Essentra Plc: Breaking Up Is Not Hard To Do

Strategic Reviews to reposition company as a pure-play components business should unlock significant value

Disclaimer

Value Situations is NOT investment advice and the author is not an investment advisor.

All content on this website and in the newsletter, and all other communication and correspondence from its author, is for informational and educational purposes only and should not in any circumstances, whether express or implied, be considered to be advice of an investment, legal or any other nature. Please carry out your own research and due diligence.

This will be the final Value Situations newsletter of 2021 as I’ll be taking some time off with family over the Christmas and New Year holidays. I would like to start off by expressing a sincere thanks to all who have read, subscribed and shared this newsletter over the last ~6 months. I am working on a healthy pipeline of ideas that I’m looking forward to sharing with readers in the New Year.

I had hoped to publish one final high conviction memo before year-end, however a name that I had been working on has become distinctly less interesting (and no longer actionable) within the last week. So for this year’s final Quick Idea, I thought I’d take a deeper look at the most recently added name on my idea bench, Essentra Plc. I previously outlined the situation here two weeks ago, but having done some further work on it I think its worth returning to as it offers a potentially attractive (and asymmetric) return profile supported by a likely near-term catalyst.

Market risk has heightened considerably in the last month or so with tech stocks, Cathy Woods’ Ark Invest ETF, meme stocks and bitcoin all rolling over. Against this backdrop I believe overlooked situations with their own idiosyncratic catalysts such as Essentra may be better insulated from wider market price action and therefore provide a more interesting (and perhaps relatively safer) arena to look for attractive risk-adjusted returns.

Situation Overview

To recap, Essentra Plc (ESNT) is a UK-listed manufacturer and distributor of industrial components, healthcare packaging and cigarette filters and is a member of the FTSE 250. Previously known as Filtrona, the company was primarily a cigarette filter manufacturer before it diversified into industrial components manufacturing, and more recently healthcare packaging through a series of acquisitions. Today it operates across 3 distinct segments:

Components (LTM Sales, June-21: £273m/~30% of total revenues) - ESNT’s Components business is a leading global manufacturer and distributor of a wide range of plastic injection moulded, vinyl dip moulded and metal components, used in a diverse range of industrial applications and end-markets, including the automotive, equipment manufacturing, metal fabrication, construction and electronics sectors.

Packaging (LTM Sales: £365m/~40% of total revenues): the Packaging division is one of only two multi-continental suppliers of packaging to the health and personal care sectors, with products including cartons, leaflets, self-adhesive labels and printed foils used in blister packs. Packaging supplies many of the world’s leading pharmaceutical and beauty companies.

Filters (LTM Sales: £284m/~31% of total revenues) - Filters is the only global independent provider of filters and related solutions to the tobacco industry, supplying a range of filters and packaging to traditional cigarette manufacturers and also to the evolving e-cigarette and “Heat not Burn” market segments. This segment supplies over 1,200 filter product specifications to more than 185 customers in over 65 different countries, including all the major multinational tobacco companies.

Looking at ESNT’s recent historic performance, it’s fair to say describe the diversification strategy led by former CEO Colin Day as disastrous. Following a series of profit warnings in 2016 into 2017, ESNT appointed the current CEO Paul Forman in 2017 who has led a multi-year rationalisation of the business. Since 2017, management have unwound much of the previous acquisition spree by disposing of several business units and simplifying operations across the current three segments.

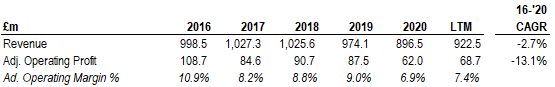

Recent Historic Performance:

Source: Company Annual Reports. All numbers in GBP.

ESNT’s stock has been something of a dog over the last 5 years, down ~30% and reflecting investors dim’ view of the company and its ongoing turnaround after the profit warnings and poor performance:

In short, there just hasn’t much positive news from the company to warrant renewed interest in the stock. I think that is perhaps changing now for 2 reasons:

H1 FY21 performance - Revenue +6% vs H1 FY20 on LfL basis with continued positive momentum following COVID hit to business throughout FY20, and adjusted operating profit +23% vs H1 FY20 to £35.7m

Furthermore, ESNT reported a robust start to H2 FY21 in its most recent Q3 trading update, reporting Q3 revenue +5.1% on a LfL basis, driven by the Components segment which grew revenue by +28.5%, with Packaging down -6.1% due to delays in the recovery of elective surgeries and prescription levels given ongoing COVID impact to health services, while Filters revenue growth was +2.8%

Strategic Review - Most interestingly, management recently announced two separate strategic reviews to unlock value and reposition ESNT as a pure play industrial components business. Firstly, in the October Q3 update management announced their new strategic goal to become a pure-play components business, and has “decided to review the full range of strategic options for the Filters business”; in a further update last month ESNT announced another separate strategic review for the Packaging division. In both announcements the company indicated a timeline of Q2 2022 at the earliest for a conclusion of both reviews.

The obvious outcome from these reviews is a sale of both units, simplifying ESNT into a pure components manufacturer and distributor. Management’s rationale here makes complete sense - there are no obvious synergies between the three units and their combination under one roof must surely mean they’re not being managed optimally, something management themselves have hinted at [emphasis in bold mine]:

Over the last few years, Essentra has simplified its portfolio into three global businesses, each with leading market positions and a clear purpose and strategy. These businesses all have strong prospects and the potential to deliver compelling returns for investors, but are at different stages of their development and have limited synergies. The Board has therefore concluded that, in order to maximise shareholder value and the potential of each of its businesses, Essentra should become a pure play global Components business over time. This will enable strategic focus and an acceleration of organic and inorganic growth.

So after five years of disappointing performance, it feels like ESNT has finally reached a turning point, as it refocuses on the core (and growing) components business.

Investment Thesis

The thesis for ESNT is essentially a break-up and re-rating story as follows:

Following its failed diversification strategy under the previous CEO and the subsequent 3+ year restructuring to unwind this, ESNT has suffered from poor performance and therefore attracted little interest from investors.

This ongoing restructuring as well as the lack of natural cohesion or synergies between the three very disparate segments has prevented each unit from being managed optimally and depressed the stock further.

As a result, the underlying fundamental value of each of ESNT’s three businesses is not reflected in the current share price, with the value of the growing Components business in particular is obscured by the company’s recent issues.

The strategic reviews should lead to the divestment of the Packaging and Filters segments, unlocking significant value and transforming ESNT into a pure play components business that can then be managed in a much more focused way.

The combination of more focused management plus the solid growth prospects for Components as a supplier of essential items to a range of industries and end-markets globally should drive a meaningful multiple re-rating for ESNT over the next ~2-3 years, in line with UK and US-listed peer multiples - ESNT currently trades at ~10.5x LTM EBITDA vs. ~15x average multiple for its peers selected peers.

Furthermore, the divestment proceeds will transition ESNT’s balance sheet to a net cash position, further supporting a multiple re-rating as well as allowing for a substantial share repurchase programme.

As I outline in my valuation analysis below, in a Base Case I estimate ESNT could be worth ~£4.84/share, offering +51% upside vs. the current share price by FY24, assuming the divestment of both the Packaging and Filters units and a market re-rating of the remaining Components business to 15x, in line with listed comps.

Valuation Analysis

The divestment of the Packaging and Filters businesses are a driver of the value upside for ESNT, so I’ll start by valuing these segments first.

Packaging Divestment

This segment has been particularly challenged in recent times and the only segment with negative YoY growth in FY21 YTD. Q3 FY21 revenue was down 6.1% due to prescriptions and elective surgeries being lower than normal due to the COVID pandemic, as well due to some supply chain issues.

However, the expectation is that global healthcare systems will recover and demand will in turn pick-up into FY22, with management stating they expect to see the market return to moderate growth in the second half of 2021 as healthcare systems start catching up on significant prescription and surgery backlogs (most recently in the Q3 trading update, management reported that the order book has started to show signs of improvement). It’s also worth noting this segment produces secondary packaging for anti-viral and vaccine products for three of the five major vaccine producers, which could drive incremental growth with future COVID booster roll-outs. Furthermore, while the H1 operating margin was 6.1%, management are guiding a return to industry average margins of 8% - 10% by year-end and into FY22. Finally, the recent acquisition of US-based 3C! Packaging (at ~9x, completed Sep-20) looks promising, with 3C! being a leading supplier to blue-chip pharma companies in the US.

Looking at broadly comparable US specialist packaging businesses that supply into the pharmaceutical industry, WestRock Company (WKR) and CCL Industries (CCL) have traded at average EBITDA multiples of 7.5x and 12.4x over the last 5 years, and currently trade on NTM multiples of ~7x and ~11x respectively:

Source: Koyfin

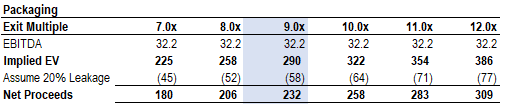

Based on these comps and given the improving margin and order book outlook for Packaging as outlined above, I believe a 9x multiple is appropriate for the segment. This implies a gross sale value of ~£290m based on LTM EBITDA of ~£32m, and again allowing for leakage due to taxes and costs at 20%, I guestimate net divestment proceeds of ~£232m:

Source: Value Situations analysis. All numbers in GBP.

One final point to make here is that as one of only two multi-continental packaging suppliers to the health and personal care sectors, Packaging offers strategic value to a larger industry acquirer/peer with focused management, so I do not see 9x as being that demanding a multiple to achieve in a sale of the unit.

Filters Divestment

Despite the negative perception around tobacco and related stocks with declining consumption and ESG mandates preventing institutional investors from investing in them, I believe there is an investment case for a divestment of Filters segment at 9x LTM EBITDA.

Firstly, Filters is growing, and has performed well YTD. In H1 FY21, Filters revenue grew +12.8% vs H1 FY20, and in the recent Q3 trading update ESNT reported Q3 revenue growth of +2.8% vs. Q3 FY20 (and interestingly +5.0% vs. pre-COVID Q3 FY19). Management also stated they expect Q4 growth to accelerate from Q3 levels, driven by ESNT’s new China JV and further outsourcing contract wins with cigarette manufacturers.

While Filters’ reported operating margin was ~8% in H1 FY21 vs. 9% in FY20 and ~12% in FY19, this includes the JV set-up costs; excluding these costs, adjusted operating margin was 10.8%, indicating improved performance YoY and this is before the China JV contributes meaningfully to the segment, given it only commenced production in June.

It’s worth highlighting here that the China JV is one of two “game changers” for the Filters business:

China JV - the JV provides a platform into the world's largest tobacco market, and effectively doubles the size of Filter’s TAM. Since commencing in June, the JV has increased volumes each month and has participated in a number of local supply tenders with tobacco companies in China, and has won three outsourcing contracts to date, all of which are now operating at full production volumes. The JV also has a healthy pipeline of further outsourcing opportunities, suggesting that there is meaningful new growth potential for the Filters segment ahead.

Biodegradable filters - Filters has developed a range of proprietary eco-products and is currently trialing non-plastic biodegradable filters with a large multinational in four European markets. This is highly significant in the context of the EU ban on single use plastics and meeting targets under the EU Single Use Plastics Directive for plastic-free and biodegradable products. As such, ESNT’s eco-filter products represent a further new growth opportunity for the segment supported by a regulatory tailwind.

In valuing the Filters segment, there are a very limited number of comparable businesses to benchmark it against. The top three largest cigarette filter manufacturers globally are subsidiaries of major chemical companies that operate across multiple segments - Celanese Corporation (CE) and Eastman Chemical Company in the US, and Daicel Corporation, listed in Japan. Given their multiple operating segments, these are not a perfect compset but they do provide a guideline for valuation purposes here, with a peer group average multiple of 8.2x LTM and 7.7x NTM EBITDA:

Source: Koyfin

Outside these three, the other large filter businesses are various domestic Chinese manufacturers and Cerdia, which is owned by Blackstone. Blackstone formed Cerdia via its acquisition of Acetow in 2017 from Belgian chemicals group Solvay for 7x EBITDA. This is the only recent private market comp for ESNT’s Filters business.

This limited compset indicates a valuation range of ~6x -10x for Filters. Given its favourable growth prospects in China (a 2x TAM opportunity) and a shift to biodegradable filters in Europe, I believe a multiple at the upper-end of this range is appropriate for the Filters business. Furthermore, the obvious acquirer for the unit is one of the above peers who will likely achieve some synergies to reduce the effective multiple. On this basis I believe a 9x multiple is appropriate for Filters.

This implies a gross sale value of ~£329m based on LTM EBITDA of ~£37m, and after again allowing for 20% leakage due to taxes and costs I guestimate net divestment proceeds of ~£264m:

Source: Value Situations analysis. All numbers in GBP.

So all told, this indicates net divestment proceeds of £495m for ESNT from the sale of these two segments.

Components

The core Components segment operates in the UK, Europe, US and more recently China following the bolt-on acquisition of Jiangxi Hengzhu Electrical Cabinet Lock Co., Ltd ("Hengzhu") in May. Hengzhu is an access hardware manufacturing and distribution business last May, and it looks to be a promising expansion of ESNT’s footprint.

Components generated segment EBITDA (pre-central opex) of £55.9m over the LTM period, and has been ESNT’s highest growth unit in FY21, with LfL growth of +20% in H1 FY21 vs. H1 FY20, and Q3 LfL growth of +28.5% vs. Q3 FY20. (Notably Q3 FY21 revenue was also +14% vs pre-COVID levels in Q3 FY19).

Regarding margins, on an LTM basis Component’s EBITDA margin (pre-central opex allocation) was ~20%, but historically the segment has achieved segment EBITDA margins of ~24% (FY19 EBITDA of~£68m on sales of £283m). In the H1 FY21 results, management indicated they expect Components to return to pre-pandemic margin levels again.

With respect to future growth, management expect the strong YoY growth to continue into Q4 and growth drivers for the segment include its new digital platform for selling components online, as well the Hengzhu acquisition in China, which gives the business a platform for substantial growth throughout Asia.

In terms of valuation, looking at a reasonably broad range of comps in the UK and US (noting that Components generates ~37% of its revenues in the US via its Reid Supply subsidiary), comparable public comps trade at an average of 15x-16x:

Source: Koyfin

Given its growth prospects as well as the likely benefit of more focused management as a pure components business, I believe a 15x multiple is reasonable for valuing the Components segment on a standalone basis.

Post-Divestment Valuation

Pulling these elements together, I estimate ESNT could be worth ~£4.84/share, offering +51% upside vs. the current share price by FY24, for a return profile of 14.7% IRR / 1.5x MOIC over a three year hold. This assumes the divestment of both Packaging and Filters as above and the market re-rating Components to 15x by FY24:

Source: Value Situations analysis. Share price as at time of writing.

Key assumptions as follows:

Total net proceeds of £495m realised from divestment of the Packaging and Filters segments as outlined above.

Residual LTM EBITDA for the Components business net of central opex is £51m, after stripping out Packaging and Filters EBITDA of £32m and £37m respectively, and adjusting for assumed central opex cost savings of £11m following these divestments.

This £11m cost saving is calculated based on LTM central opex of £15.8m for the business as is; as the Packaging and Filters segments account for ~70% of total revenues today, I assume 70% of the £15.8m, or £11m of central cost can be eliminated given the lack of synergies across the three segments. This implies a slimmed down central opex of £4.7m for the standalone Components business under more focused management, resulting in PF EBITDA £51m for LTM.

By FY24 I assume the Components business generates £76m in EBITDA after central opex, based on a 5% revenue CAGR from FY21 estimated revenues of £306m (+20% vs. FY20 in line with H1 performance) and a 21.5% EBITDA margin based on FY19 pre-COVID segment margins of ~24% and slimmed down central opex to get to pre-COVID PF EBITDA margin of 21.5%:

Source: Company Information; Value Situations analysis.

Applying a 15x multiple to FY24 EBITDA of £76m implies a value of £4.84/share including the £495m proceeds, which I assume as a Base Case for ESNT.

As an indicative Upside Case, I assume management implement a share buy-back given significant surplus cash post-divestment of Packaging and Filters. For the buyback programme, I assume management retain £100m in cash, and so deploy £236m into a buyback programme at a price of £3.53 or +10% above the current share price, reducing the share count by 67m shares. Holding the 15x multiple, this implies a value of £5.21/share or +62% upside to the current share price.

Finally I consider an indicative Downside Case, which assumes a stagnant 10x multiple on LTM EBITDA of £51m and unallocated excess cash post-divestment. This indicates downside of -14% vs. the current share price, to £2.75/share, and effectively prices in the market not re-rating ESNT based on historic poor performance and a belief that management will not allocate the cash proceeds in an optimal manner.

In summary, this indicative analysis suggests ESNT offers upside of ~50%+ over the next three years with an attractive asymmetric return profile with upside of ~3.6x the downside risk in a Base Case, and ~4.4x in an Upside scenario. Conversely, given its current stagnant valuation owing to its recent history, I see limited downside to ESNT at the current share price. Furthermore, this situation comes with a live catalyst with both strategic reviews set to be completed next year and transformative asset sales being the likely outcome.

To conclude, management’s decision to refocus ESNT into a pure Components business seems like the right move to unlock significant value for shareholders, making ESNT an interesting value situation here in my view.