5 trillion (!) of global stimulus (bail-out) packages in the wake of the COVID pandemic in 2020.

A consequence of this reliable pattern of financial rescuing is the ongoing speculation (hope?) of a “Fed Pivot” to support markets if further interest rate hikes eventually “break something” or cause a market accident. Indeed, a “Fed Put” now seems to be a standard market assumption, as much as the risk-free rate itself; if things get really bad, some kind of intervention will surely occur to prevent a total collapse, because that’s what usually happens, as in 2008, 2012 and 2020. Perhaps this “catastrophe backstop” makes sense, providing an emotional crutch for market participants to lean on, which in turn allows the markets to keep functioning rather than seize up. Moreover, perhaps this backstop has to be there because the consequences of there being no backstop is almost unthinkable - a total systemic collapse that would likely lead to a societal collapse, with all the dystopian connotations that come with that prospect.

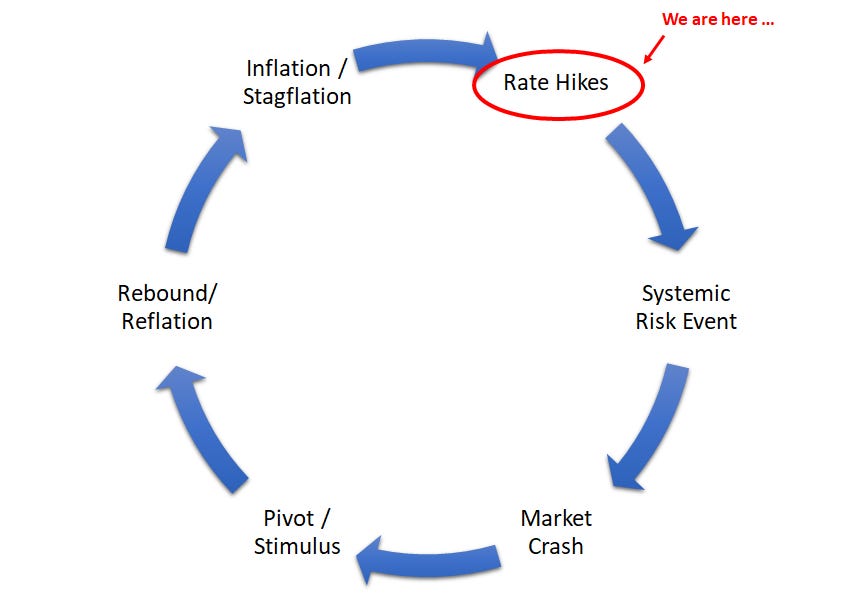

Coming back to the present predicament, I believe future intervention is virtually assured in the event of a systemic risk event or some “Lehman” moment. This leads me to conclude that financial markets are now likely caught in a stop-start stagflationary cycle. I see this cycle turning on initially rising rates (today) in the misguided belief this will solve inflation, before a rate ceiling is reached that results in a rate pivot and easing, thereby fomenting further inflation. Furthermore, the combination of this sustained inflation and the enormous global debt pile will limit growth, resulting in stagflation.

The following schematic sets out my current thinking on this:

Source: Value Situations

I’ll preface what follows with the caveat once more that I am not a macro-economist or macro investor. However as a fundamental value investor I want to try and understand the market environment in order to identify the stocks and situations that offer the most valuation upside in future, based on conditions today and their likely consequences.

So my thinking around the above stagflationary cycle is as follows.

We are currently in the Rate Hike stage, with the major central banks continuing to raise interest rates to combat inflation which is running at ~8%-10% on a headline basis across the US and Europe.

The rate hikes are a blunt instrument that are unlikely to work however, as the primary driver of current high inflation is NOT previously low interest rates and loose monetary policy; rather the root cause of inflation today is undersupply of key commodities due to years of under-investment, primarily in energy, exacerbated by ongoing supply disruption due to the COVID pandemic, ESG pre-occupations and most recently Russia’s invasion of Ukraine.

While higher rates will lead to some demand destruction, I don’t see them solving the current inflation problem as higher rates cannot increase the supply of oil, gas, fertilizer or food, which the world is currently short of and will continue to need regardless of where interest rates get to. In fact, higher interest rates mean a higher hurdle rate for investment in expanding production of the three F’s - fuel, fertilizer and food, and so higher rates today are more likely to further constrain the supply of these essential commodities. And all this is occurring at the same as Russia, a major supplier of these commodities, has been essentially removed from the global supply chain (as I’ve written about previously).

Without any other tools and with inflation surging, central banks have no choice but to continue to raise rates - the only option they have to at least try and quell inflation is to destroy demand. The problem with this approach is that raising rates only increases the likelihood of a systemic risk event and market crash given the level of debt outstanding today, while it doesn’t actually address the supply-side causes of current inflationary pressures. To illustrate this point, I’ll set out a somewhat crude analysis that I think captures the point here.

Total US debt outstanding is currently ~$92.5 trillion (tn) across government debt, municipal, corporate, household etc, and the average interest expense across all such debt is currently ~$3.5 tn, for an effective all-in rate of ~3.75%. This all-in rate is clearly going to increase into next year if the Federal Reserve is targeting a 4.5% - 4.75% federal funds rate (FFR) (vs. 3.25% currently) to kill off inflation.

But there’s a problem with this. If we assume a further say 150 bps increase in the FFR by next year ( 2 x 75 bps increases), that’s an incremental ~$1.4 tn in interest expense. In addition, given the $92.5 tn in debt outstanding is across all debt and not just “risk-free” treasury debt, AND given rising recessionary concerns (and therefore credit risk), it’s reasonable to assume some kind of credit spread of say 200 bps over the FFR to further price in these risks on the debt; as a crude sense-check, both US corporate debt and mortgage debt yields currently trade at a ~200bps spread to the US 10 Year government bond. This therefore implies an incremental interest cost of ~3.5% (+150 bps in FFR + 200 bps in additional credit spread), for an additional interest expense of $3.2 tn across all debt ($92.5 tn x 3.5%).

Of course, all $92.5 tn won’t reprice immediately as a portion of this is fixed. So let’s crudely assume 50% of this will be subject to the pass through of higher interest rates over the next year or so, reflecting floating rate debt and maturity/refinancing of existing debt (and ignoring defaults which will surely rise also). This equates to ~$1.6 tn of incremental interest expense ($3.2tn x 50%), bringing total interest expense to ~$5.1 tn (current $3.5 tn expense + $1.6 tn of incremental expense). And here lies the problem - this $1.6 tn in incremental interest expense alone represents a ~6.7% hit to US GDP (of ~$24.1 tn), which compares to a -4.3% peak-to-trough to US GDP during the GFC ! (and obviously if current GDP contracts in a bad recession, this incremental interest hit is even greater).

So based on this simplistic analysis, the signaled rate increases from the Fed imply a potential economic hit to the US economy that is ~1.6x greater than the GFC. This suggests to me that there is a clear ceiling on interest rate hikes. It also further demonstrates how rate increases cannot resolve inflation - put simply, the debt outstanding is too great to allow for the level of demand destruction required to bring down inflation via rate increases. Phrasing it another way, a massive systemic crisis greater than 2008 (which a 6%+ decline in US GDP would surely represent) may be the only way to kill off inflation, but I don’t see that being allowed to happen. So my sense is a great intervention at the moment of true systemic risk is inevitable.

However, that’s not to say a market accident or crash can’t happen given that rate hikes are set to continue plus the myriad risks and leverage embedded across the financial system. Returning to my stagflationary cycle theory above, a Systemic Risk Event (following rate hikes) is now quite likely in my view, as the recent “Lehman moment” for European energy and the near-collapse of the UK pensions system may portend. I think it is not unreasonable to expect a ~30% drawdown from current market levels, which would take the SPX to ~2,500 or so. Such a decline would imply a peak-to-trough drawdown of ~50% from the SPX’s peak in January of this year and would be consistent with previous crash experiences in 2000-02 and 2007-2009.

Clearly this level of decline would reflect panic and a market crisis, necessitating the intervention of central banks. This is when the Pivot / Stimulus stage in the stagflationary cycle finally comes back into play with rate cuts, stimulus and bail-outs as required. As with previous crises, the Pivot /Stimulus stage would then lay the groundwork for a Rebound /Reflation of the economy, with rates kept low to ensure stability for a sustained period of time.

However as all this plays out, the original root cause of the inflation that necessitated present rate hikes still won’t have been resolved. Currently the world remains short of energy and food, and further rate increases up to a risk event (crash) will only serve to further limit investment in increasing supply in the interim. Rather, if this crisis scenario plays out, it is more likely that supply of essential commodities will become even more constrained, driving renewed inflation, particularly given the ongoing war in Ukraine and Russia’s exclusion from supply chains.

The final Inflation/Stagflation stage may come about as financial conditions are eased to stimulate economic activity post-crash, where the supply of essential commodities and goods remains constrained. I see this as the second wave of inflation, similar to but more severe than the post-COVID re-opening experience. I would expect that stimulus-facilitated capital will flow into key strategic sectors including defense, infrastructure, energy security and the energy transition, as well as conventional energy, fertiliser and food production out of sheer necessity. But with growth inhibited by a global debt load that was never reduced following COVID, low rates and high inflation will be needed to both service and inflate the debt away gradually, resulting in a stagflationary environment (and possibly negative real rates again).

So what does a value investor do in facing into such a challenging environment?

While this might seem a gloomy outlook, is it not one devoid of opportunity. Constrained supply and a rebuilding of the global economy and supply chains in tandem with the energy transition and a more defense-oriented geopolitical order will mean real assets and commodities will be in great demand and highly prized by the market in time.

Again I’m not a macro investor and I may very well be wrong, but I find setting out my present thoughts useful in framing my search for undervalued or mispriced equity situations. Given my view of the world now, my focus is on selected commodity (energy and food-supply related) names which I believe are attractively valued on a medium term basis, even in the context of a possible ~30% drawdown as outlined above.

Furthermore, I think it makes sense to prepare a “shopping list” of names to acquire in the event of both a crash event and a second wave of inflation, with a focus across energy, food supply, precious metals, strategic metals (e.g. copper), and selected real estate and infrastructure names. Crash events typically happen “gradually, then suddenly” and I suspect we are in the “gradually” phase - having a list of names in preparation for the “suddenly” moment therefore seems prudent now.

Any Other Business

For this week’s AOB I’m sharing a YouTube discussion with Doomberg, entitled The History of Energy Shocks with Doomberg.

Of particular interest to me was the discussion of the concept of the Energy Density Ladder, and the relative density of uranium compared to other forms of energy.

The discussion is a short one and well worth listening to, and can be found here.

Why Not Subscribe to the Paid Tier?

If you find the ideas in this newsletter interesting, please consider signing up to the Paid Tier.

You can read more about the paid offering here.

This newsletter is 100% reader supported and free from conflicts of interest or other commercial considerations. In writing Value Situations my job is essentially to generate ideas for subscribers that supplements their own idea origination process.

Furthermore, I believe the value proposition for paying subscribers is compelling. I am a former private equity/special sits investor that has worked with one of the largest alternative investment firms in the world, and so paying subscribers will be getting thoughtful, buy-side quality ideas and analysis for a very small fraction of the cost of employing a buy-side analyst full-time.

If you find this newsletter interesting, please also consider sharing it with friends and colleagues by clicking the Share button below.

Here’s what other investors are saying about Value Situations:

Value Situations was named as one of the Top 100 Must Follow Stock Research accounts by Edwin Dorsey of The Bear Cave Newsletter:

Good thought experiment, but would inflation not translate into higher nominal gdp?