A Tactical Commodities Basket

Constructing a tactical basket of critical commodity and materials names for inflationary times.

Disclaimer

Value Situations is NOT investment advice and the author is not an investment advisor.

All content on this website and in the newsletter, and all other communication and correspondence from its author, is for informational and educational purposes only and should not in any circumstances, whether express or implied, be considered to be advice of an investment, legal or any other nature. Please carry out your own research and due diligence.

“… inflation is a far more devastating tax than anything that has been enacted by our legislatures. The inflation tax has a fantastic ability to simply consume capital.”

Warren Buffett, How inflation swindles the equity investor, Fortune magazine, April 1977.

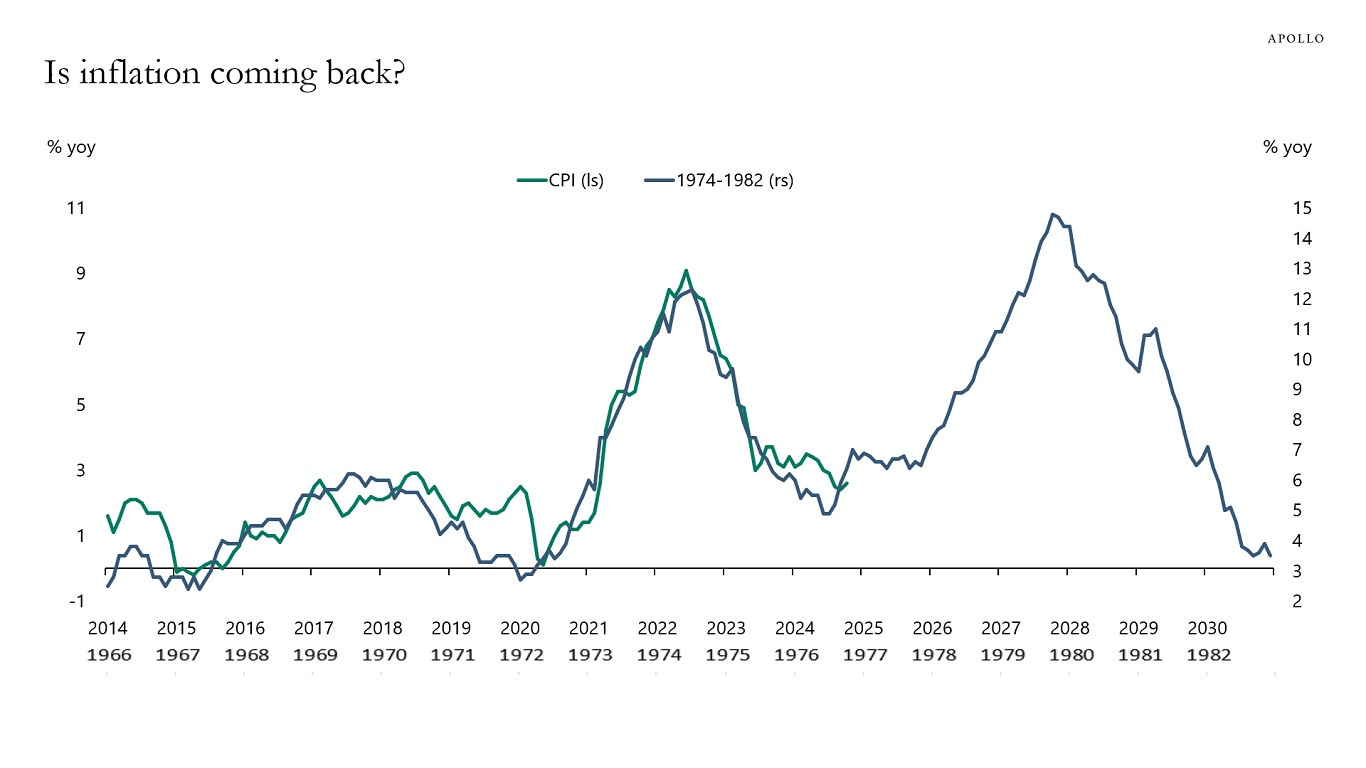

In this issue of the newsletter, I present an idea that I first started working on last October as it became increasingly apparent (to me at least) that a second wave of inflation commencing in 2025 is very plausible.

Midway through last year, the consensus expectation was that inflation had been largely defeated, finally paving the way for the Federal Reserve’s rate cutting cycle. However, the data since then has indicated a different picture, with inflation not just persisting but in fact steadily rising again since September back towards ~3%:

Source: US Inflation Calculator.

As the above chart shows, with the latest CPI print for December coming in at 2.9% the US inflation rate has essentially been flat since June 2023, averaging an annualised 3.1% over the last ~18 months. This compares to an average inflation rate of ~1.8% over the 12 month period prior to COVID hitting in February/March 2020. On this simplistic reading, one might conclude that CPI appears to be re-setting at a structurally higher level (+70% higher) than pre-COVID/energy crisis levels.

But even this apparent 70% jump in inflation since pre-COVID times doesn’t quite capture the full implications of structurally higher inflation for investors. As the opening quote from Warren Buffett alludes to, inflation eats away at investor capital in quite a pernicious way. To convey the impact of this, consider the chart below setting out the average annual inflation rate (based on US CPI) over the last six years, from pre-COVID times in 2019 to the present:

Source: US Inflation Calculator.

Based on the actual CPI rates, in simple terms what cost $100 in 2019 costs ~$122.60 today, or +22.6% more after factoring in annual YoY inflation through this period. And that’s after the supposed “cooling” of inflation to 2.9% over the last 12 months. Indeed, the “falling” inflation or disinflation narrative employed by some commentators on the basis that the inflation rate has declined from 4%+ in 2023 is somewhat misleading - while its true in a rate-of-change sense that prices rose at a slower rate in 2024, they still rose by almost 3% (well above the Fed’s 2% target level), on top of very high rates in the preceding years. Furthermore, as the first chart above shows, inflationary pressures appear to be building again, with the 1970s experience increasingly looking like the relevant market analogue to today, as I highlighted in my recent outlook for 2025:

Source: Apollo Global Management Weekly US Chart Book, 16 November 2024.

Coming back to Buffett’s characterisation of inflation as a kind of tax, based on the CPI rates above, $100,000 of capital in 2019 has been eroded or “taxed” down to $82,000 in current purchasing power terms today, all else equal, meaning an investor would have needed to compound their capital at ~4.2% just to break-even on their starting capital base - not an impossible ask given how markets have performed over the last number of years, but still an additional hurdle to capital returns.

Given this recent experience, it seems increasingly likely that we are now living in an era of structurally higher inflation compared to the previous cycle. Indeed market strategist and author Lawrence McDonald has convincingly argued that US inflation will rebound and remain elevated in a range of 3% - 5% over the next decade, something he discusses in depth in his excellent book How To Listen When Markets Speak (which I recommend reading).

If this is true, then real assets should perform strongly (as they did in the 1970s) and outperform the general market, particularly when the market is now heavily concentrated in interest-rate sensitive, long-duration tech names, as well as providing an inflation hedge. In this light it is prudent for investors to have an allocation, or at least be prepared to allocate some capital, to equities linked to commodities and critical materials to avoid the “inflation tax” and benefit from this inflationary outlook.

Prompted by this thinking and extending my previous work on the various commodity names previously covered in this newsletter, last October I commenced work on constructing a basket of equities that that would allow me to quickly and efficiently gain exposure to this real asset/inflation theme.

The result is an initial basket of 10 equities that I will publish as a series of short-form ideas over the next two weeks or so, with my first idea published below.

I must emphasise here that my basket approach is not intended to cover selected names in a deep-dive format or present overlooked, value-event type situations. Rather I view this basket as one overall thematic trade, intended as a tactical allocation for the purpose of quickly gaining exposure to critical commodities and materials as the inflationary theme plays out. For this purpose, I decided the basket should comprise larger-cap, liquid names rather than overlooked, mispriced situations, as it is the larger cap stocks that will attract more capital flows, and thereby offer greater torque in a bull market for commodities and materials.

In a way this basket idea is similar to an energy ETF, and so one might ask wouldn’t it just be easier to buy the ETF rather than going to the trouble of building a dedicated basket? However it seems to me that in buying an ETF (such as the XLE for example), one buys into the good along with mediocre and the bad. I think it makes more sense to concentrate on the best names that provide the most torque to the commodity-inflation theme without also assuming exposure to the more leveraged/speculative/less well managed names that might erode overall gains.

In deciding on what commodities and materials to have exposure to in the basket, I found two books particularly instructive - Vaclav Smil’s How The World Really Works, and Ed Conway’s Material World (both of which I’d recommend reading), and I initially conceived of this basket idea as the “Smil-Conway Index,” at it largely comprises equities offering exposure to the critical commodities and materials discussed in both books. My original thinking was to initiate the basket of 10 names as an equal weighted “index” position in the Model Portfolio based on their closing prices on 31 December 2024, and assess its performance over time against the SPX, and relevant ETF benchmarks such as the XLE, XLB and XME (relating to energy, materials and mining stocks respectively).

However I decided against that as some of the names started to appreciate rapidly into year-end and I wanted to allow myself to opportunistically build and scale into the basket at attractive entry points on pull-backs or amid general volatility.

As such, my preference is to start with a watchlist approach for now, and I may initiate the basket with say a 10% - 20% max allocation over time, while being mindful that I already have significant commodity/materials exposure in the Portfolio.

I’ll leave it to you the reader to decide whether you prefer a “Day 1” index or a more opportunistic basket-building approach, but in any event I’ll probably report quarterly “index” performance against relevant benchmarks and notify paid subscribers of any basket-related activity with regard to the Model Portfolio in due course.

With that context, let’s move on to how I approached constructing the basket, before revealing the first of the 10 names I propose including in it.

A Tactical Commodities & Materials Basket

The purpose of this project is to present my preferred stock selections across a range of essential commodity and critical materials categories, with the aim of constructing a tactical equity basket to take advantage of any subsequent inflationary bull market for commodities and materials.

It is my view that the current economic cycle (that began with the post-COVID economic recovery in late 2020) is likely to be characterised by structurally higher inflation compared to the previous cycle (post-GFC – COVID years), due to several powerful social, economic, and geopolitical megatrends that I believe are now entrenched, namely:

Global energy security concerns;

The energy transition and decarbonisation investment;

Increased defence spending post-Ukraine conflict;

Resource nationalism, with regional competition to secure critical commodities and materials;

Onshoring/near-shoring and deglobalisation of global supply chains post-COVID disruptions;

Increased urbanisation and mobility, primarily in emerging markets and developing economies;

A general rise in geopolitical tensions, and a newly competitive multipolar order, resulting in a general increase in supply-chain friction.

As a result of these trends, I believe that essential commodities and critical materials will be in greater demand and/or subject to greater supply frictions this cycle, with producers of these likely to benefit and periodically outperform the general market as a result. Furthermore, I do not believe this outlook and resulting business prospects have been fully priced into equities linked to commodities and materials just yet.

In assessing what companies are best positioned and most likely to outperform under this outlook, the post-COVID recovery period that began in approximately September 2020 through the energy crisis of 2022 and beyond is instructive in this regard, as it provides a very recent and still relevant case study as to which equities can be expected to outperform again under similar supply-constrained, inflationary conditions in the future.

Approach & Methodology

In selecting the commodity categories for inclusion in the tactical basket, I’ve been guided by the following sources in determining which were the most critical and therefore favourable for investment:

Vaclav Smil’s “four pillars of modern civilization,” as discussed in his book How The World Really Works, namely ammonia, concrete, plastics and steel;

Ed Conway’s “Six most crucial substances in human history,” as discussed in his book Material World, namely copper, iron, lithium, oil, salt and sand (Conway also publishes a very interesting newsletter on Substack here for those interested)

My own coverage and analysis of commodity and materials markets in the course of writing this newsletter, through which I’ve identified coal, grains, natural gas, potash and phosphate as critical commodities in addition to the Smil and Conway categories.

The table below outlines the key commodities and materials that I considered for selecting equities for the commodity basket:

Source: Value Situations.

In selecting my preferred equities to play each of these themes, I’ve assessed companies using the following proprietary checklist to identify names that balance the highest quality and (relatively) lowest risk profiles against offering the most torque to the theme, with reference to their performance during the post-COVID/energy crisis period and my assessment of their current positioning relative to peers:

Source: Value Situations.

In the course of my research and analysis across the commodity categories identified and their corresponding universe of equities, I concluded that a basket of 10 names from across 10 categories should sufficiently capture the opportunity and potential upside in a commodity/materials bull market environment. In my view a basket exceeding 10 names would likely become too unwieldy and the resulting diversification would potentially erode the outsized returns that one could expect individual names to deliver.

From my review and analysis of each category, I’ve excluded the following commodities from consideration for the basket:

Iron & Steel – Iron ore is essentially a play on steel alongside metallurgical coal; given that metallurgical coal equities offer the simplest way to play steel demand and exhibited the greater torque to this theme in the post-COVID recovery period, I’ve selected metallurgical coal as the optimum way to play the general metallurgical coal/iron ore/steel theme.

Salt – Salt is a niche commodity category with no pure-play way to play this via public equities; as such I exclude it from the basket.

Potash & Phosphate – both potash and phosphate are fertilisers that are regarded as critical minerals, however they are less critical than nitrogen to the global food production/scarcity theme with nitrogen-based fertilisers being the most widely used globally, accounting for ~56% of global fertiliser consumption, attributable to the fact that nitrogen has a greater impact on crop yields. As such I’ve selected nitrogen fertilisers (ammonia) as the preferred way to play the food scarcity theme.

Concluded Categories & Equities

From my research and analysis based on the above approach, I concluded on the following commodity categories for inclusion in the tactical basket: