Disclaimer

Value Situations is NOT investment advice and the author is not an investment advisor.

All content on this website and in the newsletter, and all other communication and correspondence from its author, is for informational and educational purposes only and should not in any circumstances, whether express or implied, be considered to be advice of an investment, legal or any other nature. Please carry out your own research and due diligence.

While it’s pleasing to see a previously identified catalyst play out for one of my Model Portfolio names, last Wednesday’s announcement that Dowlais Group Plc’s (DWL) board have accepted an unsolicited offer from US-listed American Axle & Manufacturing Holdings (AXL) to acquire DWL for £1.16bn, or ~£0.85/share made for disappointing news. On reading through the headline deal terms, AXL’s offer price is well short of my previous estimate of DWL’s SOTP break-up value.

Indeed, the reaction among other DWL investors I’ve spoken with generally seems to be one of disappointment and even disbelief that the board are unanimously recommending AXL’s offer, particularly given how the strategic review process for the Powder Metallurgy (PowderMet) segment was only recently reported to have been “progressing well.”

As I outlined in my previous analysis, I expected a successful divestment of PowderMet to unlock substantial value for shareholders, transform the balance sheet, and allow for a significant capital return to shareholders, while positioning the business to comfortably weather current industry headwinds until a sector recovery takes hold.

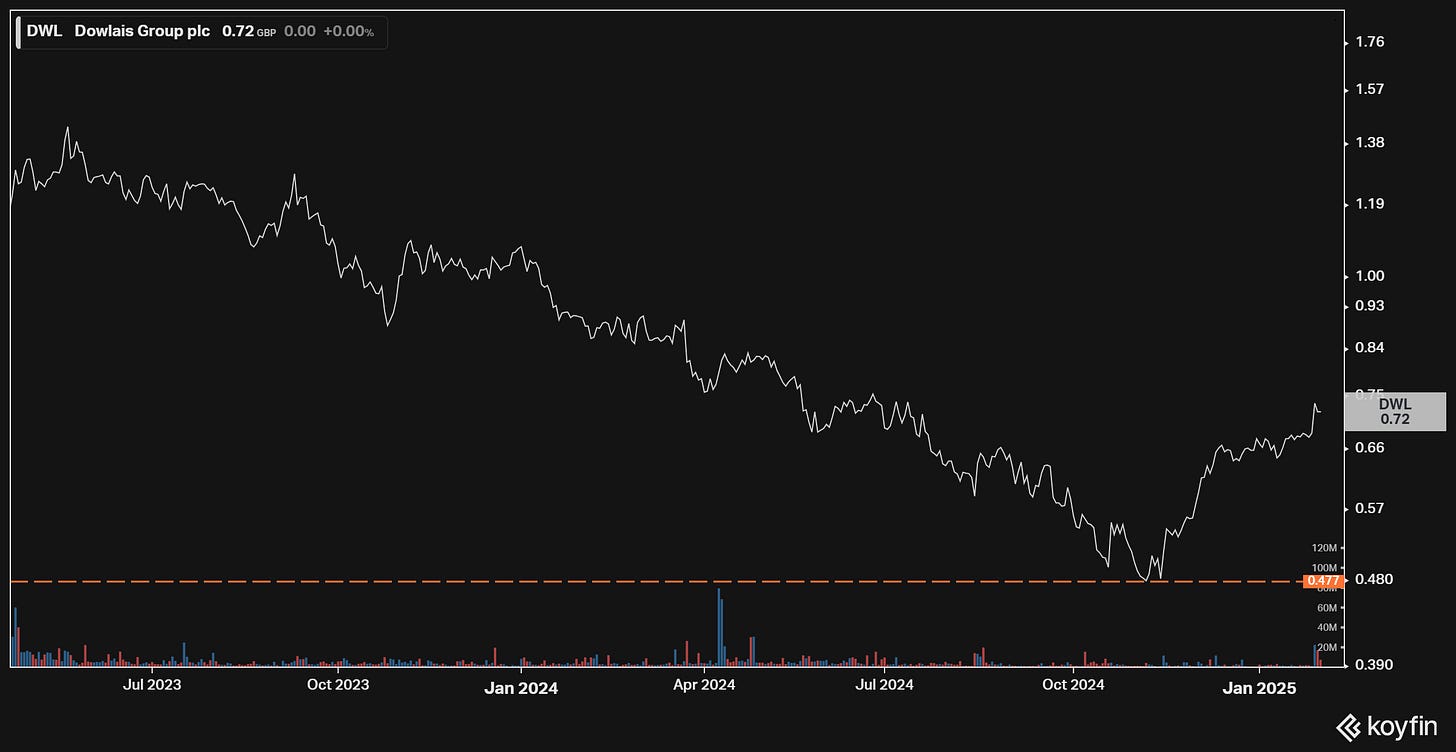

Instead, AXL’s offer seems to be an opportunistic, low-ball one, representing a miserable 25% premium to DWL’s already depressed (and arguably bottoming out) share price:

I’m sure anyone who bought in the near the recent lows around ~£0.50/share will be pleased with a prospective ~70% return within a 12 month time frame (assuming AXL’s stock holds at its pre-bid price of $5.82/share), but I can’t help but feel the board have just agreed to a take-under by taking this deal.

So let’s review AXL’s offer and what it might mean for DWL holders …