Weekly Bulletin #5

Portfolio: DHG, PANR, WTW | Monitoring: WG, BG, HBRN | Developing: Volkswagen / Porsche

Disclaimer

Value Situations is NOT investment advice and the author is not an investment advisor.

All content on this website and in the newsletter, and all other communication and correspondence from its author, is for informational and educational purposes only and should not in any circumstances, whether express or implied, be considered to be advice of an investment, legal or any other nature. Please carry out your own research and due diligence.

Model Portfolio Updates

There are three brief updates of note from the past week with respect to Model Portfolio names Dalata Hotel Group Plc (DHG), Pantheon Resources Plc (PANR) and Willis Towers Watson (WTW).

DHG

Recent private market transaction evidence continues to suggests that DHG is undervalued by the public markets, noting the following deals announced over the last week or so:

Irish property group FBD Hotels & Resorts has acquired the four-star Killashee Hotel in Co. Kildare, Ireland for €25 million. The asset is a 141-bedroom hotel with extensive conferenceand leisure facilities, located ~30km from Dublin city centre. The €25m valuation equates to a value/key of ~€177k.

The TMR Hotel group controlled by Austrian investor Thomas Röggla has acquired the Ballymascanlon House Hotel in Dundalk, Co Louth for €15m. The asset is a 97 bedroom hotel set on 130 acres of parkland, located ~90km from Dublin city centre. The €15m valuation equates to a value of €155k/key.

Outside of DHG’s domestic market, Atlas Hotels Limited has acquired the Chardon Group of hotels, which comprises a portfolio of six properties in Scotland with a total of 569 bedrooms. The portfolio includes Holiday Inn Express hotels in Dunfermline, Edinburgh Airport, Edinburgh's Royal Mile, Perth and Glasgow (where DHG has two leasehold hotel interests). The transaction value for Chardon has not been disclosed but Atlas have earmarked £200m earmarked for further expansion. Atlas is the largest franchisee of Holiday Inn Express hotels in the UK and Europe and is owned by leisure and hospitality-focused PE-RE firm London & Regional Properties.

While the assets acquired above are not directly comparable to DHG’s, they are nonetheless relevant data points that suggest the market’s valuation of DHG’s portfolio at ~€120k/key is much too low. This also seems particularly true when one considers the relatively superior profile of DHG’s hotels in prime locations in strong regional city centre locations.

A second observation is that despite the disruption inflicted on the hotel industry from the COVID pandemic, private capital continues to have a clear appetite for hotel assets as we move to a post-pandemic world and cities and economies reopen. In this light, given DHG’s strong investment characteristics private capital may well cataylse value for shareholders if public markets continue to misprice DHG.

PANR

Another week, another update from PANR as it progresses the drilling and testing programme at its Talitha and Theta West sites.

Last Monday PANR reported that flow testing was completed on the Slope Fan System ("SFS") at its Talitha test site. Testing produced high quality oil, flowing at an average of 45 barrels of oil per day over a three day test period. This is an encouraging result, with these flow rates exceeding previous expectations and it’s also worth noting that the SFS is a secondary target location. The test results confirm the presence of quality, moveable oil at the SFS, with the upshot of this being a likely further upgrade to PANR’s resource and recoverable oil estimates in due course - note that the oil found in the SFS testing is not accounted for in any of management’s previous resource estimates.

Here’s CEO Jay Cheatham displaying a sample of the sweet, light oil produced from the SFS flow test at Talitha #A last week:

Additionally, management reported that testing at Theta West has been delayed following an error by a third-party service contractor, which involved the incorrect configuration of a cement stage tool being used to cement the wellbore for sealing prior to further drilling.

PANR expect remedial work will take a week to complete before conducting flow testing on the Theta West Basin Floor Fan. While this issue is frustrating and has incurred a time and money cost, it is a delay rather than a real operational issue and it doesn’t compromise the reservoir potential at Theta West.

WTW

WTW last week announced a quarterly dividend of $0.82/share for the quarter ended 31 Dec-21 and payable on 15 Apr-22. The dividend equates to a forward annualised yield of ~1.5% at the current share price.

Separately, the scale of activist investor Starboard Value’s position in WTW has now been disclosed in Starboard’s latest 13-F filing with the SEC. The filing shows Starboard holds ~2.1m shares, or 1.7% of WTW, and equates to a ~$460m position at WTW’s current share price, which is a sizeable position for Starboard. It was previously reported that Starboard took a position in WTW last October, at which time Starboard CEO Jeff Smith stated he believed WTW could be worth $456/share (~2x the current share price) should management deliver on their growth and capital return strategy.

Additionally, the latest 13-F for the Baupost Group shows an increase in its position in WTW by ~250k shares to 1.25m, or 1% of WTW, equating to a ~$218m position based on WTW’s current share price and representing ~2.75% of Baupost’s reported equities portfolio.

The continued presence of shareholders of this profile alongside activist Elliot Management on WTW’s register suggests to me that management will continue to focus on delivering on their turnaround strategy following the collapse of the proposed AON merger.

Situations Monitor

There are updates for three names I’m monitoring from this past week, namely Wood Group Plc (WG), Bunge Limited (BG) and Hibernia REIT Plc (HBRN).

WG

WG is a Quick Idea name I wrote about last November when it was priced at ~£2/share. As a quick recap, I had viewed WG as a potential value situation for the following reasons:

WG is an engineering services business with ~37% of revenues coming from the Conventional Energy (i.e. traditional oil & gas) business segment - clearly with the ongoing energy crisis in Europe and surging oil prices (even before the Russian invasion of Ukraine last week), WG should benefit from a positive growth outlook and increased services contracting in the O&G sector, something WG confirmed in the previous trading update and outlook for 2022 last month, when it cited “notable growth” and winning “significant work” in the segment.

Value catalyst in play with WG announcing last November that it initiated a strategic review of its Built Environment Consulting business, to unlock value “for shareholders that Wood believes is not currently being recognised in its market capitalisation.” Noting that comparable businesses were trading in the private markets for 15x - 20x, I originally estimated that this divestment could conservatively generate ~$2bn in gross proceeds (at 12x), transitioning WG to a net cash position and repositioning the company at an opportune time in the cycle for its other business segments (O&G, renewables). Bloomberg subsequently reported that the Built Environment unit may trade for a full price of $2.7bn / 17x, in line with the private market comps I cited originally.

Based on my original analysis and revising for the updated indicative disposal pricing, WG could be worth ~£3.50/share, or +75% to the current share price when I originally wrote about it.

However, there was a material update last Tuesday with WG’s stock declining 11% on the news that the company would incur an exceptional charge of $100m on its Aegis Poland project, a legacy engineering project for the construction of US anti-missile defence facility in Poland. Furthermore, as a result of this material development, the year-end financial results publication date was delayed.

At the time of writing WG’s share price is ~£1.80, and given that it will be reporting the full $100m hit in the FY21 year-end results, it is now trading at 6.6x FY21 EBITDA. But stepping back from this negative news and assuming no other unwelcome surprises in the full year results, I think the market has overreacted to this update for the following reasons:

It’s a once-off exceptional charge on a legacy project - it’s not a permanent impairment to forward earnings power.

The robust FY22 outlook remains unchanged from previous guidance, as per the update on the Aegis Poland project.

In this light, WG would appear to offer even better value today should it succeed in divesting of the Built Environment unit at the valuation being touted (again with the caveat that there no other negative issues arise that impact earnings or contracts). I estimate that WG may offer ~90% upside to ~£3.50/share assuming an undemanding 6x multiple on PF EBITDA post-divestment of ~£390m.

BG

The Russian invasion of Ukraine that started last week is another instance of what I previously termed as unhedgeable political risk for the global food supply chain that is now playing out in real time. The consequence of this new war is likely to be sustained food price inflation and scarcity given that Russia and Ukraine combined account for up to ~30% of the world’s wheat exports, a fifth of its corn trade and almost 80% of sunflower oil production, according to the US Department of Agriculture:

In addition to wheat and grains, Russia, Belarus (also a party to the invasion) and Ukraine are among the major exporters of fertilisers and raw materials used in fertilisers:

From a combination of trade sanctions, Russian withholding of grains and fertiliser in retaliation to sanctions, and Ukrainian exports and supply chains disrupted by the war, global food prices are very likely to rise further despite agricultural commodities already reaching multiyear highs. As I’ve written before, this type of dislocated market environment is one that commodity traders tend to perform well in, benefiting from both the volatility and price inflation.

Interestingly, when the invasion was launched last Thursday BG’s shares rose +2.3% vs. 1.5% for the S&P 500 and -3.3% for the European Stoxx 600.

Separately, BG last week announced the signing of definitive transaction agreements to form the previously announced renewable diesel JV with Chevron. The JV will create renewable feedstocks using BG’s expertise in oilseeds and Chevron’s expertise in fuels manufacturing and marketing. Under the agreements, BG will operate the facilities, and Chevron will have purchase rights for the oil to use as a renewable feedstock to manufacture lower carbon transportation fuels. A renewable fuel production boom is forecast in the coming years and is a major new source of demand for vegetable oils produced by BG.

HBRN

HBRN was the first quick idea I wrote about in this newsletter back in June last year, as a potential PE-RE takeover candidate. At that time the stock was trading at €1.25/share or 0.7x NAV vs. comps trading at ~1x. HBRN rallied as a high as €1.37 last August and was holding around the €1.30 price level until about a month ago, but has since declined ~11% to €1.16/share as at the time of writing. At the current price, HBRN trades at a P/NAV of just 0.66x vs. a range of 0.8x - 1x NAV for comparable UK and Irish office REITs, and offers a ~4.7% dividend vs. yields of ~2% - 2.5% for peers. This valuation seems truly anomalous when one considers the quality of HBRN’s portfolio, comprising prime city centre offices leased to a sticky government/tech/ blue chip tenant base, and with one of the strongest rent collection rates of any REIT across Europe through the COVID lockdowns.

Recent private market transactions suggest that the public markets continue to undervalue HBRN’s portfolio - HBRN’s much smaller, niche peer Yew Grove REIT has just been acquired by Canadian Slate Office REIT at a slight premium to NAV (~1.01x) while HBRN itself recently divested of two office blocks in central Dublin to German investor Commerz Real AG at a slight premium to book value (where book value reflected an independent appraiser’s estimate of current market value - HBRN has its entire portfolio revalued every 6 months).

And just last Friday, the private markets provided another comp on valuation with a fund managed by Brookfield Asset Management announcing a take-private of Belgian office REIT Befimmo SA (BEFB) at 0.79x NAV, and at a ~52% premium to the pre-bid trading price. BEFB is a very comparable REIT to HBRN, in that it owns a prime portfolio of office assets located mainly in Brussels city centre, leased primarily to public sector, professional services and large corporate occupiers.

In my view HBRN’s undervaluation is attributable to negative sentiment, rather than any fundamental flaws with its portfolio or prospects. Given the nature of its tenant base, the improving Dublin office market outlook post-COVID (for prime office space sought by tech, professional services and multinational corporates) and the gradual unwinding of WFH practices, HBRN should see a re-rating in line with peers as COVID fades.

If HBRN were to re-rate to the midpoint of its peer P/NAV range of 0.9x, this would imply a price of ~€1.56/share or ~35% above the current share price. As for downside, it’s actually hard to see any real downside to owning HBRN at the current price in my view - through the worst of the pandemic lockdowns from March-August 2020, HBRN traded at an average price of €1.08/share, or -7% below the current share price - and that pricing reflected a very dire outlook a the time, with commentators rushing to declare the death of the office, and there was no prospect of a COVID vaccine at that point. On this basis, the set-up today looks highly asymmetric, with potential upside of 35% vs. downside of ~7% or a reward/risk ratio of ~5x.

I’ve written before about office REITs becoming PE-RE targets and much like HBRN’s former peer Green REIT, and most recently Yew Grove REIT and Befimmo, if public markets continue to overlook HBRN’s obvious value I can see private markets correcting this mis-pricing via a take-private at a substantial premium to the current price.

Developing Situations

A developing and somewhat complex value situation emerged last week with the news that Volkswagen AG (VOW / VOW3) was in advanced talks with controlling shareholder Porsche Automobil Holding SE (PAH3, which I’ll refer to as Porsche SE, or “PSE”) to IPO its Porsche automobile unit (Porsche AG, or “PAG”).

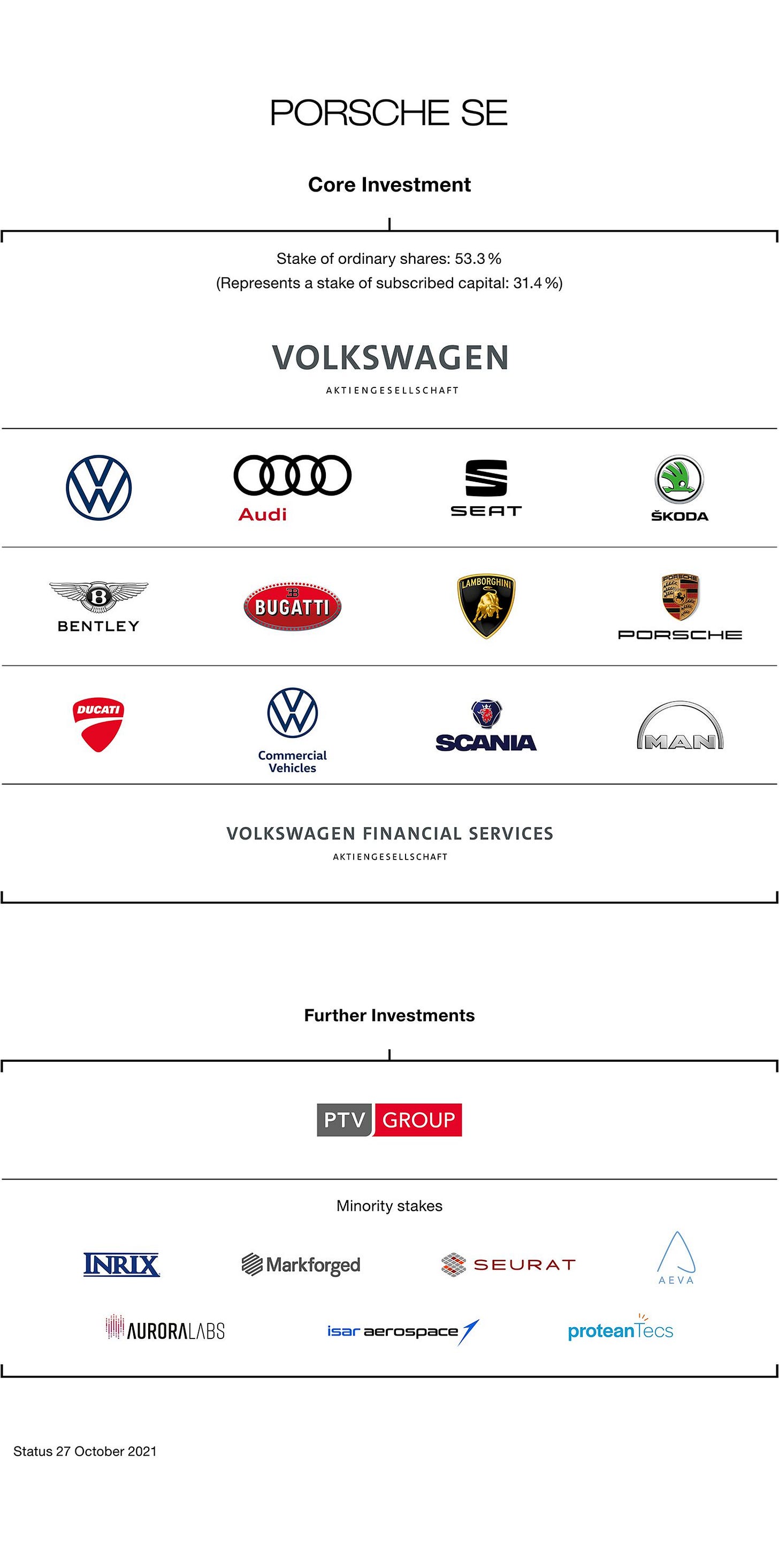

Porsche SE is the investment vehicle of the Porsche-Piëch family, which controls VOW with ~53% of total voting rights. VOW in turn owns 100% of both the Volkswagen and Porsche marques, plus a range of well known marques including Audi, Seat, Bentley, Bugatti and Lamborghini:

Source: www.porsche-se.com/en/company/holding-structure

Volkswagen and the various auto marques constitute PSE’s core investment holdings, while it also owns a number of other investments and minority interests across the auto and auto-technology value chain, as shown above.

Last Thursday it was confirmed that VOW and Porsche SE had reached a framework agreement for an IPO of Porsche AG, with a proposed structure as follows:

Source: Volkswagen Group Presentation - Porsche Announcement

In summary, the proposal is for VOW to structure PAG with 50% new non-voting pref shares and 50% in voting ordinary shares. VOW will then list up to 25% of the new pref shares via an IPO, and sell “25% +1” of PAG ordinary shares back to PSE at a premium of 7.5% to the listing price of the PAG prefs (no pricing details have been provided as of yet, so this is just a working structure for now).

The PAG segment accounts for ~12% of VOW’s LTM group sales and ~25% of LTM EBIT, and it’s being reported that the unit could be valued at up to €90bn for the IPO, which equates to ~16x PAG’s LTM EBIT. What makes this valuation particularly interesting is that a €90bn value represents ~83% of VOW’s current market cap and ~33% of VOW’s EV, so the IPO could unlock substantial value for VOW given it will retain a ~75% interest in POR while realising cash proceeds of ~€23bn (or ~21% of its current market cap) post-IPO.

A point that is generating some excitement with respect to this situation is the perceived parallels with Fiat-Chrysler’s (now Stellantis) spin-off of Ferrari back in 2016 - Ferrari (RACE) opened at €43/share in January 2016 and went on to become a 4-bagger, exceeding ~€200/share at the beginning of this year (~27% IRR / ~4.4x MOIC as at the time of writing):

In my view, comparing PAG to RACE is flawed in that RACE merits a premium valuation to PAG, being a super-luxury brand with ~25% EBIT margins, while PAG is a tier below RACE in terms of prestige and pricing, and is a lower margin manufacturer at ~18.5% (LTM period).

I would see Mercedes Benz Group and perhaps BMW as more appropriate comps to PAG, which trade at ~11x and 14x LTM EBIT respectively. By comparison, RACE trades at ~31x LTM EBIT, reflecting its premium product and corresponding margins. The €90bn touted valuation for PAG at ~16x EBIT therefore makes sense as it puts PAG closer to the Mercedes/BMW end of the high-end / luxury car spectrum.

The IPO of PAG prefs is expected to happen in Q4 this year, with further updates expected on the IPO process in the summer. This is an unusual situation worth watching, and one I expect to return to.

Any Other Business

Firstly, I think it’s important to state at the outset here that what is happening in Ukraine is horrific and a humanitarian catastrophe, and the financial market impact must always be regarded as secondary to the human impact of Russia’s invasion of Ukraine.

With markets in shock and the conflict seemingly in the early stages, investors still need to navigate through this highly uncertain market environment. In this context, Claire Jones published an interesting piece in the FT last week which included the following chart:

The chart comes from Costas Milas, a professor at the University of Liverpool, and is based on a geopolitical risk index compiled by Dario Caldara and Matteo Iacoviello at the Federal Reserve Board. It shows shows that the historical stock market reaction to war is weak, with a correlation of -0.29. If this correlation continues to hold, then it suggests that the Ukrainian invasion will have limited impact on wider market action over the medium-to-long term.

What inference or conclusion can be drawn from this? From an investment standpoint, investor Jeremy Raper of Raper Capital perhaps offers the best response to this question:

In my view, when facing heightened market uncertainty, idiosyncratic situations possessing their own catalysts and which are independent of wider macro/ geopolitical events seem like the most sensible/ least risky opportunity set to focus on. In this context, I continue to believe situations such as those in my Value Sits Model Portfolio are well placed to hold up and outperform through the current market challenges.