Disclaimer

Value Situations is NOT investment advice and the author is not an investment advisor.

All content on this website and in the newsletter, and all other communication and correspondence from its author, is for informational and educational purposes only and should not in any circumstances, whether express or implied, be considered to be advice of an investment, legal or any other nature. Please carry out your own research and due diligence.

Reports of my death have been greatly exaggerated.

Mark Twain (attributed).

In this issue of the newsletter I present my final new equity idea of the year.

Long-time readers might recall that I regard structural changes in companies and industries as a source of potential investment opportunity, and I believe my latest idea sits at the intersection of this and another key theme of mine, namely commodities and critical materials, in this instance coal.

I regard coal as a very interesting sector despite its assumed demise as an energy source given global climate change initiatives, as the opening quote above alludes to. Following the global economy’s recovery from the COVID pandemic that began in late 2020 through the energy crisis of 2022, coal has been the standout performer among energy commodities, despite it seemingly being destined for phase-out with the world’s shift to renewables in the quest to achieve net zero emissions:

Indeed, if anything recent experience in geopolitics and energy markets has taught us that the world remains heavily reliant on coal to both power and build the global economy, and despite ESG-constrained investment mandates coal equities have made for excellent investments in recent times (for those with the flexibility to allocate capital to them). As the chart below shows, the major US-listed coal companies have significantly outperformed the broader US energy sector comprising more “palatable” O&G equities (as denoted by the XLE) and US large-cap equities more generally (SPX):

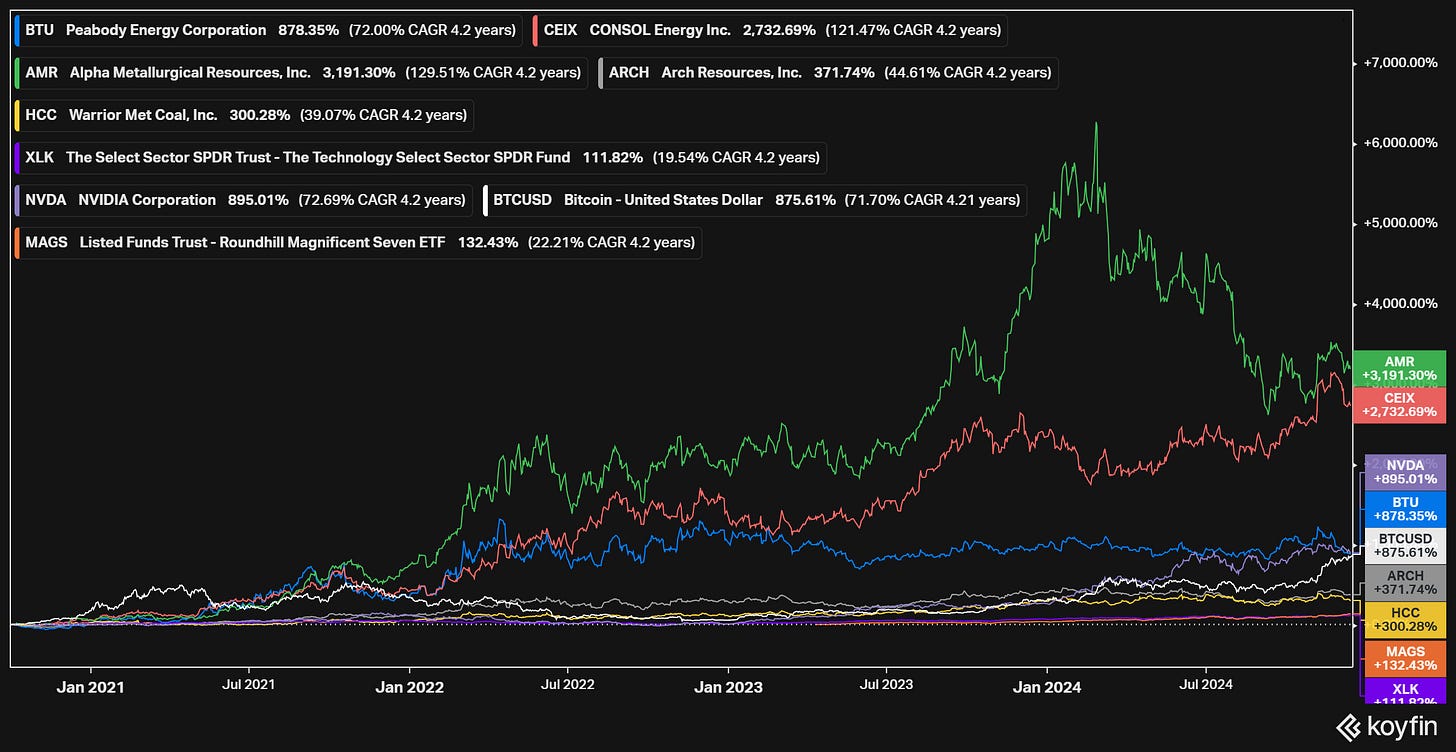

Even more interestingly, several of the major US coal names have also significantly outperformed the market darlings of recent times, including the US tech sector (XLK), the Magnificent 7, Nvidia and even bitcoin!:

While this might seem surprising, if one digs into how the global economy actually works, the outperformance of coal equities through this period becomes more evident. In his book How The World Really Works (which I regard as being very relevant for investors today given the inflationary outlook), Vaclav Smil does an excellent job of explaining how coal plays an indispensable role in modern civilization, being both a critical energy source and input into steel and cement production. In this new age of energy security, resource nationalism, deglobalisation, increasing urbanisation and population growth, it is not that surprising that equities linked to a commodity as critical and prized as coal should perform so well.

Indeed despite global efforts to transition to a low-carbon economy and the trillions that continue to be invested in renewable energy sources, coal remains the second largest source of energy globally after oil, providing ~26.5% of all primary energy consumed last year, down marginally from ~29% in 2010 in terms of overall energy consumption mix:

Source: Our World In Data.

The steady growth in coal consumption has primarily been driven by rising electricity demand globally amid continued population growth and economic and technological developments across multiple sectors, from transportation and heavy industry, to air-conditioning, to data centres and computing.

Over the last ~40 years, coal’s share of global electricity production has hovered around the 35%-40% range, with declining usage in the West offset by growing production in emerging markets (e.g. China, India, Indonesia):

Source: Our World In Data.

While coal is mostly associated with power generation, it is also a critical input for steel manufacturing, and it is important to distinguish between the two types of coal that serve these different end-markets.

Thermal coal is burned in coal-fired power plants to generate electricity, while metallurgical or “met” coal (also referred to as coking coal) is a critical input for steel production, being used in blast furnaces as part of the steel manufacturing process. Thermal coal is also used in industry, most notably in cement production, where it is used as a fuel in cement kilns.

Thermal coal is by far the larger of the two coal markets, and is the main target of zero emissions policies as it is the greatest contributor to climate change, being the single largest source of carbon emissions globally. As such, the global phase-out of coal typically refers to thermal coal for power generation, and not met coal.

However, despite carbon emissions concerns, global coal consumption for power generation reached a new record high in 2023, and thermal coal continues to be the largest source of electricity generation globally. Furthermore, coal demand is expected to increase again this year and remain stable next year, largely driven by emerging market demand (primarily India and China), rising power demand more generally from industrial applications, and ironically from the shift to electrification - EVs are a growing incremental source of demand for electricity, and thermal coal’s reliability and relative cost-effectiveness as a baseload power source means it often fills the gap arising from intermittent renewables such as wind and solar. More recently still, surging power demand with the advent of AI computing also points to increased demand for thermal coal power.

Conversely, while thermal coal consumption is regarded as being in structural decline over the longer-term under phase-out targets (to be replaced by natural gas, nuclear and renewable power), met coal benefits from a much more favourable outlook, given its critical role in steel production. Demand for steel (and therefore met coal) is expected to increase significantly in the coming years, supported by strong emerging market demand (most notably in India), global infrastructure investment, increasing urbanisation and population growth, and the build-out of the low carbon economy - again somewhat ironically, “green economy” infrastructure such as wind turbines, solar panel installations and EV manufacturing all require vast amounts of steel.

In this light, given “how the world really works” with met coal demand set to increase and thermal coal likely not the “melting ice cube” that the consensus phase-out view would have us believe, this all has significant and positive implications for investing in coal equities.

Against this intriguing backdrop, I believe a recently announced merger situation in the sector provides a very attractive way to play this theme, namely …