A Copper-Bottomed Situation

An overlooked copper play critical to European defence and infrastructure offering ~70%+ upside.

Disclaimer

Value Situations is NOT investment advice and the author is not an investment advisor.

All content on this website and in the newsletter, and all other communication and correspondence from its author, is for informational and educational purposes only and should not in any circumstances, whether express or implied, be considered to be advice of an investment, legal or any other nature. Please carry out your own research and due diligence.

There has been extensive commentary recently about how the Trump administration’s tariffs and economic policies generally are signaling the end of American exceptionalism and that investors need to re-price US equities to factor in a new political risk premium. This in turn has resulted in the so-called “Sell America” trade gaining traction, with an apparent rotation out of US assets as evidenced by the decline in the US dollar and the SPX and NASDAQ benchmarks, as well as elevated US treasury yields despite safe-haven demand amid increased volatility and recession concerns:

This increase in perceived risk in owning US assets has resulted in a rotation into other markets (e.g. Brazil, Germany, Mexico among others) on fears that the US may no longer be the most reliable or stable jurisdiction to invest in, with the uncertainty around proposed tariffs effectively placing the US in the “too hard” pile for now:

Recession and inflation/stagflation are perhaps the biggest concerns for investors currently, resulting in safe-haven and store-of-value demand driving the price of gold to record highs this year, with silver also appreciating significantly. However, looking across the commodity complex, it is somewhat surprising to see that copper is up ~21% YTD, not that far of gold and ahead of silver:

What makes this so surprising is that “Dr. Copper” is often regarded as a useful barometer for the health of the global economy, so it seems counter-intuitive that its price should appreciate so strongly as recession concerns have increased. Indeed over the last three weeks as market volatility spiked following Donald Trump’s “Liberation Day,” copper has actually outperformed all the other major commodities, even gold:

Granted, copper’s performance is in part attributable to a rush to secure copper supplies before the impact of tariffs fully hit, but even allowing for this and the impact of a trade war between the US and China, the fundamental outlook for copper remains robust, given underlying infrastructure and electrification demands.

Another support for copper demand that is less discussed in my view is the implications of the EU and Germany’s “game-changing” spending plans for defence and infrastructure, which will require enormous amounts of copper in order to deliver new civil, military, energy and transport infrastructure, as well as defence and electronic warfare systems.

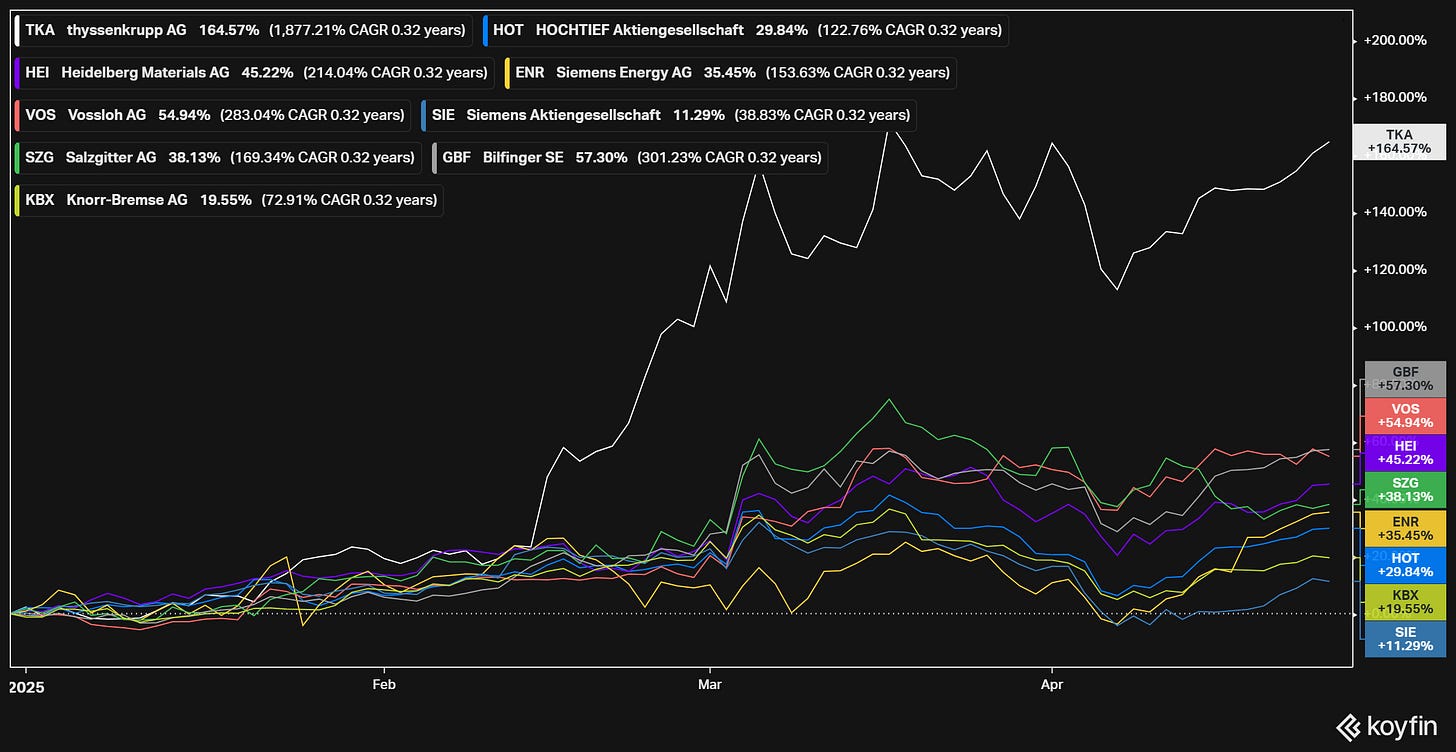

Not surprisingly, these spending plans have provided a major tailwind for European-listed names, with German-listed industrial/defence and infrastructure-related stocks in particular performing strongly this year:

As the above chart shows, Thyssenkrupp (TKA) has been the stand-out performer in Germany YTD, however there are several other industrial/infrastructure-related names that are yet to catch up with TKA and the other names in the chart above, and which are positioned to benefit from the same tailwinds.

One such name is both an overlooked copper play providing exposure to German (and broader European) defence and infrastructure spending as a critical supplier of copper and other metals, and an idiosyncratic single name with both internal and external catalysts, including being a possible takeover target.

Against this backdrop, in this issue of the newsletter I present an investment case for …