Wickes Group Plc (WIX.LN)

A Wickedly Cheap Spin-Off Situation

Disclaimer

Value Situations is NOT investment advice and the author is not an investment advisor.

All content on this website and in the newsletter, and all other communication and correspondence from its author, is for informational and educational purposes only and should not in any circumstances, whether express or implied, be considered to be advice of an investment, legal or any other nature. Please carry out your own research and due diligence.

Wickes Group Plc (WIX) is the second largest DIY/home improvement business in the UK, and was demerged from former parent Travis Perkins Plc (TPK) in a spin-off transaction in April 2021.

WIX is a classic post-spin off value situation, with the stock down ~37% since listing on the London Stock Exchange’s main market, despite consistently positive trading updates post-spin and a positive outlook coming into FY22. The sell-off is attributable to TPK shareholders selling off unwanted WIX stock distributed to them in the spin-off transaction.

WIX is currently valued at ~4.7x EBITDA / 5.6x FCFF (on a post-IFRS 16 basis including lease “debt”; on a pre-IFRS 16 basis, WIX is trading at just 2.3x EBITDA); this compares to recent comparable private market transactions completed in the 6x - 7x range, and WIX’s listed peer s who trade at an average ~7x multiple.

I estimate WIX is worth ~£3.44/share or 98% above the current market price on a stabilised basis, which implies a 40.8% IRR / 2.0x MOIC profile over a two year investment term.

WIX is mispriced due to sustained selling over the last 12 months by TPK shareholders for non-fundamental reasons - they do not want to own WIX stock due to mandate and/or size reasons - WIX is a small-cap at a £450m market cap, vs. TPK at ~£2.8bn.

This situation also comes with meaningful downside protection - WIX’s net cash position equates to ~45% of its market cap, while its depressed valuation and slowing trading volumes now suggest a price bottom may soon be reached (if not already); I estimate downside risk at ~£1.30/share or ~25% below the current share price, which implies an attractive asymmetric return/risk profile with upside of 4x the downside risk.

The catalysts for a substantial re-rating in value are two-fold: (1) as the forced selling from TPK holders comes to an end, WIX stock will attract buyers given its combination of very cheap absolute and relative valuations and positive business fundamentals, and (2) WIX is an obvious takeover candidate given its fundamental attributes, cheap valuation and recent private market transaction evidence.

Situation Overview

Wickes Group Plc (WIX) is a UK-listed home improvement retailer that demerged from Travis Perkins Plc (TPK) in April 2021. The rationale for the spin-off was that TPK’s management wanted to simplify its business and focus on trade-only customers as a builders merchant and materials supplier serving the UK homebuilding and construction sectors. WIX serves small local trade and retail customers at the opposite end of the wider building materials market and so was deemed non-core by TPK management (accounting for ~20% of TPK’s total revenues).

The demerger was structured as a 1-for-1 share distribution to existing TPK shareholders. Upon listing on the LSE Main Market in April 2021, WIX’s shares initially traded at £2.50/share implying a market cap of ~£630m and an indicative valuation of 7x EBITDA. Post-listing, the stock price briefly rallied and closed at a peak of £2.77/share in June 2021, before steadily declining since then by ~37% to current price of ~£1.74/share (as at the time of writing).

This share price decline is at odds with underlying business performance since the demerger, with H1-21 (to Jun-21) revenue and operating profits growing +32.5% and +100% YoY respectively, followed by successive positive trading updates in October, December and most recently January. In the December update, management guided earnings ahead of both their previous guidance and consensus estimates (and reiterated this again in January), yet the share price decline accelerated following this update, falling ~27% since then.

The strong performance through H1-21 is not unexpected given how COVID restrictions boosted the home improvement and DIY markets with the change in working habits and increased time spent at home prompting homeowners to renovate and refurbish their properties. In the January trading update WIX reported continued strong performance in its Local Trade segment driven by home renovation demand, and a year-end order book more than 2x the size of FY20’s year-end book in its Do-It-For-Me (DIFM) home projects segment, which will further support DIFM sales through FY22.

At the current share price, WIX has a market cap of ~£450m and an EV of ~£1bn (reflecting leases on an IFRS 16 basis - WIX has no financial debt), and is trading at 4.7x LTM EBITDA (to Jun-21) and ~4.6x consensus FY21 EBITDA.

Additionally it’s worth highlighting that WIX is highly cash generative with FCF/EBITDA conversion of ~85% on an LTM basis, and from a FCF valuation perspective it is trading at 5.6x LTM FCFF (or a ~18% FCFF yield on EV including lease “debt”).

To put WIX’s current valuation in context, its current 4.7x EBITDA multiple compares to its initial listing at 7x, and similarly 6x-7x for comparable private market transactions, while public peers currently trade on an average multiple of 7.1x NTM EBITDA (further note that public peer group has historically traded at an average “through-the-cycle” multiple of ~11x over the last 10 years).

Given the strong performance and positive outlook for the business, the declining share price is clearly attributable to non-fundamental reasons, specifically forced selling by TPK shareholders who cannot or do not want to hold WIX shares for mandate reasons (see the Variant Perception - Why Does This Opportunity Exist? section below for discussion of this).

Business Overview

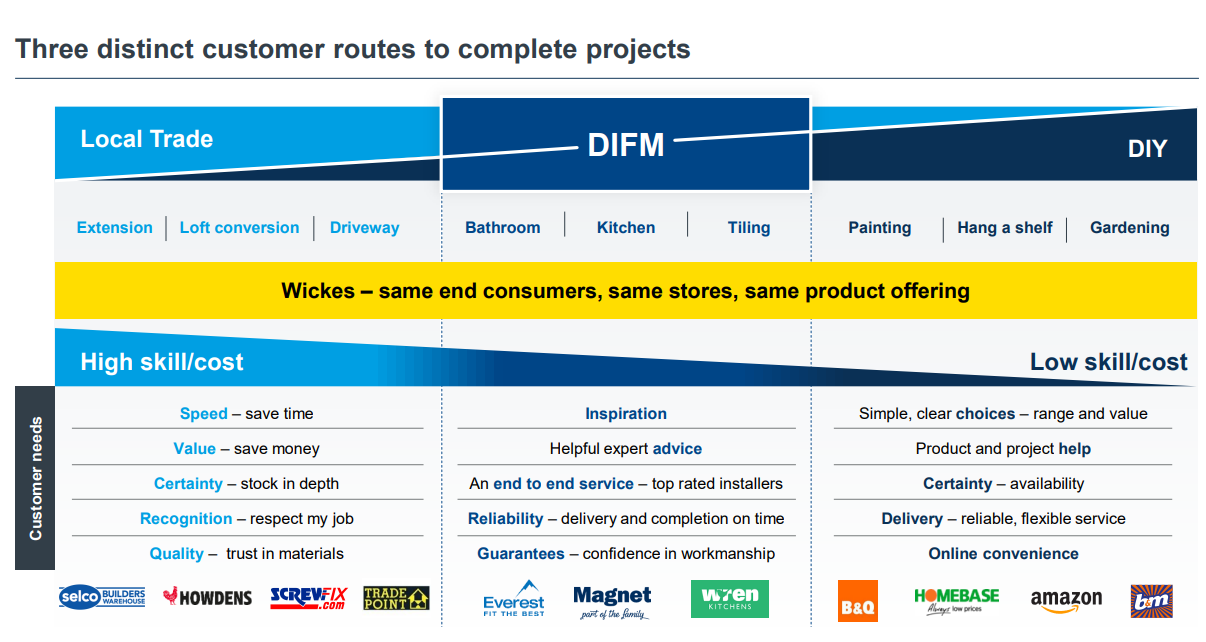

WIX is the second largest pure-play home improvement/DIY retailer in the UK, and operates across three segments:

Source: Wickes Group Plc Capital Markets Presentation March 2021.

WIX trades from 232 stores throughout the UK, and segment operations can be summarised as follows:

1. Local Trade - caters for home improvement projects where the end consumer appoints a tradesperson to a project, and the tradesperson sources the products required to complete the job from WIX. This segment sells to local, small (one or two-person) trade businesses, undertaking projects such as home extensions, kitchen and bathroom renovations, and flooring and tiling. These require products such as timber, plasterboard, sheet materials, quick-set cement and other building products. Local Trade customers are typically focused on convenience, immediate access to products required and competitive pricing. WIX provides a targeted proposition to Local Trade customers via in-store and online channels, which includes the TradePro membership programme and mobile app (~550k members in FY20), where trade customers can avail of a 10% discount on all purchases.

Local Trade accounted for ~£634m / 47% of total group revenues in FY20, of which TradePro programme sales accounted for ~£225m.

2. Do-It-For-Me (DIFM) - is a one-stop, end-to-end service for home improvement projects, where WIX oversees the process for customers from initial concept design to installation and completion, with the process managed by a WIX design consultant who acts as the single point of contact for the customer.

The process for a typical project usually involves an in-store showroom visit and initial consultation with a WIX in-house design consultant (including a home visit to assess the space for renovation), followed by finalisation of the design through to selection of materials (tiles, fittings etc) and finally installation and completion including quality checks.

WIX employs ~550 design consultants in this segment, and the service covers a range of home projects types, primarily kitchens and bathrooms but also flooring, tiling and more recently home office installation.

This segment is a differentiator for WIX vs. peers in that none of the larger DIY/home improvement retailers in the UK provide a similar service.

DIFM accounted for ~£275m / 20% of total revenues in FY20 and is a strategic growth area for WIX (pre-COVID, DIFM was WIX’s fastest growing segment).

3. DIY - serves retail customers who purchase DIY products for home improvement work they undertake themselves, e.g. painting and decorating, shelving, planting and gardening. WIX sells products such as brushes and paint, light power tools and landscaping supplies to DIY customers. WIX’s proposition to DIY customers is stocking a curated range of products (branded and own label) both in-store and online, with click-and-collect and home delivery service, as well as in-store advice on product usage from staff.

The DIY segment accounts for ~£438m / 33% of total group revenues (FY20).

Operating Model Differentiation

WIX’s operating model is differentiated from competitors in four key respects:

1. Digitally-Led Offering - WIX has invested significantly in its digital capabilities and offers what it calls a digitally-led service proposition through a range of channels. These include its website with an “online, in-store” (“OLI”) product catalogue and order functionality, click-and-collect and home delivery options, the TradePro mobile app, virtual showrooms, the WIX Pinterest board to assist customers with design ideas, and a centralised “smart fulfilment” system that tracks product availability across WIX’s store estate and delivery centres to match online orders with a nearby store location for order fulfilment.

As a result of these investments, WIX estimates that ~66% of group revenues were generated or supported by its various digital channels, with digital customers doubling in FY20, accelerated by COVID lockdowns resulting in reduced in-store visits:

Source: Wickes Group Plc Capital Markets Presentation March 2021.

2. Store Estate - WIX has transformed its 232-store estate in recent years to maximise efficiency by right-sizing to smaller footprints and reconfiguring store lay-outs for greater operating efficiency, and easier customer navigation and shopping experience. The average size of a WIX store is 28,400 square feet which compares with an average of ~80,000 sq. ft. for competitor B&Q (largest DIY player in the UK market, owned by Kingfisher Plc, KGF.LN) which primarily operates from “big-box” and “medium-box” format stores.

WIX’s store format is designed to support its digital offering, with its centralised order fulfilment system integrated with the store estate, meaning that website orders can be fulfilled via retail stores via online order matching to the nearest store. As a result, management estimate ~98% of customer purchases touch a WIX store in some respect (e.g. store visit, click-collect, or utilising store network fulfilment capabilities):

Source: Wickes Group Plc Capital Markets Presentation January 2020.

As a result of the store refit and reconfiguration initiatives, WIX has achieved an average sales uplift of ~25% at re-fitted stores and a 25% ROIC on refit spend. WIX has refitted ~145 stores and is targeting refits for a further 35-40 stores to its newer format in the medium term as well as strategic store relocations and further right-sizing of 15-20 stores (all capable of being funded from cash flow).

WIX operates a fully leasehold model, with the estate comprising ~6.6m sq. ft. across 232 stores and two delivery centres, with an annual rental expense is ~£108m .

Ultimately, the advantage of WIX’s differentiated store model vs. peers is a lower cost, more efficient and less complex estate.

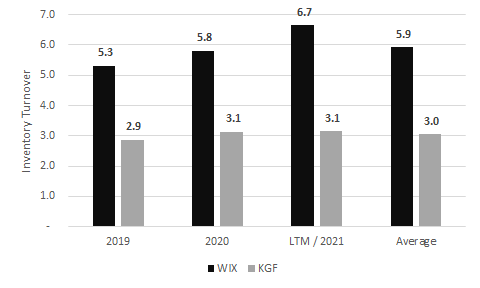

3. Curated Product Range - WIX does not operate a warehouse model stocking a vast product range, but instead provides a curated product range that covers most customer needs, with approx. 9,500 SKUs on shop floors and approx. 22,000 SKUs including its online catalogue. This compares to ~40k+ items carried by main competitor B&Q, who are adding an additional 100k SKUs later this year. This approach provides WIX with a number of advantages:

Less complex and more efficient inventory management.

Greater cost-efficiency, as WIX does not incur the carrying costs for less commonly required and therefore lower turnover items.

The simpler product range and more cost-efficient inventory management allows WIX keep prices low vs. peers and thereby enhance its value proposition to customers.

Ultimately this approach maximises inventory turnover - WIX’s average inventory turnover over the past three years has been ~6x or double that of B&Q:

Source: Company Annual Reports; Value Situations analysis.

4. DIFM segment - WIX is uniquely positioned in the DIFM market segment in that it competes against a mix of local operators, a small number of national competitors, and various DIY, generalist and online retailers who cannot provide a similar end-to-end service for projects.

Essentially, WIX faces very limited competition in this market segment as none of its large DIY peers provide a similar DIFM offering, while WIX’s scale and national footprint vs. smaller competitors provide it with numerous advantages across sourcing, design and process management oversight and expertise. Furthermore WIX has an unmatched installer network of more than 2,300 third-party installation teams to deliver projects.

To conclude, the four differentiating factors above combine to provide a low-cost, value-for-money proposition for customers, whereby WIX is able to past cost-savings on to customers and price certain products cheaper than competitors thanks to this low-cost, high efficiency operating model.

Summary Financial Performance

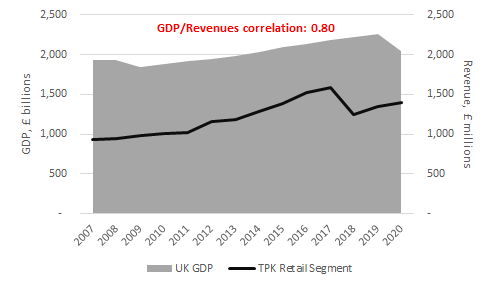

Full financials for WIX pre-2018 are not separately disclosed in TPK’s historic annual reports, however WIX has historically accounted for ~80%-90% of TPK’s Retail/Consumer segment prior to its spin-off. In order to assess recent vs. historic performance and cyclicality, the charts below present TPK’s historic Retail/Consumer segment performance from 2007-2017 as a proxy for WIX’s historic performance alongside WIX’s separately disclosed performance from 2018-2020 and LTM Jun-21 periods:

Source: Travis Perkins Plc Annual Reports; Wickes Group Plc Listing Prospectus; Value Situations analysis.

While not perfect, the above analysis shows that WIX’s recent EBITDA generation and margins are not indicative of cyclical peak performance, with LTM margin of 6.9% in line with historic segment average of ~7% while under TPK ownership.

Regarding historic growth, assuming WIX represented ~80% of TPK Retail segment revenues in 2007 or ~£750m, we can infer that WIX has grown at a CAGR of ~4.6% over this 14 year period. Indeed, the WIX demerger prospectus confirms a revenue CAGR approximating this at 4.8% over the 2013-2020 period:

Source: Wickes Group Plc Listing Prospectus.

WIX’s historic performance is particularly impressive in that it demonstrates how the business grown consistently through the cycle and through several periods of significant turbulence, including:

The Great Recession and UK housing market crash of 2008-2009 (when UK house prices declined ~19% from the 2007 peak)

Brexit

Market disruption and aggressive competition from Westfarmers (failed) entry into the market in 2016-2018 (see further details below); and

The COVID pandemic and resulting recession, which saw UK GDP contract 9.4% from 2019 to 2020 (UK Office of National Statistics data).

Market Overview

The UK home improvement market is largely tied to the overall performance of the UK economy, with an historic correlation of 0.8 between UK GDP and TPK’s Retail segment (of which WIX comprised ~80%+ of revenue):

Source: UK Office of National Statistics; Travis Perkins Plc Annual Reports

Historically, the UK home improvement market has grown at a CAGR of ~2.5% (2013 - 2019) and is estimated to be worth ~£25 billion today, based on sales by DIY retailers, generalist and specialist building merchants, fixed-price operators, direct-to-site sales and pure-play online retailers:

Source: Wickes Group Plc Capital Markets Presentation March 2021.

This historic market growth rate has exceeded UK GDP growth over the same period (~2.2% CAGR over 2013-2019 period) given a number of supportive structural trends:

Aging house stock driving new home builds and renovations, in turn driving demand for home improvement, repair and maintenance; of ~24.4m housing units in the UK, ~80% are more than 30 years old:

Source: Wickes Group Plc Capital Markets Presentation March 2021.

A continued widespread decline in DIY skills among the general population, with more limited time available to homeowners and occupiers to undertake DIY projects - this has been a particular driver of WIX’s Local Trade and DIFM segments

Continued housing turnover, with transaction volumes driving the need for home renovation and refurbishment projects.

More recently, demand for DIY products and services increased during the COVID-19 pandemic with more time spent at home prompting homeowners to renovate their homes. This has the potential for continued growth in the coming years (albeit perhaps lower than during the COVID DIY “boom”), as homeowners and renters continue to spend more time at home given increased remote working practices.

Increased customer demand for online ordering, flexible fulfilment options, and product research and support offerings including home delivery and click-and-collect have further driven incremental sales growth.

WIX’s management forecast that the UK home improvement market will continue to grow at 2.5%+ to ~£28 billion by 2025 driven by these supportive trends.

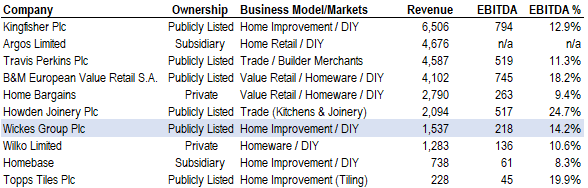

Competitive Landscape

The UK home improvement market is fragmented and highly competitive, with an array of different retailer types competing on the basis of price, quality, product range, store location, customer experience and more recently online/e-commerce offering (including delivery options).

WIX’s three end-markets are characterised as follows:

Local Trade - highly fragmented as home improvement products can be purchased from a variety of trade and specialist merchants as well as national DIY retail chains and smaller hardware stores.

DIFM - only a limited number of national service providers undertake DIFM services, and none of WIX’s direct DIY/ home improvement peers provide a similar end-to-end service. The remaining providers comprise small-scale local traders and specialist project providers.

DIY - there are only a small number of national retailers, of which B&Q/Kingfisher, WIX and Homebase comprise the top three players. Beyond these, DIY customers are served by local retailers, including small hardware stores and specialist retailers (e.g. painting and decorating retailers, garden and landscaping centres). Additionally, a variety of general and online retailers (including Amazon) also sell DIY products to UK consumers, competing on price and convenient delivery options.

Across the wider home improvement market (including general and homeware retailers, DIY retailers, and small trade suppliers) WIX is the 7th largest player in the UK by revenues:

Source: Company Reporting based on latest available financial information; Value Situations analysis. Note Kingfisher and B&M revenues and EBITDA relate to their UK operations only.

However, this ranking does not give a true sense of WIX’s competitive position as a number of the above retailers (Argos, B&M, Home Bargains) are also general/discount retailers that sell non-home improvement products for which revenues are not segmented out in their reporting. In terms of pure-play home improvement/DIY retailing, WIX is the #2 player in the UK after Kingfisher’s B&Q DIY chain:

Source: Company Reporting; Value Situations analysis.

Of these three, Kingfisher/B&Q is WIX’s main competitor with Homebase experiencing significant challenges after it was acquired by Australian conglomerate Westfarmers in 2016 in what is now regarded as a disastrous acquisition. Over the 2016-2018 period, Westfarmers sought to increase Homebase’s market share via an aggressive pricing strategy from 2016-2018, which created significant market disruption but ultimately ended in failure with Homebase being sold to restructuring specialist PE firm Hilco for a nominal amount in 2018. Since then Homebase’s performance has improved and Hilco put the business up for sale in Q4 2020, but to date no sale has completed.

Investment Thesis

The core thesis for WIX is that it is mispriced as a result of forced selling by TPK shareholders following its spin-off, and the market will re-rate it once the selling pressure is exhausted and bidders step-in given WIX’s very low valuation and its positive fundamentals.

Specifically, WIX possesses a number of attractive investment characteristics that should drive a substantial re-rating of its share price over the next 24 months:

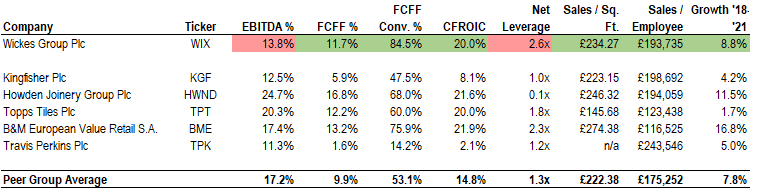

Free Cash Generation - WIX is a highly cash generative business, with a neutral working capital profile, facilitating strong EBITDA-FCFF conversion of ~85% (and averaging ~90% over the last three years) and FCFF margins (on revenue) of ~12% (three year historic average of ~13%) and robust CFROIC of ~20% - note WIX’s performance exceeds its peer group average on all three measures:

Source: Company filings; Value Situations analysis. Peer group includes Kingfisher Plc, Howden Joinery Group Plc, Topps Tiles Plc, B&M European Value Retail SA and Travis Perkins Plc.

Growth Prospects - WIX has historically grown at ~2x the wider UK home improvement market growth rate, with revenue growing at 4.9% CAGR over the 2013-2019 period pre-COVID, vs. 2.5% for the market. WIX has achieved this via its differentiated service offering and winning market share from competitors such as B&Q. On a forward looking basis, WIX’s prospects for above market-growth continue to look robust given its differentiated operating model (particularly in DIFM with a strong order book) and several growth levers including further growth in the TradePro programme, greater volumes through DIY, (including targeting large markets for common DIY products) and an expanded DIFM offering (home offices, doors and windows, loft conversions, landscaping etc). With the UK market projected to continue to grow at 2.5% in line with historic trend, WIX is well positioned to benefit from this outlook.

Independent, Competent Management - with WIX now independent from TPK where it was deemed non-core, it should now benefit from more focused management free of parent company considerations. Furthermore, WIX is led by a capable management team who have a proven track record in managing the business through numerous challenging environments historically (post-GFC, Westfarmers market entry, Brexit, COVID pandemic), while consistently growing market share and profitability.

Deeply Undervalued - WIX is clearly undervalued both in absolute and relative terms - on an IFRS 16 basis including lease “debt”, the market values WIX at ~4.7x LTM EBITDA and 5.6x LTM FCFF vs. average public peer group multiples of 7.1x EBITDA and ~17x FCFF respectively. On a pre-IFS6 16 basis, WIX appears even cheaper at 2.3x EBITDA and 3.4x FCFF. Similarly it trades at a discount to comparable private market transactions which have completed at 6x-7x. Finally, WIX currently offers a FCFF yield of almost ~18% on its current EV. All told, this simply appears too cheap for a business that generates a CFROIC of 20%, ahead of its peer group average of ~15%.

Solid Balance Sheet - while not an asset-backed business as it leases its entire store estate, WIX’s balance sheet is healthy with zero financial debt and a cash balance of £200m+, which equates to ~45% of its current market cap and ~2 years of rental expense for its entire estate. Furthermore, WIX has a stable financial position including lease obligations, with net leverage (total lease liabilties - cash / EBITDAR) of 2.6x, while its fixed charge cover ratio (EBITDAR / Total Lease Payments) is stable at 2.0x.

Takeover Target - given its strong cash generation, steady growth prospects, debt-free balance sheet and cheap absolute valuation I see WIX as an obvious takeover candidate for either a strategic or private equity acquirer - assuming it was acquired for 6x (the low-end of the private market valuation range) this implies a buy-out price of ~£2.77/share or ~60% above the current share price, which would imply a ~37% IRR / 1.6x MOIC return profile if a deal was to occur within an 18 month timeframe.

How Much Can I Make? - Valuation Analysis

Note on Presentation of Analysis

While I do not regard lease obligations as true debt, I present all valuation analysis on a post-IFRS 16 basis, by including total lease obligations within debt and enterprise valuation calculations. Similarly in presenting EBITDA, EBIT and FCFF in my analysis, each of these metrics are stated before lease interest and lease repayments, i.e. before payment of rent, in order for EBITDA/EBIT/FCFF to appropriately correspond to the lease-adjusted debt and EV calculations.

While I ultimately believe rent/lease expenses are a standard business expense, I have opted to present my analysis on a post-IFRS 16 basis to be consistent with WIX and its peers who now report on a post-IFRS 16 basis. Furthermore, given that WIX is a retailer with a fully leasehold model, understanding the total leverage picture (both financial and operating) is highly relevant here.

Summary Valuation Analysis

Source: Value Situations analysis.

Base Case Valuation

In my Base Case I estimate WIX’s EV at £1.46bn, with its equity worth ~£892m or ~€3.44/share, or +98% upside to WIX’s current share price, assuming a 7x multiple on stabilised earnings power (EBITDA) of £208m (post-IFRS 16) which I believe is maintainable from FY22 onwards. This implies a return profile of 40.8% IRR / 2.0x MOIC over a two year investment term from the time of writing.

The 7x multiple is derived from the average of WIX’s spin-off multiple, historic and NTM trading multiples for WIX’s public peers and multiples paid in recent private market transactions.

See Valuation Multiple analysis below for supporting details on the concluded multiple.

Upside Case Valuation

For an Upside Case, I assume WIX achieves a market re-rating to 9x stabilised EBITDA, which still reflects a ~20% discount to WIX’s public peers’ “through-the-cycle” historic multiple of 11x, being the average multiple for the peer group over the last 10 years.

The re-rating to 9x is assumed on the basis that the market comes to better appreciate WIX’s above-average performance vs. public peers - see the benchmarking analysis below for analysis of WIX’s stronger fundamental performance vs. its peer group.

The Upside Case analysis implies WIX is worth ~£5/share or +190% vs. the current share price, with a return profile of 70.4% IRR / 2.9x MOIC over a two year investment term.

Take-Private Scenario

As highlighted in the Investment Thesis section above, WIX has a number of attributes that make it an obvious takeover target. For an indicative take-private valuation, I assume WIX is taken private at 6x LTM EBITDA, at the low-end of the range for recent comparable private market deals (6x - 7x). This equates to a buy-out price of £2.77/share or +60% upside to the current share price.

Given WIX’s depressed valuation since the demerger ~11 months ago, I assume a take-private if it were to happen will occur within the next 18 months, and the target return profile of ~37% IRR / 1.6x MOIC is calculated on this timeframe.

Valuation Multiple Selection

In concluding on a 7x multiple under the Base Case, I reviewed the valuation evidence across WIX’s own spin-off transaction, trading multiples for publicly-listed peers and multiples paid in recent private market transactions involving comparable home improvement/building materials-related assets in the UK.

Firstly, WIX’s shares were initially priced at £2.50 in the demerger in April 2021, which equated to a 7x on LTM EBITDA at that time.

Secondly, WIX’s public peers listed in the UK have historically traded at an average multiple of 11x over the last 10 years, which I assume as a proxy for a through-the-cycle multiple for valuation purposes given given the cyclical nature of home improvement/DIY retailing. More currently, on a NTM basis, WIX’s peer group trades at an average of 7.1x NTM EBITDA:

Source: Koyfin; Value Situations analysis.

WIX’s undervaluation vs. its public peers seems particularly anomalous when benchmarked against its public peer group on 8 fundamental criteria as the table below shows:

Source: Value Situations analysis.

WIX scores better than the peer group averages on 6 of the 8 criteria, with only net leverage and EBITDA margins scoring below the peer group average. Yet despite its clearly above-average performance, WIX trades at over two turns of EBITDA lower on an NTM basis (4.7x vs. 7x), and ~6x turns of EBITDA lower vs. the peer group’s through-the-cycle multiple (4.7x vs. 11x).

Finally, recent private market transactions involving comparable businesses in the UK have completed in a range of 6x - 7x EBITDA:

Source: Company transaction announcements; Value Situations analysis.

Based on this market evidence for valuations, I conclude that a 7x multiple is appropriate for valuing WIX in a Base Case, as it approximates the average across WIX’s initial spin-off valuation, public peers NTM multiple and recent private market valuations of comparable businesses:

Source: Value Situations analysis.

Financial Projections & Earnings Power

Source: Value Situations analysis.

I estimate WIX’s maintainable earnings power at £208m in EBITDA, being the average projected EBITDA over the FY21-FY24 period based on the following assumptions:

I assume 2.5% YoY revenue growth out to FY24, approximately half WIX’s historic revenue CAGR of nearly 5%, to reflect more muted growth given impact of rising inflation and costs of living on UK consumer spending - I believe this is very conservative given WIX’s value-for-money pricing across its product range, the various levers for further growth outlined previously and its historic resilience through the previous recessionary environments, through which it consistently grew revenues.

EBIT margins (pre-IFRS 16, net of all rental expense) assumed to hold at 4%, in line with historic average over FY18-FY20, and below LTM/FY21 consensus levels reflecting some cyclical adjustment post-COVID pandemic uplift.

D&A expense is assumed to average at 2% of revenues in line with management guidance and historic average over FY18-FY20 period.

Total lease expense (comprising IFRS 16 lease interest and ROU asset depreciation charge, which equates to actual cash rents) assumed flat at ~£108m given that rents are fixed and management have stated they will not be expanding WIX’s estate further in the medium term.

Based on the above assumptions, EBITDA on a post-IFRS 16 basis averages out at £208m over FY21 - FY24 period, with an average ~13% margin vs. ~15% over FY18-FY20 (and a sub-7% average margin on a pre-IFRS 16 basis).

FCFF conversion on EBITDA (post-IFRS 16) is assumed at 85%, in line with LTM conversion rate and below recent historical average of ~90%.

How Much Can I Lose ? - Downside Analysis

I estimate downside risk at ~£1.30/share, or -25% below the current share price, based on a stagnant 5x multiple on declining EBITDA to £181m:

Source: Value Situations analysis.

The Downside Case assumes the following:

Revenues decline to -22% from LTM levels to £1.2bn - note in 14 years of trading WIX revenue has never declined YoY - revenues were approx. flat from 2007 - 2009 as the global financial crisis hit the UK and house prices declined by ~19%, indicating the resiliency of the home improvement category.

EBIT of £42m, based on margin contraction to 3.5%, in line with FY18 level when the UK home improvement market was disrupted by aggressive competition from Homebase in a strategy that ultimately failed - a return to such competition and/or declining market share and margin erosion for WIX is unlikely given its stronger market position today and the market backdrop.

D&A expense assumed at £30m, and Lease Expense at £108m in line with Base Case charges given fixed nature of these, resulting in EBITDA of ~£180m

In this scenario, WIX’s fixed charge cover on rental expense also remains sufficient at 1.67x.

I regard this Downside scenario as very pessimistic in terms of the revenue decline and margin contraction while the analysis indicates WIX remains solidly profitable at the EBITDA level. Furthermore, the downside implied by this scenario indicates WIX is a highly asymmetric situation with upside of over 4x the downside risk under the Base Case, and almost 8x the downside in the Upside Case.

Variant Perception - Why Does This Opportunity Exist?

WIX is a classic post-spin off situation created by mandated selling following its demerger from TPK.

Under the demerger terms, TPK distributed shares on 1-for-1 basis to all its shareholders, initially issuing 252m shares in WIX. At the time of the demerger, TPK/WIX’s top six shareholders were as follows:

Source: Wickes Group Plc Listing Prospectus

Cumulatively these shareholders held at least ~25% of WIX’s initial share allocation at the time of the spin, or ~62.3m shares.

A comparison of these initial holdings to today shows that excluding Blackrock (whose shareholding above was not disclosed), the original top five shareholders own just 8.6m shares/ 3.3% of WIX today:

Source: Company filings; Value Situation analysis; TIKR.com

So some 53.7m shares or ~21% of WIX’s stock has been sold down since WIX listed ~11 months ago.

Notably, of the above Ninety One UK, Harris Associates, Oppenheimer/Invesco and Sanderson Asset Management each currently hold 5%+ of TPK - so clearly these investors continue to view the UK market positively (increasing their stake in TPK above 5%) and simply disposed of unwanted WIX shares distributed to them in the demerger for mandate reasons.

Other large sellers of WIX stock over the past ~10 months include Pzena Investment Management (who still own 4.96% having initially acquired ~8% post-spin), Kiltearn Partners, M&G Investment Management and Allianz Global Investors.

Clearly whats happened is these large institutional investors have sold down the WIX shares distributed to them for the following reasons:

TPK is a larger cap and more liquid name, with a market cap of ~£2.8bn (~6x greater than WIX), and so owning a less liquid, small cap like WIX does not fit with their fund mandates. As a result, these investors are compelled to sell their WIX stock for non-fundamental reasons, irrespective of its investment merits.

WIX is a home improvement retailer, and UK retail has fallen out of favour with institutional investors given the rise of e-commerce. TPK by comparison is a large building merchant serving the homebuilding and construction sectors and so is perhaps seen as a stronger investment proposition - this ignores WIX’s strong e-commerce offering (which has grown through COVID lockdowns), its long-established retail track-record and market position as the #2 player in the UK’s home improvement retail industry.

On the basis that these investors already own TPK, they most likely don’t want secondary exposure to the wider home improvement/building materials sector - essentially they don’t want to own the same risk twice - and given the choice between TPK and WIX, they’ve opted to hold TPK due to its size and liquidity.

Given this context, it is clear that WIX’s share price decline has little to do with its business fundamentals and as such is mis-priced, with a re-rating likely once the selling pressure from original TPK investors runs its course.

Catalysts to Value Realisation

I see two catalysts driving a valuation re-rating for WIX, as follows:

1. Market Re-rating - As outlined above, WIX’s share price decline since demerging from TPK is entirely attributable to forced selling by TPK shareholders for non-fundamental reasons. However, the evidence now suggests that this selling is close to exhaustion given that (1) the original large TPK holders have largely sold down the shares originally distributed to them under the spin-off and (2) the recent price action and trading volumes suggest that a bottom may now be forming in the share price:

Regarding the price action, the chart above shows buying (green bars) since the beginning of March has exceeded selling (red bars), with WIX’s stock price rebounding ~9% since the closing low of £1.59 on 7th March.

Furthermore, looking at average quarterly volumes traded, WIX’s volumes have broadly stabilised quarter-on-quarter at ~860k shares in the current Q1 to date, i.e. lower volumes traded compared to previous quarterly volumes suggests the selling pressure has subsided:

Source: Koyfin; Value Situation analysis.

With the forced selling likely to be substantially complete, there is now a high probability that WIX’s stock will be re-rate in line with peers given the absence of further sellers and the combination of its extremely cheap valuation and positive fundamentals.

2. Takeover Target - WIX possesses all the typical attributes of a middle-market PE buy-out target with it’s depressed valuation, debt free balance sheet, strong free cash generation and positive growth prospects. Furthermore, recent private market activity also indicates a clear appetite among strategic acquirers for building materials and related businesses such as WIX. Based on the market evidence in this regard, WIX should be valued at 6x - 7x in a takeover scenario.

Risks & Mitigants

There are four main risks to the WIX thesis, as follows:

1. Cycle Turn & Recession Risk - WIX’s business prospects are tied to the strength of the UK economy. Following a surge in DIY sales during the COVID pandemic lockdowns, there is a perceived risk that the DIY cycle may turn downwards following this recent lockdown-induced boom.

Furthermore, with UK inflation at a 30 year high of over 6% (and expected to rise to 7% by Q2 2022), concerns of a “cost-of-living crisis” for UK households (and exacerbated by the Russian invasion of Ukraine) increase the risk of a recession which would dampen consumer demand and DIY/home improvement spending.

Mitigants - I see a number of mitigants to cyclical and recessionary risks to WIX’s business:

As shown in the Summary Financial Performance section, WIX’s margins are not elevated or at cyclical peaks, with LTM EBITDA margin of 6.9% in line with ~14 year average or through-the-cycle margins.

WIX operates a low-cost, value-for-money retail model, where it seeks to offer consumers the best prices on commonly needed and essential DIY products. As such, its value proposition should insulate it somewhat from a general reduction in consumer spending, which is likely to impact higher value discretionary expenditure.

Increased working from home practices are set to continue which is supportive of recent DIY and home improvement-related consumer spending.

While WIX’s business is highly correlated to UK GDP and its housing market, the DIY market is resilient and WIX has proven to be particularly so - through the previous cycle, which included the GFC which saw UK GDP decline 4.5% and UK house prices decline ~19%, WIX actually grew revenues by over 5% during this period:

Source: UK Office of National Statistics; Travis Perkins Plc Annual Reports.

Similarly during the recent COVID-induced contraction, UK GDP declined 9.4% yet WIX again grew revenues 4.2% over 2019 - 2020 (and is on track to have grown revenues by ~20% to 2021 vs. 2019 pre-COVID). This performance in recessionary conditions clearly speaks to WIX’s resilience:

Source: UK Office of National Statistics; Wickes Group Plc Annual Reports.

The UK housing stock’s aging profile ensures repair and maintenance products will continue to be in demand irrespective of the macro environment, which is supportive for WIX’s business.

UK housing market transaction levels remain healthy in 2022 YTD, with housing transaction volumes for Jan-Feb 2022 ahead of pre-COVID levels and in line with long-term average transaction volumes, indicating steady demand for home renovation and maintenance works:

Source: UK Office of National Statistics.

Regarding the wider economic outlook, earlier this month the British Chambers of Commerce reduced its 2022 forecasts for UK GDP growth to 3.6% (down from 4.2%) and consumer spending growth to 4.4% (down from 6.9%), and while these are meaningful reductions, these forecasts still indicate robust YoY growth compared to the UK’s long-term annual GDP growth rate of 1.01% over 2006-2021 (UK Office of National Statistics Data), a period when WIX grew revenues by ~5%.

Similarly, the UK Treasury’s March 2022 compilation of independent GDP forecasts indicates UK GDP is expected to grow 4.2% in 2022 and 1.7% in 2023 - notably this includes forecasts received by the UK Treasury up until 11 March and so is reflective of current inflationary concerns. Given WIX’s historic resilience and higher-than-GDP and market growth rates, this is again supportive of WIX’s prospects.

At the household level, while inflation is certain to dent consumer sentiment this year, the combination of UK household savings built-up during the pandemic lockdowns (~£165 billion built up coming into Q4 2021) and expected UK government supports for households to offset the increased cost-of-living also should serve to mitigate some of this risk to growth.

Finally, at a sectoral level, WIX peer Kingfisher Plc just reported FY21 annual results and provided its FY22 outlook, which reported a positive start to FY22 YTD, with resilient demand across all markets and its B&Q order book up +72% on FY21 levels, which offers a positive read-across for WIX.

2. Supply Chain Risk - a significant proportion of products sold by WIX are imported from outside the UK or are purchased from domestic distributors that import from outside the UK. As such there is a potential risk of supply chain disruption and a loss of product offering.

Mitigants- supply chain risk exists across the industry, however I believe this risk is mitigated for WIX by the following:

WIX maintains strong relationships with a network of domestic and international suppliers. WIX has relationships with ~370 different suppliers, and has sought to diversify its supplier base to reduce supply chain risk.

Due to the volume of suppliers, most of the products carried by WIX can be sourced from alternative suppliers if necessary.

WIX typically enters into contracts with suppliers for an average of one to three years, which mitigates supply chain risk by providing a measure of assurance on product supply as well as pricing.

Finally, given WIX’s strong balance sheet (~£200m net cash position), management have moved further on inventory rebuild in order to protect the business against supply chain disruption in the current year.

3. Cost Inflation - Similar to supply chain risk, this is an industry-wide risk for WIX and its peers. Specifically, WIX is exposed to product cost inflation on products it sells as well as labour costs among its installer network serving its DIFM segment.

Mitigant -

WIX’s supplier relationships have helped it mitigate product cost inflation - in the December trading update, management disclosed that supplier relationships in place “have resulted in a better than expected margin performance” for H2 FY21, helping to mitigate cost inflation. This is likely attributable to WIX’s buying power achieving favourable pricing from suppliers, given its scale and consistent inventory stocking approach.

WIX’s scale and lower-cost operating model vs. competitors also positions it to better weather cost inflation and where possible pass on cost increases to customers if necessary.

4. Installer Network - DIFM is a growth area for WIX and key to delivering on this is the availability and reliability of its installer network who fit kitchens, bathrooms etc. A of lack of availability or disruption to this network would impair WIX’s ability to deliver on DIFM orders and grow the segment further.

Mitigant -

The DIFM segment has a significant order book approx. 2x the FY20 year-end book, providing certainty of project pipeline to installers; in a macro environment market by increased uncertainty, this certainty of work should help WIX maintain its network of installers to ensure delivery of projects.

WIX’s competitive position as the #2 player in the UK home improvement market and the only national retailer among its peers to provide a full DIFM offering means that it should continue to provide an attractive and reliable pipeline of work for installers and trade workers, driving installer loyalty and retention for WIX projects.

Finally, WIX maintains quality control over its installer network through an in-house oversight team, thereby ensuring quality and consistency of delivery for customers.

Appendix

Key Information Links

Excellent analysis. Now before you read the below, let me add this disclaimer: YES I think Wickes is undervalued, but then so is Kingfisher. So they are undervalued on market-wide basis but not on a peer-basis.

Howdens Joinery operates a very different business, so hard to use that as a comparable. Their clients lean more towards builders who know Howden's products, whereas Wickes customers are more DIY. Howden's business model is working well and it shows: they grew revenue at an insane rate last year.

Kingfisher is a better company to use as a comparable, while they also seem undervalued their business is much more similar to Wickes' than compared to Howdens. Wickes is more DIY than "Do it for me". Although Wickes will try and compete in the "Do it for me" market, they won't get far as this is Howden's game completely. Wickes is going to play catch-up.

TPT shouldn't be used as a comparable. B&M also, should not be used as a comparable. Different market. I'm even nervous to use TPK as a comparable because they are a builder's merchant.

So best comparables I can see here are Kingfisher, Howden's. Howden's deserves a better multiple, they have a better more innovative faster growing business...Kingfisher trades relatively the same.

Thorough write up of what seems to be an insanely cheap company 🙏

The big question for me is capital allocation though. Why do they even have so much net cash? Time for some buybacks!