An Explosive Situation

An asymmetric special situation and growth play on the European defence sector offering 40% - 100%+ upside.

Disclaimer

Value Situations is NOT investment advice and the author is not an investment advisor.

All content on this website and in the newsletter, and all other communication and correspondence from its author, is for informational and educational purposes only and should not in any circumstances, whether express or implied, be considered to be advice of an investment, legal or any other nature. Please carry out your own research and due diligence.

In this issue of the newsletter I discuss a European-listed defence stock that is both a special situation and an undervalued play on the broader European defence and re-armament theme.

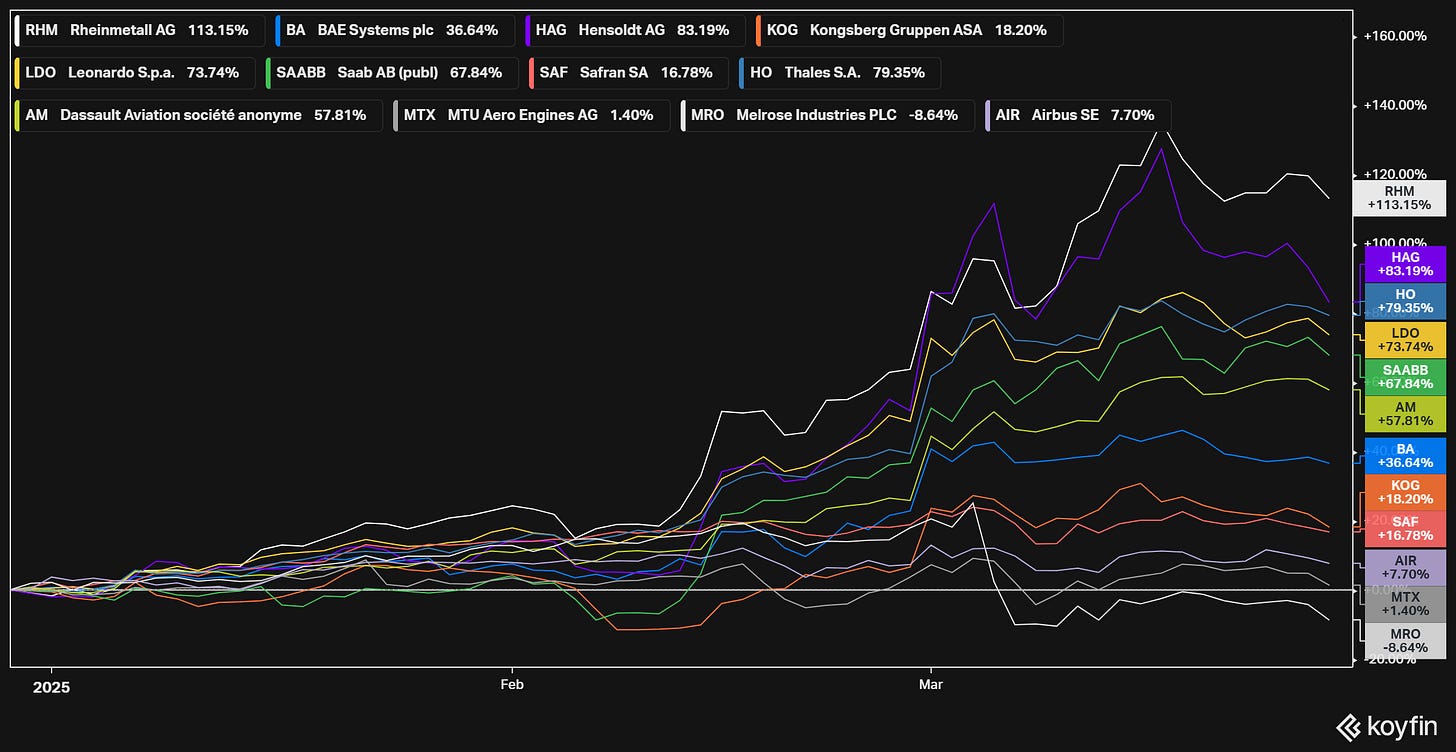

European defence names have been among the best performing cohort of stocks across developed markets YTD, outperforming both the major US and European index benchmarks, as well as erst-while market darlings the Mag7:

Indeed one could argue that EU-based defence names have supplanted the Mag7 as the hottest cohort in Western equity markets this year, and perhaps no chart conveys this rotation better than Rheinmetall (RHM) vs. Nvidia (NVDA):

Looking at the performance of individual names within the European defence sector, many of the leading companies have appreciated significantly, to the extent that one might think that their growth prospects are now fully priced in (RHM for example currently trades on comparable EBITDA multiples to NVDA, at 33x LTM / ~24x NTM):

However, after combing through the European defence sector I believe I’ve identified a name that is trading well below its fundamental value when its growth prospects are accounted for, and furthermore this name was recently reported to be the subject of a take-private bid.

As such I view this stock as both an idiosyncratic special situation and a fundamental growth story, and present it here as a “Quick Sit” value pitch…