Weekly Bulletin #6

Portfolio: DHG, DOLE, PANR | Monitoring: BG, HBRN | Developing: Sprott Inc.

Disclaimer

Value Situations is NOT investment advice and the author is not an investment advisor.

All content on this website and in the newsletter, and all other communication and correspondence from its author, is for informational and educational purposes only and should not in any circumstances, whether express or implied, be considered to be advice of an investment, legal or any other nature. Please carry out your own research and due diligence.

Model Portfolio Updates

There are three brief updates of note from the past week with respect to Model Portfolio names Dalata Hotel Group Plc (DHG), Dole Plc (DOLE) and Pantheon Resources Plc (PANR).

DHG

DHG announced full year FY21 results last Tuesday, which made for impressive reading, with revenue, EBITDA and FCF all ahead of the Value Sits Base Case Model numbers for FY21 and unsurprisingly well ahead of the FY20 COVID year.

I put out a tweet summarising my initial thoughts last week, but I’ll summarise the salient points here as follows:

Revenue +40% YoY, and +12.6% v. model

EBITDA (Post-IFRS 16) of €63.2m, +238% vs. PY, and +127% vs. Value Sits Model

EBITDA (pre-IFRS 16) of +€30m vs. -€56m in PY, and -€11m in Value Sits Model

FCF of +€28m vs -€41m in PY, and -€17.6m in Value Sits Model

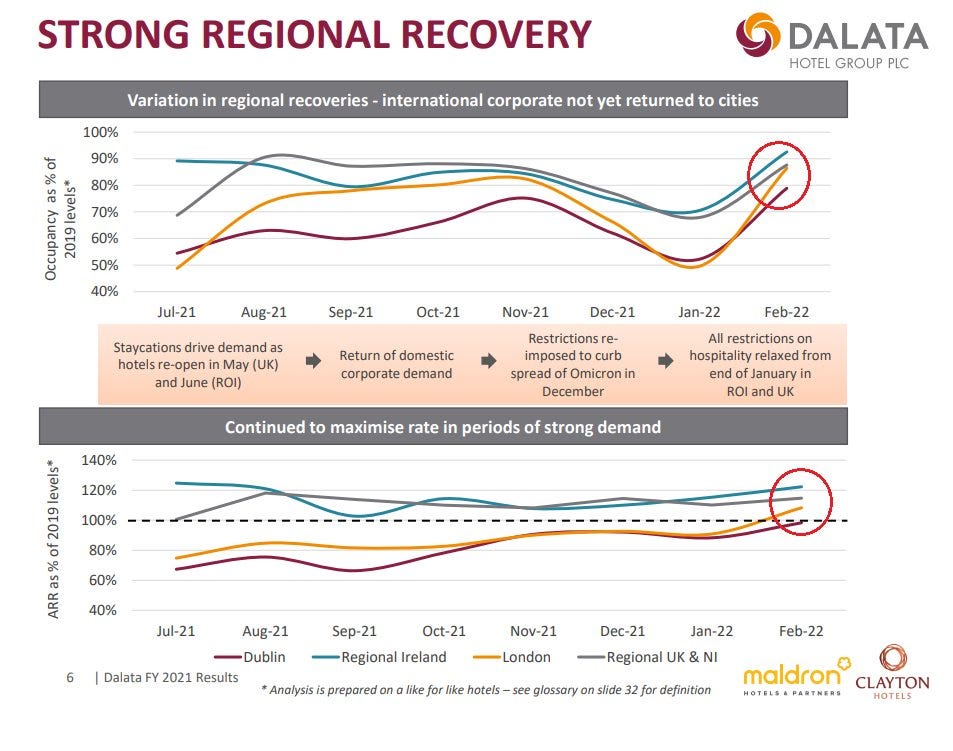

Occupancy and ARRs all ahead of PY and Value Sits Model, as shown below:

Source: Dalata Hotel Group FY21 Results announcement; Value Sits analysis.

One interesting takeaway from the Results Presentation was the clear uptick in occupancy to 80%-90% of FY19 levels, and ARRs to 100%+ of FY19 levels so far in FY22 (noting Jan & Feb are the low season for the hospitality industry, which seems clearly indicative of a market recovery now taking hold:

Source: Dalata Hotel Group FY21 Results Presentation.

Post these results, DHG is trading at ~40x FY21 EBITDA (or 24x on post-IFRS 16 basis), but this obviously obscures the value being based on very depressed FY21 earnings due to COVID - note that DHG’s hotels were effectively shut for ~6 months of FY21 due to COVID restrictions and depressed travel and economic activity.

On a pre-COVID EBITDA basis, DHG is trading at ~8x pre-EBITDA vs. ~11x for listed peers, and just ~7x my estimate of stabilised post-COVID EBITDA (based on the share price as at the time of writing). Another value perspective here is that DHG is also valued at just 0.8x EV/IC, so the business is valued by the market at a wide discount to its 6,232 room owned real estate portfolio with ZERO VALUE ascribed to its 3,675 room leasehold portfolio AND it’s pipeline of ~2k new rooms!

Finally, as I’ve highlighted before, recent private market hotel deals have traded at ~12x pre-COVID EBITDA and in a range of €155k - €180k+ per key, while DHG is valued at sub-€120k per room despite its well located and well-invested portfolio, which is superior in quality to some of these recent comps.

DHG remains an obvious value situation in my view.

DOLE

DOLE peer Fresh Del Monte (FDP) reported full year FY21 results last week, with no surprises or negative read across for DOLE in my view.

Focusing in on gross margins, FDP reported a 3.9% gross margin for Q4 FY21, down 1% sequentially on Q3’s 4.9% and similarly YoY on the 4.9% adjusted gross margin reported for Q4 FY20 (after excluding write-downs and some other exceptional charges). This decrease in underlying margin was not surprisingly mainly due to inflationary and other cost pressures in production and distribution, and including packaging materials, fertilizers, inland freight, labor and fuel. Notably, the decrease was partially offset by price increases effected with customers late in Q4.

Given the market’s current fixation with cost inflation as it pertains to DOLE’s margins, if we assume a similar 1% gross margin hit in Q4 for DOLE that flows right down to EBITDA, on guided Q4 revenue of ~$2.2bn and EBITDA of ~$60m, this implies Q4 EBITDA now of ~$38m, and implies a full year outturn of $376m, up +1.3% YoY on FY20 PF EBITDA. And this is before factoring in any price increases from customers that we know were agreed in back in Q3.

On this basis, if we assume a poorer-than-expected $376m in EBITDA (management guidance is $390m - $400m), DOLE is valued at 7x FY21 EBITDA vs. 9x for FDP. If DOLE were to re-rate to FDP’s multiple on this basis, it implies a value of ~$22/share or +48% vs. the current share price, but if DOLE were to hit guidance of ~$400m in EBITDA and (justifiably in my view) re-rate in line with FDP at 9x, this implies a value of ~€24/share or ~64% upside to the current stock price. Why should DOLE re-rate? Well one obvious reason is that we know it has greater scale and market positioning than FDP to weather cost pressures, and we also know it has agreed price increases with customers to fully offset cost inflation for FY22 which should protect margins and EBITDA.

DOLE is scheduled to report its full year results on 15 March, which I await with interest.

PANR

PANR provided a further operational update last Friday, as well as a notice of conversion of non-voting shares into voting shares.

Firstly regarding the operational update, the company announced the suspension of testing of the Shelf Margin Deltaic ("SMD") horizon at the Talitha #A site following a blockage occurring in the wellbore. This decision to suspend was made in order to prioritise testing at Theta West, with the rationale being to ensure sufficient time and resources to progress the Theta West testing programme, given it is PANR’s key resource asset. As the company explained:

The main priority for the remainder of the winter season is to allow sufficient time to satisfactorily test the BFF at Theta West, with operations expected to commence next week. The current unavailability of alternate testing equipment necessitates the movement of the Coil Tubing Unit and test equipment from Talitha to Theta West. This consequently limits the amount of time available for remedial work at Talitha.

With a limited time schedule, clearly given the choice between getting bogged down in remedial work at SMD and progressing Theta West, management’s decision is the right commercial one here. CEO Jay Cheatham further explained the position as follows:

In this strong oil price environment, many upstream companies operating in the oil and gas sector are facing equipment and logistics challenges with high equipment utilization rates. As we are well into the drilling season, we made an easy decision to suspend activity at Talitha to afford sufficient time to undertake thorough testing at the significant Theta West project.

Furthermore, SMD is not a write-off here by any means. Recall that the SMD is the final zone to be tested at Talitha following previous testing of the Basin Floor Fan (BFF) and Slope Fan Systems (SFS) at Talitha, both of which produced excellent results. Management expect that the SMD zone should produce better results than both these following completion of remedial and further testing work in time, and they do not believe the SMD’s resource potential is compromised as a result of the current blockage issue.

The company’s intention is to return to the SMD after testing at Theta West is completed either this testing season or later in the year. Testing at Theta West will commence this week.

Separately, PANR is completing the conversion of ~4.8m non-voting shares into voting shares on a one to one basis, which will have the result of increasing the issued ordinary voting shares by the same number, to ~753.7m shares. The impact of this is negligible and has no impact on my recent valuation which is on a fully diluted basis, reflecting conversion of the convertible note as well as all warrants and share options.

Russia’s invasion of Ukraine has further disrupted global commodity markets that were already highly inflationary, but with growing calls for an embargo on Russian oil and a push to reduce Europe’s reliance on Russia for energy, I would argue that PANR’s assets are becoming more strategically valuable, aside from the general oil price inflation to date. As such, I believe PANR's intrinsic value may steadily rise as a result, something not priced into my current valuation.

Situations Monitor

There are further updates for two names I’m monitoring from the past week, namely Bunge Limited (BG) and Hibernia REIT Plc (HBRN).

BG

It shouldn’t be a surprise that with the Russian invasion of Ukraine, global commodity markets continue to be significantly impacted, and thus weekly headlines regarding surging prices for crops and oil are highly relevant to the BG thesis.

As I highlighted last week, the war in Ukraine is disrupting global wheat supplies, driving wheat prices to above $11 a bushel for the first time in 14 years. In addition to the wheat market, the South American soybean crop is now expected to be smaller than expected, with indications of tightening global supply despite record breaking harvests still being expected in Brazil, due to a range of issues including adverse weather, the Ukrainian conflict and rising demand. As a result, the risk of further crop supply tightness and even shortfalls remains high.

Such conditions only serve to increase volatility and with robust demand, this makes for a profitable trading environment for BG. This appears to be increasingly understood by the market, with BG’s stock price up +15% since I published the idea last month as part of my Food for Thought inflation theme.

HBRN

Following last week’s announcement that funds managed by Brookfield Asset Management were acquiring Belgian office REIT Befimmo (BEFB), another REIT takeover announcement last Tuesday has served to again highlight HBRN’s anomalous valuation.

UK flex office space provider Workspace Group Plc (WKP) announced that it was acquiring fellow UK-listed McKay Securities Plc (MCKS) in a cash and stock deal that values MCKS at 0.9x NAV based on WKP’s current share price. MCKS is a REIT specialising in the development, refurbishment and management of office, industrial and logistics property in London and South-East UK, with ~65% of its portfolio comprising office assets, and the remainder comprising industrial and logistics properties. Unlike HBRN (or UK peers such as Derwent London or Great Portland Estates) MCKS doesn’t own the kind of ESG-compliant, amenity-rich prime office campuses that corporate occupiers are seeking post-COVID. Rather it owns out-of-town, older office stock geared more towards flexible / hybrid working office demand. Despite having what I would suggest is a meaningful quality gap vs. prime office assets, MCKS is being valued at 0.9x NAV in the deal.

By contrast, HBRN is currently valued in the public markets at ~0.64x NAV, and may well be the cheapest office REIT in Europe at present, offering a (sustainable) dividend yield approaching ~5%. HBRN has declined by ~15% YTD, on no discernible newsflow that would warrant such a decline. This just seems too cheap when one considers the quality of it's portfolio, comprising prime city offices leased to sticky government/tech/ blue chip tenant base, and which had one of the strongest rent collection rates of any REIT across Europe through the COVID lockdowns.

Private market transaction evidence clearly tells us that HBRN is significantly undervalued at this point, effectively trading at a distressed valuation despite being among the lowest geared REITs in Europe at a ~20% LTV (which compares to ~41% for BEFB and ~34% for MCKS) with a prime portfolio generating strong and resilient rental income.

This makes HBRN ripe for a take-private by PE-RE in my view.

Developing Situations

Back in the Weekly Bulletin #3, I highlighted gold (XAU) as an interesting developing theme given not just the current inflationary outlook, but also what I see as a ceiling on the raising of interest rates and therefore the likely persistence of negative real rates, which increases the attractiveness of owning gold.

I indicated that certain gold miners and royalty companies were starting to look interesting, however I believe that Canadian alternative asset manager Sprott Inc (SII) may be another, less obvious way to play this theme. The Sprott name is a well known brand in the precious metals space. SII was founded by Eric Sprott and over the last 40 years it has grown to become a leading global asset manager specialising in precious metals and real asset investing. Today SII is a somewhat unique asset manager, offering investment products including physical bullion and commodity trusts, managed equities, mining ETFs, as well as private equity and debt strategies. SII also finances natural resource companies through our its specialist brokerage and resource lending business units.

SII has a current market cap of ~$1.1bn, and has ~$20.4bn in AUM, comprised as follows:

Source: Sprott Inc. 2021 Annual Report

SII has grown AUM at a CAGR of 29% over the last five years, and generated total net revenues of ~$126m and EBITDA of ~$51m in FY21 (~40% EBITDA margin). While SII has historically been synonymous with gold and silver investing, it has most recently garnered attention for launching the Sprott Physical Uranium Trust (U.U / SRUUF) , which has driven a surge in the spot price of uranium following its launch last year.

What makes SII interesting in my view is that with gold and silver now expected to outperform in a highly inflationary and negative real rate environment, SII is effectively like a royalty company levered to this theme, as it collects management fees on the various gold and silver trusts it manages. Given that SII’s gold and silver trusts are among the most popular in the market with growing market share, I see SII akin to a toll collector on funds flowing into the precious metals space as inflationary fears continue to rise (and purchasing power declines), particularly post the commodity supply shock triggered by Russia’s invasion of Ukraine:

Source: Sprott Inc. 2021 Annual Results Presentation

Furthermore, as I’ve written before the market backdrop for uranium is particularly favourable, and with nuclear energy increasingly viewed as a potential solution to the current energy crisis (including reducing Europe’s reliance on Russian natural gas) SII’s uranium trust vehicle is one of only two physical uranium commodity vehicles in the market (along with my Model Portfolio conviction name Yellow Cake Plc, YCA). Thus SII’s U.U/SRUUF trust levers it to what I believe is a new structural energy-commodity growth theme, that should see AUM and management fees grow substantially.

So what is the potential value opportunity here?

Currently SII trades at ~22x FY21 EBITDA, which in line with its 10 year average multiple. However FY21 EBITDA reflects a year when AUM grew from $14.6bn to $20.4bn, and so understates run-rate earnings power on current AUM - on this basis, SII trades at ~18.5x Q4 run-rate EBITDA.

But AUM is unlikely to remain static, and should continue to grow meaningfully given the strongly inflationary outlook for precious metals and uranium prices. If we assume SII grows AUM at say 20% p.a. over the next three years (or half the FY21 growth rate and below its 27% AUM CAGR over the last five years), this implies AUM by FY24 of ~$35bn.

I estimate SII could generate net revenues of ~$246m and EBITDA of ~€100m (~2x current FY21 EBITDA) by FY24 on this basis, implying SII is valued today at ~11x. Given the growth prospects, and the royalty/toll collection nature of SII’s management fees, its not unreasoable to assume SII holds onto a 22x multiple into the future in line with its historic valuation. This would imply a share price of ~$85/share, assuming SII generates $100m in EBITDA by FY24, or ~94% upside to the current price (~25% IRR / 1.9x MOIC).

As for downside, given SII has steadily grown AUM over time and the supportive market backdrop for uranium, gold and silver, it’s unlikely AUM reverses dramatically. However, at a high level if we assume AUM declines by ~30% (which I view as both extreme and unlikely), this implies EBITDA may contract to ~$35m or so. Again assuming SII holds its long-term average 22x multiple on this basis, this implies a stock price of ~$30/share or -30% below the current price. Why assume SII holds a 22x multiple in a downside scenario? Given the royalty-like predictability of its earnings stream, SII’s multiple should remain relatively stable, as well as noting that SII has held this average valuation historically when both commodity prices and AUM were much lower than at present.

Of course this is only a simple, high level analysis, but it does suggest that SII is a potentially asymmetric situation with upside of 3x the downside risk based on the above.

Another thought that occurs to me is if we look at how the alternative asset managers such as Blackstone, Brookfield Asset Management etc performed through the low interest rate/PE/AUM growth boom over the last decade, this suggests an interesting read across for SII. If high inflation, negative real rates and hard asset/commodity demand are the new regime, it stands to reason that SII should ride this trend and grow AUM and earnings in a similar manner to how these PE firms did through the low rate regime of the last ~10 years (that has perhaps now ended):

Should SII follow a similar trajectory, it is clear there is significant upside potential from here.

Any Other Business

Berkshire Hathaway published its annual letter to shareholders from Warren Buffett last week, which can be read here.

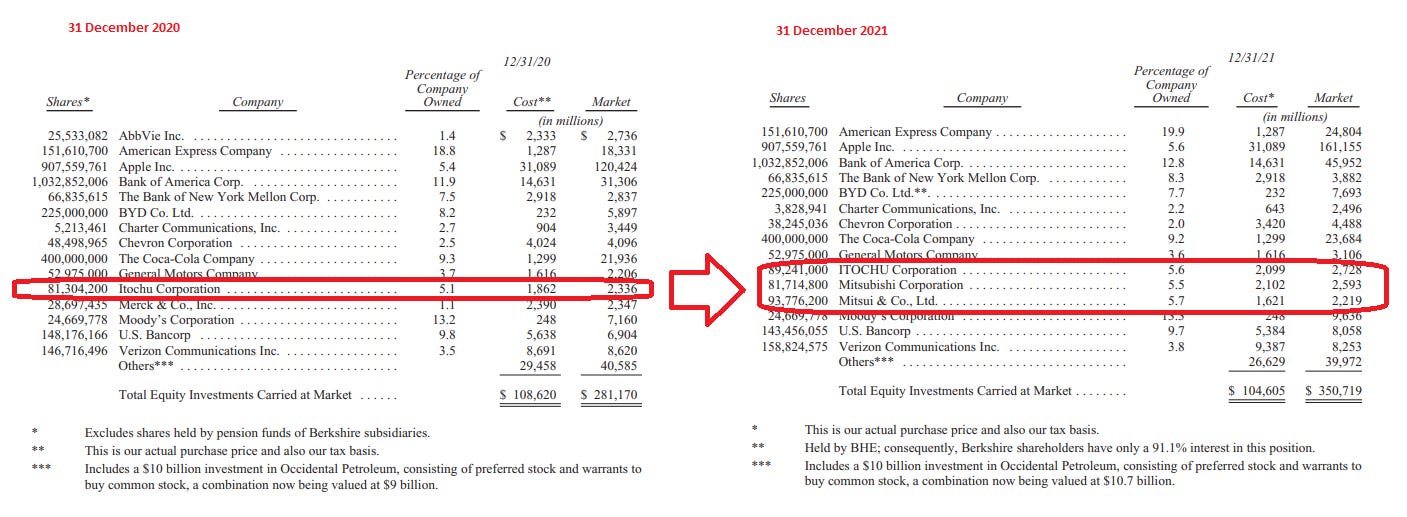

As I read through the letter, one observation struck me with respect to Berkshire’s public equity holdings: over the last 12 months, Berkshire has substantially increased its shareholdings in the Japanese commodity houses known as the “sogo shosha”. Recall that back in 2020, Berkshire acquired just over a 5% stake in each of the five largest Japanese commodity trading companies - Itochu Corp., Marubeni Corp., Mitsubishi Corp., Mitsui & Co., and Sumitomo Corp.

Approx. 18 months later, with inflation now ripping through the global economy these investments look to have been a very prescient bet. The latest Berkshire letter discloses that over 2021, Berkshire acquired a further ~8m shares in Itochu (increasing Berkshire’s ownership interest to ~5.6%), and also added to its Mitsubishi and Mitsui stakes, making them among Berkshire’s 15 largest equity positions:

Source: Berkshire Hathaway Shareholder Letters 2020 & 2021

These companies haven proven to be major winners over the last year, reporting record profits as energy, metals and crop prices surged.

This of course has an interesting read across for BG, given its position as a global commodity house. Buffett’s reasons for buying into the Japanese trading firms at the time were threefold - (1) they offered torque to coming inflationary forces, (2) they are well-managed, entrenched businesses, and (3) they were cheap relative to their fundamental prospects.

As I noted above, BG is up +15% since I wrote about it but still trades at just ~7.3x LTM EBITDA vs. a range of ~10x - 20x for the five Japanese trading firms. I would argue Buffett’s thesis in buying into the Japanese firms applies to BG today, particularly now given the Russian invasion of Ukraine increases the likelihood for further and sustained commodity price inflation and disruption, particularly for key crops.

Thanks Conor. 0.9x NAV paid for MCKS cannot be directly compared to HBNR as their logistics portfolio was probably valued above NAV

Much appreciated as usual. Thanks, Conor!