Weekly Bulletin #12

Portfolio: DHG, PANR, WTW, YCA | Monitoring: AFM, BG, SLCA | Developing: Green Metals Shortage - APF.LN

Disclaimer

Value Situations is NOT investment advice and the author is not an investment advisor.

All content on this website and in the newsletter, and all other communication and correspondence from its author, is for informational and educational purposes only and should not in any circumstances, whether express or implied, be considered to be advice of an investment, legal or any other nature. Please carry out your own research and due diligence.

Model Portfolio

There are updates with respect to four Model Portfolio names from last week.

DHG

Dalata Hotel Group Plc (DHG) provided a very positive trading update as part of its AGM notice published last Thursday.

The update stated that RevPAR for the March-April trading period is expected to be ahead of pre-COVID 2019 levels at 109%, with RevPAR for April exceeding 2019 levels in each of the group’s Dublin, Regional Ireland and UK regions.

Regarding outlook, management are optimistic for summer trade given increased flight travel and a strong events calendar, while the business is seeing some cost inflation impact in labour, energy and food.

In terms of growth, DHG will increase its portfolio of rooms by 20% this year, including four new hotels opened so far this year.

In all, a very encouraging update from DHG.

PANR

Last Wednesday, Pantheon Resources Plc (PANR) held a shareholder update presentation in which management presented the results and conclusions from the recent Winter drilling and testing programme, and outlined next steps in the development plan for PANR’s oil assets. (the video of the presentation is available here and presentation materials can be found here.)

True to form, this was another extraordinarily detailed and technical presentation that in my view provides further confidence as to the substantial value of PANR’s enormous, world-class oil resource that is not reflected in its current market cap.

For some perspective, the results of the Winter programme indicate that PANR sits on the what is probably the largest and most significant onshore oil discovery in North America in ~50 years, as Technical Director Bob Rosenthal summarised:

We have made several, significant new light oil discoveries… importantly we have a major upgrade in our confidence that these are huge accumulations, and they represent probably collectively the highest resource density, that’s barrels of oil per unit area discovered on the North Slope, in perhaps all of North America since Prudhoe Bay which was about 50 years ago.

My main takeaways from the ~2.5 hour presentation and Q&A session are as follows:

Management have proven four giant oil reservoirs, now comprising 23.5 billion barrels of oil in place (OIP), consisting of three reservoirs at the Talitha A well, being the Lower Basin Floor Fan (LBFF), the Slope Fan System (SFS) and the Shelf Margin Deltaic (SMD), with the fourth reservoir being the giant Theta West Lower Basin Floor Fan (LBFF)

This 23.5 billion barrels number reflects a significant resource upgrade by management who now estimate that Theta West LBFF contains 17.8 billion barrels OIP (vs. 11 billion previously estimated, a +62% increase), and of which they estimate 1.78 billion barrels are recoverable (vs. 1.2 billion previously, +48% increase).

It’s also worth noting that this latest 23.5 billion barrel OIP number compares to management’s previous estimate of 17 billion barrels as outlined in the January AGM update presentation; however that January OIP total included an estimated 1.4 billion barrels for the Kuparuk reservoir and 1.1 billion barrels for the Theta West Upper Basin Floor Fan (UBFF) - as PANR didn’t test these two reservoirs during the Winter programme (due to time constraints), these have been excluded from this latest 23.5 billion barrel resource number. So assuming further testing confirms the previous Kuparuk and UBFF estimates (a high probability in my view), PANR should have a total OIP resource of ~26 billion barrels.

Management are assuming overall recoverability rates of ~10% - 11% on the 23.5 billion barrels, implying a recoverable oil resource of ~2.35 billion - 2.58 billion barrels. However this recovery rates appears very conservative relative to other oil fields on the Alaskan North Slope - the Tarn Oil Field has demonstrated a 40% recovery rate to date, while the Prudhoe Bay oil field (the largest oil field in North America at ~33 billion barrels OIP), has a recovery rate estimated at over 60%. CEO Jay Cheatham made a notable comment in this regard during the presentation when he said were they to add an additional 5% recovery to the 23.5 billion estimate this would add “over a billion barrels more” of oil recoverable, and suggested the recovery rate could go up to 20% - 30% in time, which obviously implies enormous valuation upside.

Alkaid (a 0.9 billion barrel well, ~77m barrels recoverable) is expected to be production by October, following planned commerical production testing for July - once successfully producing, PANR will be a producing company which will further de-risk the situation.

These latest testing results have further de-risked the overall PANR equity story, with four now-proven reservoirs, an increased resource base and the company on the cusp of production, all in a higher oil price environment that is likely to persist for some time; furthermore the renewed emphasis on energy security and independence following the Russian invasion of Ukraine means PANR’s assets now benefit from increased strategic value given their North American on-shore location.

Finally management re-iterated the strategy is to “Prove up and sell” - they remain open to future farm-in discussions with other partners but the potential terms have now changed in PANR’s favour given that the company is sufficiently well funded to further prove and develop the assets with a view to an exit at the right price - as Justin Hondris, Director of Finance & Corporate Development stated:

We’re … building a proper company .. we’re trying to build a proper, grown-up blue-chip company that’s worthy of attracting institutional investment, that capital will allow us to grow that company and to pursue our strategy of proving up and selling at the right price.

In summary PANR is on track to unlocking a gigantic, world class oil play that implies a valuation that is a multiple of its current market cap. Given this is a material new update, I will be publishing an updated valuation analysis for PANR later this week.

WTW

Willis Towers Watson reported Q1 FY22 results last Thursday (Q1 presentation materials here). The results were solid and in line with expectations, with highlights as follows:

Revenue decreased -3% to $2.2 billion vs. Q1 FY21 (organic growth +2%)

Adjusted EBITDA +6% YoY at $518 million (24% margin) up 6%, vs. $488 million (21.9% margin) in Q1 FY21

Adjusted Operating Income +10% YoY at $371 million (17.2% margin), vs. $338m (15.2% margin) in Q1 FY21 operating - margin increase of 200 bps reflecting improved operating leverage and cost savings

Capital Allocation - during Q1, WTW repurchased 9.9m shares / $2.3 billion (implied average price of $232/share), achieving the $4.1 billion share repurchase target set at last September’s Investor Day target for FY22 ahead of schedule.

Following staff attrition in the wake of the AON merger process last year, hiring has strengthened again with Q1 FY22 hiring activity up 23% vs. Q4 2021, while voluntary terminations declined 19%

Outlook - management are maintaining previous FY22 guidance for mid-single digit organic revenue growth and adjusted operating margin expansion for the full year.

The results indicate WTW is on track to achieve its planned growth trajectory and is ahead of schedule on its enormous capital return plan (with 40% of an intended $10bn+ of capital return by FY24 already achieved). On this basis I see no change to the value thesis for WTW, with the stock down -11% since my original underwrite and trades at sub-12x LTM EBITDA vs. peer group average of ~18x.

With WTW performing to its growth plan and returning significant capital to shareholders I continue to believe it represents a very compelling, undervaled situation.

YCA

There were also some brief updates for Yellow Cake Plc (YCA) from last week:

The 30 day $3m share buyback programme continued last week with two further repurchases of shares last Monday and Friday, amounting to ~£732k for a total of ~179k shares (average price of £4.09/share).

Separately, YCA provided a Q1 Operating update last Wednesday which stated YCA’s ability to take delivery of U3O8 from Kazatomprom (in Kazakhstan) remains unaffected by the geopolitical events in Ukraine. As such YCA management do not expect any issues or delays with the contracted deliveries of ~2.97m lbs of U308 from Kazatomprom scheduled in May and June. Including these deliveries, YCA’s PF NAV assuming a $53/lb uranium spot price is £4.40 vs. the current share price of £3.98/share, or 0.9x PF NAV.

Both the spot price of uranium and uranium equities have pulled back from recent highs due to risk-off sentiment, most likely attributable to the latest COVID lockdowns in China and mining cost inflation concerns.

However, with the energy crisis set to continue due to the conflict in Ukraine and a move away from Russian oil and gas dependence (particularly now that Russia is suspending supply to parts of Europe), increased demand for nuclear energy seems inevitable given its relative immunity to oil and gas price fluctuations and the fact that it is regarded as a green, zero-carbon power source.

Changing attitudes among policy makers further supports this view, such as South Korea’s reversal on its previous nuclear phaseout plan and growing support for nuclear power again in Japan. Despite the current volatility, I remain comfortable with the uranium thesis and with YCA as being the optimum (and a discounted) instrument to capitalise on this situation.

Situations Monitor

There are updates for three names I’ve been monitoring from this past week:

AFM

Alphamin Resources (AFM), the leading tin miner and last week’s featured Developing Situation, announced a very positive update last Tuesday regarding its latest drill results at its Bisie Tin Complex in the DRC.

The drilling update covered both its existing, operational Mpama North mine and the as yet undeveloped Mpama South development project adjoining Mpama North.

Regarding Mpama South , AFM reported the best drill intercepts to date at the project, with tin grades of between 3% - 10.35%, while the expansion drilling at Mpama North found tin grades of between 5.9% - 7.5% at one drill site, and 21.75% - 40.57% at a second drilling site. Given that the existing Mpama North mine is regarded as the highest grade tin mine in the world with an average tin grade of 4.5% (which is approx 3x - 4x higher grade than most other operating tin mines), these latest results are extraordinary, and should only serve to enhance the value of AFM in its current sale process.

In summary, AFM sits on a world class and strategically very valuable asset in the context of the global energy transition to electrification. Given this latest update, I expect AFM to achieve a substantial premium to its current share price in any sale, and it is now a candidate for inclusion in the Value Sits Model Portfolio as a shorter-duration (given imminent expected sale) special situation.

I continue to track this situation and will update subscribers if/when AFM is added to the Model Portfolio.

BG

Bunge Limited (BG) announced very solid Q1 FY22 results last week, beating both revenue and earnings consensus estimates, with key highlights as follows:

Revenue increased 14.7% YoY to $11.2bn due to higher sales prices, offset by lower volumes vs. Q1 FY21

EBITDA decreased ~16.5% YoY to $0.99bn (vs. $1.19bn in Q1 FY21), primarily attributable to higher energy, commodity and input costs within COGS in the core Agribusiness and Refined & Specialty Oils segments.

Regarding outlook, management are increasing their earnings forecast from previous guidance given expected strong demand and tight supply in the Agribusiness segment, while Refined & Specialty Oils are forecast to be up on previous guidance driven by strong demand from food and fuel in North America and Europe. Finally in the Milling segment, full-year results are expected to be ahead of the previous outlook and significantly higher than last year due to continued strength following Q1 results.

Management are raising EPS guidance from previous $9.50/share to at least $11.50/share for the full year (+21% increase).

The results are not that surprising given the dislocation in global food-commodity markets and the war in Ukraine significantly disrupting global wheat and vegetable oil supply - CEO Greg Heckman characterised the current environment as an “unprecedented global market” for key food, feed and fuel products. Clearly BG is benefiting from this macro backdrop.

Post-results BG trades at ~8.5x LTM EBITDA vs. ~12x for direct peer ADM, indicating it remains fundamentally undervalued against a highly supportive outlook and despite the stock already being up ~22% since I originally presented the idea in January.

In tandem with BG’s results, a plethora of wider market news items and updates last week would appear to support the thesis for BG:

Peer ADM reported its most profitable quarter ever and sees years of tight supply for agri-commodities.

Indonesia has placed an export ban on palm oil (the worlds most consumed edible oil) to ease surging domestic prices (as a major global producer of vegetable oils, BG is a beneficiary of this further supply disruption).

The World Bank published its April 2022 Commodity Markets Outlook Report, in which it concludes that food and energy price shocks due to the war in Ukraine could last for years, referring to the current situation as “the largest commodity shock we’ve experienced since the 1970s.”

The unfortunate truth of this market backdrop is that the global food-commodity oligopoly of which BG is a member looks set to continue to benefit from these conditions.

SLCA

US Silica (SLCA) reported positive Q1 results on Friday, highlights as follows:

Revenue of $304.9m for Q1, +30% YoY vs. Q1 FY21

Adjusted EBITDA of $52.9m in Q1, +38% YoY vs. Q1 FY21

O&G Frac Sand segment was the main driver of the increase, with revenue growth +45% vs. Q1 FY21, while Industrial & Specialty Products (ISP) segment revenues were up +14% vs. Q1 FY21.

Regarding outlook, management are guiding for further margin expansion and growth across both O&G and ISP through FY22, with the O&G segment set to benefit from what management sees as a “multi-year growth cycle” for the O&G industry.

Supporting this outlook point, the WSJ reported last week about the growing shortage of labour and materials, including sand, at the Permian Basin (the largest oil and gas producing basin in the US, and to which several of SLCA’s mines are in close proximity to). On this evidence, SLCA’s prospects appear very favourable with continued demand growth and higher prices for proppant (frac sand products) seemingly inevitable.

Finally, regarding the proposed sale of the ISP segment, CEO Bryan Shinn provided the following update on the earnings call:

Regarding the status of our strategic revenue of the ISP segment, as we stated on our last earnings conference call, we continue to consider a broad range of options, including a potential sale or separation of our industrial segment. The process is ongoing and as of today, I have no further information to share.

Should a sale of ISP be eventually achieved at the valuations I previously discussed, I believe SLCA’s stock price could break $30/share (~60%+ upside from here), particularly given the strengthening outlook for the O&G segment.

Developing Situations

Over the past few weeks, I have noticed increasingly frequent news coverage of yet another constrained commodity theme, namely a “green metals” shortage. One particular article that piqued my interest was a story in the FT about how electric vehicle (EV) production targets will be impossible to achieve without changes to the lithium supply pipeline. One particular quote from the CEO of Lake Resources, an Australian-listed lithium producer stood out for me:

There simply isn’t going to be enough lithium on the face of the planet, regardless of who expands and who delivers, it just won’t be there,” he said. “The carmakers are starting to sense that maybe the battery makers aren’t going to be able to deliver.

This looming lithium shortage appears primarily attributable to three factors:

Aggressive targets set in the United States and Europe for the roll-out of EVs to place internal combustion engine (ICE) cars

Lack of investment by Western governments and companies in developing supply chains for lithium and other metals essential to the production of EVs (such as cobalt and nickel); and

China’s strategic dominance of the clean energy metals supply chain, with China currently controlling 70%-80% of the entire supply chain for EVs and lithium-ion batteries, and therefore energy storage.

This chart from the Visual Capitalist website gives a good overview of just how dominant China is in this regard:

Source: Visual Capitalist.

Such is the extent of the lithium shortage that Elon Musk called for increased investment in lithium production on Tesla’s earnings call last month:

“I’d certainly encourage entrepreneurs out there who are looking for opportunities to get into the lithium business,” Musk said Wednesday. “We think we’re going to need to help the industry on this front.”

And in case anyone might think that Musk’s pronouncements are not always reliable, his assessment is supported by Joe Lowry, a lithium sector expert known as “Mr. Lithium” in the mining industry, who has been warning of a lithium shortage for some time. In a recent Bloomberg interview, Lowry had the following to say:

In the next two years, even though there will be significant growth in supply, it will be less than demand, so the gap will just continue to grow.

Furthermore, a new study commissioned by Eurometaux (the European Association of Metals) concluded that there is a risk that Europe will not have sufficient supplies of metals for its climate programme. The study predicts that a metal supply crunch will emerge over the next 15 years, when global shortages of lithium, cobalt, nickel, rare earths and copper are expected to emerge because of a lack of new mining projects and competition among countries to decarbonise.

And as if the various reports above don’t sufficiently convey the position, the excellent Doomberg team published a fascinating piece entitled 20,000 Volts Under The Sea two weeks ago (highly recommended reading) that perhaps best summarises the green metals shortage:

… there are simply not enough “green” metals – cobalt, lithium, and nickel (the key ingredients needed to make lithium-ion batteries) – to facilitate a meaningful transition away from legacy internal combustion engine vehicles as it is.

As the last 12 months have shown, a constrained supply situation is often a more attractive investment set-up than a TAM or exponential demand one, so how might one play this green metals theme?

In a similar manner to the energy and fertiliser companies and how their respective themes started to play out last year (and continue to do so), one might think that mining companies involved in the production of green metals might be the way to play this theme. However, investing in mining companies in this space is fraught with risk, including operational, environmental and jurisdictional risks, as well as being highly capital intensive. Furthermore, rising input cost inflation as recently flagged by the mining sector majors now highlights an additional challenge for mining companies in the current market.

Given these considerations, the royalty and streaming model seems a particularly attractive way of investing in this theme. This model is most associated with the precious metals segment of the mining industry where it has proven to be particularly successful with companies such as Franco-Nevada Corporation (FNV) who pioneered the model, and Wheaton Precious Metals (WPM) among others. The royalty model typically works by a royalty company providing capital to a miner in exchange for a share of future revenues (royalty income) from the mining operation being funded, with the royalty company usually never actually seeing the actual commodity produced from the mine.

The benefits of the royalty model are maximised in inflationary environments such as we have today. Firstly, the royalty company is able to participate in the rising price of the underlying commodity without assuming any of the operating risks associated with mining it, as the contracted income stream grows with commodity price inflation. Secondly, being asset-light financing businesses with no heavy capex requirements, royalty companies do not suffer from input cost inflation as miners do.

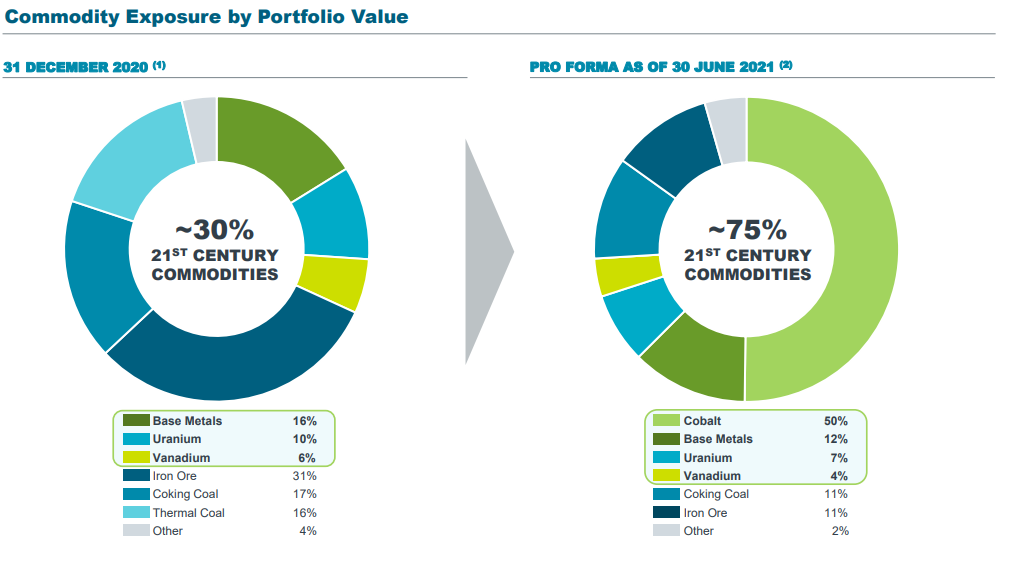

In this context, Anglo Pacific Group Plc (APF:LN / APY:CN) looks to be a very interesting equity play on a green metals shortage. APF is the only non-precious metals royalty and streaming company listed on the London and Toronto Stock Exchanges, and has a diversified portfolio of 16 royalty and streaming-related assets across 10 commodity types in established and “safe” jurisdictions (e.g. 74% of portfolio in Canada and Australia). Furthermore, APF is focused on what it terms “21st Century commodities” that are integral to the energy transition to electrification, such as cobalt, copper, nickel, vanadium and uranium:

Source: Anglo Pacific Group PLC Investor Presentation, December 2021.

Aside from its business model and commodity exposure, what makes APF a particularly interesting situation at this juncture is its valuation - APF is currently trading on LTM multiples of ~6.7x EBITDA and 8.6x FCFF, and just 5.5x NTM EBITDA. These seem extraordinarily low levels for a highly cash-generative, asset-light business focused on commodities essential to the energy transition and which look to be set for a supply squeeze.

To put APF’s valuation in context against some broad comparables (per Koyfin data):

Major lithium producers currently trade on an average multiple of ~15x NTM EBITDA

Major copper miners trade at an average 5.8x NTM EBITDA

Major precious metals royalty companies trade at an average of ~18x NTM EBITDA

In my view, APF’s valuation appears anomalous given that it benefits from the same upside exposure to rising “green” commodity prices, but without the heavy capital requirements and input cost inflation hurdles.

APF is a relatively illiquid small cap (~£387m market cap) with limited analyst coverage (only 4 analysts cover the stock) but as the shift to electrification gathers pace I would expect it to become better appreciated by investors (particularly given its somewhat unique position as the only listed green metals-focused royalty company). In time, as APF’s royalty income grows I think it is reasonable to expect its multiple to re-rate in line with the other established royalty companies, supported by the structural growth tailwinds underpinning green metals investment.

Any Other Business

I read the FT’s recent article Blackstone takes aim at publicly listed real estate vehicles with interest as it essentially captured the playing out of two themes of mine that I had previously written about in this newsletter.

The article highlighted Blackstone’s recent wave of REIT take-privates, noting the firm taken four listed real estate companies private since the beginning of the COVID pandemic in 2020. In fact, Blackstone has been on a REIT purchasing spree of late, with 7 deals completed over the last ~18 months, deploying ~$40bn:

Extended Stay (joint deal with Starwood Capital)

This REIT spree reflects both the Forced Purchaser theme that I wrote about last June, and the Real Asset Ownership Complex theme regarding the private capital industry’s gathering up of real assets.

In Weekly Bulletin #9 I had highlighted how Brookfield Asset Management’s acquisition of Hibernia REIT Plc represented a playing out of my Forced Purchaser theme (Hibernia was my quick idea within this) and I see Blackstone’s REIT acquisitions as further evidence of both themes continuing to play out.

Regarding APF - shouldn't you look at NAV / DCF of reserves instead of EBITDA multiples? If the comps have different reserve levels that easily explains why APF is trading at a lower EV/EBITDA. In fact, looking at the disclosed NAV, APF seems to be farily valued (i.e. it is in line with the stock price). The NAV was calculated a while ago but even if you adjust for the rise in prices of the commodities since then, the discount is narrow.