Weekly Bulletin #14

Portfolio: KMR, WTW | Monitoring: AFM | Developing: Dassault Aviation SA (AM)

Disclaimer

Value Situations is NOT investment advice and the author is not an investment advisor.

All content on this website and in the newsletter, and all other communication and correspondence from its author, is for informational and educational purposes only and should not in any circumstances, whether express or implied, be considered to be advice of an investment, legal or any other nature. Please carry out your own research and due diligence.

Model Portfolio Updates

There are brief updates for three of the Model Portfolio names from last week:

KMR

Kenmare Resources Plc (KMR) held an analyst site visit at it’s Moma mine in northern Mozambique last Thursday & Friday, and published an accompanying presentation available here.

The main purpose of the visit was to allow analysts view KMR’s existing mining operations at Namalope and Pilivili, and to visit the Nataka ore zone, where KMR will commencing mining and production from in 2025.

The update presentation provides a very helpful recap of KMR’s operations but for me the key takeaways were management’s reiteration of previous FY22 guidance, noting that strong market conditions in terms of favourable supply/demand and pricing have continued into the YTD - KMR saw a sixth consecutive quarter of ilmenite price increases in Q1 2022, and management report that positive momentum has continued into Q2 2022, supported by continuing low global inventories and strong demand, particularly from Chinese pigment producers. This is both notable and encouraging in the context of recent events in China with regard to COVID lockdowns and consequent growth concerns.

KMR’s share price has pulled back ~19% from its high of €6.50 reached ~3 weeks ago, coinciding with an escalation of lockdown measures in Shanghai, so clearly this has driven KMR’s latest price action. However, looking beyond current news headlines KMR remains very attractively valued, trading at 2.7x NTM EBITDA / 3.4x FCF. At this level of valuation, it is an obvious takeover target in my opinion current in the current supply-constrained and inflationary environment.

WTW

There was some notable newsflow relevant to Willis Towers Watson (WTW) last week, with the announcement from US insurance group White Mountains Insurance Group (WTM) that it had agreed to sell it’s specialty insurance provider NSM Insurance Group to the Carlyle Group for $1.78bn.

NSM is a specialty property and casualty insurance brokerage business that places insurance in niche sectors including specialty transportation, social services, real estate and pets. It is also a Managing General Agent (MGA) which has underwriting authority from insurers, allowing it to underwrite and place insurance on behalf of insurance carrier partners.

The interesting aspect of the transaction is the valuation - at the headline deal value of $1.78bn, Carlyle are paying 23.7x LTM EBITDA for NSM. Clearly, NSM is a much smaller business than WTW with a strong pathway for further growth under Carlyle ownership and the valuation reflects this, but it remains an interesting datapoint when one considers how undervalued WTW is today. WTW’s stock price has declined ~16% from its recent high of ~$243/share and is now valued at 10.9x LTM EBITDA vs. ~16x for its peer group average (AON, MMC, AJG), despite it being on track to achieve its growth plan and ahead of schedule on its capital return plan (as I wrote about recently here).

With several activists on the shareholder register and significant PE appetite for insurance brokerage businesses, WTW could well become a buy-out target if it remains this cheap while continuing to generate significant FCF (~19% LTM FCF margins on revenues, 71% EBITDA-FCF conversion).

Situations Monitor

Last week was an eventful one for Alphamin Resources (AFM), with it’s stock price declining ~27% on the week by Thursday, despite the fact the company is in play and likely to be acquired by a Chinese strategic acquirer in the coming months if market intelligence is to be believed. AFM’s stock rebounded on Friday to ~CAD$1/share, in line with where it traded prior to the announcement of a strategic review last November, and ~29% below the ~CAD$1.40 level it reached last month following a Bloomberg report that the company was in a formal sale process.

The recent share price pullback reflects a ~22% decline in the price of tin to ~$34k/tonne since the end of March (as at the time of writing). This is the lowest price tin has reached this year and is attributable to the wider sell-off across mining and commodity sectors prompted by renewed growth concerns amid COVID lockdowns in China:

Source: LME

Separately, AFM formally released Q1 FY22 results last Friday (which had already been flagged in a previous April trading update) and there were no surprises, with the following highlights:

Q1 EBITDA of US$98.1m up +32% vs. Q4 FY21 and +169% vs. Q1 FY21

Average tin price/tonne achieved of US$43.8k/t vs. $38k/t in Q4 FY21 and vs. $23.k/t in Q1 FY21

Contained tin sold up +9% from the prior quarter to 3,336 tonnes

Net cash position +90% to US$129.8m, after a US$30m dividend payment

Maiden mineral resource declared and subsequently updated at Mpama South, with a decision to commence construction of Mpama South mine following positive Preliminary Economic Assessment (PEA) study results

Continued high grade assay results from ongoing drilling campaigns at Mpama North and Mpama South (previously highlighted in Weekly Bulletin #12)

There was no update on the sale process in the Q1 results release, but with initial offers expected at the end of April, I would expect an update on the process soon.

Following the recent share price fall, AFM is currently valued at ~3.4x run-rate EBITDA assuming the current spot tin price (~$34k/t) and annualised Q1-FY22 production and cost levels. However, this excludes the Mpama South expansion which I estimate would contribute an incremental ~$150m in EBITDA (following ~$116m of capex) by FY24 at $34k/t tin prices. So on a PF basis including Mpama South, I estimate AFM could generate ~$415m in EBITDA at spot tin prices, which would imply a current valuation of just 2.5x after factoring the capex cost into the current enterprise value.

As I’ve highlighted before in my analysis of Anglo Pacific Group Plc (APF:LN / APY:CN), miners of strategically important metals now trade at double-digit multiples, while AFM itself has historically traded at 7x - 8x on a normalised basis. A re-rate to say 7x PF EBITDA would imply a value of CAD$2.85/share for AFM at spot tin prices (2.85x the current share price!).

Given the sale process currently underway, I believe AFM will be acquired before it’s stock price ever reaches this level, but this analysis does support the view that there is substantial value upside embedded in the stock. With controlling shareholder Denham Capital fully aware of this value and leading the sale process, it seems reasonable to conclude they will achieve a substantial premium over AFM’s current share price in any sale of the company. If no sale materialises, AFM appears very well positioned to re-rate in a highly supportive market for tin.

Developing Situations

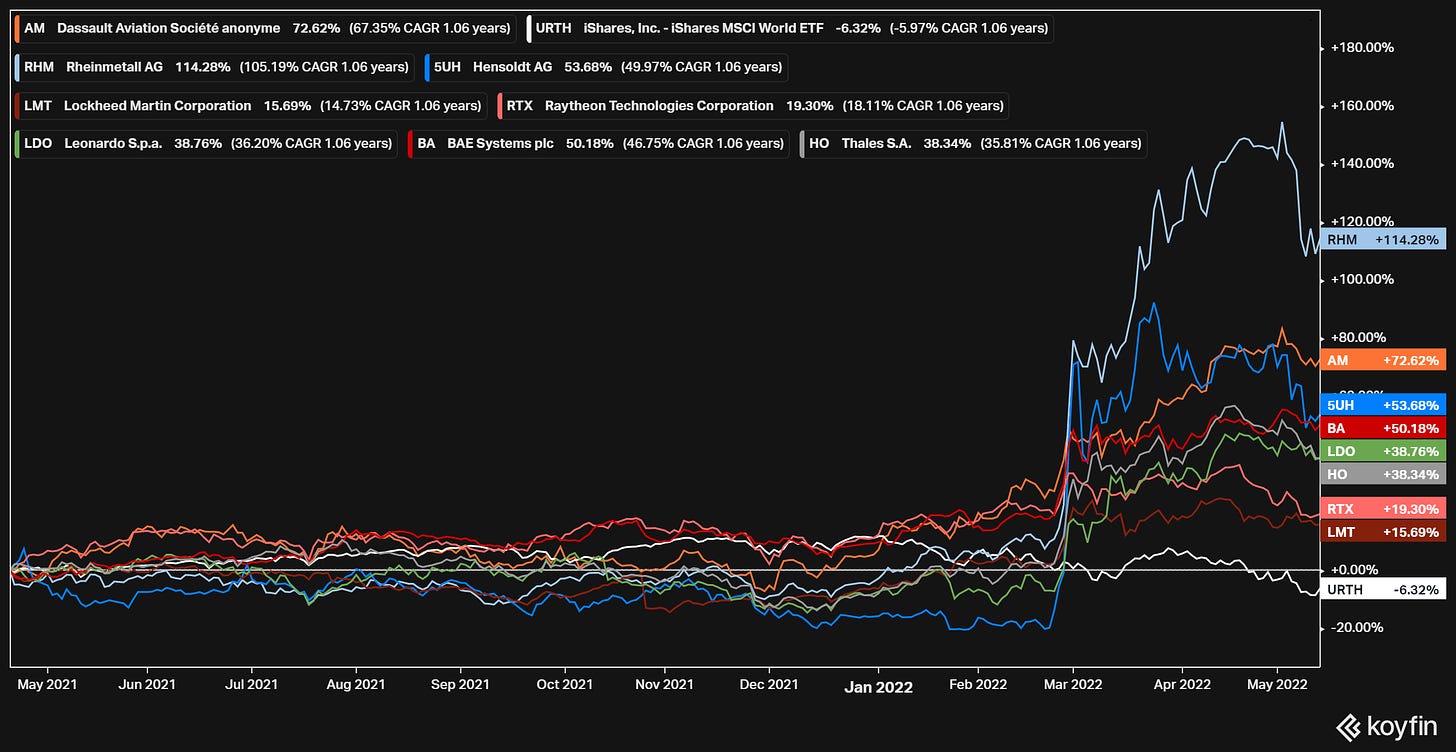

A recent FT article highlighted how defence stocks have been beating the global indices this year, on expectations of higher military spending by western governments following Russia’s invasion of Ukraine driving a renewed focus on national security.

The article included a chart showing highlighting how a selection of defence stocks have rallied since the invasion of Ukraine at the end of February:

Source: Defence stocks beat global market on expectations of higher spending, FT 22 April 2022.

In my view, one notable defence stock missing in the chart was Dassault Aviation SA (AM), the French military and business jet manufacturer, which has also performed well over the same period as above (+72%):

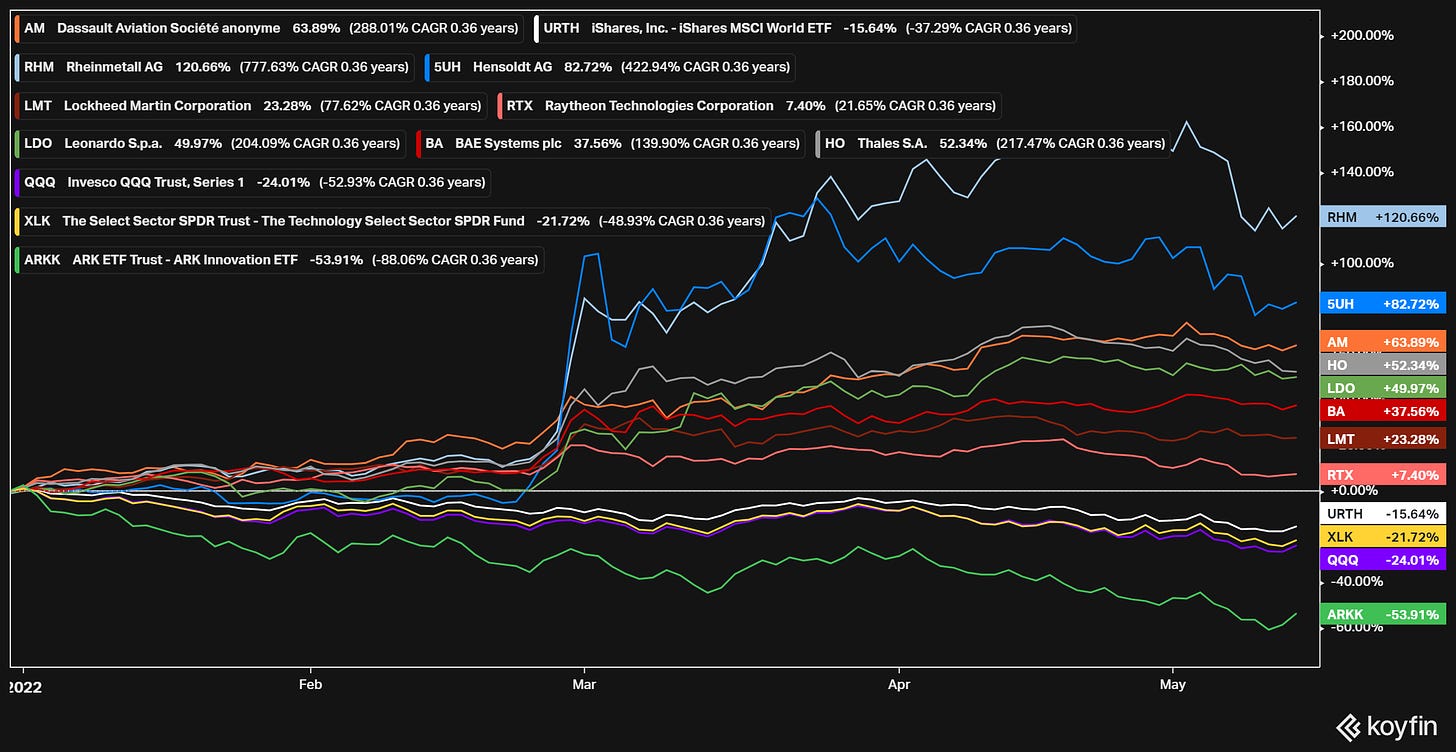

Notably, AM (as with the other defence stocks) has outperformed strongly this year, up ~64% YTD, and up +30% since 24 February when Russian commenced its invasion of Ukraine. This outperformance has occurred in the midst of a wider sell-off in equities, driven by sharp decline in growth/tech stock valuations as reflected in the performance of the NASDAQ, the SPDR Technology Sector ETF (XLK) and the ARK Innovation ETF (ARKK):

So why my interest in AM, apart from it not being included in the FT article despite its strong outperformance this year?

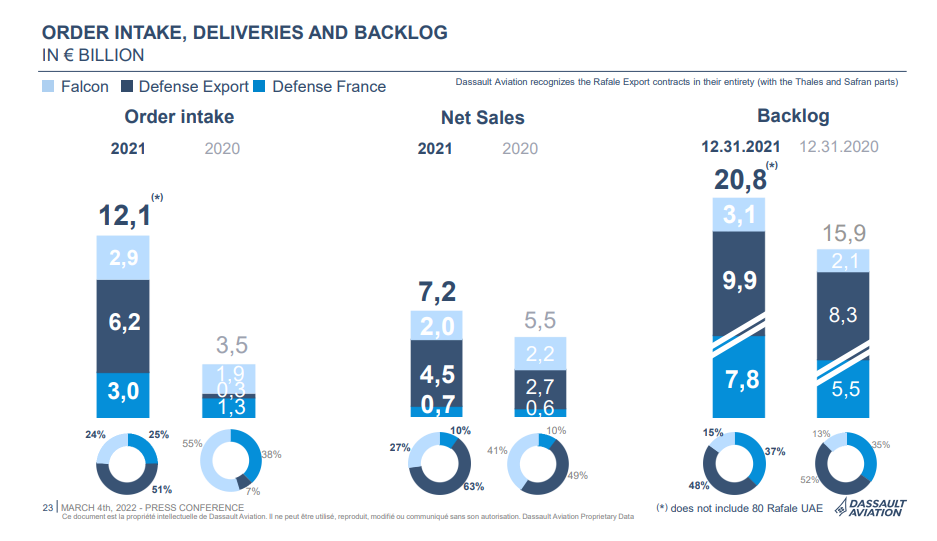

Firstly, a quick overview on AM - it is a French-listed, ~€13bn market cap manufacturer of jet aircraft, best known for its Rafale military fighter jet and its commercial Falcon aircraft. Of its ~€7.2bn in revenues in FY21, ~€5.2bn / 72% related to defence aircraft sales, and with ~€17.7bn or 85% of its ~€20.8bn year-end order book relating to defence aircraft, it is very much a military/defence-focused business:

AM is also a key player in the European Future Combat Air System (FCAS) project, a new European defence project launched by Germany and France in 2017 and seen as a central component of Europe’s future defence policy. FCAS is focused on developing a new European combat system, led by a consortium of European defence companies comprising AM, Airbus, Indra Sistemas and Thales Group. The FCAS project involves the development of a New Generation Fighter (NGF) aircraft to replace AM’s Rafale jet (used by French military), the Eurofighter Typhoon (manufactured jointly by Airbus/BAE Systems/Leonardo, used by the German military) and the EF-18 Hornet (a Boeing jet, used by Spanish military).

The progress of the FCAS project has been hampered by internal disagreements between the various parties over technology sharing and who should lead critical parts of the programme. However given the renewed security concerns across Europe following the war in Ukraine, I think it’s reasonable to expect the project will progress with AM being a clear beneficiary of this. In the event that the project stalls, AM remains very well positioned given strong demand for its Rafaele jet and it’s huge order book - note that the €20.8bn order backlog reported at FY21 year-end does not include an additional ~€16bn order recently signed with the UAE for delivery of 80 new Rafaele jets in what French President Macron called “the biggest military contract in our history.” The UAE order was formally signed last month, meaning AM now has an order book of ~€36.8bn which equates to ~5-6 years worth of revenues.

In addition to AM’s strong visibility to future revenue and earnings given its order book, it also has a very strong balance sheet position with net cash of ~€4.9bn, which equates to ~60% of its EV (€8.2bn as at time of writing) or ~40% of its market cap (€12.95bn). Regarding valuation, AM is currently valued at 11.8x FY21 EBITDA of €697m, below its historic 10 year average multiple of ~14x, and slightly ahead of the historic average multiple of ~11x for its military-aviation peers (Boeing, Airbus, Lockheed Martin, Northrup Grumman).

On a headline multiple basis, AM’s valuation may not seem that compelling but there is some obscured value here - AM owns ~25% of French defence electronics business Thales Group (HO), which is worth ~€6.1bn based on HO’s current share price. HO is an important member of the European security/defence complex, and as noted above is involved in the FCAS project, for which it is developing sensors for the FCAS fighter jet. As such it should also benefit from the renewed focus on defence spending in Europe.

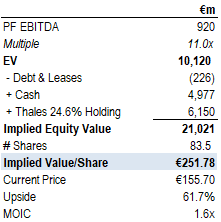

This is where AM becomes interesting. Netting out the €4.95bn in cash and the €6.1bn HO stake from AM’s current market cap of €13bn implies the market is valuing AM’s core business (with its ~€37bn order book) at just ~€2bn or 3x LTM EBITDA:

Source: Value Situations analysis.

This just seems too low for a debt-free business supported by an order book that is ~5x LTM revenue, and new defence spending tailwinds. On this basis I believe AM is an interesting value situation.

So what is AM worth if its operating business is re-rated in line with defence-aviation peers? On a simple SOTP basis, I get to a value of €250/share or +60% above the current share price as follows:

Source: Value Situations analysis.

The above analysis assumes the following:

PF EBITDA estimated based on current order book of ~€37bn equates to annual revenues of ~€7.4bn over the next 5 years; applying AM’s historic 5 year average EBITDA margin of ~12.5% implies ~€920m in PF EBITDA.

Market re-rates core AM business in line with historic average peer multiple of ~11x supported by robust growth outlook for defence spending.

Thales stake valuation based on current market cap - in reality, the value of Thales stake will increase given the wider defence market outlook, which would further enhance AM’s equity value.

This quick analysis implies substantial upside while there is clear downside protection in the form of the order book covering future revenues while the €4.9bn in cash and €6bn+ Thales stake combined equates to ~85% of AM’s current market cap! With this level of downside protection, AM appears to offer an asymmetric return opportunity also.

There is one potential catch here though and that is AM’s ownership, which is impacted by three important considerations:

The founding Dassualt family own 62% of AM;

Peer Airbus own another ~10% of the company.

French government / national security interests.

The lack of free float and concentration of ownership may warrant some kind of liquidity discount. Furthermore, the French and German governments each own ~10% of Airbus and so have an indirect influence on AM, while Thales is ~26% owned by the French government and the Dassault family also own another ~25% of Thales as well. Given these are businesses with national security implications for France they, and ultimately AM’s valuation may be subject to unhedgeable political risk, rather than just fundamental business economics.

However, in the current defence environment with the suspension of the “peace dividend” in Europe, AM appears very well positioned to appreciate in value given the change in defence policy across the continent. As such it merits a place on my Idea Bench watchlist.

Any Other Business

For this week’s AOB, I thought I’d share an excellent podcast discussion with Russell Napier and Jeremy Hosking hosted by Stephen Clapham of Behind The Balance Sheet.

The discussion is a very timely and insightful one, covering the coming age of financial repression and why the capital cycle theory is important for investors in this new era, as well as touching on the banking sector, the Asian crisis, value vs growth and the problem with ESG.

Stephen is a former hedge fund analyst and author who now runs an institutional investment training and research consultancy, and he hosts a regular investment podcast series that is worth following.