Disclaimer

Value Situations is NOT investment advice and the author is not an investment advisor.

All content on this website and in the newsletter, and all other communication and correspondence from its author, is for informational and educational purposes only and should not in any circumstances, whether express or implied, be considered to be advice of an investment, legal or any other nature. Please carry out your own research and due diligence.

“High quality assets can be risky, and low quality assets can be safe. It’s just a matter of the price paid for them.”

Howard Marks, The Most Important Thing.

“Even the ugliest of assets purchased at the right price can make a great investment.”

Marathon Asset Management.

“Ick investing' means taking a special analytical interest in stocks that inspire a first reaction of 'ick.' I tend to become interested in stocks that by their very names or circumstances inspire unwillingness - and an 'ick' accompanied by a wrinkle of the nose on the part of most investors to delve any further.”

Dr. Michael J. Burry.

As I recently reflected on the Model Portfolio’s performance and what worked and what didn’t in equity markets in 2022, I was prompted to return to an equity situation that I can’t help but feel was the “one that got away” last year.

In this instance, the situation in question falls within the “Quick Sit” category of idea, being a shorter duration value trade rather than the 2-3 year conviction ideas I’ve previously written about. Indeed, in the current market I believe there is a place for opportunistic, shorter-duration quick sits within equity portfolios (where such flexibility is allowed), given how volatile equities generally remain, being largely driven by macro newsflow rather than fundamentals. I regard such quick sits as a sub-category of special situation investing, being opportunistic plays that can contribute to excess returns for a portfolio.

In this week’s issue, I pick apart an idea I highlighted last year that in hindsight seemed like a no-brainer, if one could see past the horrendous chart for the stock at the time, which showed a ~99% decline in the space of ~6 months:

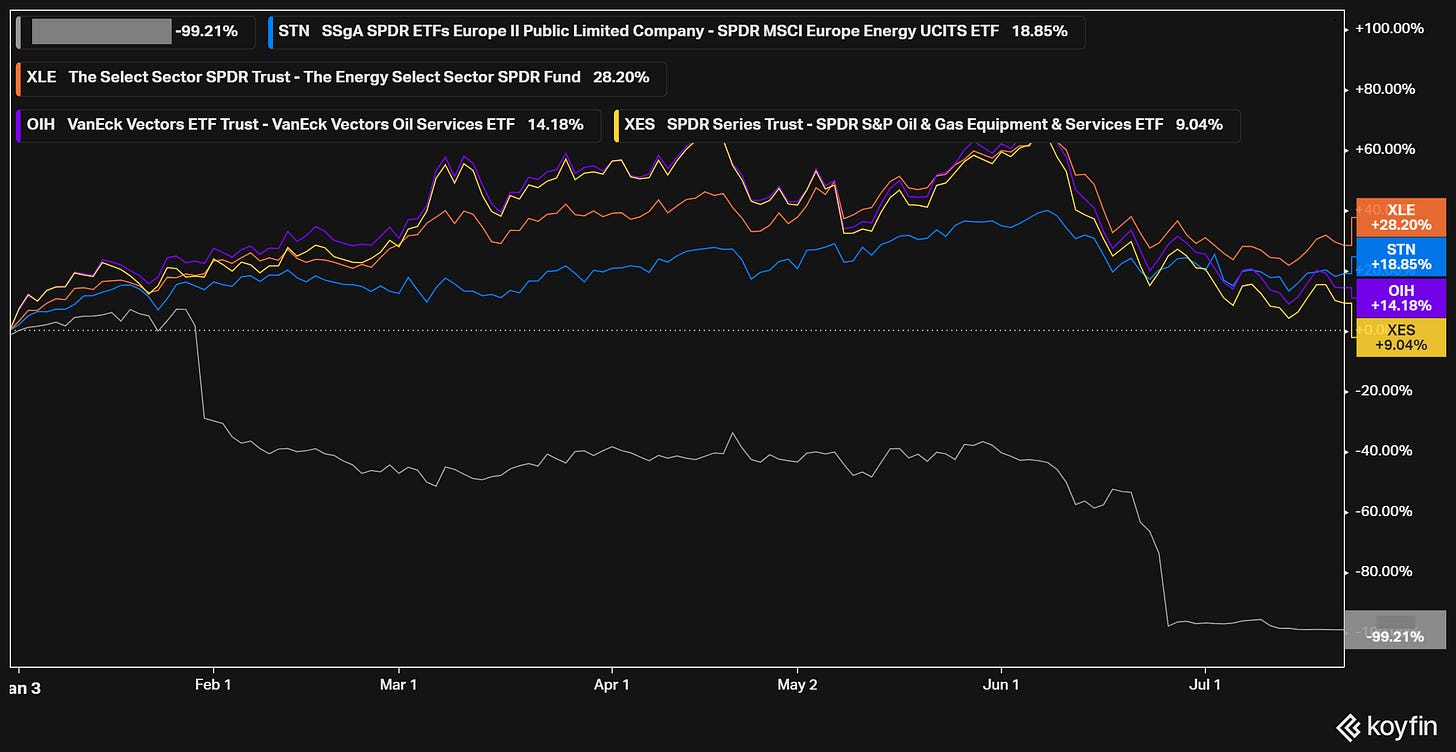

And no, this idea is not Carvana (CVNA) or some other ARKK-like disruption/growth tech name, but rather an energy stock that stunningly collapsed in the year that energy outperformed all other sectors - here’s how this stock was faring mid-way through last year relative to some of the main energy benchmarks:

Indeed this stock was neck-and-neck with CVNA last July as one of the worst-performing stocks YTD at that point:

This would surely qualify as an “ick” investment in Dr. Michael Burry’s words.

Interestingly since its lows in the second half of last year (after I previously highlighted it), the stock is up ~113% as at the time of writing.

So what is the stock, and what made it such a highly asymmetric, “no brainer” value trade?

Let’s revisit the situation …