PGMs: Time To Shine?

While gold prices soar, platinum and palladium trade at deep discounts to gold despite a very favourable supply-demand set-up.

Disclaimer

Value Situations is NOT investment advice and the author is not an investment advisor.

All content on this website and in the newsletter, and all other communication and correspondence from its author, is for informational and educational purposes only and should not in any circumstances, whether express or implied, be considered to be advice of an investment, legal or any other nature. Please carry out your own research and due diligence.

This issue of the newsletter is a little different to my usual format, in that it is more of a thematic piece than a single stock write-up.

Firstly, I discuss what I believe is an interesting situation unfolding in the precious metals markets, and then outline a number of potential ways to play this theme. I then conclude with my preferred stock pick to play the theme initially, which I have just added to the Model Portfolio this morning.

But firstly, let’s begin with some market context.

After reaching a record high last week, gold reached a new record high of $2,789.86 yesterday and is up +34.9% YTD as of the time of writing, making it the second best performing asset this year (more on the best performing below). Gold’s run this year is attributable to central bank buying and so-called safe haven demand, with the combination of economic and geopolitical concerns prompting investors to increase their exposure to the metal as a hedge against a range of potential risks.

On the economic front, the Federal Reserve’s recent cutting of interest rates while inflation remains above the target 2% level raises the prospect of lower real yields, which makes gold relatively more attractive. In addition, the ever-increasing US national debt driven by a rising budget deficit has further contributed to inflation fears should the US government resort to printing more money to finance its debt obligations.

With regard to geopolitics, the uncertainty around the outcome of the US presidential election combined with concerns over an escalating war in the Middle East have further contributed to investor fears, leading to increased demand for gold as a safe haven.

Similarly, gold’s “sister” metal silver has also appreciated significantly this year and has actually outperformed gold, rising +43.7% YTD as at the time of writing, making it the best performing asset this year so far:

As with gold, silver has benefited from its its safe haven qualities as a precious metal, supported by its increasing scarcity value, with the Silver Institute forecasting that 2024 will be the fourth successive year of supply deficits for the global silver market.

Furthermore, silver is also an industrial metal, with ~50% of annual production used in industrial applications, primarily in electronics and solar PV technology, and this combination of strong investment and industrial demand has boosted silver’s performance ahead of gold this year.

With gold and silver now clearly back in vogue among investors, it is interesting to note that their fellow precious metals platinum and palladium have not similarly appreciated in price this year, particularly given they are both precious and industrial metals (like the outperforming silver):

YTD platinum has appreciated just 5% while palladium is up ~6.5%, with much of this appreciation occurring over the past week following last Tuesday’s news that the Biden administration had asked the G-7 group of nations to consider sanctions on Russian palladium exports (Russian miner Nornickel is the world’s largest palladium producer with an estimated ~40% share of global annual production). Prior to this news, palladium prices were actually down -4.7% for the year, while platinum was marginally up by +1.7%.

Both platinum and palladium are part of a group of six metals referred to as platinum group metals (PGMs). This group also includes rhodium, ruthenium, iridium, and osmium, but platinum and palladium are by far the largest in terms of annual production volumes and demand.

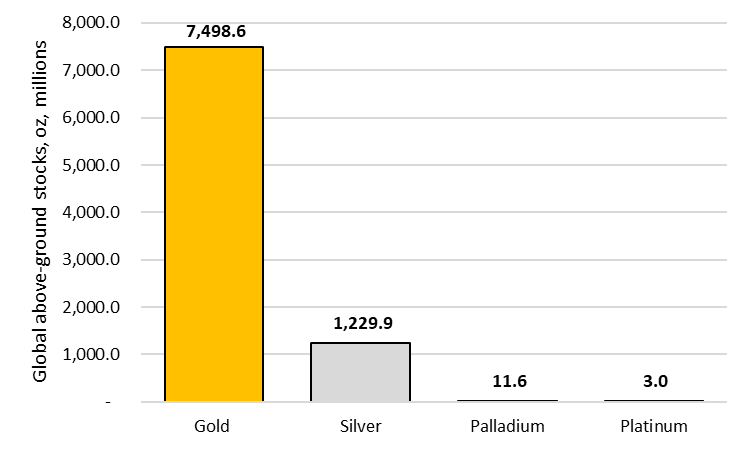

While platinum and palladium are classified as precious and therefore implicitly rare metals, it is worth highlighting that they are significantly more rare than gold and silver. The general market view is that platinum and palladium are up to 30x rarer than gold based on a composite understanding of their abundance in the earth’s crust, mine/production volumes and general market availability based on estimates of above-ground stocks.

Based on recent US Geological Survey data, over ~917m tonnes of silver and ~105m tonnes of gold were produced in 2023, which compares to just ~7.4m tonnes of palladium and ~6.3m tonnes of platinum:

Source: USGS data; Value Situations analysis.

This data implies that in production terms at least, palladium is ~14x rarer than gold and ~124x rarer than silver, while platinum is ~17x rarer than gold and ~145x rarer than silver.

Based on estimates of global above-ground stocks for each metal, the picture is even more stark, with an estimated ~213k tonnes of gold globally, or ~7.5 billion ounces (oz), compared to an estimated ~11.6 million oz of palladium and just ~3 million oz of platinum, implying that the total stock of gold is ~645x greater than that of palladium and ~2,500x greater than platinum:

Source: World Gold Council; Silver Institute; World Platinum Investment Council; Metals Focus.

In addition to PGMs being more scarce in terms of both production and above-ground stocks, both palladium and platinum have been in sustained market deficits in recent years.

The palladium market has experienced successive deficits over the past four years, and is expected to be in deficit again in 2024 by ~358k oz, following deficits of over 1m oz in 2023 and ~756k oz in 2022, as demand (which is primarily from the auto industry) continues to outstrip supply:

Source: Johnson Matthey PGM Market report May 2024.

Furthermore, some analysts now estimate that above-ground stocks are nearly depleted after consecutive deficits in each of the last four years, with security of supply further complicated by the relatively opaque nature of the market which makes it very difficult to quantify the true level of global inventories. Additionally production cuts from major producers for a variety of reasons have also contributed to the current deficit.

All of this serves to increase the likelihood of price spikes, as has happened last week when palladium prices surged nearly 10% on the news of possible sanctions on Russian exports.

It is a broadly similar picture for platinum, with the market in deficit last year and forecast to be in deficit again this year by ~598k oz:

Source: Johnson Matthey PGM Market report May 2024.

Indeed, a more recent forecast from the World Platinum Investment Council (WPIC) forecasts a deficit of over 1m oz for 2024, which would be the largest market deficit in a decade. Notably this is occurring just as investor demand is forecast to increase, driven by ETF purchasing and Chinese demand for platinum bars and coins. Furthermore the WPIC’s latest analysis forecasts that the substantial market deficits of 2023 and 2024 are expected to persist through to 2028.

Aside from market deficits, the supply of platinum and palladium is also highly precarious due to political and operational factors relating to their very concentrated sources of production.

Approximately 70-75% of global platinum production comes from South Africa, where power outages, worker strikes and under-investment in mines frequently disrupts mining activities, thereby contributing to supply instability. Additionally, Russia accounts for ~10% of global production, with geopolitical tensions and economic sanctions following the invasion of Ukraine resulting in further supply instability.

The supply of palladium is also vulnerable for the same reasons, with Russia accounting for ~40%+ of global production, followed by South Africa which accounts for ~35%.

On this basis then, it would be reasonable to think that the combination of PGMs’ inherent scarcity relative to gold and the instability of their primary sources of production should enhance their value as precious metals.

Yet the gold market dwarfs PGMs in terms of market value. As at the time of writing, based on current spot prices and estimates of above-ground stocks, the total market value of gold is ~$21 trillion, which compares to a total market value of ~$42bn for silver, ~$14bn for palladium and ~$3bn for platinum:

Source: Value Situations analysis.

Furthermore, despite increased investor appetite for precious metals this year and PGMs greater scarcity relative to gold and silver, palladium and platinum are trading at extremely deep discounts to gold today.

Palladium is trading at a ~58% discount to gold at current spot prices, its widest discount to gold in over 8 years:

It’s also worth noting that the last time palladium traded at a similar discount to gold in 2016, the market deficit at that time was not as severe as today’s situation. This implies that any convergence in its valuation vs. gold today (amid resurgent demand for precious metals and increased scarcity) could lead to substantial price increases in due course; over the 2016-2021 period (pre-Ukraine invasion) palladium prices rose ~490%.

With regard to platinum, it’s discount to gold is even more pronounced, trading at a record discount of ~63% vs. gold as at the time of writing:

Similar to the palladium set-up, should platinum prices converge vs. gold this implies substantial price appreciation. Over the long-term, platinum has traded at a premium to gold, but if platinum were simply to trade at par vs. gold again this implies ~175% upside from current levels.

So with both palladium and platinum being scarce precious metals facing sustained supply deficits, this begs the question of why are they so deeply discounted to gold? Furthermore, given silver’s outperformance vs. gold as both a precious and industrial metal like the PGMs, palladium and platinum’s discounted prices seem even more curious.

The answer to this question likes in the end uses for PGMs as industrial metals.

The primary end use for both palladium and platinum is for catalytic converters in the auto industry, which accounts for ~80%+ of palladium demand and ~40%+ of platinum demand. Both metals are key components in catalytic converters, as their chemical properties make them ideal for reducing vehicle emissions by converting pollutants such as carbon monoxide and nitrogen oxides into less harmful gases before these are released into the atmosphere.

With regard to palladium, it is primarily used in petrol (gasoline) engine vehicles, while platinum is used mainly in diesel engine vehicles, although platinum is sometimes substituted for palladium in petrol engines for cost reasons, due to its typically lower cost relative to palladium.

The auto industry’s challenges have been well reported on over the past 12 months (as those who have read my recent updates on Dowlais Group Plc will be aware), and it is this exposure to the auto industry that largely explains PGMs price discount and lackluster performance compared to gold and silver. In addition, while the industry’s recent challenges have related to a slowdown in EV sales and investment, the PGMs’ exposure to internal combustion engine (ICE) vehicles in particular has weighed on their market prices, as ICE vehicles are expected to be phased out in favour of EVs under global net-zero emissions targets between 2030 - 2040.

Essentially the bear argument for PGMs today is that they face a long-term structural decline in demand as their main use in catalytic converters will eventually become obsolete as EVs replace ICE vehicles over time.

However there are growing indications that this view is misguided.

Firstly, as I posited in my analysis of Johnson Matthey Plc (JMAT) last year, the expected timeline for the phase-out of ICE vehicles under current emissions targets is likely to be over-optimistic given the myriad obstacles facing mass vehicle electrification (and electrification in general). Since I wrote about this, subsequent market reports have borne this out, with numerous auto manufacturers scaling back their EV roll-out plans due to various hurdles, with a widespread acknowledgement now that the EV transition will take longer than previously expected. One of the direct consequences of this has been an improving demand outlook again for ICE vehicles amid consumer cost and infrastructure concerns around EVs.

It therefore seems reasonable to believe that the lives of ICE vehicles will extend well beyond current market expectations, implying a recovery in demand for PGMs.

Secondly, the growth in hybrid electric vehicles over full EVs represents an additional catalyst for a recovery in PGM demand, given that hybrids require 10%-15% more PGMs than ICE vehicles. This is likely to drive additional demand for PGMs, and against the backdrop of sustained market deficits this implies a price recovery for PGMs.

Thirdly, it must be remembered that the auto industry is highly cyclical and the current slowdown that has loomed over PGM prices is also likely to turn again at some point, supported by the trends noted above. As I wrote in my recent update on Dowlais, the current challenges will likely prove temporary given the structural trends that underpin new vehicle production into the medium term, including the record age of vehicles on the road today and increasingly rigorous vehicle standards that drive tighter emissions controls. Furthermore, interest rate cuts and the expectation of a soft landing should also support a consumer demand recovery for new vehicles in due course.

Looking beyond the auto industry, there are other positive catalysts for a recovery in PGM prices.

Despite their current discounts to the price of gold, PGMs have historically had a strong positive correlation to gold, ranging between 0.6 - 0.9. Given the inflationary and geopolitical concerns supporting gold prices, it seems reasonable to think that PGMs will converge towards gold prices at some point, being the next most investable group of precious metals after gold and silver, and particularly given how the supply/demand imbalance looks likely to persist. This should drive increased investment flows into platinum and palladium, something which has already started to occur, and which gathered pace on last week’s news about possible sanctions on Russian palladium exports:

Finally, outside auto catalysts and precious metal investment demand, palladium and platinum are also used in a range of chemical industry applications, including as chemical catalysts in the production and storage of hydrogen energy. While not a major use case at present, this could prove to a be new driver of incremental demand in time as global investment in hydrogen energy increases, even despite recent headwinds.

In summary, I believe the current PGM market shares some parallels with coal; like coal, these metals are seen as being in terminal decline, in this instance due to growth in EVs as part of global net-zero targets. Yet the reality is that PGMs will be needed for years to come given the practical constraints in actually achieving the transition to fully electric vehicles.

And so having established that PGMs seem primed for renewed price appreciation, let’s now look at the various ways to play this theme.